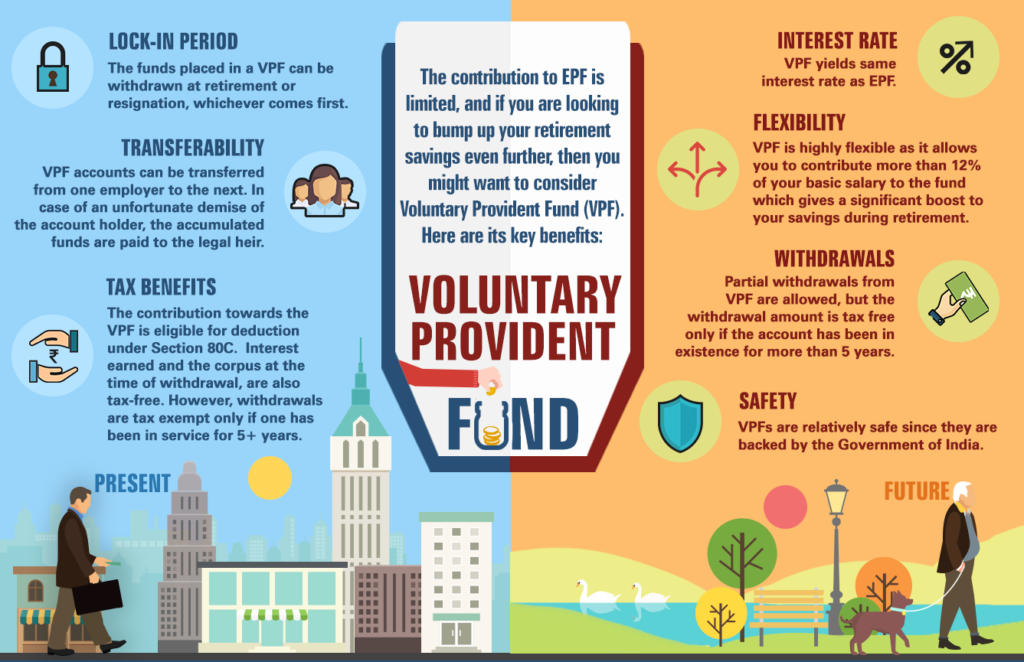

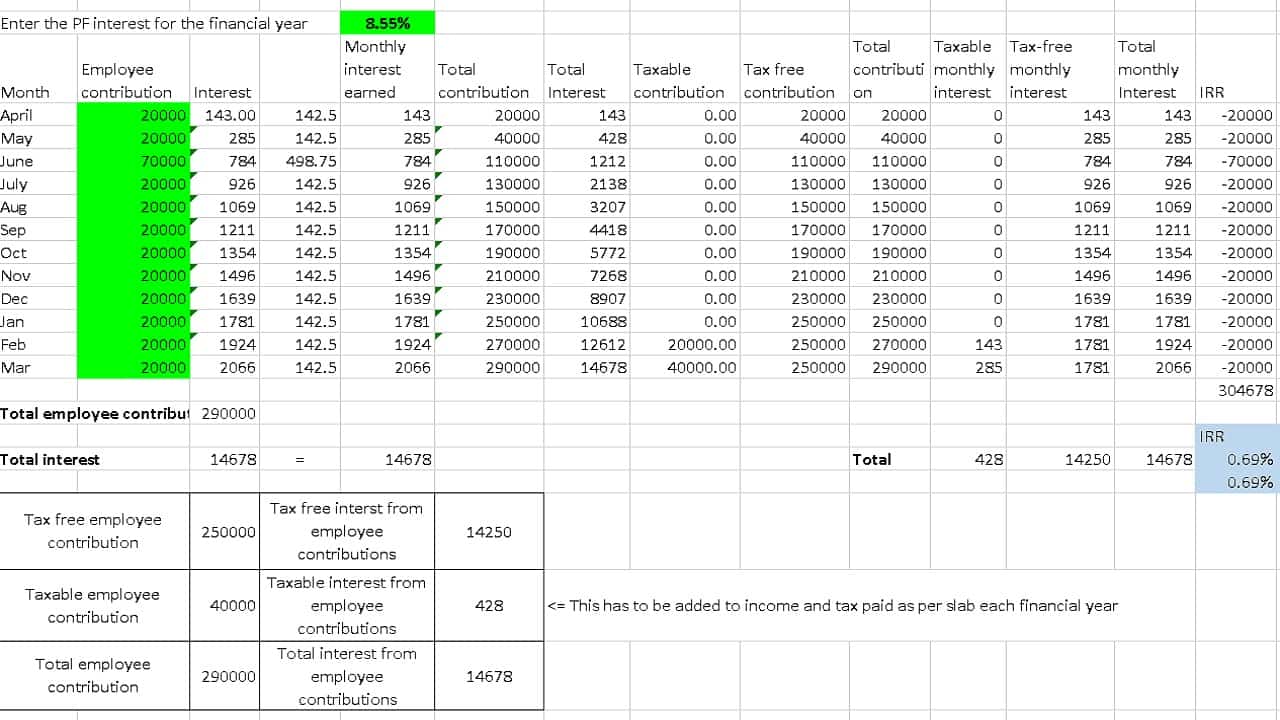

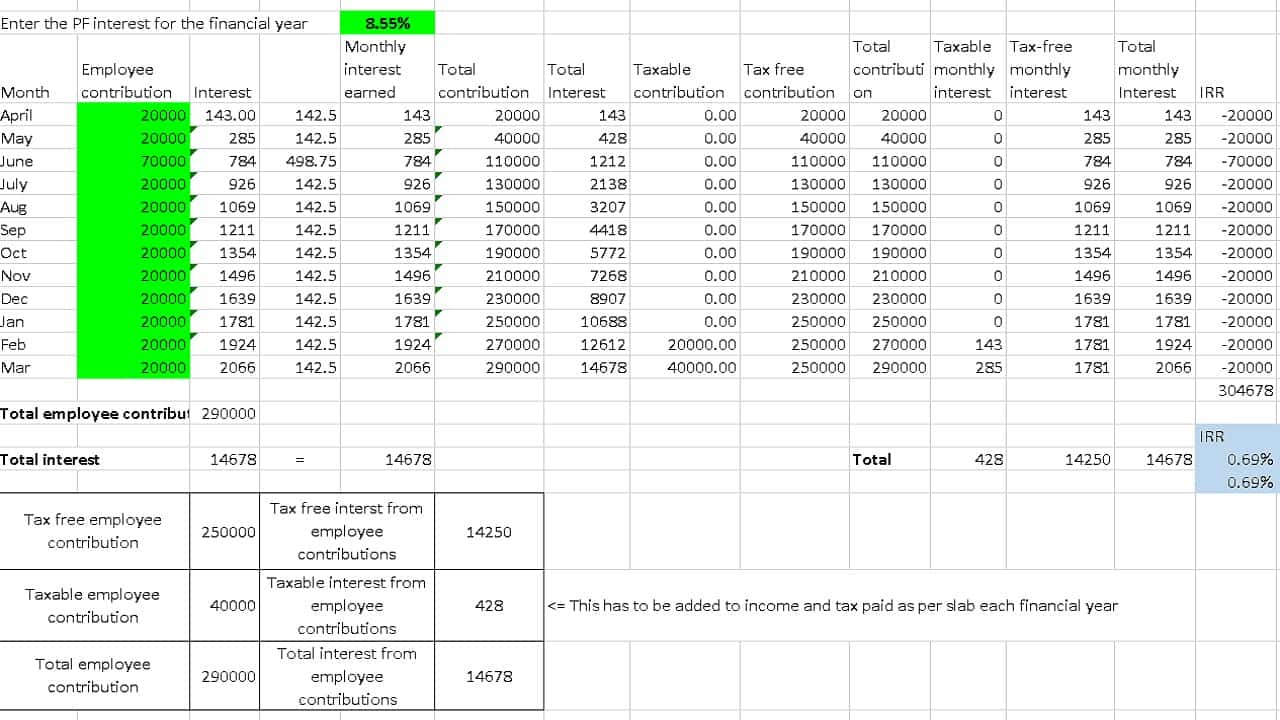

Vpf Tax Benefit Limit How much can you invest in VPF so that your total contribution from EPF VPF does not exceed Rs 2 5 lakh and the interest earned remains tax free The answer depends

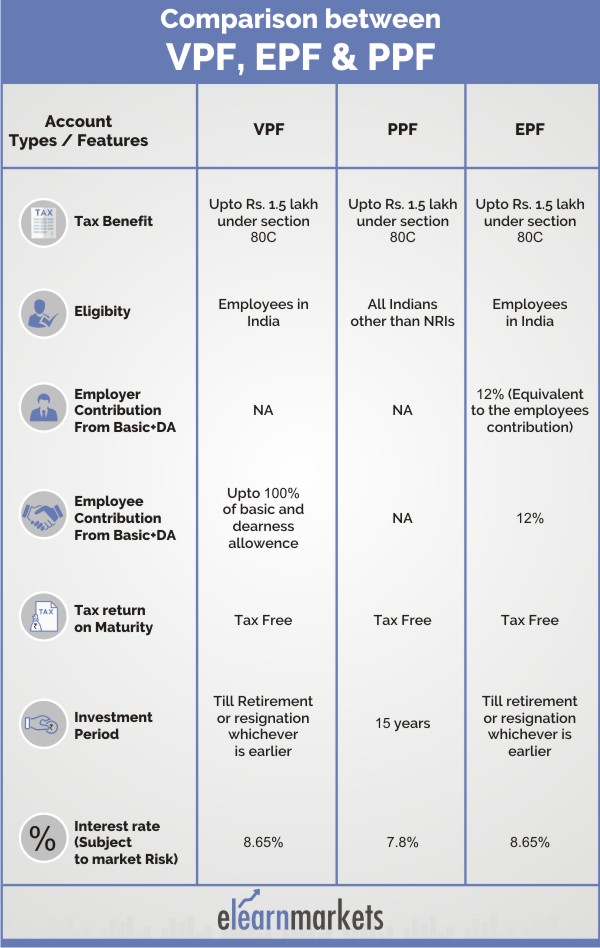

Tax Efficiency The VPF payments along with the interest received are free from income tax under Section 10 12 of the Income Tax Act subject to the threshold limit of Rs 2 50 000 in VPF contributions made towards the EPF accounts are eligible for tax deductions under the provisions of Section 80C of the Income Tax Act 1951 Hence you can contribute

Vpf Tax Benefit Limit

Vpf Tax Benefit Limit

https://www.apnaplan.com/wp-content/uploads/2012/03/VPF-A-Good-Tax-Saving-Retirement-Option-1024x662.png

How To Calculate Vpf Interest CETDGO

https://freefincal.com/wp-content/uploads/2021/02/Full-screenshot-of-the-Taxable-PF-contribution-calculator-with-results.jpg

VPF Voluntary Provident Fund Tax Exemption Benefits Features Fisdom

https://www.fisdom.com/wp-content/uploads/2021/08/72.jpg

Tax Benefits Maturity proceeds received under VPF are totally exempted under the Income Tax VPF is categorized under EEE category and the principal interest and contribution are exempted under Income tax VPF falls under the E E E category i e EEE exempt on contribution exempt from the principal exempt on interest thus making it a good tax saving option VPF

With respect to the tax benefits under section 80C the employees can claim deductions up to INR 1 50 000 In addition to this the interest that is generated from these contributions is also exempt from taxes provided that However the VPF limit for tax exemption on the interest earned is Rs 70 000 Voluntary Provident Fund VPF is most beneficial but also the most ignored tax saving scheme Monetarists or HR

Download Vpf Tax Benefit Limit

More picture related to Vpf Tax Benefit Limit

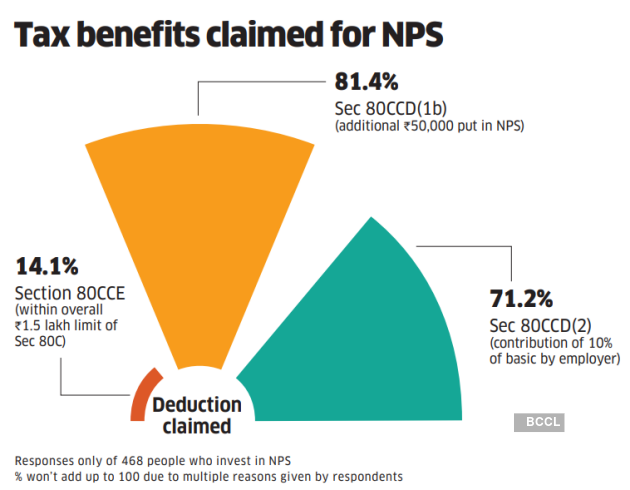

NPS Vs ELSS Vs VPF Which One Should You Choose For Higher Tax Benefit

https://imgk.timesnownews.com/story/money_stacks.png?tr=w-560,h-292,fo-top

EPF PPF And VPF Tax Saving Investments For Guaranteed Returns YouTube

https://i.ytimg.com/vi/dbxbBR7it10/maxresdefault.jpg

Voluntary Provident Fund Tax Saving Option For Retirement

https://www.elearnmarkets.com/blog/wp-content/uploads/2018/09/VPF-EPF-PPF-Comparison.jpg

VPF tax benefits The tax benefits of the Voluntary Provident Fund are as follows The contributions made towards the scheme are eligible for tax deductions under Section 80C of the Income Tax Act 1961 subject to the VPF is eligible for tax benefits under Section 80C up to Rs 1 5 lakh in a financial year While the contribution could be higher tax exemption is available only up to this limit

The Voluntary Provident Fund VPF is one of the tax saving investments covered under Section 80C of the Income Tax Act 1961 It offers tax deductions of up to Rs 1 50 000 a year and VPF Rules As per VPF rules an individual can choose to contribute 100 of his her income to an EPF account as a Voluntary Provident Fund Get basics of VPF rules and guidelines

EPF And VPF Get More Benefit From EPF EPF Vs VPF What Is EPF And

https://i.ytimg.com/vi/QJ0UQhyGd-s/maxresdefault.jpg

What Is VPF Know VPF Interest Rate VPF Full Form Benefits

https://paytm.com/blog/wp-content/uploads/2022/08/Blog_VPF_final.png

https://stableinvestor.com › maximum-vpf-investment-tax-free-epf.html

How much can you invest in VPF so that your total contribution from EPF VPF does not exceed Rs 2 5 lakh and the interest earned remains tax free The answer depends

https://cleartax.in › vpf-calculator

Tax Efficiency The VPF payments along with the interest received are free from income tax under Section 10 12 of the Income Tax Act subject to the threshold limit of Rs 2 50 000 in

Voluntary Provident Fund VPF Interest Rate Benefits Eligibility

EPF And VPF Get More Benefit From EPF EPF Vs VPF What Is EPF And

PPF Vs VPF Which One Is A Good Tax Savings Investment Namita

Tax On PF Interest Should You Stop Investing In VPF How Bank FDs RBI

VPF Tax Free Interest Tax Saving Voluntary Provident Fund

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

Why Should You Check Your EPF Contribution After Salary Hike Mint

Saving Schemes Best Saving Schemes In India 2023

VPF Vs EPF In Hindi VPF Kya Hota Hai Vpf Voluntary Provident Fund

Vpf Tax Benefit Limit - Employees can claim tax benefits of up to Rs 1 5 lakh on VPF contributions under Section 80C of the Income Tax Act 1961 Moreover the interest earned on VPF is also