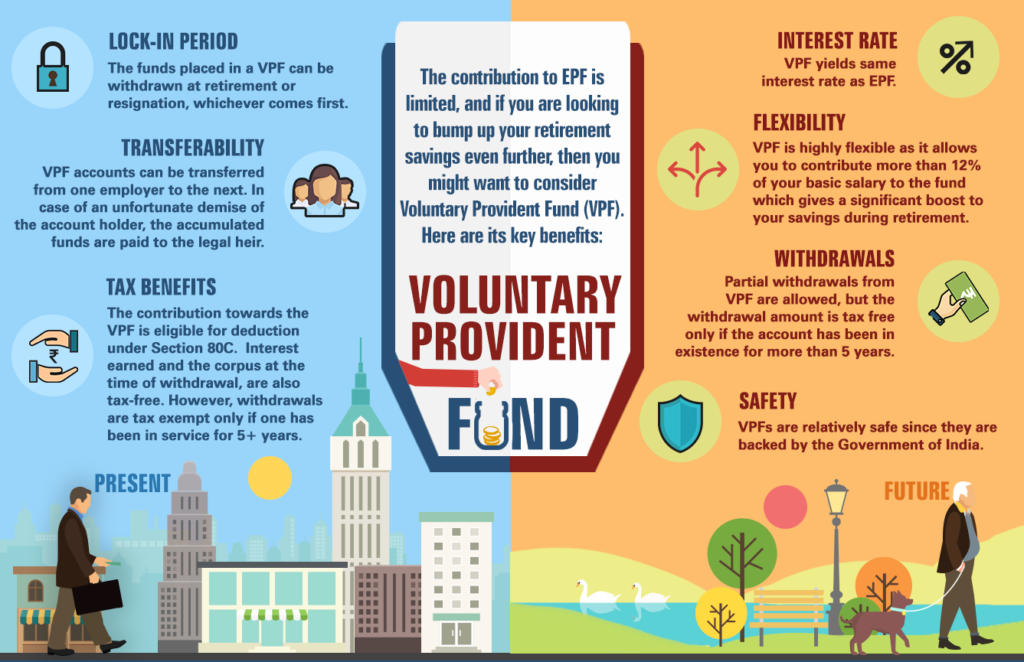

Vpf Tax Benefit VPF contributions are tax deductible under Section 80C and follow EPF s lock in period Starting VPF contributions is simple via informing the employer VPF

Learn about the Voluntary Provident Fund VPF and explore its benefits eligibility criteria required documents and withdrawal process Discover how VPF can VPF Calculator Calculate your Voluntary Provident Fund VPF maturity amount online upon retirement and check your total amount accumulated in your VPF

Vpf Tax Benefit

Vpf Tax Benefit

https://www.apnaplan.com/wp-content/uploads/2012/03/VPF-A-Good-Tax-Saving-Retirement-Option-1024x662.png

The VPF Tax In India What To Expect

https://griffinschein.com/wp-content/uploads/2022/08/epf-calculator-850x425.png

Voluntary Provident Fund Tax Saving Option For Retirement

https://www.elearnmarkets.com/blog/wp-content/uploads/2018/09/VPF-EPF-PPF-Comparison.jpg

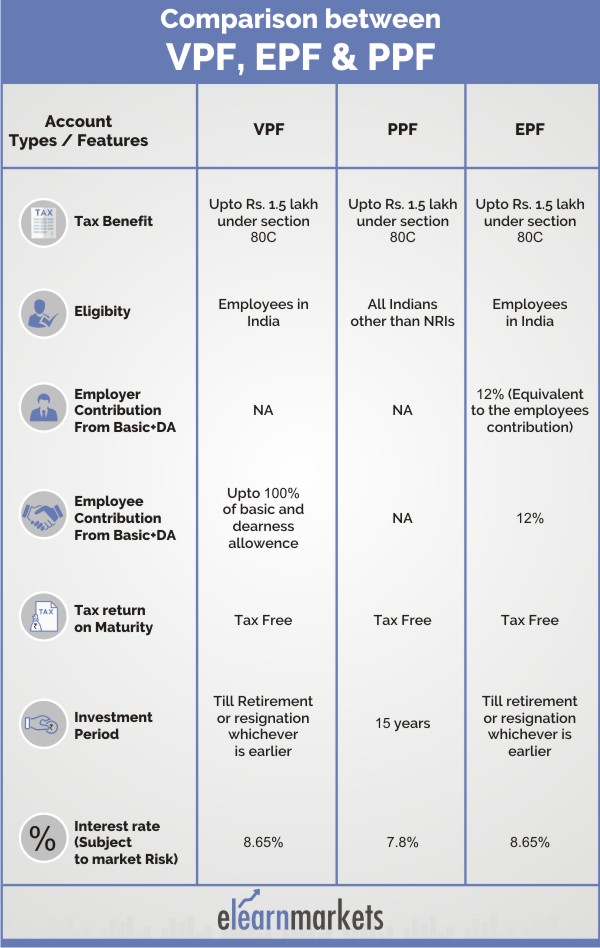

VPF Tax Benefits As mentioned previously a Voluntary Provident Fund enjoys all the benefits of EPF including tax benefits Contributions made to an EPF account in a Tax benefits available under a VPF When it comes to various investment options in India the VPF account is considered among the best Under Section 80C of the Income Tax Act 1961 employees are eligible for tax

Voluntary Provident Fund VPF is a voluntary savings scheme by the EPFO Read to find out the eligibility benefits withdrawal rules interest rate in 2022 and tax benefits VPF Tax Benefits Exemption Your VPF contribution up to Rs 1 5 lakh is exempt from tax under Section 80C increasing the return potential of VPF Further if your contribution via EPF and VPF is less

Download Vpf Tax Benefit

More picture related to Vpf Tax Benefit

VPF Voluntary Provident Fund Tax Exemption Benefits Features Fisdom

https://www.fisdom.com/wp-content/uploads/2021/08/72.jpg

EPF PPF And VPF Tax Saving Investments For Guaranteed Returns YouTube

https://i.ytimg.com/vi/dbxbBR7it10/maxresdefault.jpg

VPF Interest Rate Eligibility Withdrawal Rules And Tax Benefits

https://www.tickertape.in/blog/wp-content/uploads/2022/07/[email protected]

Employees can claim tax benefits of up to Rs 1 5 lakh on VPF contributions under Section 80C of the Income Tax Act 1961 Moreover the interest earned on VPF is also exempt from tax Additionally the VPF Tax Benefits The Voluntary Provident Fund emerges as a top notch tax saving option in India According to Section 80C of the Income Tax Act 1961 employees can avail of

Voluntary provident fund vpf benefits The VPF account is classified as Exempt Exempt Exempt EEE Employees can thus benefit from tax breaks while also earning a lot of money in the long term by To make an additional contribution to the EPF account one can do so via Voluntary Provident Fund VPF However do note that if the contributions via EPF and

EPF And VPF Get More Benefit From EPF EPF Vs VPF What Is EPF And

https://i.ytimg.com/vi/QJ0UQhyGd-s/maxresdefault.jpg

PPF Vs VPF Which One Is A Good Tax Savings Investment Namita

https://i.ytimg.com/vi/5n5zUqbzq7w/maxresdefault.jpg

https://cleartax.in/s/pf-vs-vpf

VPF contributions are tax deductible under Section 80C and follow EPF s lock in period Starting VPF contributions is simple via informing the employer VPF

https://tax2win.in/guide/voluntary-provident-fund...

Learn about the Voluntary Provident Fund VPF and explore its benefits eligibility criteria required documents and withdrawal process Discover how VPF can

PPF Vs VPF Which Is Better For Achieving Long term Investment Goal Mint

EPF And VPF Get More Benefit From EPF EPF Vs VPF What Is EPF And

What Is VPF Voluntary Provident Fund Tax Benefit In VPF VPF Vs EPF

The Difference Between VPF PPF Rupiko

Voluntary Provident Fund VPF Interest Rate Benefits Rules

Voluntary Provident Fund VPF Interest Rate Benefits Eligibility

Voluntary Provident Fund VPF Interest Rate Benefits Eligibility

VPF Tax Free Interest Tax Saving Voluntary Provident Fund

VPF Vs EPF In Hindi VPF Kya Hota Hai Vpf Voluntary Provident Fund

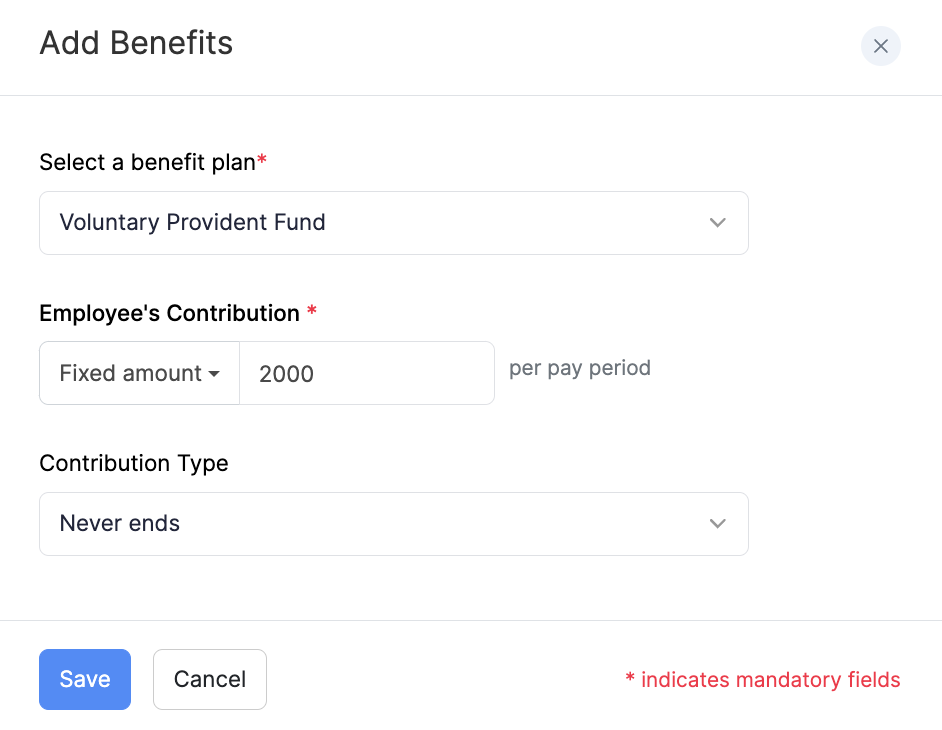

Adding VPF To Employees Knowledge Base Zoho Payroll

Vpf Tax Benefit - Contributions to VPF are eligible for deduction under Section 80C of the Income Tax Act and the interest earned on VPF is also tax exempt This means that the amount you