Walz Tax Rebate 2024 Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

ST PAUL Minn The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of the historic 2023 One Minnesota Budget signed into law by Governor Tim Walz on May 24 2023 This rebate will help millions of Minnesotans pay for everyday expenses such as groceries school supplies rent or childcare How to maximize your 2024 tax refund according to a CPA 02 34 Many Americans got a shock last year when the expiration of pandemic era federal benefits resulted in their receiving a smaller tax

Walz Tax Rebate 2024

Walz Tax Rebate 2024

https://townsquare.media/site/150/files/2023/08/attachment-RS1304_AA000499-scr.jpg?w=980&q=75

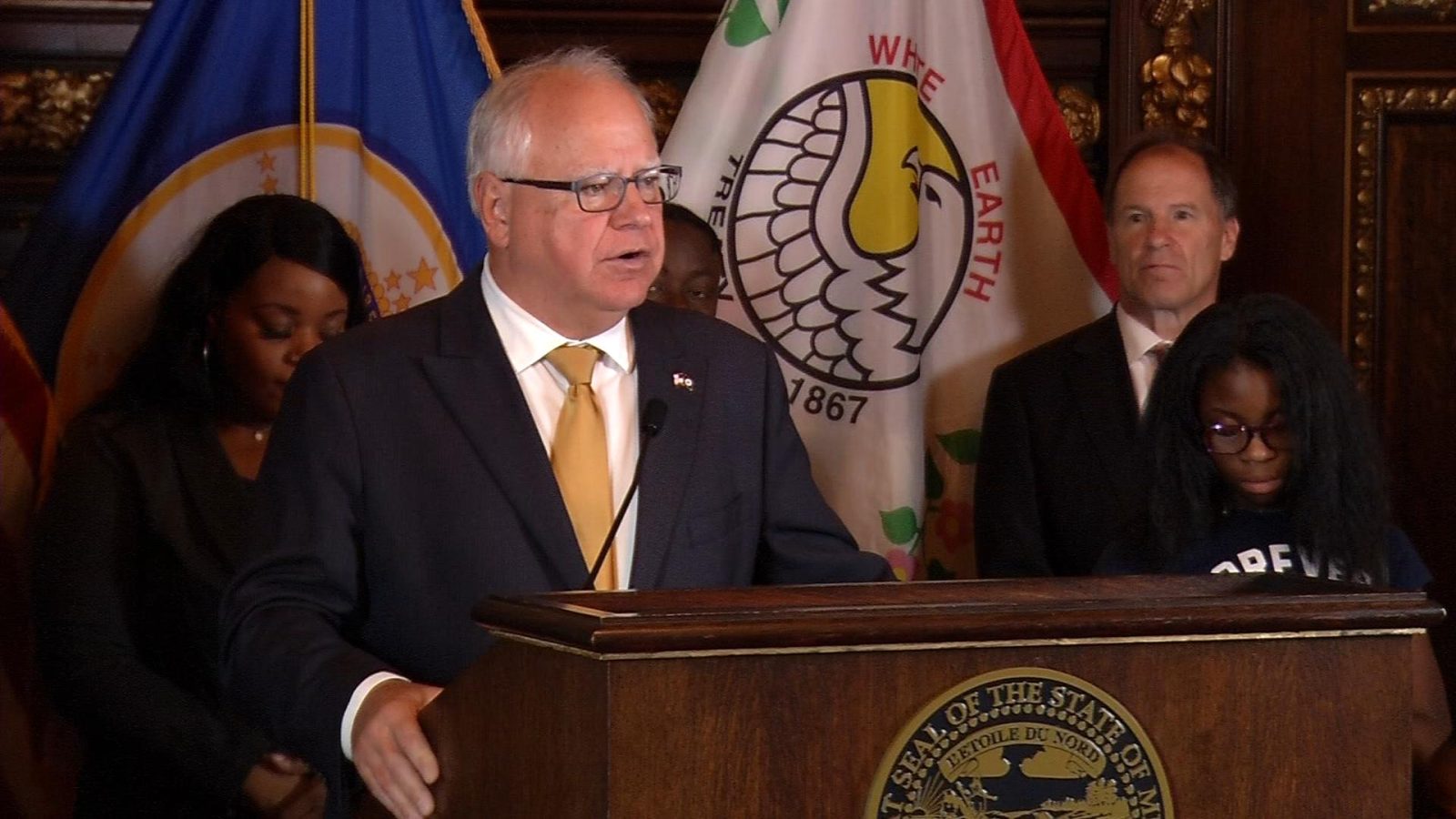

Gov Walz Elected Officials Tout Tax Rebates At Capitol

https://ccxmedia.org/wp-content/uploads/2023/08/TAX-REBATE-CHECKS-LKL-NS-20230816-still.jpg

Walz Urges Congress To Pause 18 cents a gallon Gas Tax MPR News

https://img.apmcdn.org/597296febc064689ff7503caa7fd7ea6f7fae171/widescreen/776c70-20220302-biden-montgomery05-2000.jpg

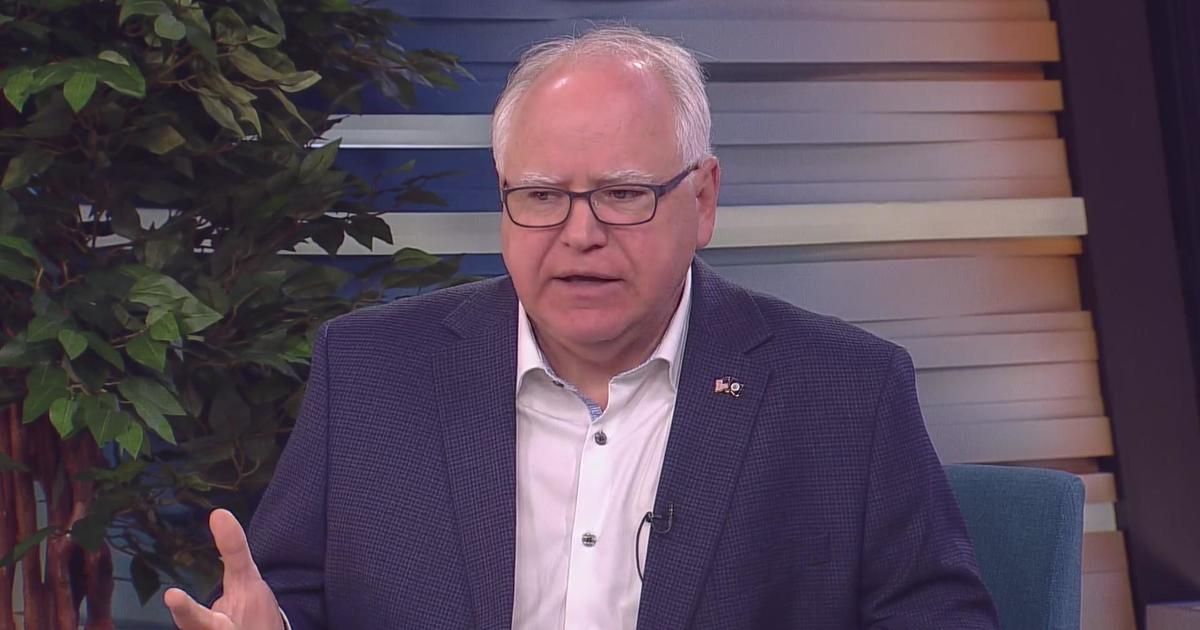

This legislation also encompassed a child tax credit for the state reaching a maximum of 1 750 per child dependent Governor Walz conveyed his unequivocal disapproval of the IRS s decision to deem the rebate checks taxable during a recent news conference addressing the anticipated budget surplus for Minnesota in 2024 The state has been pushing the IRS to remove the federal tax penalties on the rebates for months but Minnesota only has a few weeks remaining before the 2023 tax season begins January 29 Walz

ST PAUL Minn Governor Tim Walz recently signed legislation that directs the Minnesota Department of Revenue to distribute direct tax rebate payments to eligible taxpayers These payments are 520 for married joint filers who had a 2021 adjusted gross income of 150 000 or less 260 for all other filers who had a 2021 adjusted gross income of 75 000 or less An additional 260 per Update Jan 14 1 48 p m Posted Jan 12 2 22 p m Gov Tim Walz dialed the head of the federal tax system this week to make a last ditch ask Don t tax Minnesota s rebate checks as income

Download Walz Tax Rebate 2024

More picture related to Walz Tax Rebate 2024

After Dying Off In 2022 Partisan Gridlock Chances For Walz Checks Good In 2023 MinnPost

https://www.minnpost.com/wp-content/uploads/2022/12/TimWalzPodium2022ElectionNight940.png?fit=940%2C627&strip=all

Walz s tax The Rich Plan Doesn t Just Tax The Rich MinnPost

https://www.minnpost.com/wp-content/uploads/2021/01/TimWalz0320_940.jpg?w=940&strip=all

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

The rebates are considerably smaller than the 2 000 for families and 1 000 for individuals that Walz had proposed in January a slight increase from the rebate proposal he campaigned on in 2022 He acknowledged that he wanted the rebates to be bigger but said he compromised in the end Republican Senate Majority Leader Mark Johnson of East Grand Forks called the rebates a slap in the The 2024 tax season officially opens Monday meaning the IRS will begin accepting and processing returns for the 2023 tax year The deadline to file is April 15

August 16 2023 ST PAUL MN Governor Tim Walz announced today that the one time tax rebate payments of up to 1 300 per family will start going out this week As Minnesotans plan for back to school we know that the excitement families are feeling is mixed with the stress that comes with buying books backpacks and clothes said Walz s budget Tax rebates of up to 2 600 plus 11B for schools housing workforce more The governor will lean on the state s record 17 6 billion surplus from a mix of unspent savings and

260 Tax Rebate Deposits Catching Some Minnesotans By Surprise Albert Lea Tribune Albert Lea

https://www.albertleatribune.com/wp-content/uploads/sites/14/2023/08/0819.rebates.jpg?w=800

WCCO CBS News Minnesota On Twitter Gov Tim Walz Talks Rebate Checks Legislature s Other

https://pbs.twimg.com/media/FwrItIkXwAQS2j4.jpg

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief

https://www.revenue.state.mn.us/press-release/2023-07-10/department-revenue-announces-process-one-time-tax-rebates

ST PAUL Minn The Minnesota Department of Revenue announced today the process to send 2 4 million one time tax rebate payments to Minnesotans This rebate was part of the historic 2023 One Minnesota Budget signed into law by Governor Tim Walz on May 24 2023 This rebate will help millions of Minnesotans pay for everyday expenses such as groceries school supplies rent or childcare

New Walz Plan For Surplus Includes Bigger Tax Rebate Checks Fox21Online

260 Tax Rebate Deposits Catching Some Minnesotans By Surprise Albert Lea Tribune Albert Lea

Virginia Tax Rebate 2024

New Walz Plan For Surplus Includes Bigger Tax Rebate Checks

/cloudfront-us-east-1.images.arcpublishing.com/gray/YXGC324B4BCEJI42T2QYB5KCQU.jpg)

New Walz Plan For Surplus Includes Bigger Tax Rebate Checks

Governor Walz Proposes Raising Taxes Increasing Gov t In Recovery Budget Action 4 Liberty

Governor Walz Proposes Raising Taxes Increasing Gov t In Recovery Budget Action 4 Liberty

AlconChoice Rebate Form How To Qualify And Fill Out Printable Rebate Form

Walz Other Governors Calling For Suspension Of Federal Gas Tax WDAY Radio

Tax Rebate In Thailand For 2023 Save Up To 40 000 THB

Walz Tax Rebate 2024 - The state has been pushing the IRS to remove the federal tax penalties on the rebates for months but Minnesota only has a few weeks remaining before the 2023 tax season begins January 29 Walz