Washing Allowance Tax Rebate Web 84 lignes nbsp 0183 32 1 janv 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate

Web If you claim a deduction for laundering washing and drying you must keep details of how you work out your claim If your laundry expenses washing drying and ironing but not Web 5 oct 2022 nbsp 0183 32 The uniform tax return is a tax relief you can claim if you re responsible for washing repairing and replacing your work uniform without any reimbursement from

Washing Allowance Tax Rebate

Washing Allowance Tax Rebate

https://blogs.sap.com/wp-content/uploads/2012/12/9999_5_167442.jpg

High Efficiency Clothes Washer Rebate Hays KS

https://haysusa.com/ImageRepository/Document?documentID=1687

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

https://blogs.sap.com/wp-content/uploads/2012/12/9999_3_167433.jpg

Web 3 mars 2016 nbsp 0183 32 Claim online Before you start You cannot use this service if you are claiming on behalf of someone else complete Self Assessment tax returns except current year Web 28 mars 2023 nbsp 0183 32 In the 2023 24 tax year the flat rate expense for uniform is 163 60 so If you earn up to 163 50 270 you can claim 20 of that 163 60 back If you earn over 163 50 270 you

Web The standard amount you can claim back is 163 60 per tax year this can be more depending on your job Tax relief is applied to the 163 60 which will normally be at a rate of 20 or Web You are entitled to claim a uniform washing allowance for the cost of washing your uniform provided that your employer does not provide on site washing facilities Tools amp

Download Washing Allowance Tax Rebate

More picture related to Washing Allowance Tax Rebate

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

https://blogs.sap.com/wp-content/uploads/2012/12/9999_2_167432.jpg

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

https://blogs.sap.com/wp-content/uploads/2012/12/9999_1_167428.jpg

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

https://blogs.sap.com/wp-content/uploads/2012/12/nlr_5_167425.jpg

Web You paid tax in the year you re claiming for How much can I claim for washing my uniform The amount you can claim depends on your occupation The minimum allowance is 163 60 and the highest is 163 1170 Web 29 d 233 c 2022 nbsp 0183 32 Last updated 29 Dec 2022 Uniforms are required as part of many jobs but did you know that you might be missing out on the uniform tax rebate That s right if

Web In detail myTax 2022 Work related clothing laundry and dry cleaning expenses myTax 2022 Work related clothing laundry and dry cleaning expenses Complete this section Web Provided that your employer does not provide on site facilities to wash your uniform you are entitled to claim a tax rebate for your uniform washing allowance Union Fees amp

Which Allowance Is Exempt From Epf Evan Sharp

https://blogs.sap.com/wp-content/uploads/2012/12/nlr_1_167421.jpg

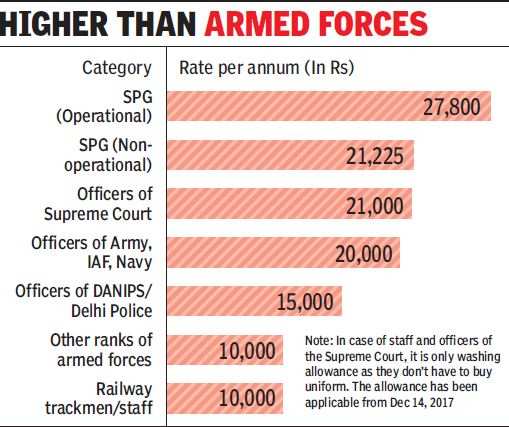

Washing Allowance SC Law Officers To Get Rs 21 000 Yearly As Washing

https://static.toiimg.com/photo/imgsize-61311,msid-62515783/62515783.jpg

https://www.gov.uk/guidance/job-expenses-for-uniforms-work-clothing...

Web 84 lignes nbsp 0183 32 1 janv 2015 nbsp 0183 32 Flat rate expenses sometimes known as a flat rate

https://www.ato.gov.au/Individuals/Income-deductions-offsets-and...

Web If you claim a deduction for laundering washing and drying you must keep details of how you work out your claim If your laundry expenses washing drying and ironing but not

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Which Allowance Is Exempt From Epf Evan Sharp

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Washing Allowance Exemption In Form 16 Under Section 10 Using IT 0582

Seattle City Light Appliance Rebates Clothes Washer Rebate

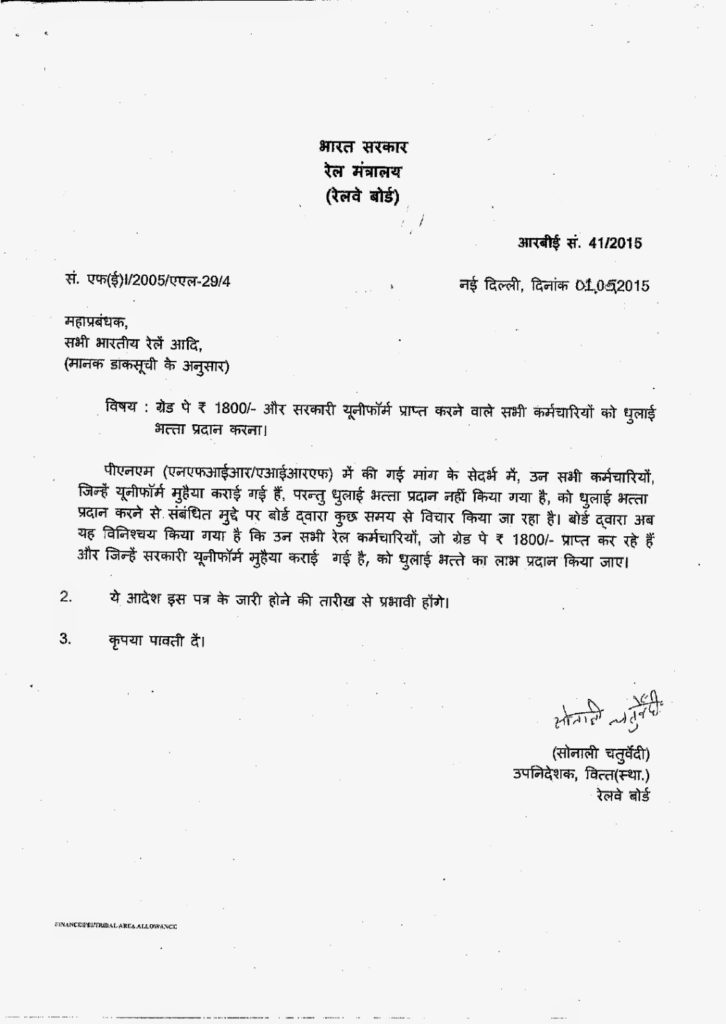

Washing Allowance To All Railway Employees Drawing Grade Pay Of Rs 1800

Washing Allowance Tax Rebate - Web 3 mars 2016 nbsp 0183 32 Claim online Before you start You cannot use this service if you are claiming on behalf of someone else complete Self Assessment tax returns except current year