Washington Dc Tax Deduction Verkko District of Columbia allows limited itemized deductions You may be able to claim most of the same deductions on your District of Columbia income tax return as you do on your Federal return but more limitations and phase outs may exist for higher income taxpayers For more information see the list of District of Columbia itemized

Verkko District of Columbia DC Paycheck Calculator For Salary amp Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator Verkko DC does not allow a deduction for state and local income taxes You can deduct your entire state and local real estate taxes Refer to Calculation D if a part year resident or Calculation F if a full year resident

Washington Dc Tax Deduction

Washington Dc Tax Deduction

https://i.pinimg.com/originals/c1/fe/77/c1fe77bfd3a19358901fe3dcd052a853.jpg

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

IRS Announces Inflation Adjustments To 2022 Tax Brackets Foundation

https://www.ntu.org/Library/imglib/2021/11/ntuf-table1.png

Verkko 1 tammik 2023 nbsp 0183 32 The standard deduction in D C for the 2022 tax year is 12 950 Married couples filing jointly can claim a standard deduction of 25 900 As an alternative you can also claim itemized deductions in D C Verkko Tax Brackets Rates and Standard Deductions in Washington D C Information about income taxes forms tax brackets and rates for Washington D C can be found here by tax year You can prepare and e File your current tax year Washington D C Income Taxes here on eFile together with your Federal Income Tax Return

Verkko 12 tammik 2023 nbsp 0183 32 Standard Deduction The standard deduction has increased for Tax Year 2022 as follows From 12 550 to 12 950 for single and married registered domestic partner filers filing separately From 18 800 Verkko Tax rates The tax rates for tax years beginning after 12 31 2015 and before 1 1 2022 are 4 of the taxable income 400 plus 6 of the excess over 10 000 2 200 plus 6 5 of the excess over 40 000 3 500 plus 8 5 of the excess over 60 000 28 150 plus 8 75 of the excess above 350 000

Download Washington Dc Tax Deduction

More picture related to Washington Dc Tax Deduction

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Pin On Brutalism

https://i.pinimg.com/originals/e4/74/3a/e4743ace263e4e2fa4e558a762dc9af0.jpg

Small Business Creative Tax Deductions Erin Armstrong Blog Taxes

https://i.pinimg.com/736x/bb/a8/05/bba80502cfe1d0e3b72ee6810271085f.jpg

Verkko The District of Columbia Opportunity Zone Tax Benefits available to a DC taxpayer if the taxpayer meets certain criteria are 1 a deferral of a capital gains tax payment for investing in a QOF 2 a reduction of capital gains Verkko What is my standard deduction The DC standard deduction is determined by your filing status as shown below However if you itemize deductions on the federal Form Schedule A you are not entitled to the standard deduction Filing Status Standard Deduction A Single 2 000 B Head of Household 2 000 C Married filing jointly 2 000

Verkko If you lived in the District of Columbia you are required to file a DC tax return However your employer may not be required to withhold DC taxes Use Form D 40 visit Tax Forms Publications and Resources however you must prorate your standard deduction or itemized deductions and your personal exemptions Verkko 30 syysk 2021 nbsp 0183 32 These tax changes will take effect October 1 2021 unless otherwise noted for the following tax types Individual Income Corporation Franchise and Unincorporated Business Taxes The following sources of income will be excluded from the computation of District gross income Unemployment insurance benefits provided

DC Tax Rates 2022 Past Years Internal Revenue Code Simplified

https://www.irstaxapp.com/wp-content/uploads/2022/11/dc-tax-ratesr-2022-1200-×-675-px-1024x576.png

Abolition Of State Tax Deduction Keeps NJ Tax In Check

https://d.newsweek.com/en/full/718411/gettyimages-109917953.jpg

https://www.tax-rates.org/district_of_columbia/income-tax

Verkko District of Columbia allows limited itemized deductions You may be able to claim most of the same deductions on your District of Columbia income tax return as you do on your Federal return but more limitations and phase outs may exist for higher income taxpayers For more information see the list of District of Columbia itemized

https://www.forbes.com/advisor/taxes/paycheck-calculator/district-of...

Verkko District of Columbia DC Paycheck Calculator For Salary amp Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator

What Will My Tax Deduction Savings Look Like The Motley Fool

DC Tax Rates 2022 Past Years Internal Revenue Code Simplified

Tax Deduction 2022 Sonosite

/cloudfront-us-east-1.images.arcpublishing.com/tgam/W6JWPGS5MZAINPGV24C65SXD6Q)

Two Tax deduction Strategies For Procrastinators The Globe And Mail

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

How To Fully Maximize Your 1099 Tax Deductions Steady

How To Fully Maximize Your 1099 Tax Deductions Steady

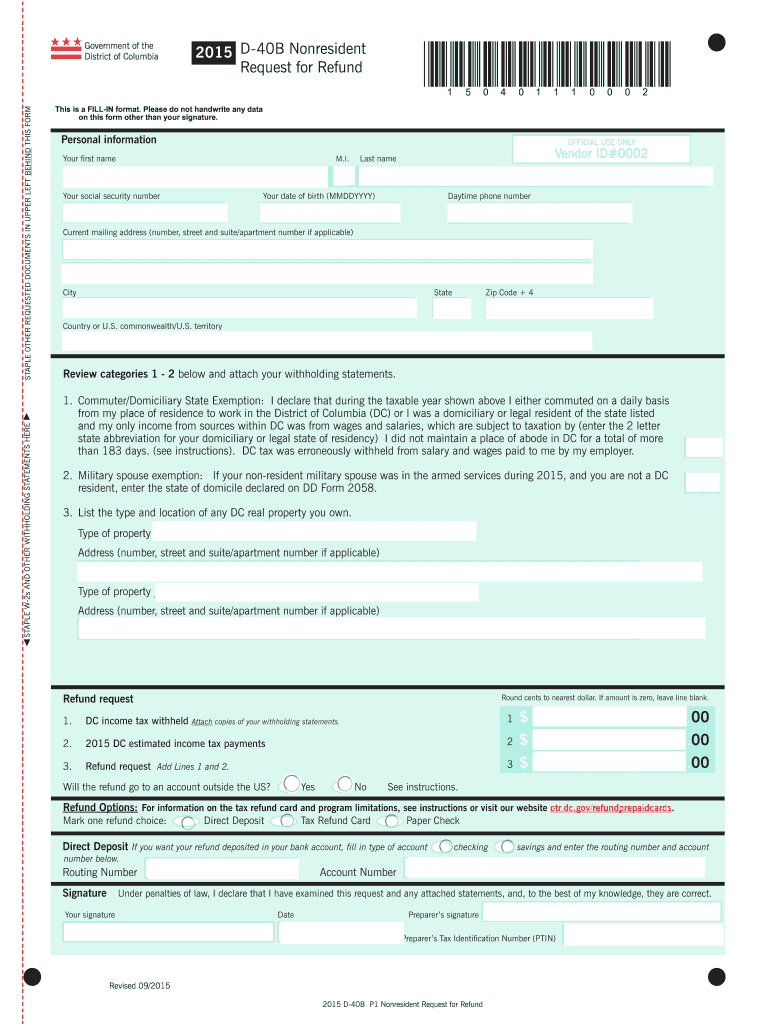

Dc Form D 40b Fill Out And Sign Printable PDF Template AirSlate SignNow

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Illumination Wealth ManagementSection 199A Tax Reduction Strategies

Washington Dc Tax Deduction - Verkko Tax Brackets Rates and Standard Deductions in Washington D C Information about income taxes forms tax brackets and rates for Washington D C can be found here by tax year You can prepare and e File your current tax year Washington D C Income Taxes here on eFile together with your Federal Income Tax Return