Washington Dc Tax Exemption Form Applicants for Income and Franchise Tax Exemption under Sec 47 1802 1 of the DC Code Most organizations recognized by the Internal Revenue Service will qualify for

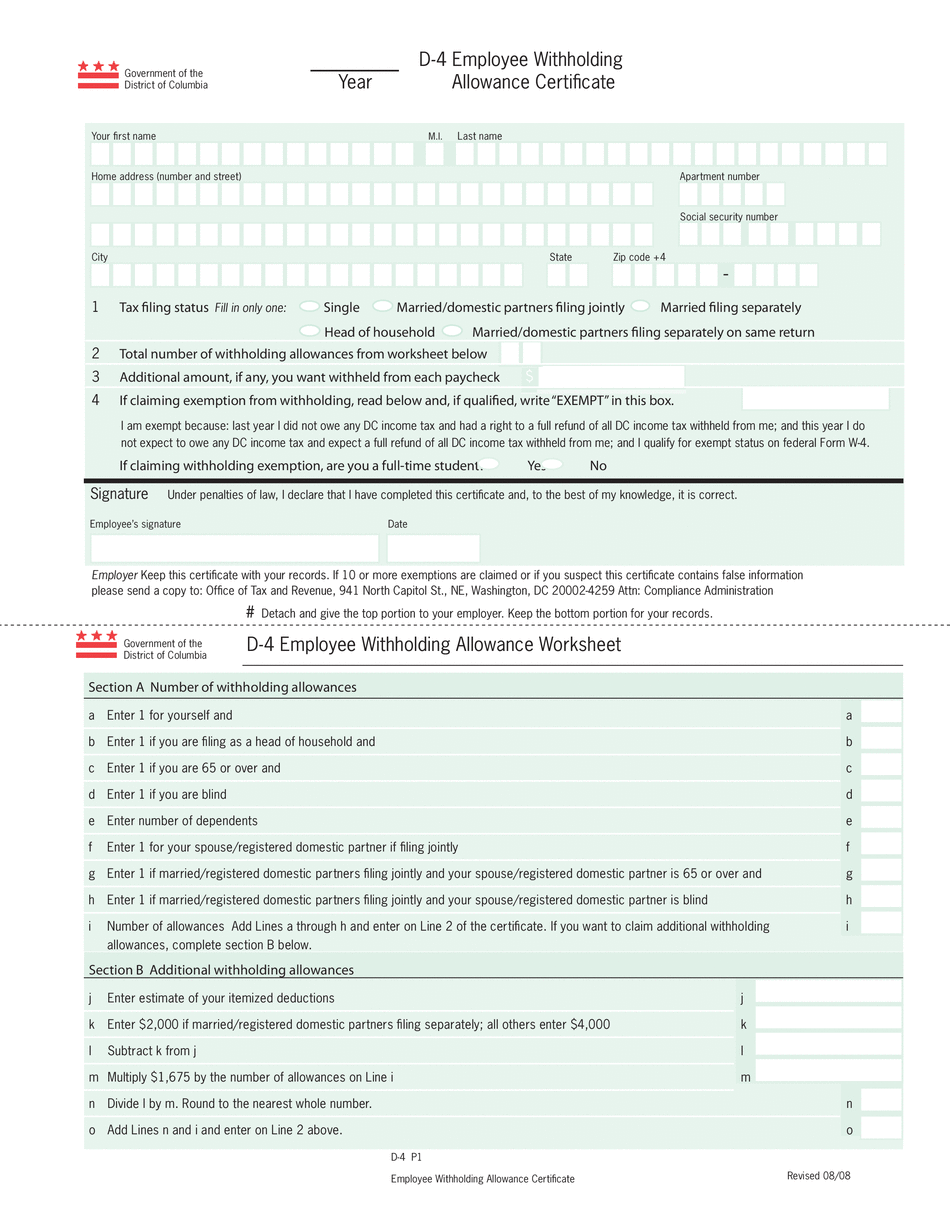

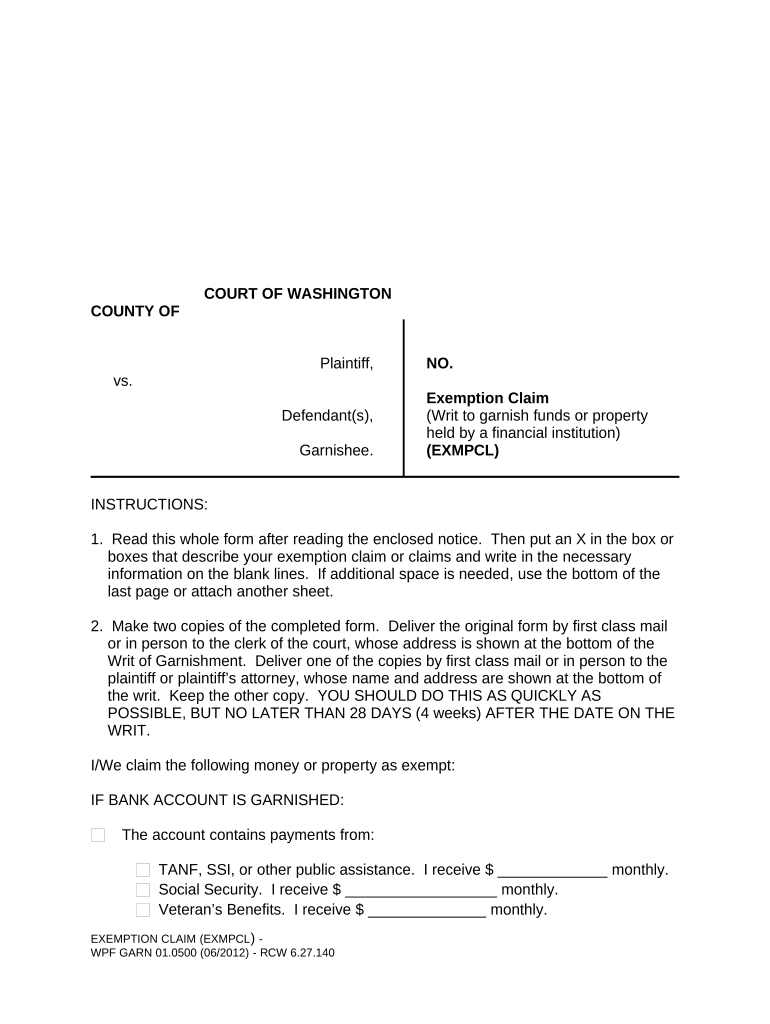

If you are not liable for DC taxes because you are a nonresident you must file Form D 4A Certificate of Nonresidence in the District of Columbia with your employer DC Office of Tax and Revenue Accessibility Privacy and Security Terms and Conditions About DC Gov

Washington Dc Tax Exemption Form

Washington Dc Tax Exemption Form

https://thumbs.docslides.com/265799/texas-hotel-occupancy-tax-exemption-certiother-document-to-v.jpg

Printable Tax Exempt Form

https://i2.wp.com/images.sampletemplates.com/wp-content/uploads/2016/12/19155856/Equipment-Tax-Exemption-Form.jpg

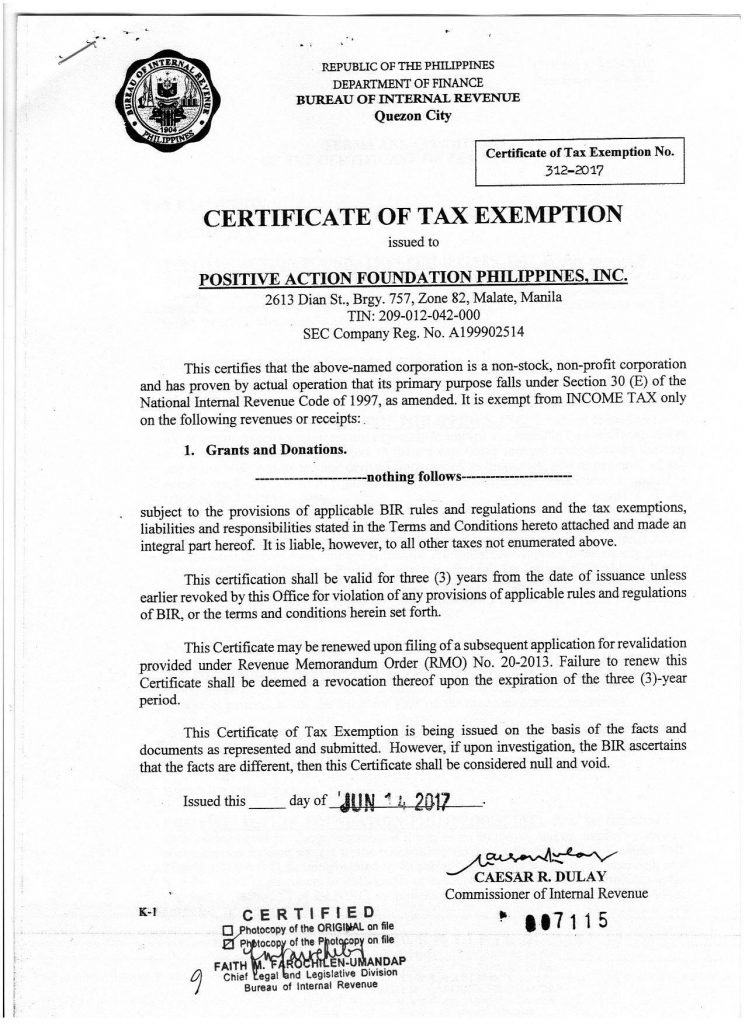

Tax Exemption Certificate Sachet Riset

https://pafpi.org/wp-content/uploads/2017/07/2017-PAFPI-Certificate-of-TAX-Exemption-745x1024.jpg

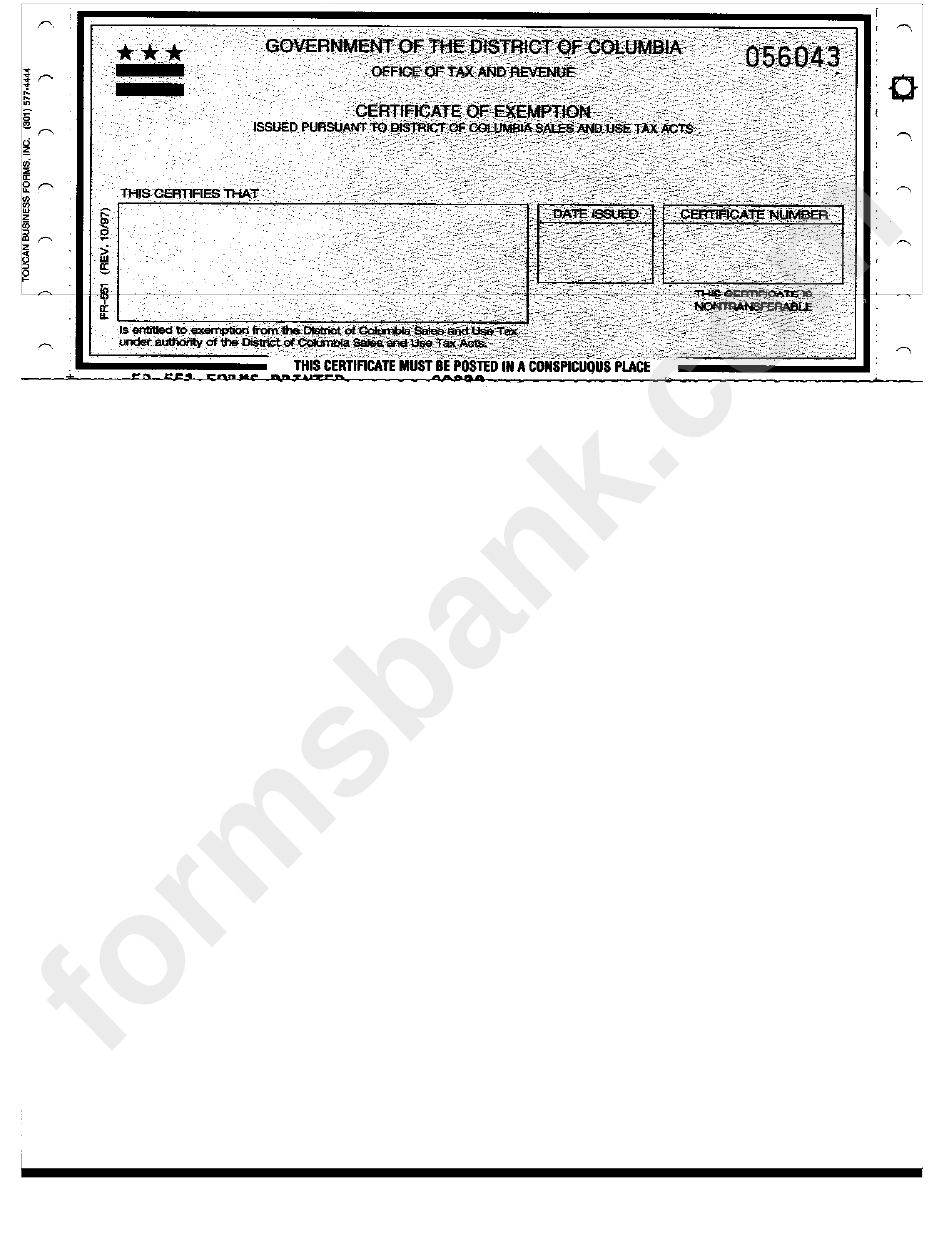

As a reminder effective November 1 business taxpayers can apply for exemption certificates electronically via the Office of Tax and Revenue s OTR tax portal MyTax DC gov If the exemption is This page explains how to make tax free purchases in District of Columbia and lists three District of Columbia sales tax exemption forms available for download

This guidance is useful for federal government employee travelers vendors hotels and restaurants who provide services to federal government employee travelers tax exempt In addition to receiving the Homestead Deduction for your property you may be eligible for either the Senior Citizen Tax Relief or Disabled Tax Relief benefits These benefits

Download Washington Dc Tax Exemption Form

More picture related to Washington Dc Tax Exemption Form

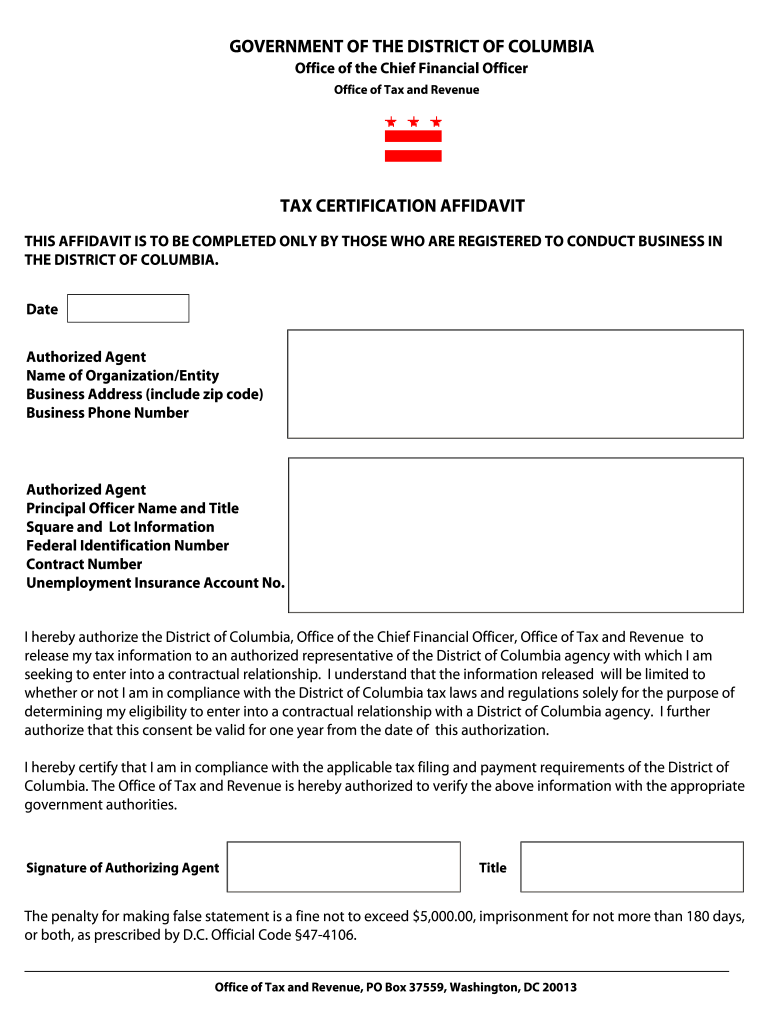

Dc Tax Certification Affidavit Fill Online Printable Fillable

https://www.pdffiller.com/preview/100/79/100079587/large.png

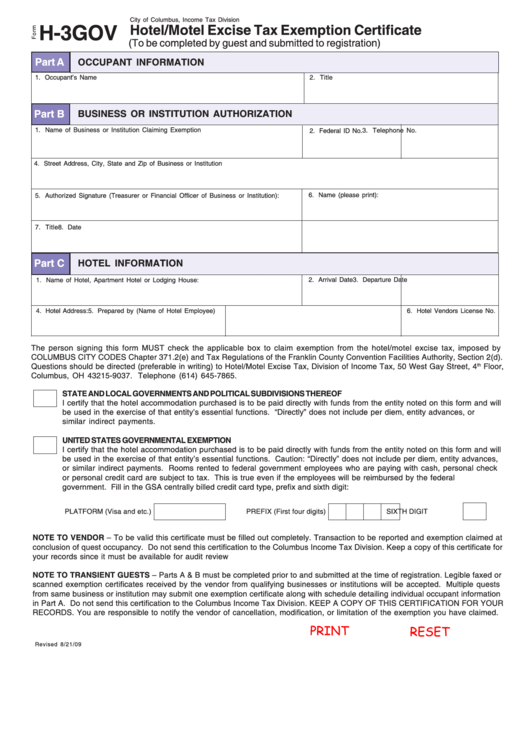

Fillable H 3gov Hotel motel Excise Tax Exemption Certificate

https://data.formsbank.com/pdf_docs_html/43/432/43283/page_1_thumb_big.png

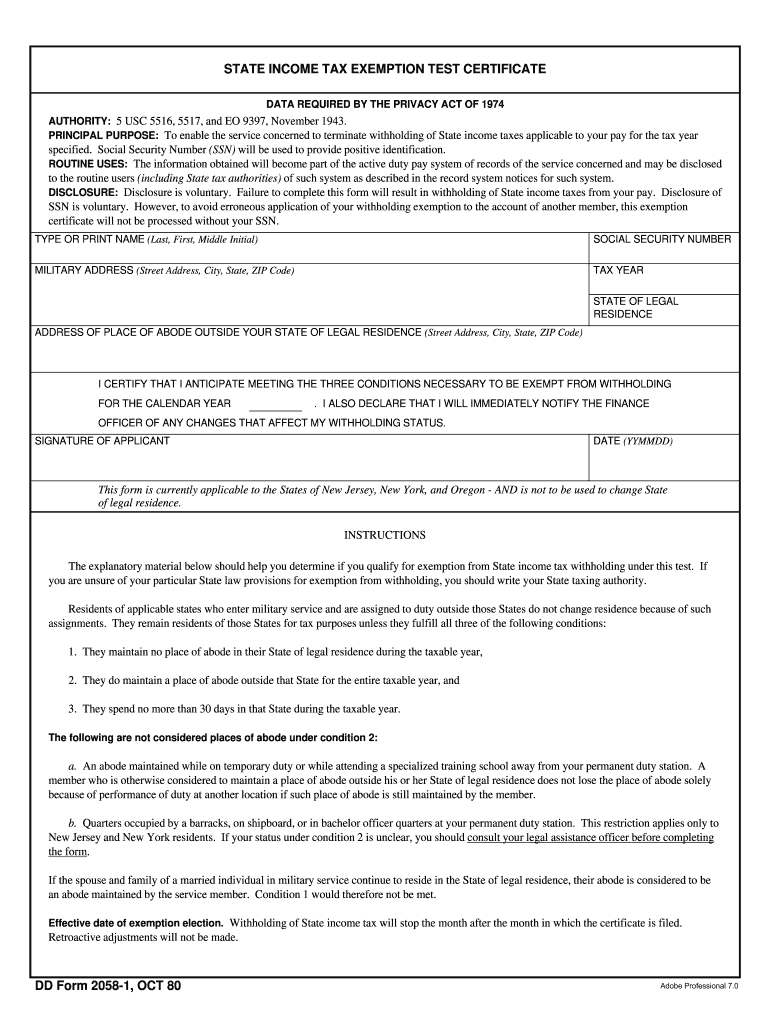

State Exemption Military Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/10/211/10211329/large.png

Tax Forms and Publications In addition to the forms available below the District of Columbia offers several electronic filing services to make filing your taxes simpler Title United States Tax Exemption Form Form SF1094 Current Revision Date 04 2015 Authority or Regulation GSA FAR 48 CFR 53 229 PDF versions of

Attachment s ROD 4 Required for Claiming Exemption from Recordation or Transfer Taxes 131 1 KB pdf Follow Us on X Facebook Mobile Tax on residents and nonresidents Personal exemptions a In the case of a resident the exemptions provided by this section shall be allowed as deductions in

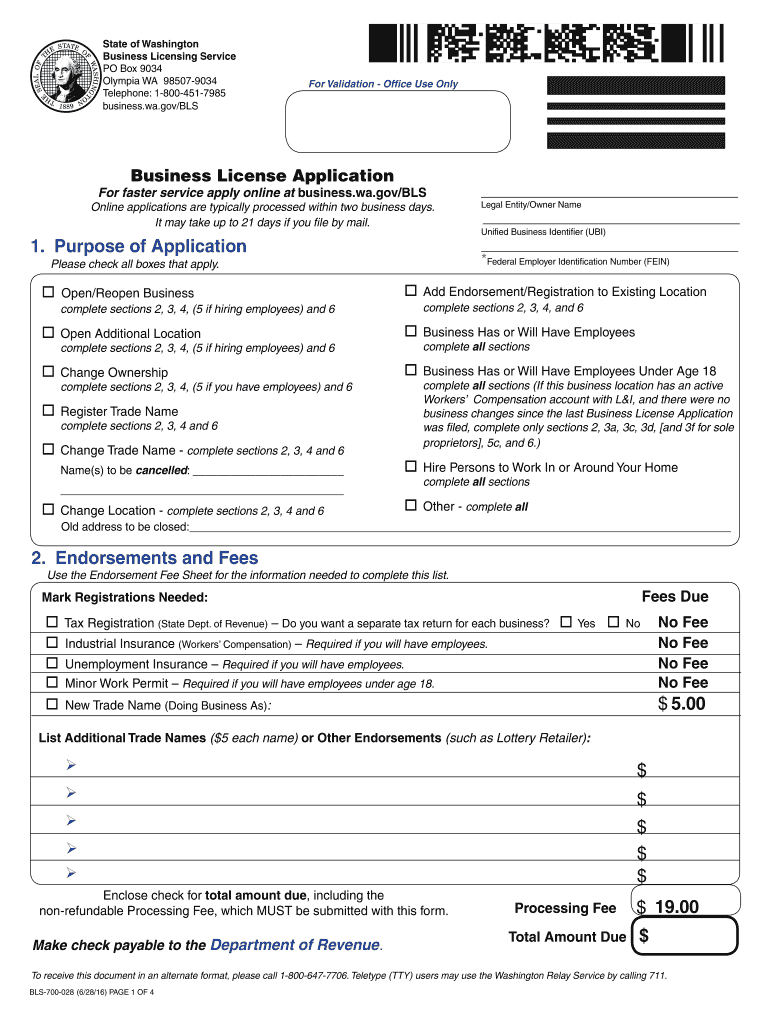

State Tax Exemption Forms TP Tools Equipment

https://cached.tptools.com/Images/dlp/WASHINGTON_v1.png

Employee Dc Tax Withholding Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/d-4-2021-employee-withholding-allowance-certificate-dc-tax-1.png

https://otr.cfo.dc.gov/sites/default/files/dc/...

Applicants for Income and Franchise Tax Exemption under Sec 47 1802 1 of the DC Code Most organizations recognized by the Internal Revenue Service will qualify for

https://www.commerce.gov/sites/default/files/2020...

If you are not liable for DC taxes because you are a nonresident you must file Form D 4A Certificate of Nonresidence in the District of Columbia with your employer

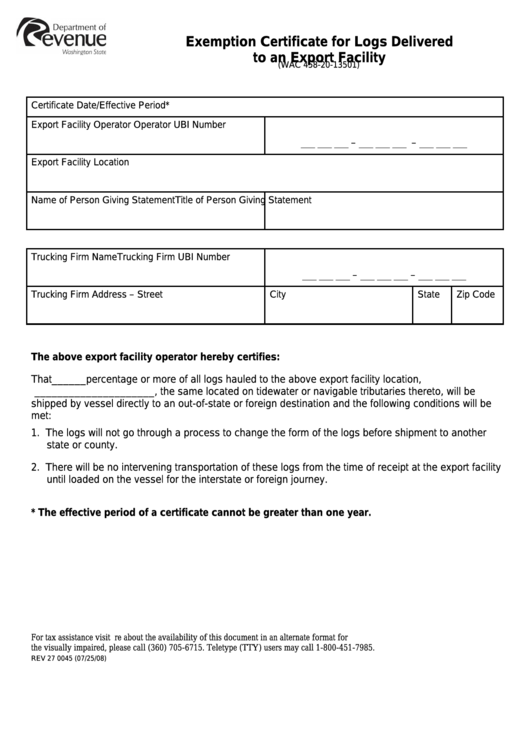

Washington State Certificate Of Exemption Form ExemptForm

State Tax Exemption Forms TP Tools Equipment

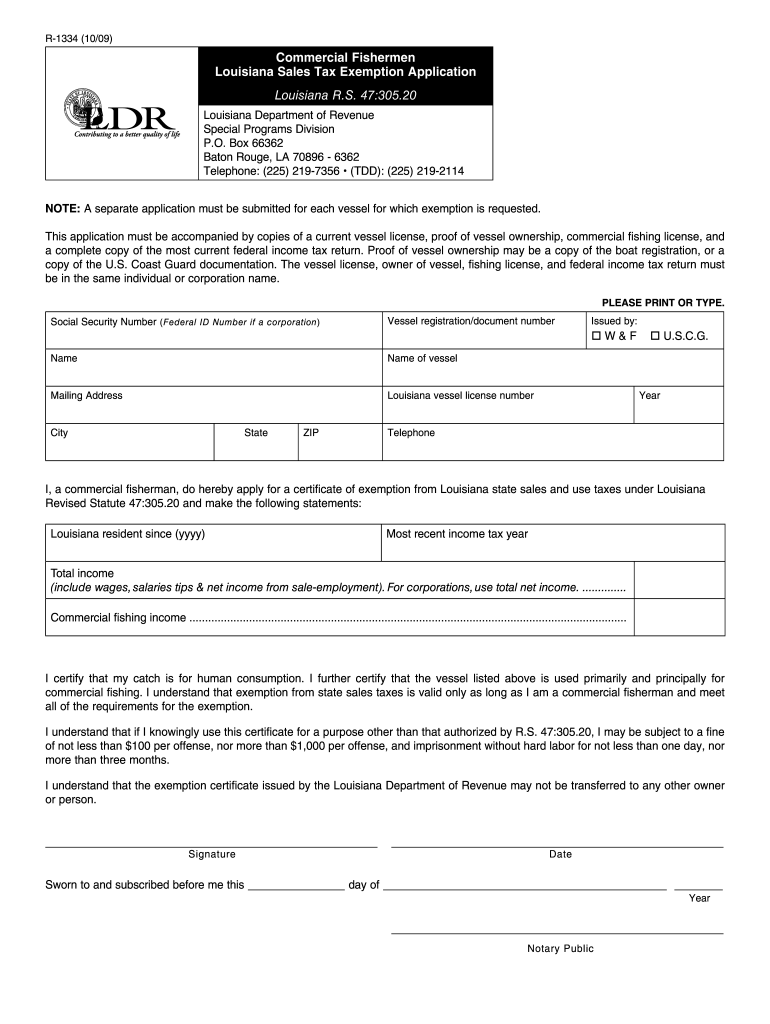

Louisiana Resale Certificate PDF Complete With Ease AirSlate SignNow

Arizona Emissions Exemption Form Fill Out Sign Online DocHub

Exemption Certificate Format TUTORE ORG Master Of Documents

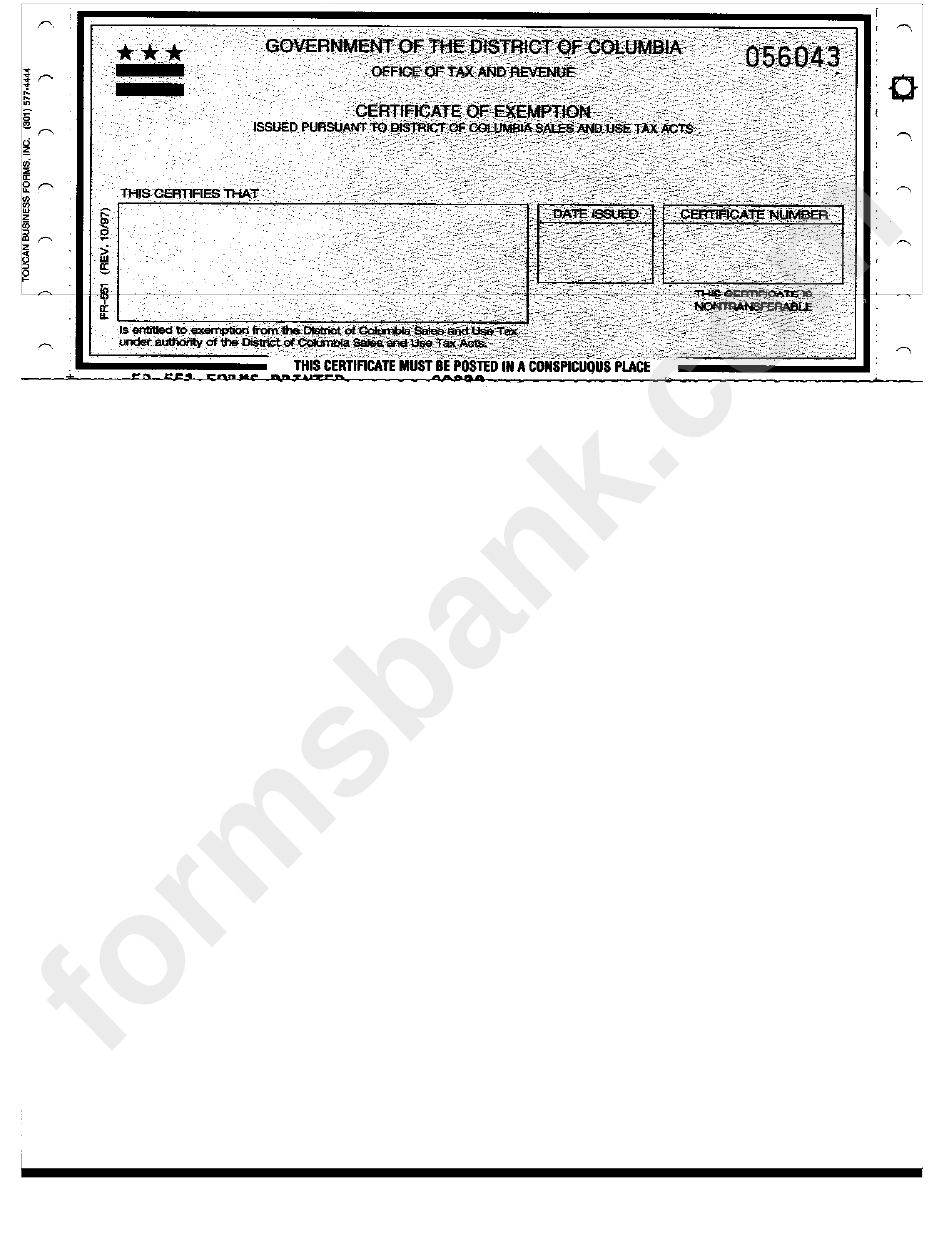

Certificate Of Exemption Form Government Of The District Of Columbia

Certificate Of Exemption Form Government Of The District Of Columbia

Nevada Sales Tax Rates By Zip Code Walden Wong

Mask Exemption Washington State Complete With Ease AirSlate SignNow

Fillable US Washington Tax Forms Samples To Complete Fill Out And

Washington Dc Tax Exemption Form - For the purposes of this subsection the term tax threshold means the point at which a taxpayer begins to owe income tax after allowance of the standard deduction and all