Wear And Tear Tax Return Ireland Web 19 Okt 2023 nbsp 0183 32 The company can claim an allowance known as a wear and tear allowance at a rate of 12 5 of the net cost of the machine for the 12 month accounting period

Web Leasing expenses incurred on replacement car where car is leased rather than purchased Retail price of replacement car when new only relevant where car is leased Web cornerstone of tax policy in Ireland However with the withdrawal of these reliefs taxpayers must now go back to the basics of capital allowances to avail of tax benefits from

Wear And Tear Tax Return Ireland

Wear And Tear Tax Return Ireland

https://live.staticflickr.com/4585/24964852738_a1f97021c5_b.jpg

Wear And Tear My Hands Roel 6x6 Gone Motorcycling Flickr

https://live.staticflickr.com/4023/4281386567_3035585347_b.jpg

Understanding The Normal Wear And Tear On Your Items When Moving

https://readytomovellc.com/wp-content/uploads/Understanding-The-Expected-Wear-And-Tear-scaled.jpg

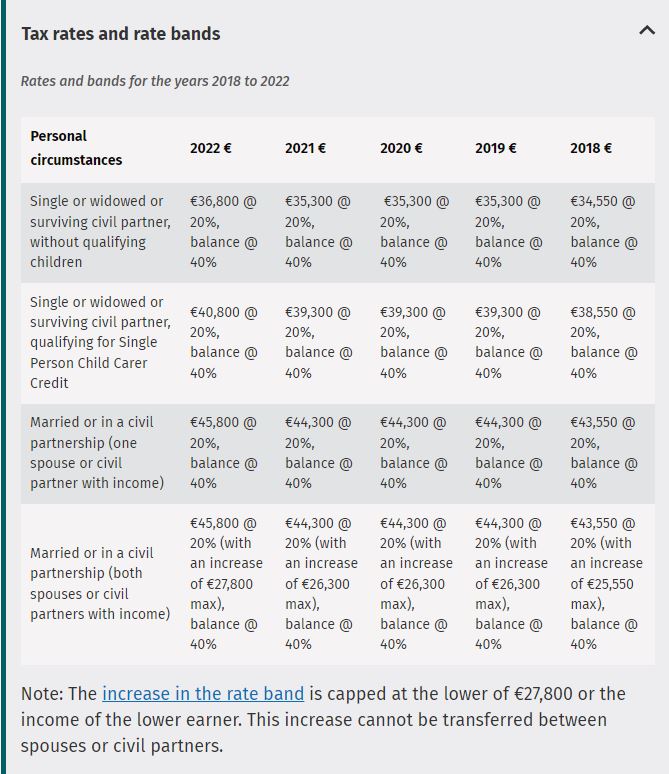

Web 15 Okt 2023 nbsp 0183 32 Annual wear and tear allowance of 12 5 can be claimed over 8 years for the cost of capital expenditure on plant and machinery If a car is for business purposes Web 6 Okt 2023 nbsp 0183 32 Wear and tear allowances for qualifying plant and machinery 12 5 over 8 years Industrial buildings allowances 4 over 25 years Accelerated capital

Web Wear and tear allowances claims for qualifying plant and machinery P amp M claimed at 12 5 over 8 years Plant and machinery analysis for R amp D tax credit claims Industrial Web The write off period for annual wear and tear allowances is eight years for expenditure incurred after 4 December 2002 i e 12 189 per annum on a straight line basis

Download Wear And Tear Tax Return Ireland

More picture related to Wear And Tear Tax Return Ireland

Income Tax Rates 2022 Ireland Been Nice Webcast Photo Galery

https://techlifeireland.com/wp-content/uploads/2016/05/table-revenue.jpg

Don t Believe In Wear And Tear Osteopathy Joint Mobility Movement

https://boroondaraosteopathy.com.au/wp-content/uploads/2020/06/Depositphotos_30458493_s-2019.jpg

Wear And Tear VS Tenant Damage Manchester Lettings Limited

https://www.manlet.co.uk/uploads/news/Broken-Window.jpg

Web n Wear and tear allowances claims for qualifying plant and machinery P amp M claimed at 12 5 over 8 years n Plant and machinery analysis for R amp D tax credit claims n Industrial Web Claim We assisted the client with claims for wear and tear allowances of c 6m and IBAs of c 4 5m Benefit The client received a total tax benefit of c 1 3m

Web 11 Mai 2023 nbsp 0183 32 Landlords can claim capital allowances in their tax return on the cost of furniture and fittings in their property This is known as a wear and tear allowance The Web A special regime of wear and tear allowances 40 per cent per annum on a reducing balance basis applies in the case of taxis and short term hire vehicles see section 286

Wear And Tear Delhi Public School Barra Kanpur

https://dpsbarra.com/wp-content/uploads/2023/07/Wear-and-Tear-6.jpeg

Tax Return Ireland Kimono

https://i2.wp.com/www.taxback.com/resources/blogimages/20200703141544.1593774944701.32b9f8436f010df7d587e6abb62.jpg

https://www.revenue.ie/en/companies-and-charities/corporation-tax-for...

Web 19 Okt 2023 nbsp 0183 32 The company can claim an allowance known as a wear and tear allowance at a rate of 12 5 of the net cost of the machine for the 12 month accounting period

https://www.revenue.ie/en/employing-people/documents/clai…

Web Leasing expenses incurred on replacement car where car is leased rather than purchased Retail price of replacement car when new only relevant where car is leased

Dividend Withholding Tax Declaration Form WithholdingForm

Wear And Tear Delhi Public School Barra Kanpur

Wear And Tear Delhi Public School Barra Kanpur

Commercial Property Tax Depreciation Schedules Explained

Wear And Tear Nation

Wear Pass Excess Wear And Tear Plan Cochrane Toyota

Wear Pass Excess Wear And Tear Plan Cochrane Toyota

Tax Depreciation Schedules For Property Investors Washington Brown

Irish Tax Form Personal Income Tax Form Royalty Free Stock Photo

Wear And Tear Between Urban And Wild

Wear And Tear Tax Return Ireland - Web the amount of the wear and tear allowance to be made shall be an amount equal to 20 per cent of the actual cost of the machinery or plant including in that actual cost any