West Virginia Tax Rebate 2024 1 16 2024 CHARLESTON WV In his State of the State address last week Gov Justice unveiled a tax cut package designed to put more money back into the pockets of West Virginians of all ages The plan includes significant reforms to the state s Social Security income tax child and dependent care credit and senior citizen property tax credit

Go to our Income Tax Cut and Property Tax Rebate Page Income Tax Filing Season Opens January 29 2024 Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Division s primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia January 21 2024 6 24 pm Gov Jim Justice delivers policy proposals during his annual State of the State address Perry Bennett West Virginia Legislative Photography Following on the heels of

West Virginia Tax Rebate 2024

West Virginia Tax Rebate 2024

https://wtov9.com/resources/media2/16x9/full/1015/center/80/1274912c-ee64-4cd0-ae31-3a5027bc5e06-large16x9_taxes.JPG

Virginia 2023 Tax Form Printable Forms Free Online

https://www.pdffiller.com/preview/577/777/577777503/large.png

How Much Is Virginia Inheritance Tax Have Severe Blogs Photo Gallery

https://files.taxfoundation.org/20210329162318/State-Throwback-and-Throwout-Rules-for-Sales-of-Tangible-Property-West-Virginia-income-tax-repeal-proposal.-Explore-Governor-Jim-Justice-income-tax-proposal..png

West Virginia House Bill 2526 approved during the 2023 regular session of the West Virginia Legislature immediately reduces the income tax in tax year 2023 by an average of 21 25 percent The legislation also provides for a number of refundable tax credits for payment of property taxes Hardy said there will be a line on the state income tax return in 2024 that allows West Virginians to claim the personal property tax credit He said 2024 is the transition year and every

Taxpayers who pay their personal property taxes on time will receive a rebate on their 2024 income tax return even if the second half was paid in 2023 That is the return that taxpayers file in 2025 Everyone is eligible for this credit except for motor vehicle dealers So how will you get that When you file your state income taxes for 2024 that will of course be in the spring of 2025 there will be a line on your state income tax return that will allow

Download West Virginia Tax Rebate 2024

More picture related to West Virginia Tax Rebate 2024

Fillable West Virginia Tax Form It 140 Printable Forms Free Online

https://www.pdffiller.com/preview/102/2/102002702/large.png

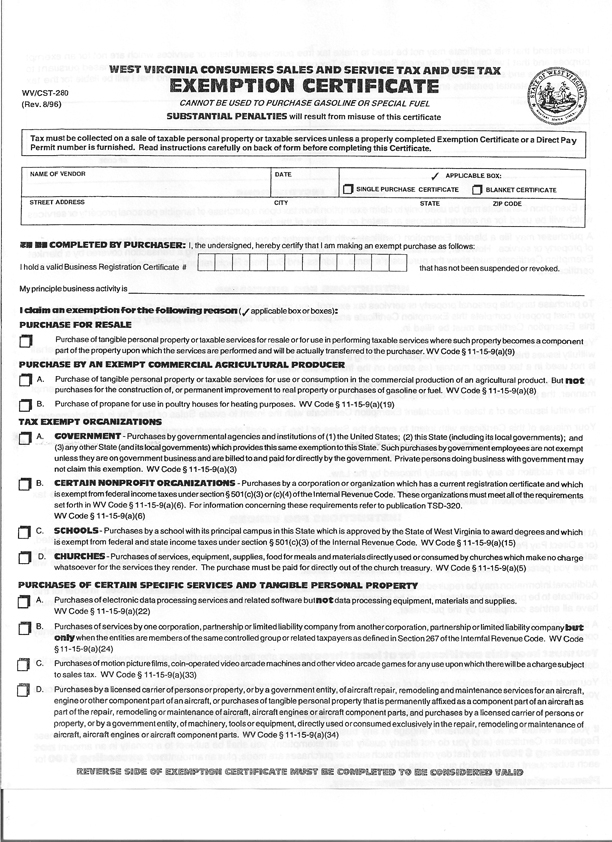

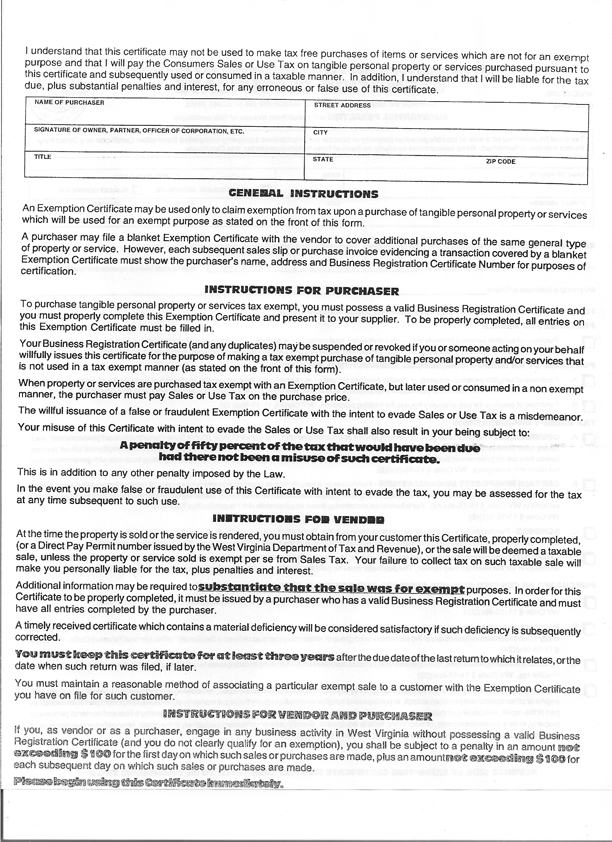

West Virginia Tax Exemption Certificate Form ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/west-virginia-tax-exempt-3.jpg

Wv Tax Exempt Form Fill Online Printable Fillable Blank PdfFiller ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/west-virginia-tax-exempt-7.jpg

Rebates from 2024 will return to residents in 2025 Although Johnson is working to promote the possible credits the rebates and the taxes themselves are unrelated to the assessors office This motor vehicle tax rebate program will provide relief to eligible taxpayers in West Virginia for the 2024 tax filing season Under the program eligible taxpayers will receive a tax credit equal to 100 of their motor vehicle personal property tax payment against personal and corporate net income taxes paid timely on motor vehicles

Taxpayers that do not owe WV income taxes and are not required to file a WV income tax return will be able to file a claim for a rebate in early 2025 of their Motor Vehicle property taxes paid Continue to check tax wv gov for more information and form requirements as they become available HB 2526 is a compromise with Justice and the House on one side and the Senate on the other side combining part of the governor s original proposal for a 50 cut in personal income tax rates

Virginia Tax Rebate 2024

https://www.taxuni.com/wp-content/uploads/2023/01/Virginia-Tax-Rebate-1024x576.jpg

Virginia Taxpayers One Time Tax Rebate Washington DC CPA

https://www.cbmcpa.com/wp-content/uploads/2022/07/Social-Media-Header-Virginia-Tax-Rebate.jpg

https://governor.wv.gov/News/press-releases/2024/Pages/-Gov.-Justice-proposes-major-tax-relief-for-West-Virginians.aspx

1 16 2024 CHARLESTON WV In his State of the State address last week Gov Justice unveiled a tax cut package designed to put more money back into the pockets of West Virginians of all ages The plan includes significant reforms to the state s Social Security income tax child and dependent care credit and senior citizen property tax credit

http://www.tax.wv.gov/

Go to our Income Tax Cut and Property Tax Rebate Page Income Tax Filing Season Opens January 29 2024 Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the West Virginia Tax Division s primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia

Chart 4 West Virginia Local Tax Burden By County FY 2015 JPG West Virginia Virginia Burden

Virginia Tax Rebate 2024

West Virginia Tax Return Change Sample 1

West Virginia s Income Tax Elimination Plan Has Supporters Critics News Sports Jobs

How To Get Your 250 Or 500 Virginia Tax Rebate WSET

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

Gov Justice Submits Legislation To Repeal Personal Income Tax Putting More Money In Every West

500 Virginia Tax Rebate Checks You Still Have 10 Days To Claim It 24 7 Wall St

2023 Virginia Tax Rebate How To Claim Your State Tax Refund Tax Rebate

West Virginia Tax Rebate 2024 - Hardy said there will be a line on the state income tax return in 2024 that allows West Virginians to claim the personal property tax credit He said 2024 is the transition year and every