What Age Do You Get Property Tax Exemption As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending on the state you live in and often

Senior Citizens and Tax Relief Senior citizens particularly those 65 years of age or older may qualify for exemptions like the standard homestead exemption or Tax on property You have to pay tax to the Finnish Tax Administration on inheritance valuable gifts rent income sales profits investment income and real estate for

What Age Do You Get Property Tax Exemption

What Age Do You Get Property Tax Exemption

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

Out Of State Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/36/638/36638765/large.png

Difference Between Tax Exemption Tax Deduction And Tax Rebate The

https://economictimes.indiatimes.com/img/60155156/Master.jpg

Qualifications The exemption program qualifications are based of of age or disability ownership occupancy and income Details of each qualification follows Age Individuals 65 Years of Age and Older May Claim a 4 000 Exemption Individuals 65 years of age or over may claim a 4 000 exemption from all county ad valorem taxes if

This annual exemption is available for property that is occupied as a residence by a person 65 years of age or older who is liable for paying real estate taxes on the property and is Gains from the sale of property are included in the income from capital category and taxed at progressive rates from 30 to 34 Gains not exceeding 1 000

Download What Age Do You Get Property Tax Exemption

More picture related to What Age Do You Get Property Tax Exemption

Homestead Related Tax Exemptions Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/547/892/547892759/large.png

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

http://www.propertytax.lacounty.gov/images/Tax-Bills/adjbill2016.gif

At What Age Do You Stop Paying Property Taxes In AZ YouTube

https://i.ytimg.com/vi/pfxGNxaKVzM/maxresdefault.jpg

For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes The biggest Under the new rules all homeowners over the age of 62 are eligible to have their property taxes frozen at 2024 levels starting in 2025 and their tax amount will

You may be eligible for real property tax relief in most Virginia cities and counties if you are 65 years old or have a disability regardless of age You may also qualify for additional There are two ways that seniors in Florida may get an additional exemption from property taxes or even be completely exempt from property taxes Here s how

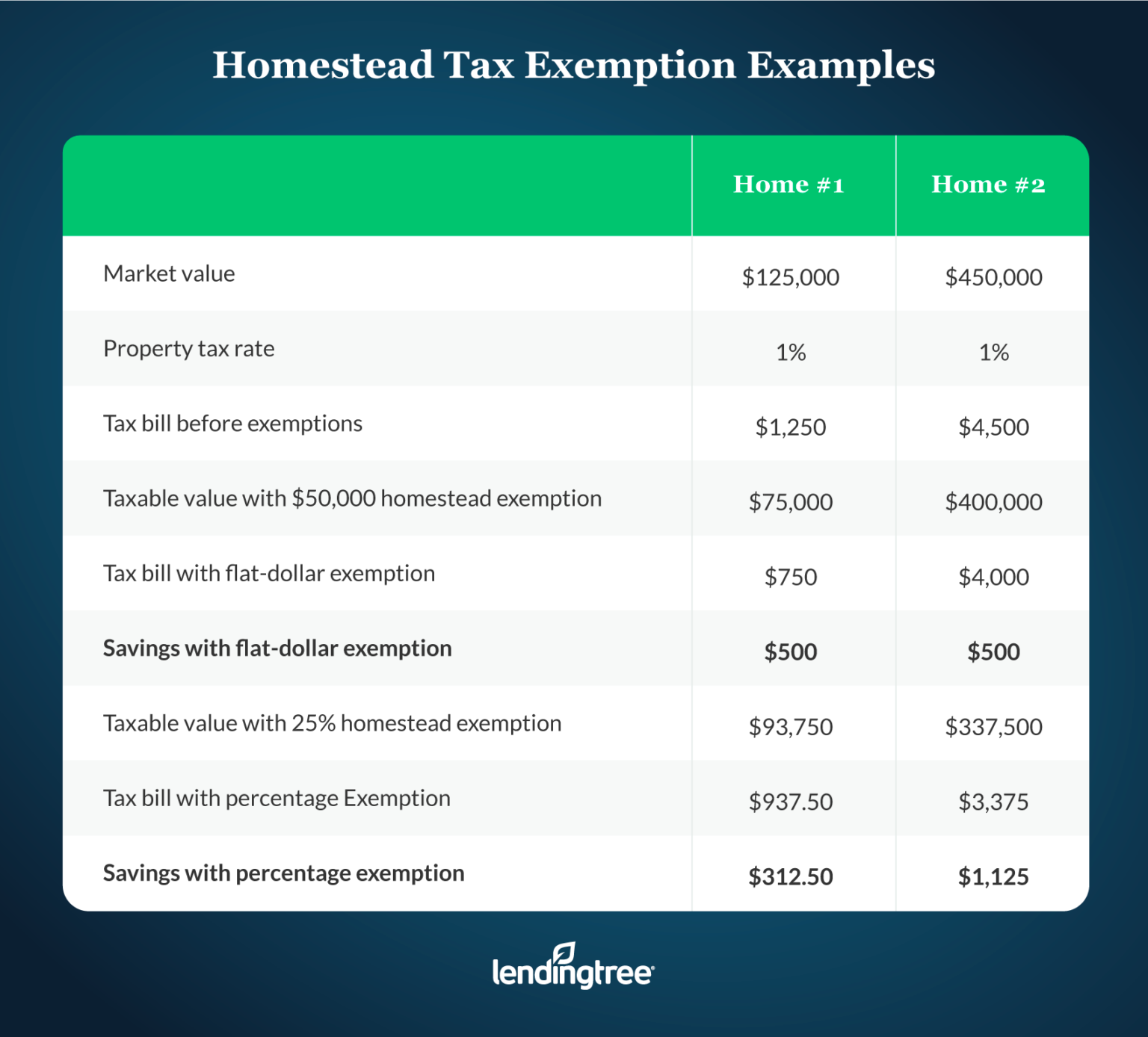

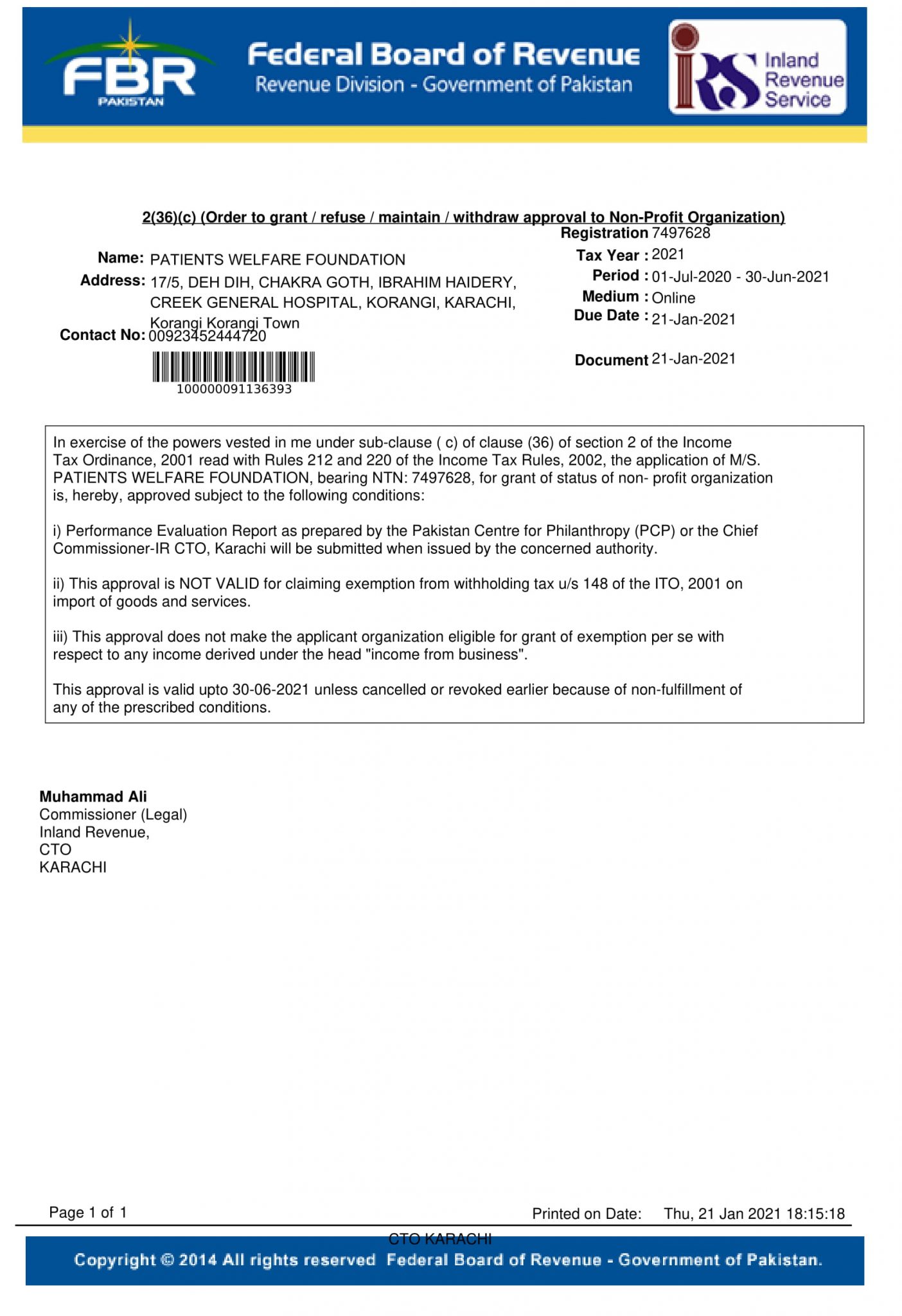

What Is A Homestead Exemption And How Does It Work LendingTree

https://www.lendingtree.com/content/uploads/2020/12/Homestead-Tax-Exemption-Examples-1536x1388.png

Property Tax Exemptions Do You Qualify

https://pics.harstatic.com/content/hr/749-775_pic.jpg

https://smartasset.com/retirement/at-what-age-do...

As a senior citizen you probably will end up paying property taxes for as long as you are a homeowner However depending on the state you live in and often

https://www.taxfyle.com/blog/property-tax-exemptions

Senior Citizens and Tax Relief Senior citizens particularly those 65 years of age or older may qualify for exemptions like the standard homestead exemption or

18 States With Full Property Tax Exemption For 100 Disabled Veterans

What Is A Homestead Exemption And How Does It Work LendingTree

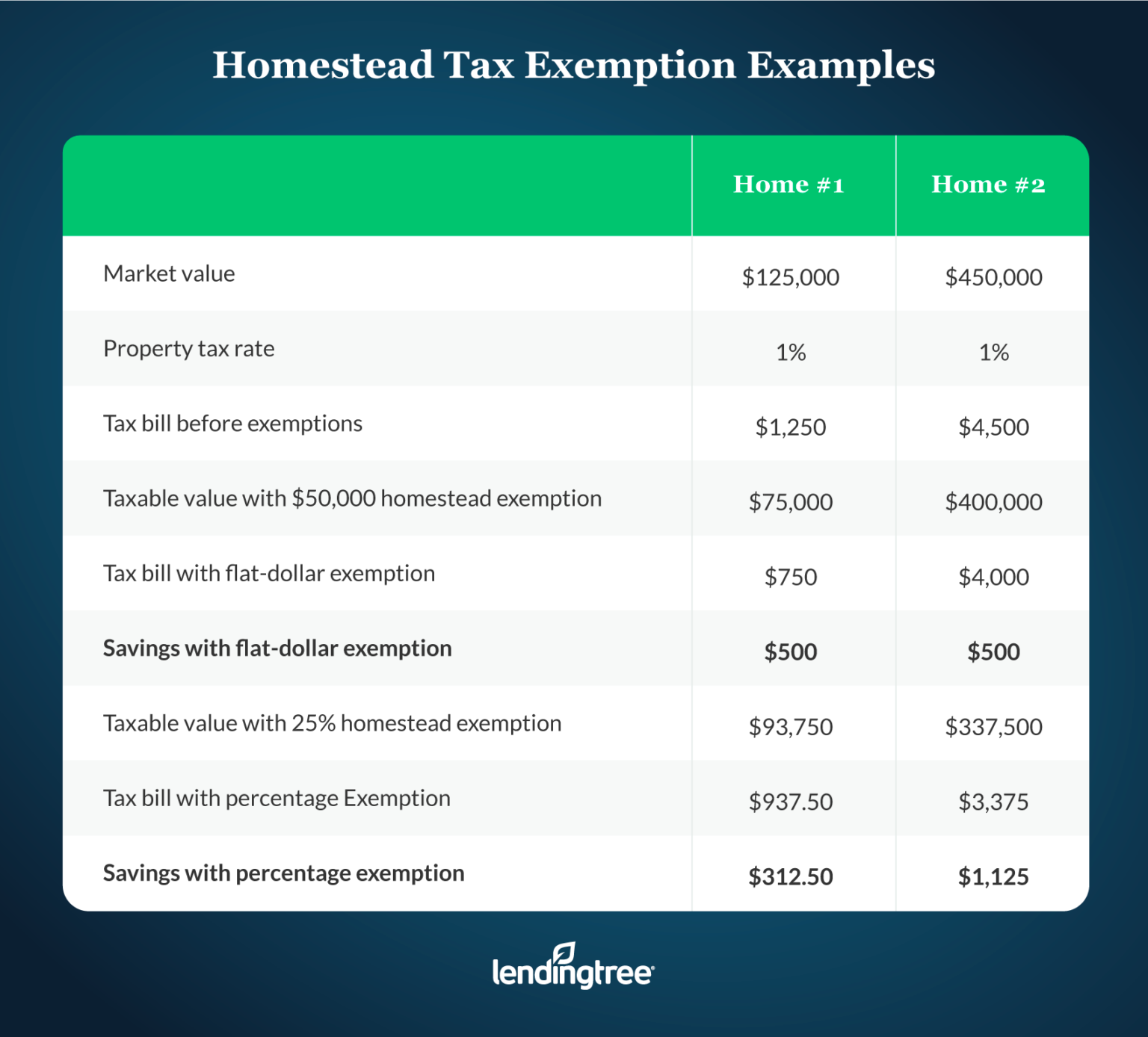

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Estate Tax Exemption Level Tax Policy Center

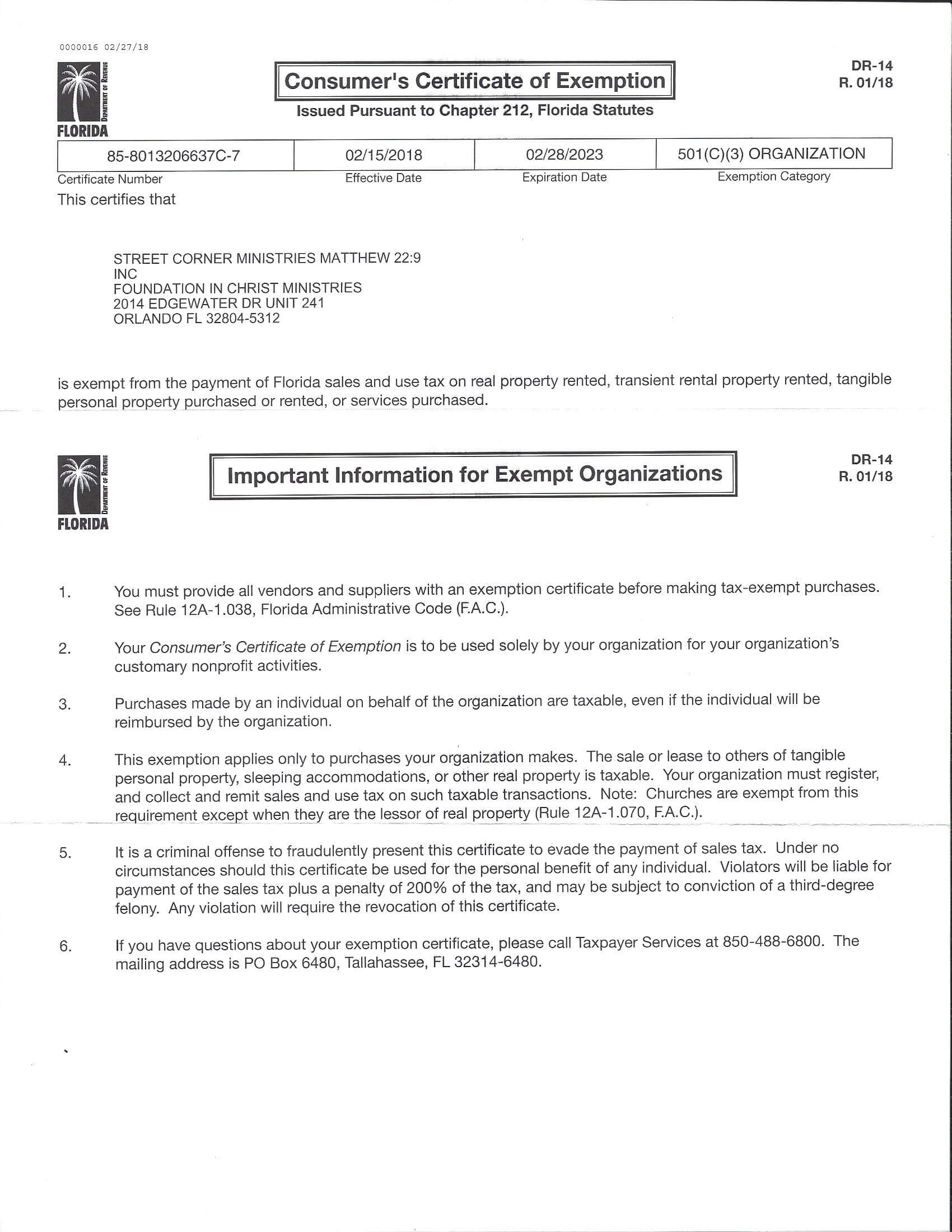

Tax Exemption Certificate PWF Pakistan

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

Ca Sales Tax Exemption Certificate Resale Fill Online Printable

Texas Homestead Tax Exemption Cedar Park Texas Living

Printable Exemption Form From Garnishment Printable Forms Free Online

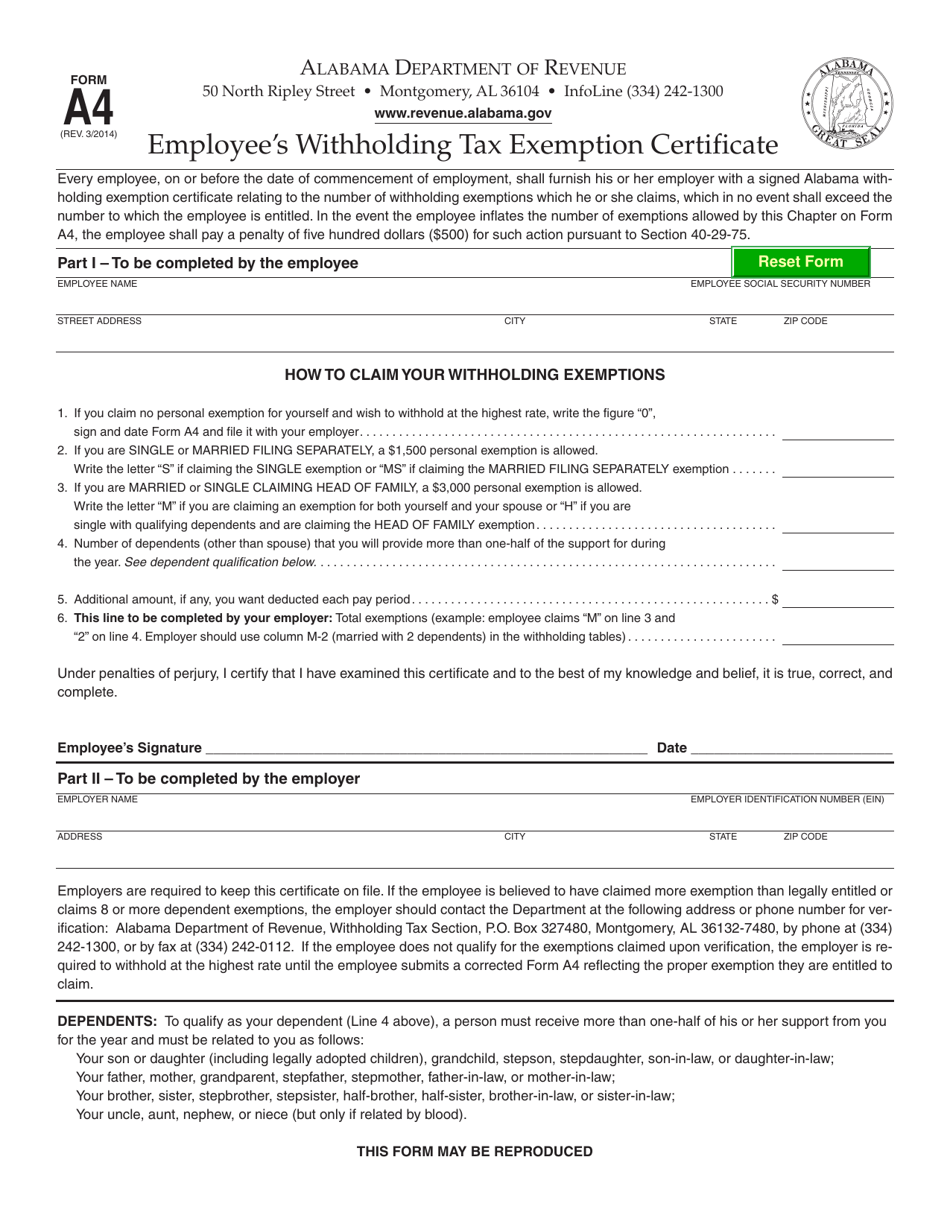

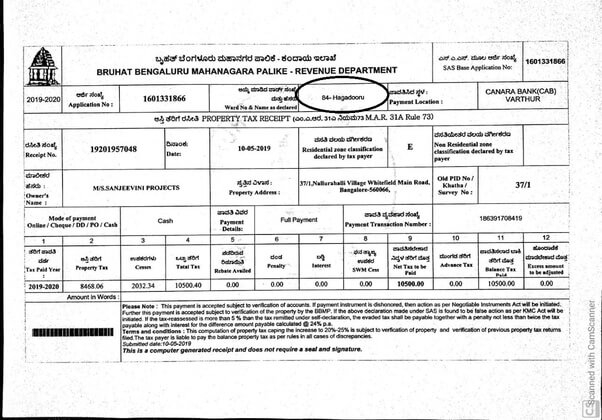

How Can I Get My Property Tax ID In Bangalore

What Age Do You Get Property Tax Exemption - The widow widower must be at least sixty two years of age by December 31 of the year the taxes are due OR be retired from regular gainful employment by reason of disability