What Age Does Child Tax Credit Phase Out 1 Age test For these tax years a child must have been under age 17 i e 16 years old or younger at the end of the tax year for which you claim the credit 2 Relationship test The child must be your own child a stepchild or a foster child placed with you by a court or authorized agency

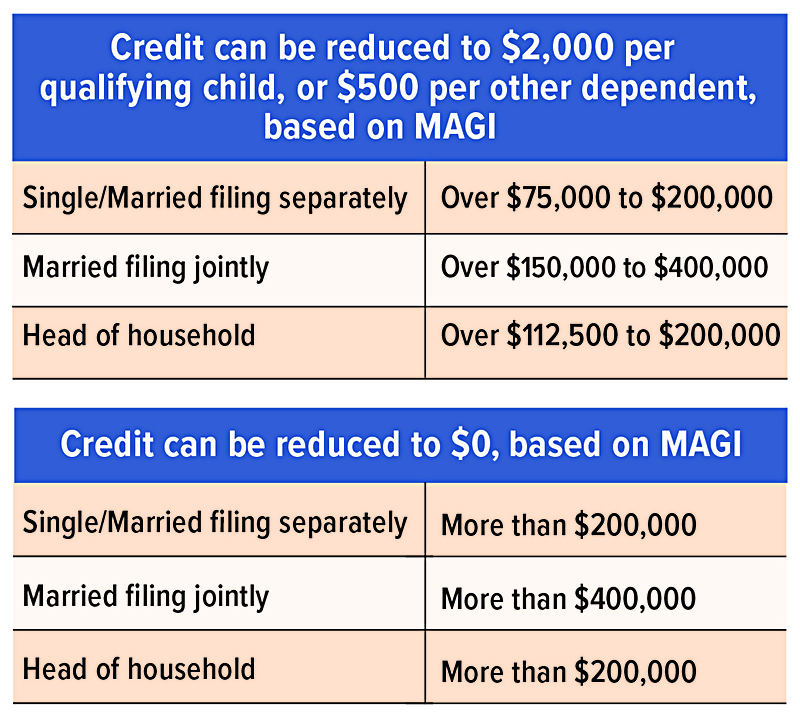

The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021 The first phaseout can reduce the Child Tax Credit to 2 000 per child That is the first phaseout step can reduce only the 1 600 increase for qualifying children ages 5 and under and the 1 000 increase for qualifying To qualify for the credit the taxpayer s dependent must generally be under the age of 17 and must have a Social Security number The full benefit is available to people whose income did not

What Age Does Child Tax Credit Phase Out

What Age Does Child Tax Credit Phase Out

https://www.courier-journal.com/gcdn/-mm-/a75b61cdf29c924e642301138dcb5b5b73c5e5d5/c=0-30-1998-1159/local/-/media/2018/01/31/Louisville/Louisville/636530052069237063-IMG-3796.jpg?width=1998&height=1129&fit=crop&format=pjpg&auto=webp

/cdn.vox-cdn.com/uploads/chorus_asset/file/24264256/GettyImages_1369365884a.jpg)

At What Age Does Child Tax Credit Stop Leia Aqui Does My 21 Year Old

https://cdn.vox-cdn.com/thumbor/fr6s_fhUdnuJVAVrbwyCH1WX308=/1400x1400/filters:format(jpeg)/cdn.vox-cdn.com/uploads/chorus_asset/file/24264256/GettyImages_1369365884a.jpg

Child Tax Credit 2022 Income Phase Out Latest News Update

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/t21-0190.gif

The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers A7 The Child Tax Credit is reduced phased out in two different steps which are based on your modified adjusted gross income AGI in 2021 The first phaseout can reduce the Child Tax Credit down to 2 000 per child

The most important provision of the expanded CTC was doubling the amount of money that families could claim per child on their 2021 tax return Before this amount was increased the child tax credit was 1 800 per child under six and 1 500 per child between ages six and 16 For the 2021 income tax filing season families can now claim For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that you file by April 15 2024 or by

Download What Age Does Child Tax Credit Phase Out

More picture related to What Age Does Child Tax Credit Phase Out

2023 2024 Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

New Child Tax Rebate Available Applications Being Accepted Now

https://www.cthousegop.com/mccarty/wp-content/uploads/sites/44/2022/05/Baz-child-tax-credit.png

Does The Child Tax Credit Continue In 2022 Must Know For Parents

https://media.marketrealist.com/brand-img/SWwYe-NBr/0x0/does-child-tax-credit-continue-2022-1642613456076.jpg

In addition to the rules above your child must have been under the age of 17 at the end of 2023 This means a child who turns 17 during the tax year doesn t qualify for the purpose of the Tax Changes and Key Amounts for the 2022 Tax Year Parents with higher incomes also have two phase out schemes to worry about for 2021 The first one applies to the extra credit amount added to

The total credit is up to 3 600 for each child under age 6 and up to 3 000 for each child age 6 to 17 Monthly payments will be 250 for older children and 300 for younger ones Previously Published 18 29 ET Dec 7 2022 Updated 18 36 ET Dec 7 2022 YOUR child tax credit rebates are mostly dependent on your income Last year the child tax credit CTC was temporarily boosted to a maximum of 3 600 under the American Rescue Act 1 The expanded child tax credit was not renewed and is reverting back to 2 000

Child Tax Credit Vs Dependent Care Fsa Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Does The Child Tax Credit Phase Out YouTube

https://i.ytimg.com/vi/LrYNlJLfn7U/maxresdefault.jpg

https://turbotax.intuit.com/tax-tips/family/7...

1 Age test For these tax years a child must have been under age 17 i e 16 years old or younger at the end of the tax year for which you claim the credit 2 Relationship test The child must be your own child a stepchild or a foster child placed with you by a court or authorized agency

/cdn.vox-cdn.com/uploads/chorus_asset/file/24264256/GettyImages_1369365884a.jpg?w=186)

https://www.irs.gov/credits-deductions/2021-child...

The Child Tax Credit phases out in two different steps based on your modified adjusted gross income AGI in 2021 The first phaseout can reduce the Child Tax Credit to 2 000 per child That is the first phaseout step can reduce only the 1 600 increase for qualifying children ages 5 and under and the 1 000 increase for qualifying

Earned Income Credit Calculator 2021 DannielleThalia

Child Tax Credit Vs Dependent Care Fsa Kitchen Cabinet

The Child Tax Credit Is Coming Here s What To Expect From The IRS

Child Tax Credit For 2021 Will You Get More Velocity Retirement

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

Month 2 Of Child Tax Credit Hits Bank Accounts AP News

7 Important Money Matters Every New Mom Forgets Like The Child Tax Credit

Your First Look At 2023 Tax Brackets Deductions And Credits 3

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

What Age Does Child Tax Credit Phase Out - For tax year 2023 you can claim the child tax credit and the additional child tax credit on the federal tax return Form 1040 or 1040 SR that you file by April 15 2024 or by