What Age Is Senior Property Tax Exemption In Illinois The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

Most senior homeowners are eligible for this exemption if they are 65 years of age or older born in 1958 or prior and own and occupy their property as their principal place of residence Once this exemption is applied the Assessor s Office automatically renews it Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of 65 000 or less in the 2022 calendar year A Senior Freeze Exemption provides property tax savings by freezing the equalized assessed value EAV of an eligible property

What Age Is Senior Property Tax Exemption In Illinois

What Age Is Senior Property Tax Exemption In Illinois

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

Senior Citizen Property Tax Exemption California Form Riverside County

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/how-to-apply-for-senior-property-tax-exemption-in-california-prorfety.jpg?fit=1080%2C1349&ssl=1

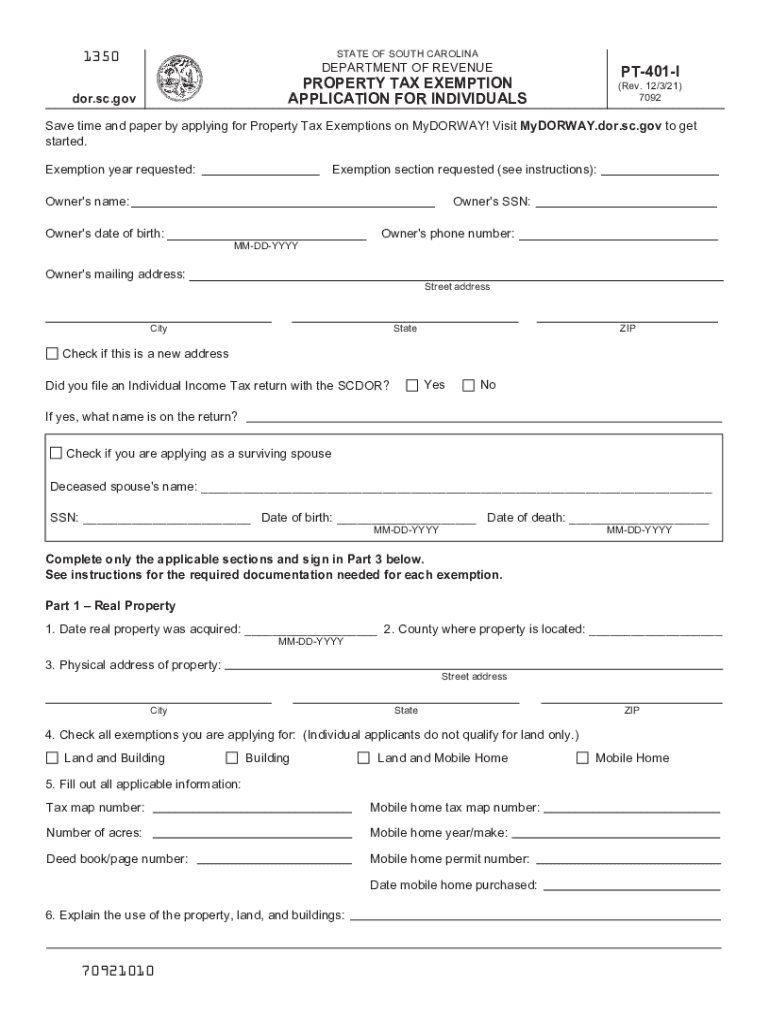

2021 Form SC PT 401 I Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/586/132/586132282/large.png

Be 65 years of age or older Own and live in the property as their principal residence To Apply All applications must be submitted online through the Smartfile E Filing Portal There is no annual renewal for this exemption Applicants will need to provide proof of age ex driver s license state ID Senior Citizen Homestead Exemption Seniors can save on average up to 300 a year in property taxes and up to 750 when combined with the Homeowner Exemption The applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older during the tax year in question

To receive the Senior Citizen Homestead Exemption the applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older during the tax year in question To apply Cook County Assessor s Office 118 North Clark Street Room 320 Chicago IL 60602 312 443 7550 The Senior Freeze Exemption provides tax relief to eligible homeowners who meet age and income requirements see below and whose homes have drastically increased in value It allows qualified seniors to apply to freeze their home s equalized assessed value EAV for the year in which they apply and qualify

Download What Age Is Senior Property Tax Exemption In Illinois

More picture related to What Age Is Senior Property Tax Exemption In Illinois

Senior Property Tax Exemptions 101 How You Can Save Big

https://na.rdcpix.com/0f6ea462159088aa63055d8d4f552cacw-c2145427720srd_q80.jpg

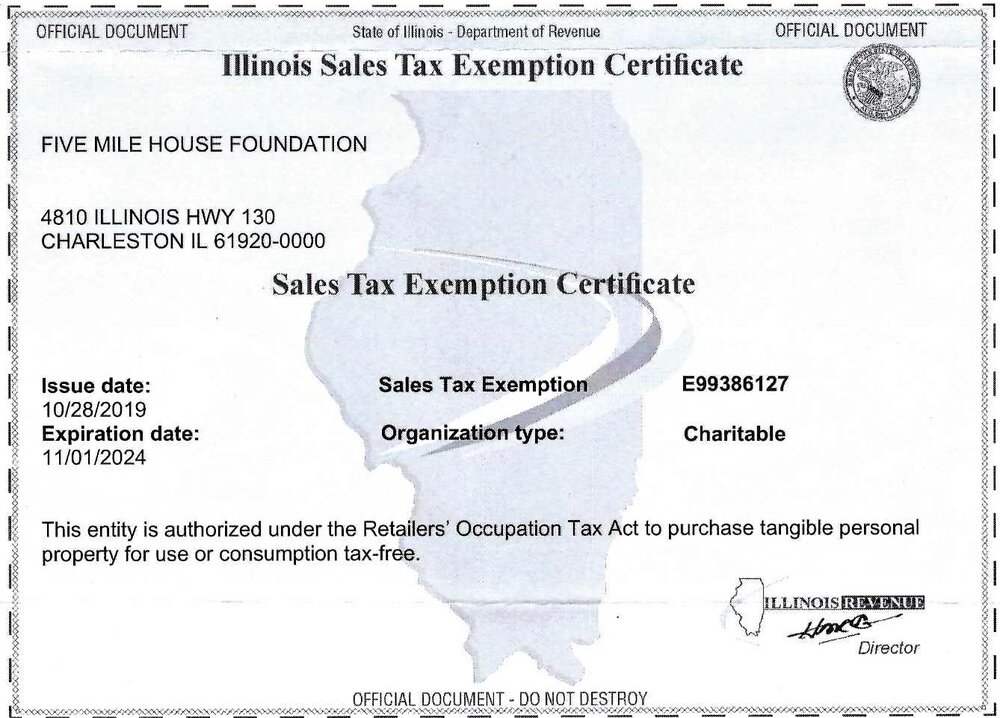

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg?format=1000w

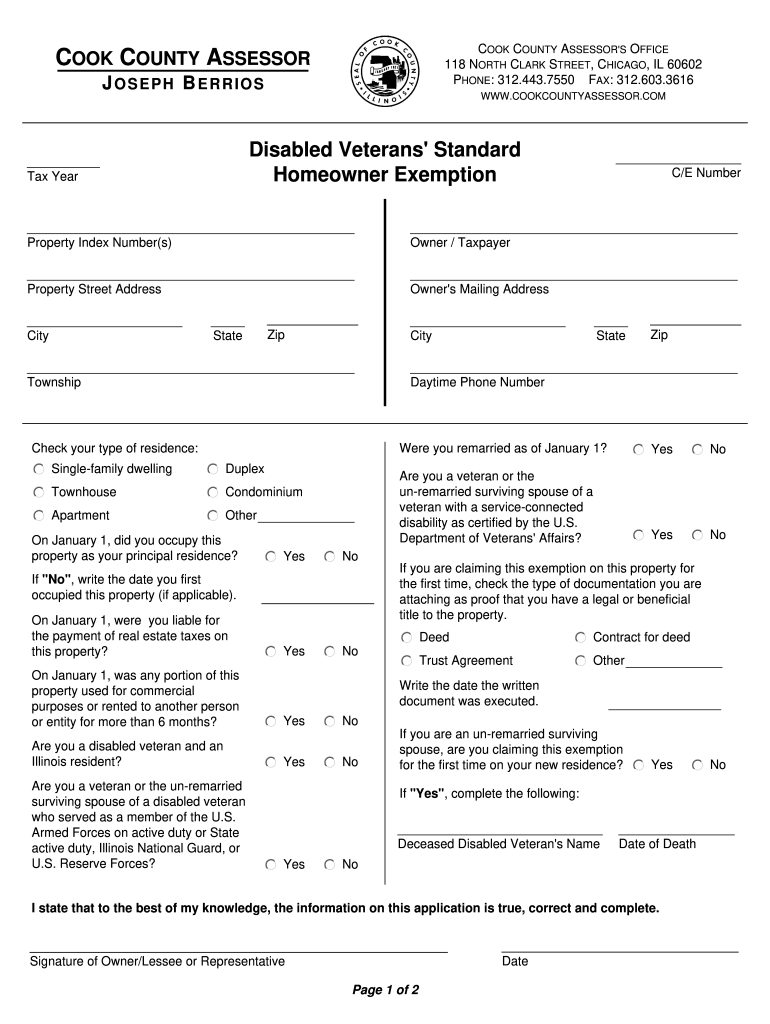

Illinois Disabled Veterans Exemption Form Fill Out And Sign Printable

https://www.signnow.com/preview/26/913/26913050/large.png

News Tuesday February 14 2023 Email The Senior Citizens Real Estate Tax Deferral Program allows qualified seniors to defer all or part of their property taxes and special assessment payments on their principal residences Seniors needing assistance paying their property taxes have until March 1 2023 to apply for the program Senior Citizens Homestead Exemption Statutory Citation 35 ILCS 200 15 170 Who is eligible To qualify you must be age 65 by December 31st of the assessment year for which the application is made own and occupy the property be liable for the payment of real estate taxes on the property How do I apply

Property tax exemptions are provided for owners with the following situations Homeowner Exemption Senior Citizen Exemption Senior Freeze Exemption Longtime Homeowner Exemption Home Improvement Exemption Returning Veterans Exemption Disabled Veterans Exemption Disabled Persons Exemption The legislation which went into effect immediately increases the general homestead exemption and senior citizens homestead exemption reduces interest rates on tax deferrals for seniors and

Senior Property Tax Exemption Available Weld County

https://www.weld.gov/files/sharedassets/public/newsroom/2023/images/2023-news/05_may/2023_getty_senior-tax-exemption_w.jpg?w=1200

Property Tax Exemption For Illinois Disabled Veterans

https://www.homesteadfinancial.com/app/uploads/2023/05/VA-TAX-EXCEMPTION2-1000x618.jpg

https://www.illinoislegalaid.org/legal-information/...

The senior citizen homestead exemption is available to property owners over age 65 for the applicable tax year Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or before

https://www.cookcountyassessor.com/senior-citizen-exemption

Most senior homeowners are eligible for this exemption if they are 65 years of age or older born in 1958 or prior and own and occupy their property as their principal place of residence Once this exemption is applied the Assessor s Office automatically renews it

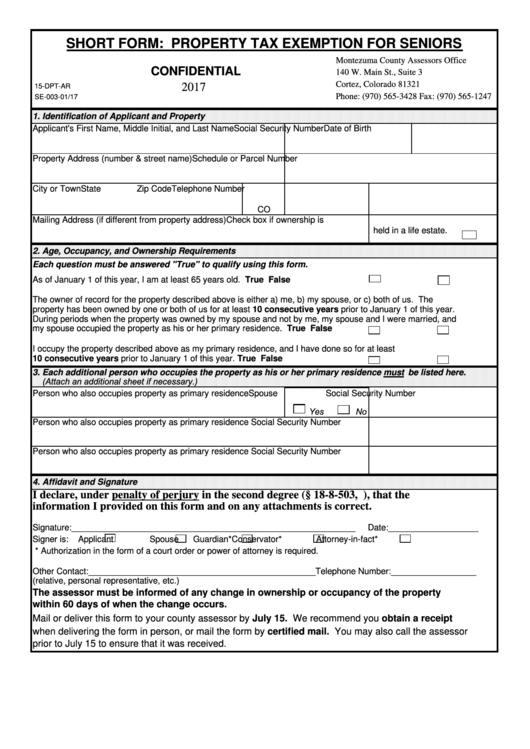

Jefferson County Property Tax Exemption Form ExemptForm

Senior Property Tax Exemption Available Weld County

Colorado Resale Certificate Dresses Images 2022

Property Tax Appeals And Exemptions MyTicor

Texas Property Tax Exemptions For Seniors Lower Your Taxes

Property Tax Exemption For Seniors In California PRFRTY CountyForms

Property Tax Exemption For Seniors In California PRFRTY CountyForms

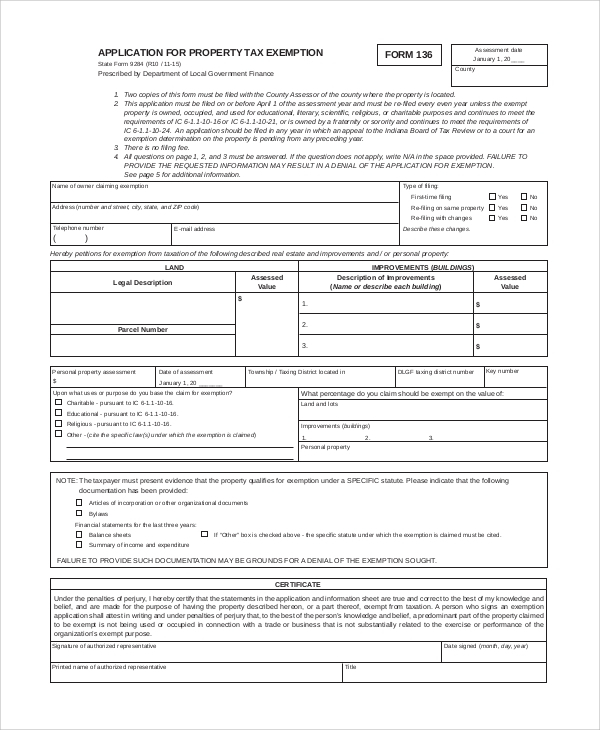

FREE 10 Sample Tax Exemption Forms In PDF ExemptForm

Seniors Alerted About Property Tax Break March 1 Is Deadline

County Legislature Increases Senior Citizen Tax Exemption Rodney J

What Age Is Senior Property Tax Exemption In Illinois - Senior Citizen Homestead Exemption Seniors can save on average up to 300 a year in property taxes and up to 750 when combined with the Homeowner Exemption The applicant must have owned and occupied the property as of January 1 and must have been 65 years of age or older during the tax year in question