What Are Post Tax Deductions Web 14 M 228 rz 2023 nbsp 0183 32 Types of post tax deductions Types of retirement contributions Many employers offer 401k plans which allow employees to contribute a portion of Post tax retirement plans It should be mentioned that most pension contributions are made on a before tax basis Contribution Limits It s important

Web 11 Apr 2022 nbsp 0183 32 Post tax deductions on the other hand are payroll deductions taken from an employee s check after taxes have already been withheld Post tax deductions do not reduce your tax Web 16 Dez 2022 nbsp 0183 32 Here are things that are usually post tax deductions from payroll Certain small business retirement plan options like a Roth 401 k Disability insurance Life insurance Charitable contributions Garnishments

What Are Post Tax Deductions

What Are Post Tax Deductions

https://fitsmallbusiness.com/wp-content/uploads/2021/08/Infographic_Pre-Tax_Deductions_vs_Post-Tax_Deductions.svg

What Are Post Tax Deductions From Payroll

https://assets-global.website-files.com/63dc1edda3aaf2683af8c423/65ae505a0dd4d7ee1f2e7a4b_What-Are-Post-tax-Deductions-from-Payroll_.webp

A Closer Look At Post tax Deductions From Payroll Guide

https://www.patriotsoftware.com/wp-content/uploads/2016/07/closer-look-at-after-tax-deductions-768x432.jpg

Web 29 Nov 2023 nbsp 0183 32 Wondering how post tax deductions work This comprehensive guide explains everything about them and how they can benefit you financially Web 16 Dez 2022 nbsp 0183 32 Common post tax deductions include Some retirement plans such as a Roth 401 k plan Disability insurance Life insurance Garnishments You might need to withhold some of these deductions before taxes based on the policies your business has set up Post tax example Let s say your employee Carole earns 500 per week Carole

Web Specific examples of each type of payroll deduction include Pre tax deductions Medical and dental benefits 401 k retirement plans for federal and most state income taxes and Mandatory deductions Federal and state income tax FICA taxes and wage garnishments Post tax deductions Web Also known as an after tax deduction post tax deduction is the amount subtracted from a taxpayer s earnings and withheld for various reasons including Roth 401 k contributions life insurance union dues and disability insurance What is an after tax deduction

Download What Are Post Tax Deductions

More picture related to What Are Post Tax Deductions

Understanding Pre And Post Tax Deductions On Your Paycheck

https://s.yimg.com/ny/api/res/1.2/7CVZ.Us1nX3Hr7lZZJhYsA--/YXBwaWQ9aGlnaGxhbmRlcjt3PTk2MDtoPTU0MA--/https://media.zenfs.com/en/gobankingrates_644/c138abac53f5472fdc3cb3fc0fb6e7ff

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

What Are Pre Tax Deductions

https://www.realized1031.com/hs-fs/hubfs/iStock-827709156.jpg?width=2508&name=iStock-827709156.jpg

Web Post tax deduction examples As noted above post tax deductions are amounts subtracted from an employee s paycheck after all applicable taxes have been calculated and subtracted from their gross salary These deductions are diverse and reflect various aspects of an employee s personal financial and occupational interests Web 25 Dez 2023 nbsp 0183 32 Payroll deductions are portions of an employee s pay that are subtracted from their total compensation to make required payments such as taxes and voluntary investments The two main types of payroll deductions are those made for mandatory requirements tax laws court orders etc and those made voluntarily by an employee

Web Post tax deductions or after tax deductions are expenses or contributions subtracted from an employee s income after taxes have been withheld Web 20 Juni 2019 nbsp 0183 32 Pre tax deductions occur before the individual s tax obligations are determined This saves the individual on Federal State Local if applicable and FICA obligations The savings average 30 40 for an individual Additionally employers save 7 65 on payroll tax obligations

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

https://synder.com/blog/what-are-post-tax-deductions-and-how-they-can...

Web 14 M 228 rz 2023 nbsp 0183 32 Types of post tax deductions Types of retirement contributions Many employers offer 401k plans which allow employees to contribute a portion of Post tax retirement plans It should be mentioned that most pension contributions are made on a before tax basis Contribution Limits It s important

https://finance.yahoo.com/news/understanding-pre-post-tax-deductions...

Web 11 Apr 2022 nbsp 0183 32 Post tax deductions on the other hand are payroll deductions taken from an employee s check after taxes have already been withheld Post tax deductions do not reduce your tax

List Of Tax Deductions Here s What You Can Deduct

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

The Standard Deduction And Itemized Deductions After Tax Reform

Section 125

Section 80C Deductions List To Save Income Tax FinCalC Blog

The 6 Best Tax Deductions For 2020 The Motley Fool

The 6 Best Tax Deductions For 2020 The Motley Fool

Standard Deduction 2020 Self Employed Standard Deduction 2021

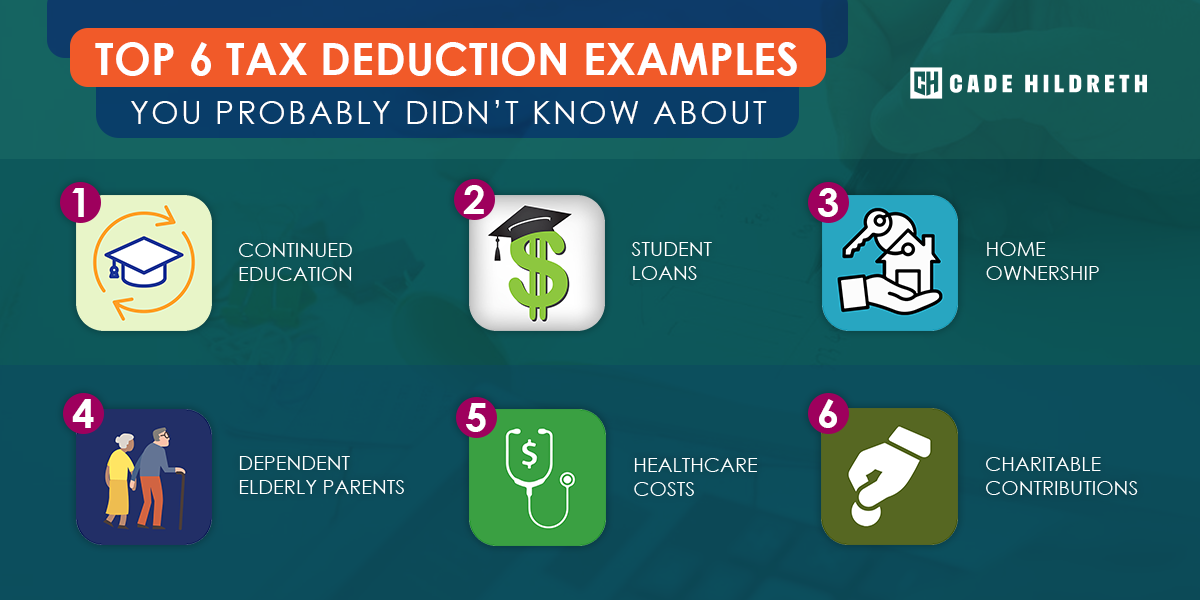

Top 6 Tax Deduction Examples You Probably Didn t Know About

7 Most Overlooked Tax Deductions Small Business CPA Tax Accountants

What Are Post Tax Deductions - Web An after tax deduction also known as a post tax deduction is an amount of money that is subtracted from a taxpayer s earnings after taxes federal state and local income Social Security and Medicare are withheld After tax deductions can vary by