What Are Renewable Energy Tax Credits If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces Jump to How do renewable energy tax credits work What renewable energy tax incentives does the IRS offer for individuals vs businesses Overview of clean energy credits by energy type Helping clients with renewable energy credits

What Are Renewable Energy Tax Credits

What Are Renewable Energy Tax Credits

https://www.nortonrosefulbright.com/-/media/images/nrf/thought-leadership/us/us_43201_social-media-capital-account-implications-for-renewable-energy-tax-credits_1200.jpeg?revision=a5e6caf0-1dea-4076-9c5e-6774a98047b7&revision=5249587443937387904

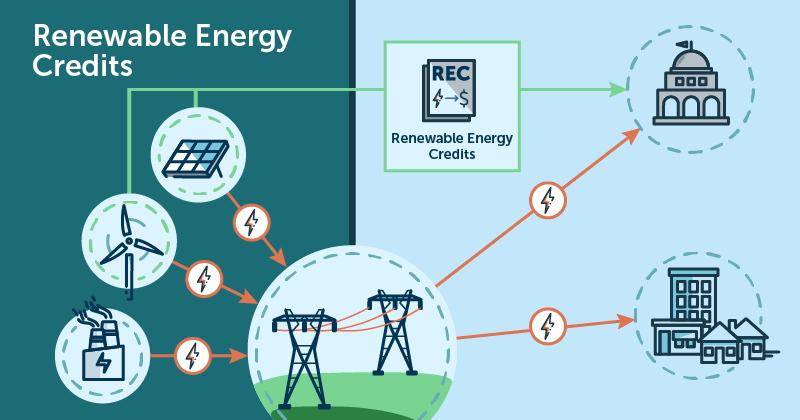

Renewable Energy Credits RECs Second Nature

https://secondnature.org/wp-content/uploads/RenewableEnergyCredit.png

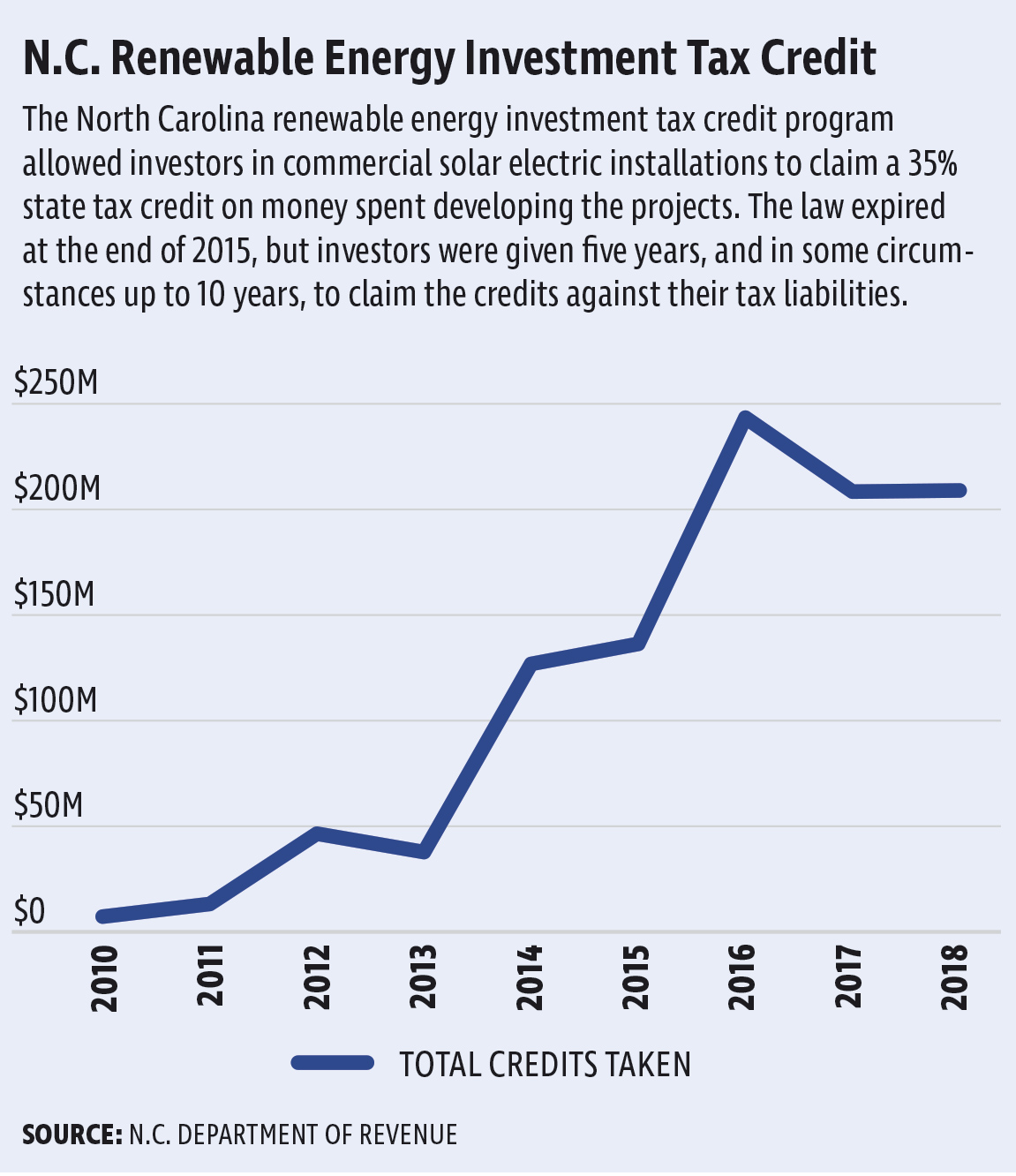

N C Has Issued More Than 1 Billion In Renewable Energy Tax Credits

https://www.carolinajournal.com/app/uploads/2019/06/nc-renewable-energy-tax-credit.jpg

The federal tax incentives or credits for qualifying renewable energy projects and equipment include the Renewable Electricity Production Tax Credit PTC the Investment Tax Credit ITC the Residential Energy Credit and the Modified Accelerated Cost Recovery System MACRS The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work More information about reliance is

Download What Are Renewable Energy Tax Credits

More picture related to What Are Renewable Energy Tax Credits

Residential Energy Tax Credit Use Eye On Housing

https://i1.wp.com/eyeonhousing.org/wp-content/uploads/2014/12/res-energy-credits_09_12.jpg

Tax Incentives For Renewable Energy Impacts And Analyses Nova

https://novapublishers.com/wp-content/uploads/2018/12/9781536104561-e1544466322781.jpg

Extending Tax Credits For Renewable Energy Projects Is It An

https://www.law.georgetown.edu/environmental-law-review/wp-content/uploads/sites/18/2021/01/renewable-energy-montage-705444748-Shutterstock_FotoIdee-980x552.jpg

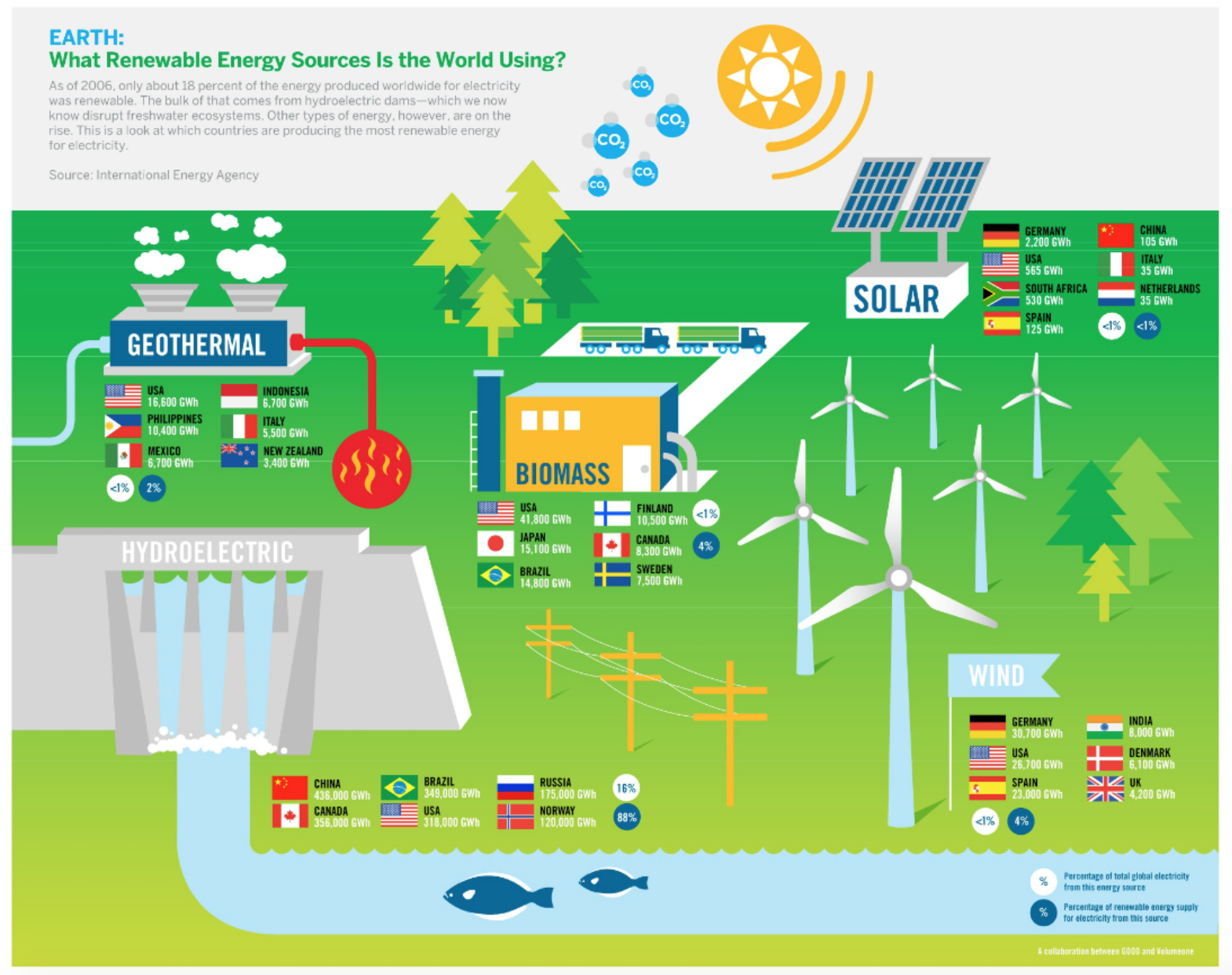

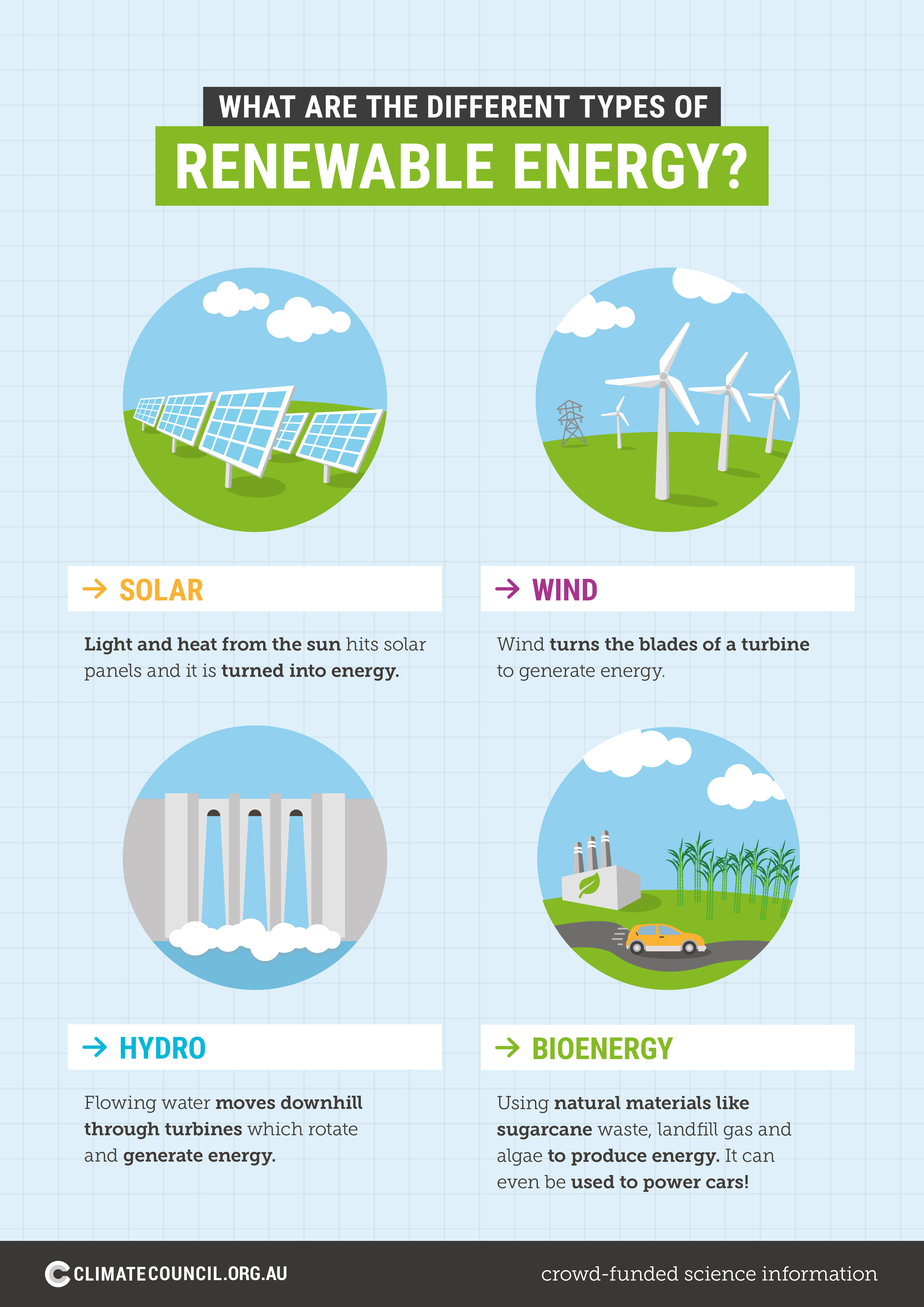

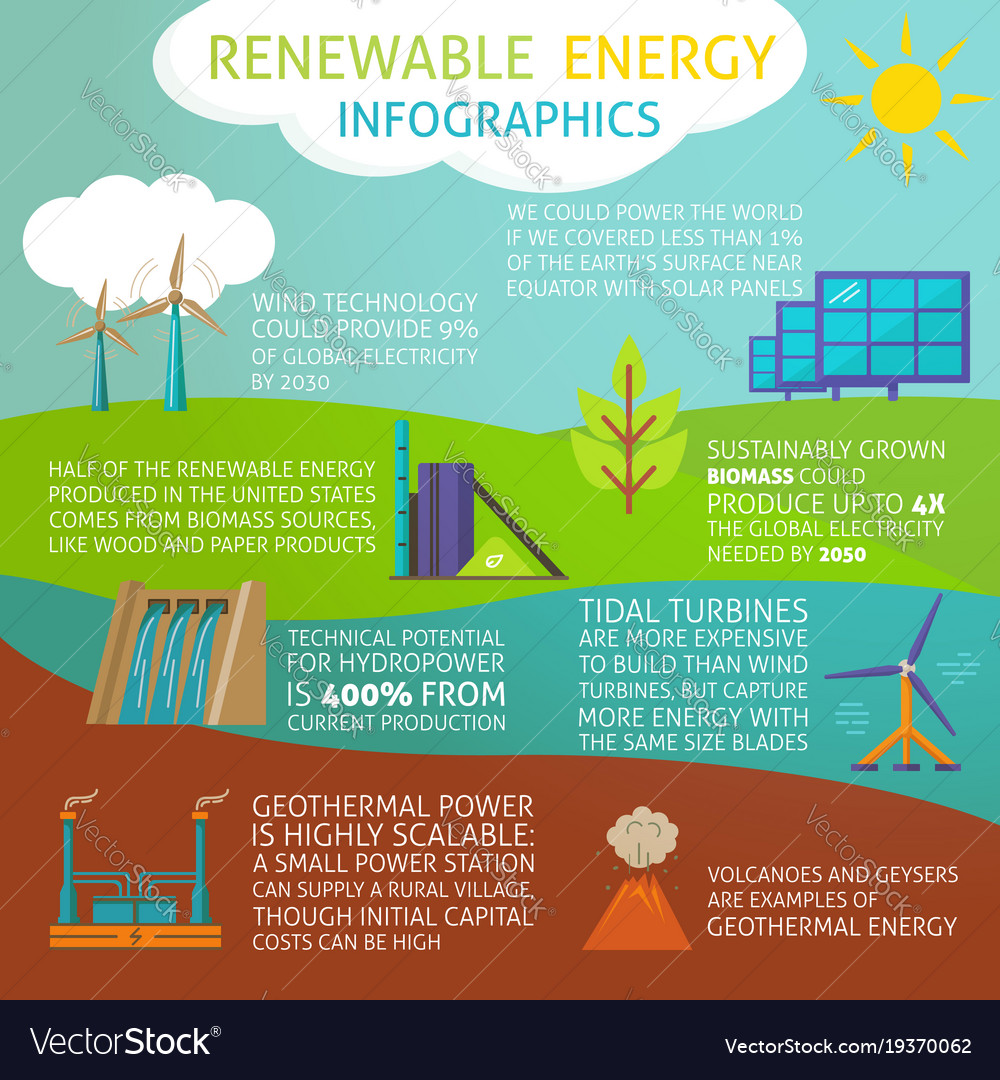

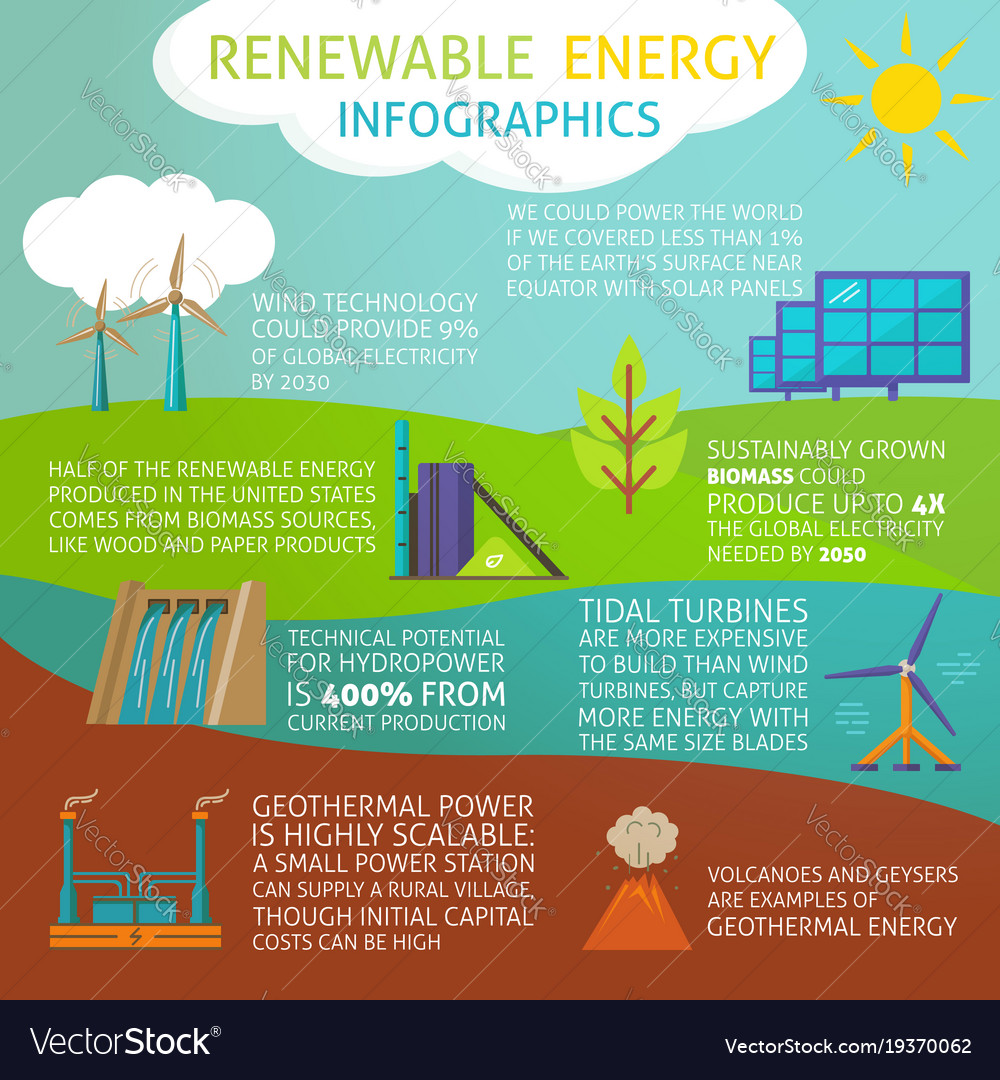

Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 A Renewable energy credit REC is a certificate corresponding to the environmental attributes of energy produced from renewable sources such as wind or solar RECs were created as a means to track progress towards and compliance with states Renewable Portfolio Standards RPS meant to support a cleaner generation mix

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of Federal Tax Credits for Energy Efficiency The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources

Renewable Energy Tax Incentives Selected Issues And Analyses Nova

https://novapublishers.com/wp-content/uploads/2019/04/9781633215085-e1555519755106.jpg

The State Of Renewable Energy Legend Power Systems Inc

http://legendpower.com/wp-content/uploads/2015/05/Screen-Shot-2015-05-11-at-1.21.32-PM.png

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit On This Page How It Works Who Qualifies Qualified Expenses Qualified Clean Energy Property How to Claim the Credit Related

https://www.investopedia.com/terms/e/energy-tax-credit.asp

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces

Solar Power System Sacramento Want Solar Panels For Your House Ask

Renewable Energy Tax Incentives Selected Issues And Analyses Nova

Renewable Energy Statistics Statistics Explained

What Are The Different Types Of Renewable Energy Climate Council

Types Of Renewable Energy Sources Inspire Clean Energy

Renewable Energy Infographic Royalty Free Vector Image

Renewable Energy Infographic Royalty Free Vector Image

Renewable Energy Facts Natural Resources Canada

Renewable Energy Is Not Growing Fast Enough To Fight Climate Change

House Passes Historic Inflation Reduction Act V E Energy Update

What Are Renewable Energy Tax Credits - The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance