What Are Tax Rates In Ireland Personal income tax rates Exemption limits An income tax exemption is available for certain individuals aged 65 years or over These individuals are only liable

A tax rate band is the amount of income which will be taxed at a particular percentage tax rate The current tax rates are 20 and 40 Standard rate of tax Your income up to a How your Income Tax is calculated If you are paid weekly your Income Tax is calculated by applying the standard rate of 20 to the income in your weekly rate band applying

What Are Tax Rates In Ireland

What Are Tax Rates In Ireland

https://wp.motorcheck.ie/app/uploads/Motor-tax.png

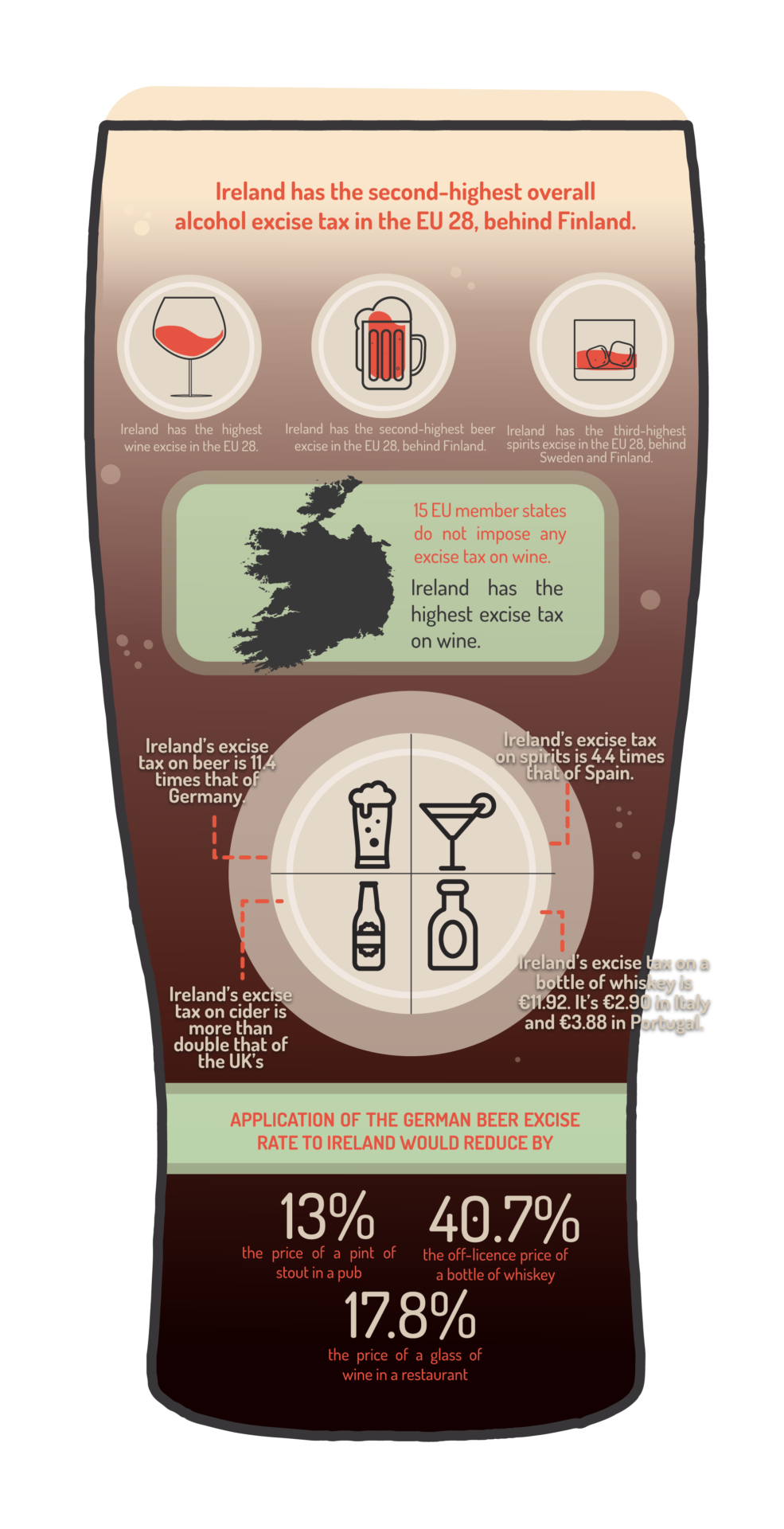

Excise Tax Rates In Europe How Ireland Compares Support Your Local

https://supportyourlocal.ie/wp-content/uploads/TaxR_infofull-985x1920.png

Cross Border Effective Average Tax Rates In Europe And G7 Countries

https://files.taxfoundation.org/20200311141319/G7-countries-flag-international-tax-global-tax-e1583950408555.jpeg

Taxation in Ireland in 2017 came from Personal Income taxes 40 of Exchequer Tax Revenues or ETR and Consumption taxes being VAT 27 of ETR and Excise and Customs duties 12 of ETR The Income tax rates and personal allowances in Ireland are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include

Income tax How your income tax is calculated Tax on income you earn from employment is deducted directly from your pay Find out how this tax is calculated Universal Social What are tax credits Tax credits reduce the amount of tax you pay What are tax reliefs Tax reliefs reduce the amount of income that you pay tax on The tax credits and reliefs

Download What Are Tax Rates In Ireland

More picture related to What Are Tax Rates In Ireland

Car Tax Rates In Ireland A Simple Guide

https://www.theaa.ie/wp-content/uploads/2023/10/down-net_http20231009-37935-rxjmkw-scaled.jpg

European Tax Trends Reforms Tax Foundation

https://taxfoundation.org/wp-content/uploads/2023/09/Tax-Trends-in-European-Countries-scaled.jpeg

Corporate Income Tax Rate CIT In Indonesia

https://www.paulhypepage.co.id/wp-content/uploads/2017/12/Corporate-Tax-Rates-in-Indonesia.svg

VAT 9 Rate Since 1 January 2019 the 9 rate only applied to printed newspapers and periodicals the provision of sporting facilities and certain electronic publications Review the latest income tax rates thresholds and personal allowances in Ireland which are used to calculate salary after tax when factoring in social security contributions

Ireland s income tax rate is composed of several different bands or brackets for individuals each with its own set of rules about how much to withhold from paychecks Earned income in Ireland is taxed in three different ways Income Tax Universal Social Charge USC Pay Related Social Insurance PRSI Income Tax Ireland s Income Tax

Ireland s Low Tax Rates Attract Big Corporations DW 03 21 2018

https://static.dw.com/image/36820998_6.jpg

Tax Avoidance Rules Increase The Compliance Burden In EU Countries

https://taxfoundation.org/wp-content/uploads/2018/12/eu4-enhanced.jpg

https://taxsummaries.pwc.com/ireland/individual/taxes-on-personal-income

Personal income tax rates Exemption limits An income tax exemption is available for certain individuals aged 65 years or over These individuals are only liable

https://www.revenue.ie/.../tax-rate-band.aspx

A tax rate band is the amount of income which will be taxed at a particular percentage tax rate The current tax rates are 20 and 40 Standard rate of tax Your income up to a

Effective Income Tax Rates In Ireland Over Time Social Justice Ireland

Ireland s Low Tax Rates Attract Big Corporations DW 03 21 2018

Latest Income Tax Slab And Rates

Withholding Tax Rates In Thailand According To Income Category

What Are The Car Tax Rates In Ireland

Income Tax Rates In The UK

Income Tax Rates In The UK

Europe Has The Lowest Corporate Tax Rates In The World While Africa Has

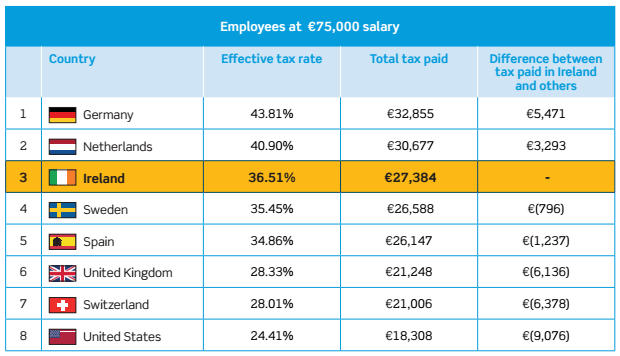

Top Irish Earners Are Paying More Tax Than The Swedes TheJournal ie

Centre Mulling Over Reducing Income Tax Rates Under New Regime

What Are Tax Rates In Ireland - A brief summary of the Income Tax Rates in Ireland is given below the figures shown are valid from January 2022 Note As well as income tax other