What Are Taxable Exemptions Key Takeaways Personal and dependent exemptions are no longer used on your federal tax return They were suspended beginning in tax year 2018 A tax exemption reduces taxable income just like a deduction does but typically has fewer restrictions to claiming it

Key Takeaways An exemption reduces the amount of income that would otherwise be taxed Until the end of 2025 personal exemptions have been repealed and replaced by higher A tax exemption represents a monetary exclusion that reduces the amount of income subject to taxation By decreasing taxable income these exemptions lead to significant savings on tax bills Read more about How Many Times Can You Go Exempt Without Owing Taxes here Types of Tax Exemptions

What Are Taxable Exemptions

What Are Taxable Exemptions

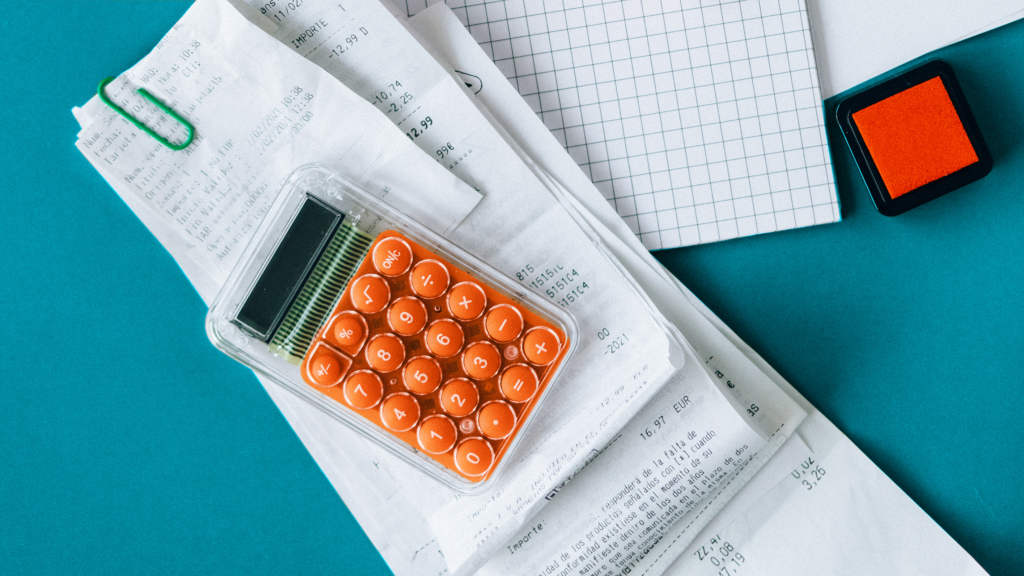

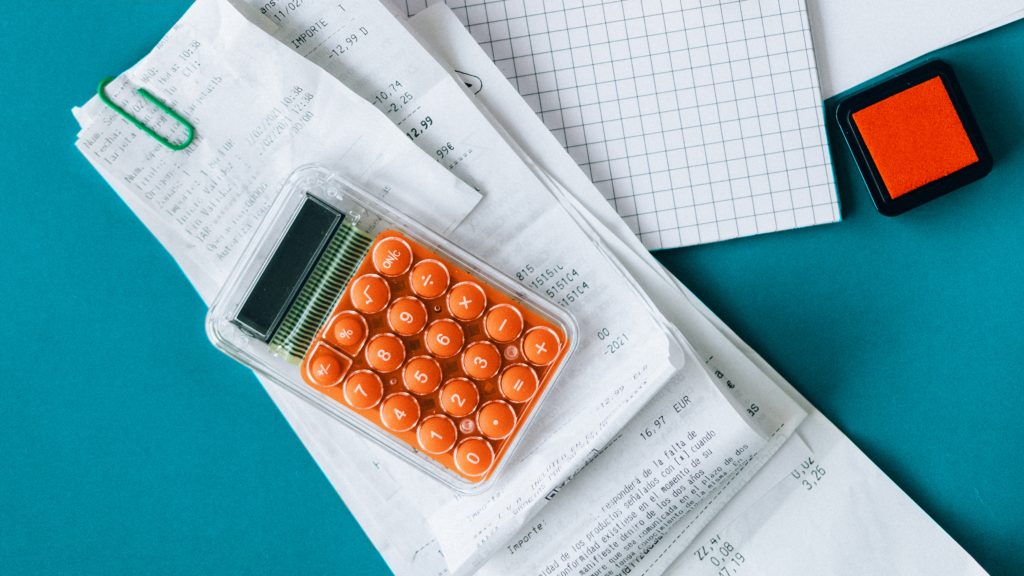

https://events.com/wp-content/uploads/2022/01/Event-Sales-Tax-Basics-What-Is-Taxable-Exemptions-Which-States-Are-Marketplace-States-and-More-IMAGE-1024x576.png

Income Exempted Business Tax Deductions Income Tax Return Tax

https://i.pinimg.com/originals/da/a4/11/daa41151f5a8a0c1fcf98686bc23747b.jpg

How To Calculate Taxable Social Security Form 1040 Line 6b Marotta

https://www.marottaonmoney.com/wp-content/uploads/2022/04/Form1040.png

Exempt income refers to certain types of income not subject to income tax Some types of income are exempt from federal or state income tax or both The IRS determines which Tax exempt refers to income or transactions that are free from tax at the federal state or local level The reporting of tax free items may be on a taxpayer s

Tax exempt means some or all income isn t subject to tax at the federal state or local level Here s how it works and who qualifies The personal exemption allows you to claim a tax deduction that reduces your taxable income Learn more about eligibility and when you can claim it

Download What Are Taxable Exemptions

More picture related to What Are Taxable Exemptions

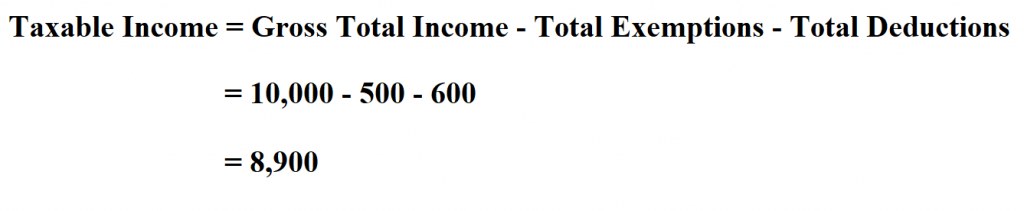

How To Calculate Taxable Income

https://www.learntocalculate.com/wp-content/uploads/2020/06/taxable-income-2-1024x211.png

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

How To Calculate Taxable Income H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2013/01/how-to-calculate-taxable-income.jpg

Updated on April 27 2022 Reviewed by Eric Estevez View All Photo HRAUN Getty Images Definition A tax exemption allows individuals or organizations to reduce or avoid paying certain taxes such as some income property or sales taxes Simply put a tax exemption gives you access to tax free income For every tax exemption you claim you reduce your taxable income In 2017 there were both personal and dependent tax

A tax exemption is a type of tax break that reduces your taxable income or zeroes it out entirely In this way an exemption is similar to a tax deduction which helps reduce your taxable income when you file your federal tax return Under the tax deductions and exemptions definition exemptions are portions of your personal or family income exempt from taxation Before the Tax Cuts and Jobs Act in 2018 the Internal Revenue Code allowed taxpayers to claim exemptions that reduced their taxable income

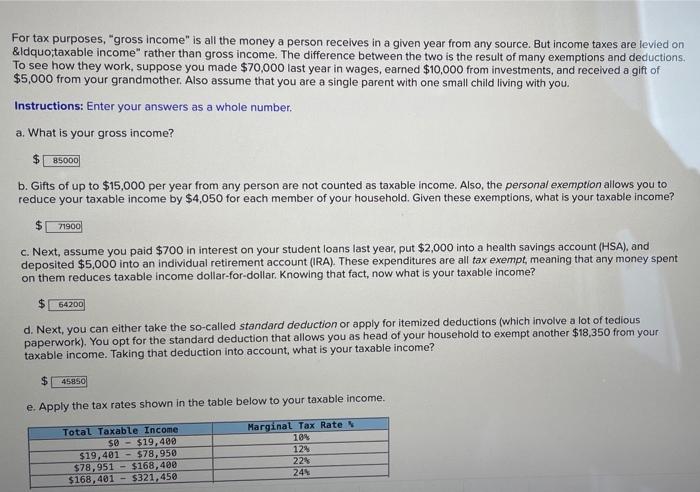

Solved For Tax Purposes gross Income Is All The Money A Chegg

https://media.cheggcdn.com/study/e6a/e6ae163e-fdf9-4b05-aa76-2c755902e2fb/image

85k Salary Effective Tax Rate V s Marginal Tax Rate KR Tax 2024

https://kr.icalculator.com/img/og/KR/100.png

https://turbotax.intuit.com/tax-tips/irs-tax...

Key Takeaways Personal and dependent exemptions are no longer used on your federal tax return They were suspended beginning in tax year 2018 A tax exemption reduces taxable income just like a deduction does but typically has fewer restrictions to claiming it

https://www.investopedia.com/terms/e/exemption.asp

Key Takeaways An exemption reduces the amount of income that would otherwise be taxed Until the end of 2025 personal exemptions have been repealed and replaced by higher

Tax Exemptions What Part Of Your Income Is Taxable

Solved For Tax Purposes gross Income Is All The Money A Chegg

Tax Prep Form 1040 2 Taxable And Non Taxable Income Skill Success

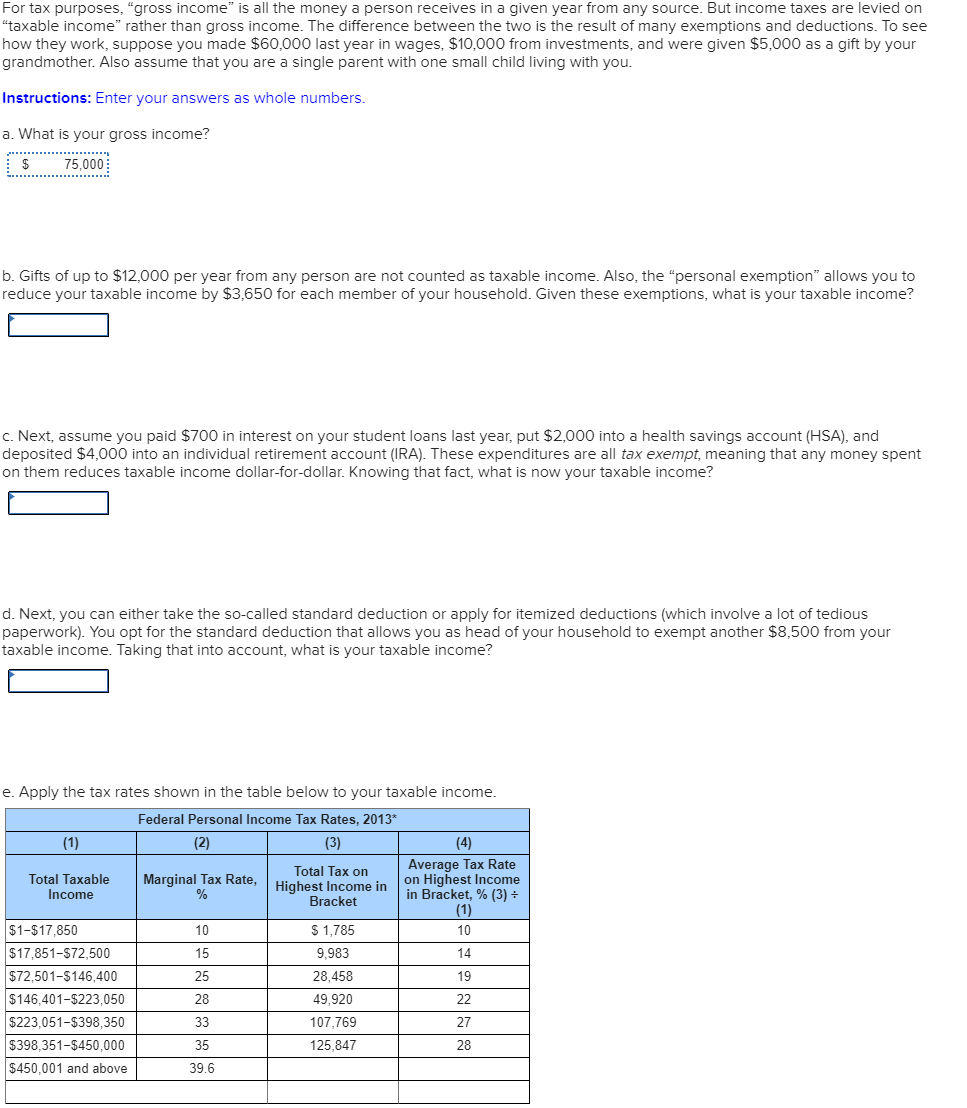

For Tax Purposes gross Income Is All The Money A Chegg

90k Salary Effective Tax Rate V s Marginal Tax Rate BI Tax 2024

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

80k Salary Effective Tax Rate V s Marginal Tax Rate BF Tax 2024

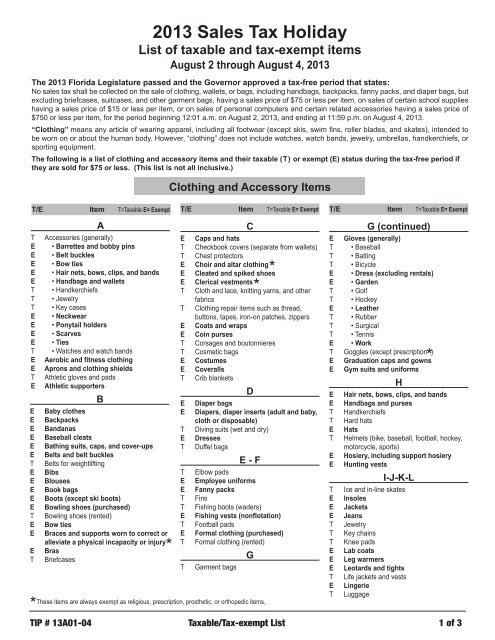

List Of Tax exempt And Taxable Items

Tax Withholding Exemptions Explained Top FAQs Of Tax Jan 2023

CAG Report On Wrong Availment Of Service Tax Exemptions

What Are Taxable Exemptions - Generally an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but is not taxable A list is available in Publication 525 Taxable and Nontaxable Income