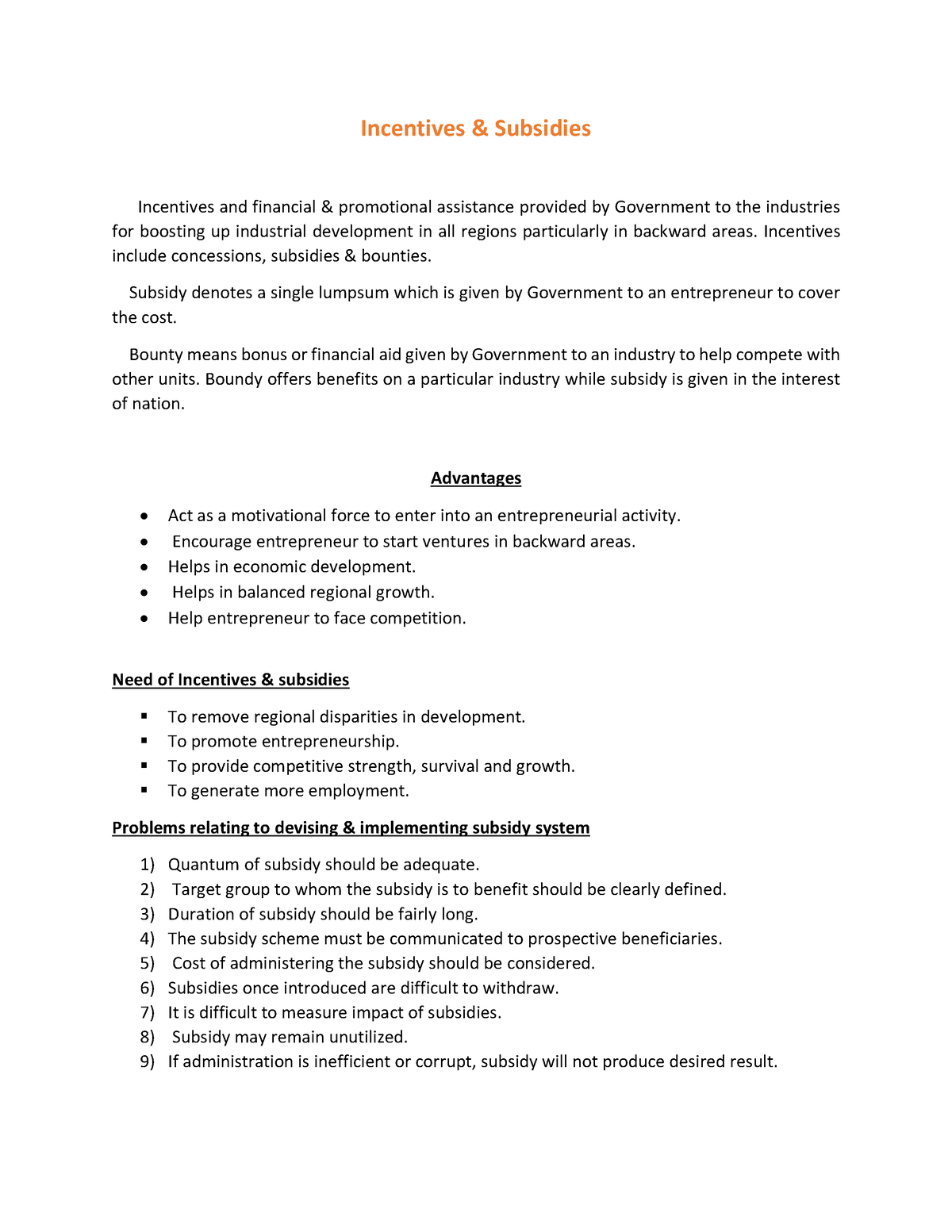

What Are The Government Incentives For Solar The first and most important solar incentive to know about is the federal solar tax credit which can earn solar owners 30 of the cost to install solar panels back on their income taxes in the year after installation

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe Generally you can claim a tax credit on the expenses related to the new solar PV system that already came installed on the house for the year in which you moved into the house assuming the builder did not claim the tax credit in other words you may claim the

What Are The Government Incentives For Solar

What Are The Government Incentives For Solar

https://solarnrg.ph/wp-content/uploads/2022/09/Blog20-Incentives-for-Solar-Energy.jpg

Generous Government Incentive Makes It A No brainer To Upgrade Your

https://www.tresami.com.au/wp-content/uploads/2022/04/will-county-government-incentive-agreement-lawyer.jpg

Government Incentives To Switching Over To Green

https://www.grcooling.com/wp-content/uploads/shutterstock_1299695593_b6afefa5b7ff71b0917b0f1d4fecfaa5_2000.jpg

This credit can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system Let s take a look at the biggest changes and what they mean for Americans who install rooftop solar The ITC increased in amount and its timeline has been extended If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit

The Investment Tax Credit ITC or solar federal tax credit is a nationwide incentive for homeowners and business owners who install solar panels The credit is worth 30 of your total The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

Download What Are The Government Incentives For Solar

More picture related to What Are The Government Incentives For Solar

Incentives Subsidies Advantages Need And Problems In Implimenting

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/548ef56b4c2c540de9424b78259bb847/thumb_1200_1553.png

7 Key Government Incentives For Sustainable Businesses 2023

https://mindseteco.co/wp-content/uploads/2022/08/Sustainable-Business-Incentives-2.png

All Solar Panel Incentives Tax Credits In 2023 By State

https://www.solarreviews.com/images/og/SolarIncentives.jpg

IR 2024 202 Aug 7 2024 WASHINGTON The Department of the Treasury and the Internal Revenue Service today issued statistics on the Inflation Reduction Act clean energy tax credits for tax year 2023 The Inflation Reduction Act or IRA extended and expanded tax credits PDF that allow taxpayers to claim residential and By Nadja Popovich Aug 8 2024 Americans claimed more than 8 billion in climate friendly tax credits under the Inflation Reduction Act last year according to new data released by the Treasury

The federal solar Investment Tax Credit ITC offers a direct reduction in taxes owed as an incentive for installing a new solar energy system Per the Inflation Reduction Act the ITC is The 2024 30 federal solar tax credit can help you save big on solar installation This complete guide explains how it works and how to make the most of it

Tax Incentives A Guide To Saving Money For U S Small Businesses

https://www.freshbooks.com/wp-content/uploads/2022/04/tax-incentives-examples.jpg

Government Incentives Prosperity Advisers

http://www.prosperityadvisers.com.au/Government Incetives.jpg

https://www.solarreviews.com/solar-incentives

The first and most important solar incentive to know about is the federal solar tax credit which can earn solar owners 30 of the cost to install solar panels back on their income taxes in the year after installation

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe

Why Are Incentives So Important For Your Staff IRIS FMP

Tax Incentives A Guide To Saving Money For U S Small Businesses

Solar Rebates And Incentives EnergySage

Tax Incentives And Sustainability Smart Incentives

What Does It Take The Role Of Incentives In Forest Plantation

The Power Of Government Support 5 Funding Schemes For Indian Startup

The Power Of Government Support 5 Funding Schemes For Indian Startup

Government Incentives For Solar Panels Accelerating Clean Energy

Government Incentives C W Stirling Co Chartered Accountants

Through Government Rebates And Tax Incentives This Solar Program Is

What Are The Government Incentives For Solar - If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit