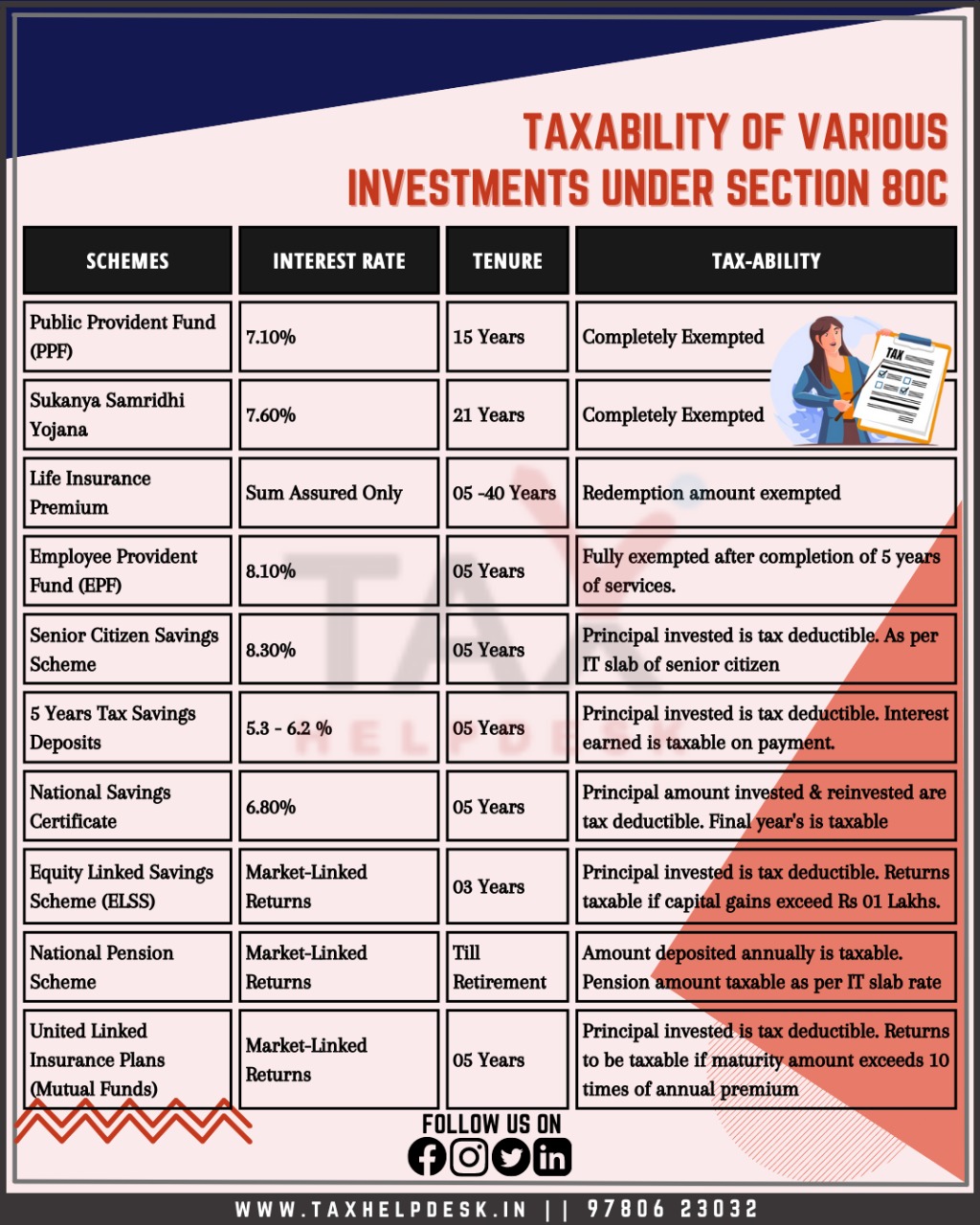

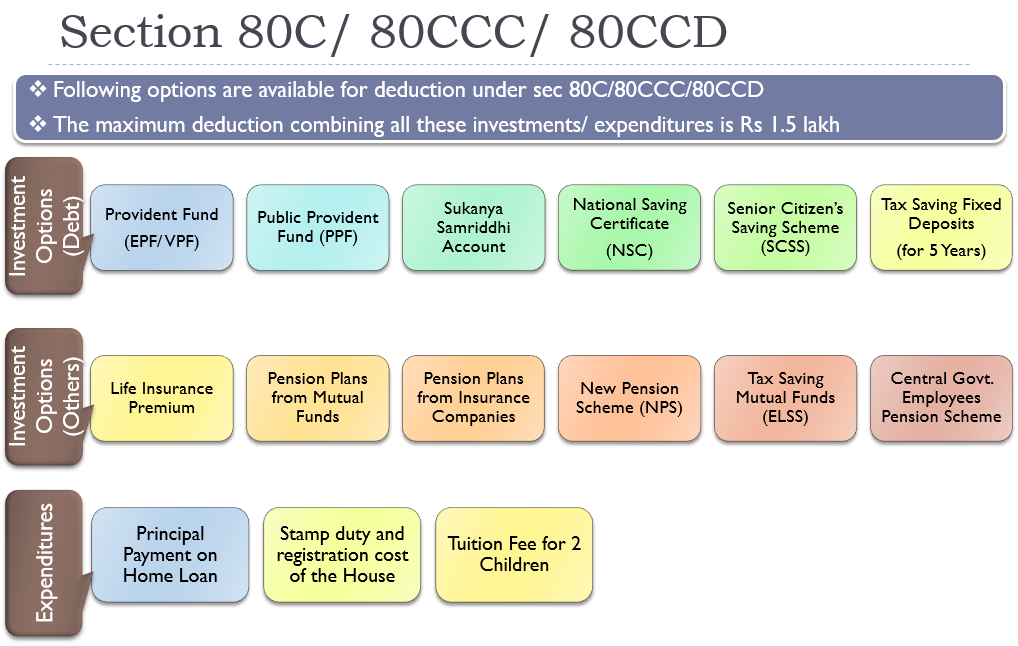

What Are The Investments Under 80c By well planning the 80C investments that are spread diversely across various options like NSC ULIP PPF etc an individual can claim deductions up to Rs 1 50 000 By taking tax benefits under 80C one can avail of a reduction in tax burden

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25 The various investment options under section 80C include Public Provident Fund PPF Interest earned is fully exempt from tax without any limit Annual contributions qualify for tax rebate under Section 80C of income tax

What Are The Investments Under 80c

What Are The Investments Under 80c

https://online.hbs.edu/PublishingImages/7-types-of-alternative-investments.png

11 Types Of Investments What They Are How They Work Mint

https://blog.mint.com/wp-content/uploads/2021/10/Mint-Blog-Post-1_Graphic-3.jpg?resize=740

What Are The Different Types Of Investments Understanding Diversification

https://assets.site-static.com/blogphotos/610/7007-different-investment-types.jpg

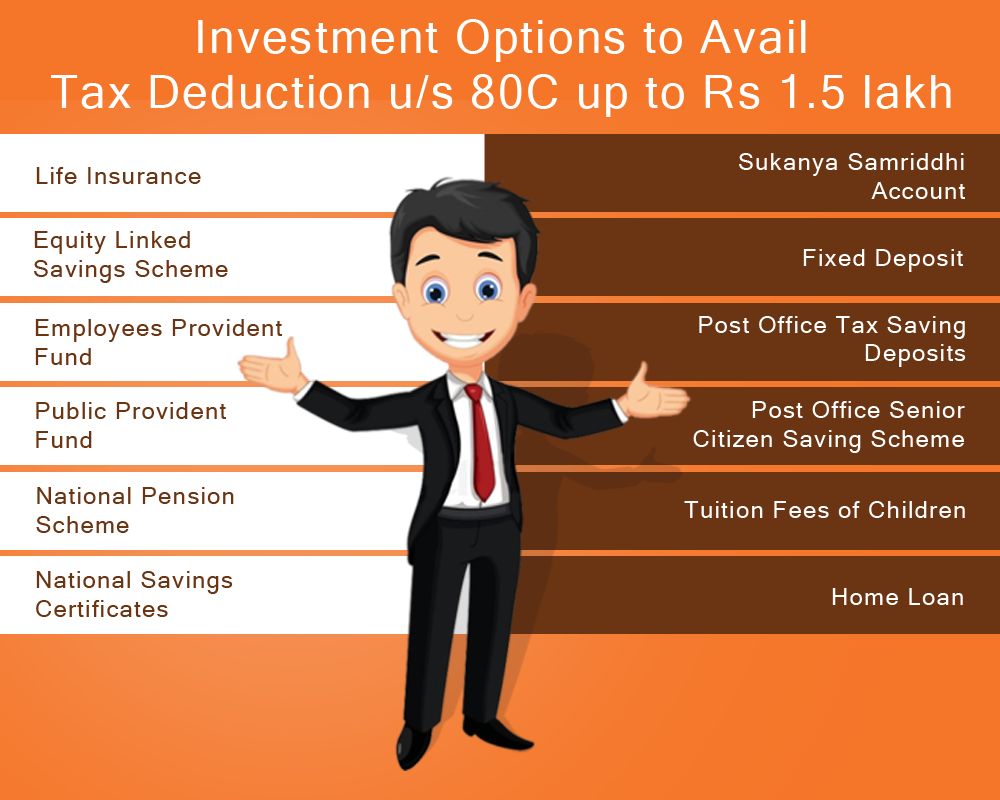

Section 80C of the Income Tax Act is like a treasure trove for taxpayers offering various investment options that not only help save taxes but also encourage savings and investments Here s a brief overview Public Provident Fund PPF A popular long term investment option with tax exempt interest and maturity benefits There are several instruments in which a person can invest and claim deduction under Section 80C The 10 most popular investments which can be claimed as a Deduction under Section 80C have been discussed below

Investing in ELSS funds is a tax efficient way under Section 80C ELSS offers a shorter lock in period and professional fund management making it a preferred tax saving option ELSS outperforms other 80C investments with higher returns Combining PPF with ELSS yields additional benefits Under section 80C the following provisions are made to ensure substantial tax reduction on funds related to the ELSS scheme The total principal amount invested in ELSS is exempt from taxation provided the amount is under Rs 1 5 Lakh

Download What Are The Investments Under 80c

More picture related to What Are The Investments Under 80c

Investment Options To Avail Tax Deduction Under Section 80C

https://www.comparepolicy.com/blogs/wp-content/uploads/2017/11/investment-options-to-avail-tax-deduction-under-section-80c.png

Investments Under Section 80C Section 80C Schemes Deductions Under 80c

https://i.ytimg.com/vi/6J7fge82Z9k/maxresdefault.jpg

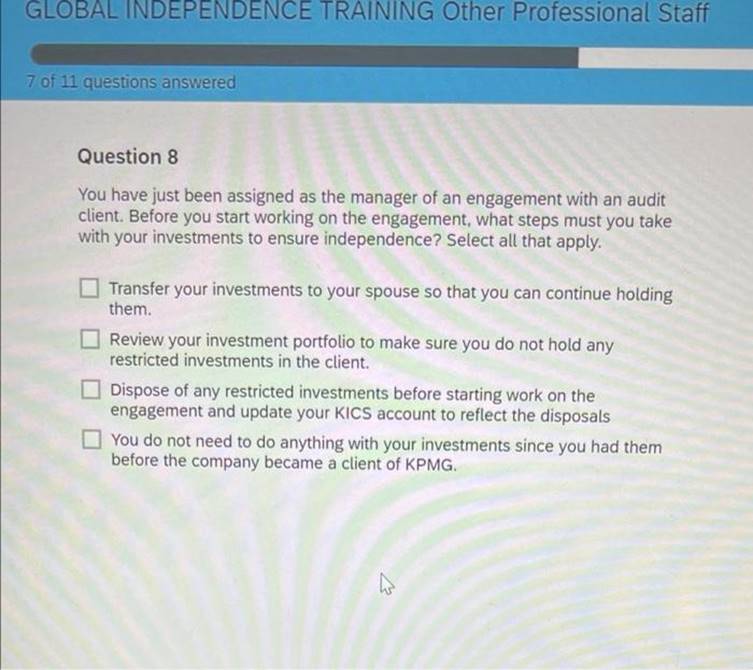

Solved GLOBAL INDEPENDENCE TRAINING Other Professional Staff 7 Of

https://files.transtutors.com/book/qimg/cdde09d5-fab2-4198-88a7-d63d829b67bb.png

Investment in Equity Linked Saving Scheme or a tax saving mutual fund attracts a deduction under section 80C Investment in ELSS funds comes with a lock in period of 3 years and higher deliverable returns compared to FD PPF or NPS How to fully utilise deductions available under Section 80C investment Tax saving can be a challenge especially if you have just started your journey in the corporate world Most people do their tax planning at the last moment This can result in poor investment choices

[desc-10] [desc-11]

:max_bytes(150000):strip_icc()/investing.asp-final-9cbfccbd50344a828ddf1882a2fdc07c.png)

Investing Explained Types Of Investments And How To Get Started

https://www.investopedia.com/thmb/6PhOzANk5XqxQK4jE59MPMsywUg=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/investing.asp-final-9cbfccbd50344a828ddf1882a2fdc07c.png

Invest In Tax saving MFs To Enjoy Dual Benefits

http://static.dnaindia.com/sites/default/files/styles/full/public/2017/12/01/628896-investment-thinkstock-120117.jpg

https://groww.in/p/tax/section-80c

By well planning the 80C investments that are spread diversely across various options like NSC ULIP PPF etc an individual can claim deductions up to Rs 1 50 000 By taking tax benefits under 80C one can avail of a reduction in tax burden

https://cleartax.in/s/80c-80-deductions

Section 80 Deductions A complete guide on Income Tax deduction under section 80C 80CCC 80CCD 80D Find out the deduction under section 80c for FY 2023 24 AY 2024 25

Understand About Taxability Of Various Investments Under Section 80C

:max_bytes(150000):strip_icc()/investing.asp-final-9cbfccbd50344a828ddf1882a2fdc07c.png)

Investing Explained Types Of Investments And How To Get Started

Section 80C Deduction Under Section 80C In India Paisabazaar

Deductions Under Section 80C Benefits Works Myfinopedia

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Investments Under SECTION 80C Cafemutual

Investments Under SECTION 80C Cafemutual

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

What Are The Investments Under 80c - Section 80C of the Income Tax Act is like a treasure trove for taxpayers offering various investment options that not only help save taxes but also encourage savings and investments Here s a brief overview Public Provident Fund PPF A popular long term investment option with tax exempt interest and maturity benefits