What Can Contractors Claim On Tax This handy guide for independent contractors explains tax responsibilities deadlines deductions and how to pay

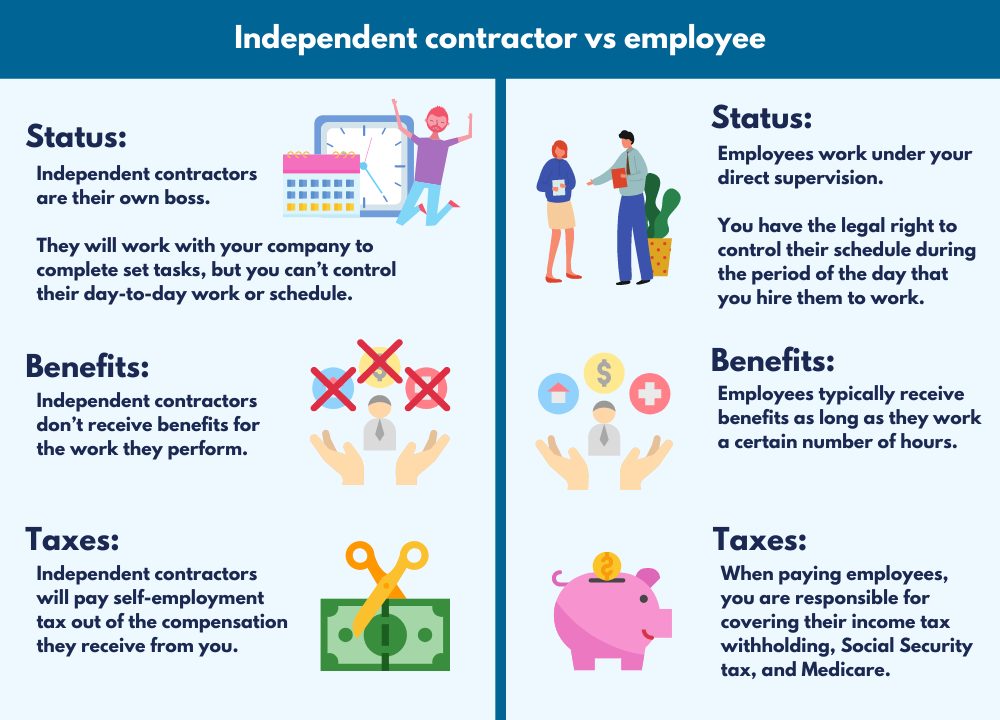

If you re an independent contractor in the building and construction industry you must also lodge a taxable payments annual report TPAR Check if you are an employee or independent contractor Independent contractors have different tax and super obligations to employees If you re a contractor or a consultant your personal services income may affect the deductions you can claim If you are unsure about what deductions you can claim contact your accountant business adviser or the

What Can Contractors Claim On Tax

What Can Contractors Claim On Tax

https://images.ctfassets.net/rb9cdnjh59cm/1TSCwZdVubc6PkVgKDmdb5/ae50f39e054cdab82146f78f013c0c84/R50_1190995919.jpg?fm=webP

When Material Costs Go Crazy What Can Contractors Do

https://atto-production.s3.us-west-2.amazonaws.com/uploads/blog/cover_6119f57ae1ee43.39618335.jpg

What Is A Contractor All You Need To Know About What Contractors Can

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2021/07/What-is-a-Contractor.jpg

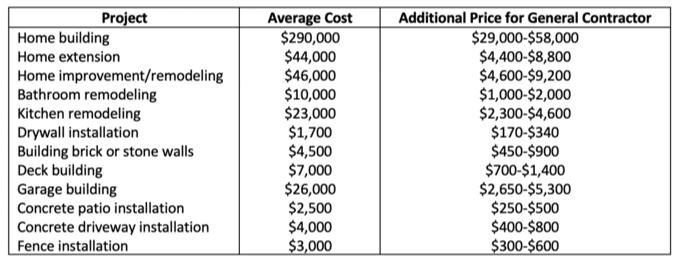

A guide to the tax and super obligations when working as an independent contractor compared to an employee The table below outlines the main tax and super obligations a business has when you re working for them as an independent contractor compared to working as an employee By following these essential record keeping practices contractors can ensure they are well prepared to claim all eligible work related tax deductions reduce their taxable income and support their claims in case of an ATO audit

Project 2025 is backed by a 22m 17m budget and includes strategies for implementing policies immediately after the presidential inauguration in January 2025 Heritage is also creating a That hacker claimed the stolen files include 2 7 billion records with each listing a person s full name address date of birth Social Security number and phone number Bleeping Computer said

Download What Can Contractors Claim On Tax

More picture related to What Can Contractors Claim On Tax

A Guide To Independent Contractor Taxes Ramsey

https://cdn.ramseysolutions.net/media/blog/taxes/business-taxes/independent-contractor-taxes.jpg

10 Questions You Must Ask When Hiring A Contractor

https://housely.com/wp-content/uploads/2016/06/Contractor.jpg

Can Contractors Claim Unfair Dismissal Bambrick Legal

https://bambricklegal.com.au/wp-content/uploads/2022/11/Can-Contractors-Claim-Unfair-Dismissal.jpg

Vice President Kamala Harris has backed the elimination of taxes on tips for hospitality and service workers endorsing a policy first offered by former President Donald Trump What Tax Deductions Can Independent Contractors Claim The key to lowering your tax bill is through tax deductions and there are a bunch of them for independent contractors One of the largest deductions you can take is the home office deduction which lets you deduct a portion of your home s expenses mortgage

There are two types of expenses that contractor can claim Running expenses such as office stationery and wages Capital expenses such as machinery computers and laptops and vehicles Pro Tax Tip Running expenses can be claimed in the same year as they ve been incurred while capital expenses may need to be expensed All of these deductions can be claimed by sole proprietorships as well as C corps and S corps partnerships and LLCs although there might be different rules for each 1 Startup and

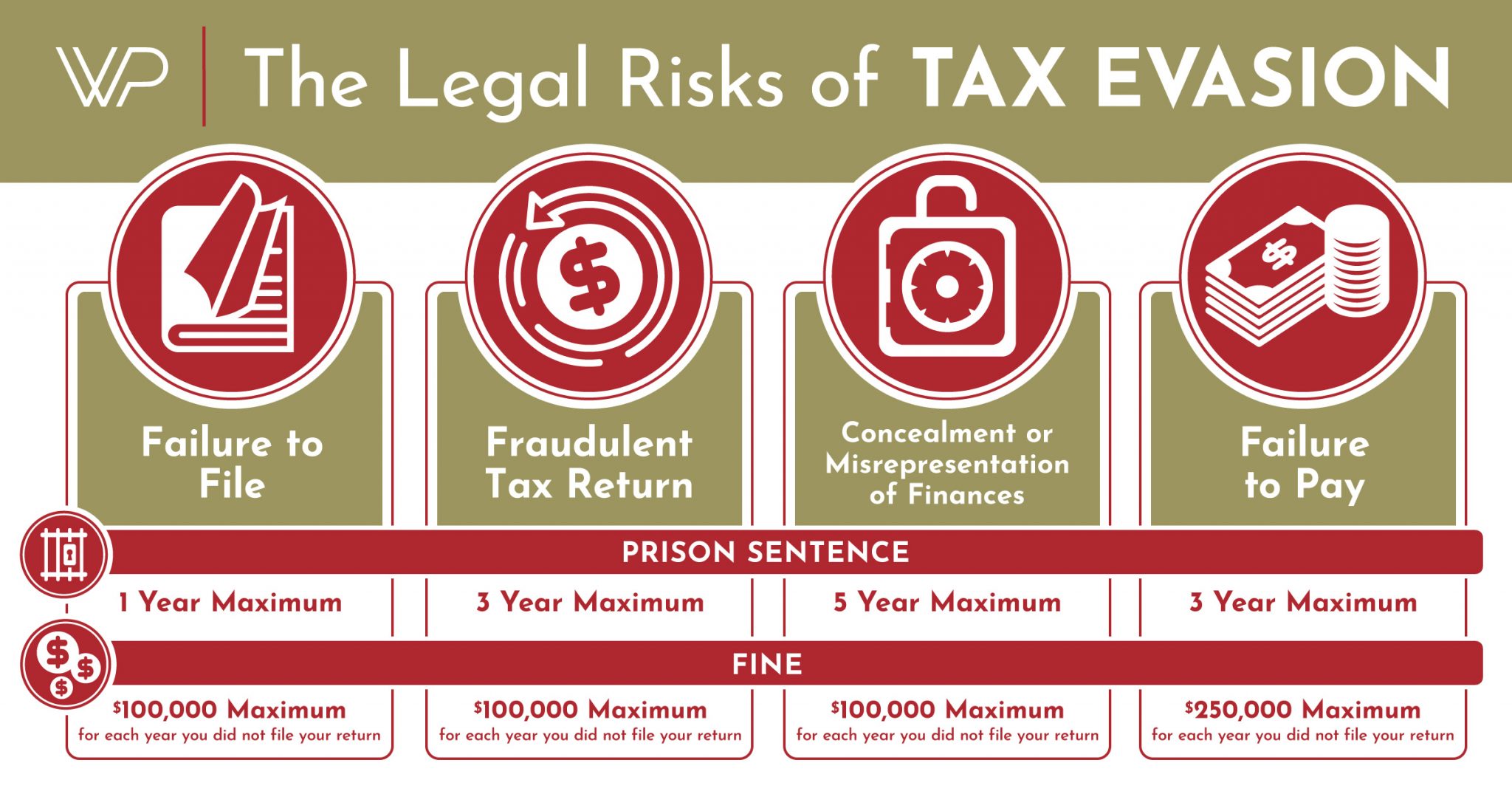

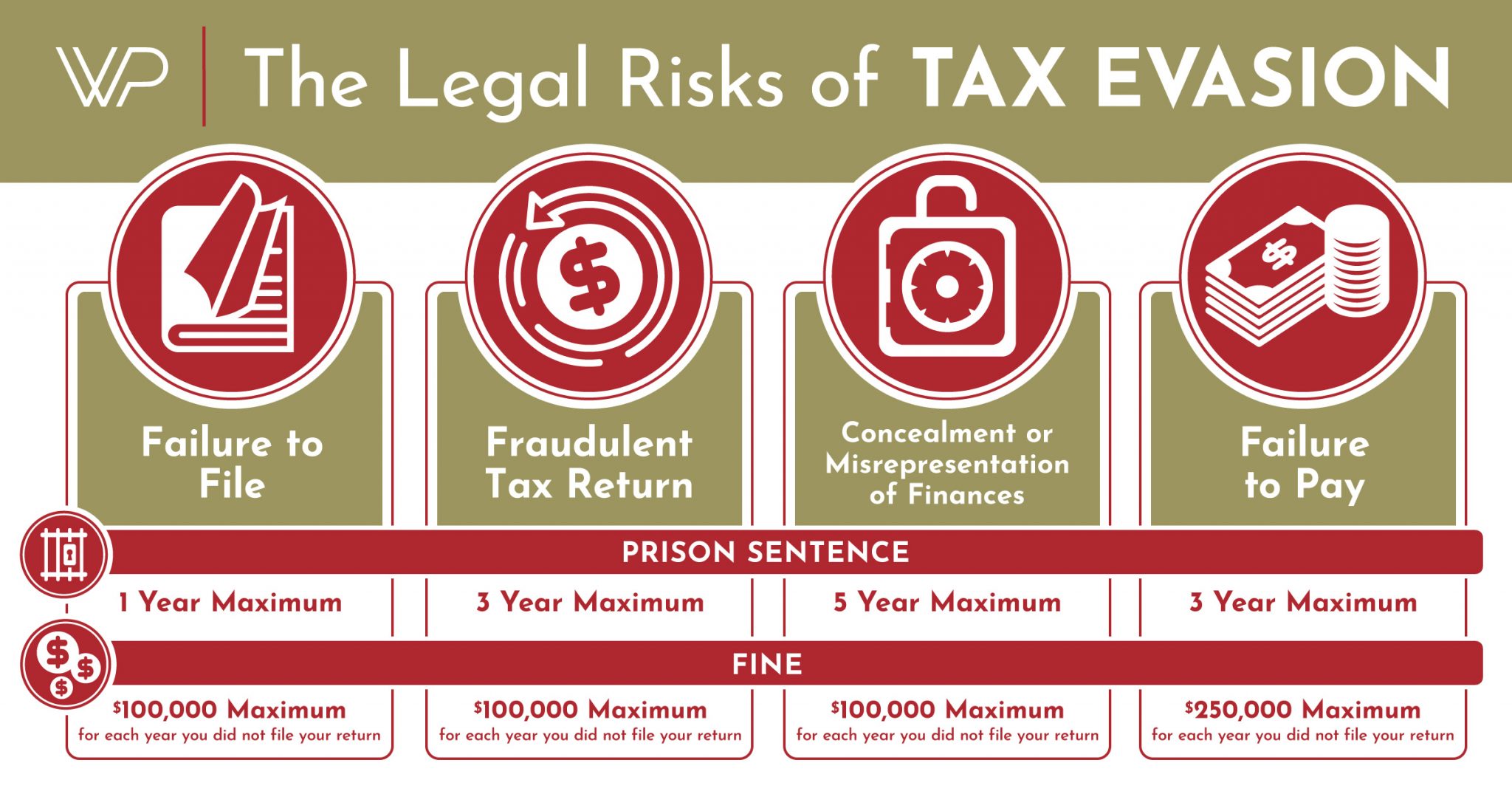

Tax Evasion Vs Tax Avoidance What Are The Legal Risks Entrapped

https://www.entrapped.com/wp-content/uploads/2022/08/TaxEvasion-InfoGraphic-1-2048x1075.jpg

Let s Build 7 Tips To Find A Contractor To Complete Your Job

https://www.findabusinessthat.com/blog/wp-content/uploads/2018/10/find-a-contractor.jpeg

https://www.nerdwallet.com/article/small-business/...

This handy guide for independent contractors explains tax responsibilities deadlines deductions and how to pay

https://www.ato.gov.au/.../working-as-a-contractor

If you re an independent contractor in the building and construction industry you must also lodge a taxable payments annual report TPAR Check if you are an employee or independent contractor Independent contractors have different tax and super obligations to employees

What Are The Different Types Of Contractors

Tax Evasion Vs Tax Avoidance What Are The Legal Risks Entrapped

Taxation Graph Hot Sex Picture

IR35 Can Contractors Claim Back Tax Offsets Freelance Informer

Contractor Hourly Rate Calculator RashumYohana

The Pros And Cons Of Hiring Independent Contractors

The Pros And Cons Of Hiring Independent Contractors

Blog Construction Management Construction Project Management

Printable Independent Contractor 1099 Form Printable Forms Free Online

Problems Of The Contractors Claim Management Download Table

What Can Contractors Claim On Tax - The United Auto Workers union on Tuesday filed federal labor charges against former President Donald Trump and Tesla CEO Elon Musk for threatening to intimidate workers who go on strike