What Can Disability Workers Claim On Tax A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and retirement accounts These deductions and rules are in addition to several tax credits that help recipients of disability benefits

If you are unable to complete your tax return because of a disability you may be able to obtain assistance from an IRS office or the Volunteer Income Tax Assistance or Tax Counseling for the Elderly Programs sponsored by IRS Community support workers and direct carers guide to income allowances and deductions for work related expenses Last updated 2 June 2024 Print or Download For a summary of common expenses see Community support workers PDF 427KB

What Can Disability Workers Claim On Tax

What Can Disability Workers Claim On Tax

https://www.consolidatedcreditcanada.ca/wp-content/uploads/2021/12/disability-tax-credit.jpg

How Does Disability Employment Services South Australia Help People

https://f8gure.com/wp-content/uploads/2021/11/wheelchair-4482537_960_720-945x630.jpg

Can I Get Disability After Workers Comp Settlement

https://www.shouselaw.com/wp-content/uploads/2022/08/disabled-person-workers-comp-disability.jpeg

You can claim the credit on Form 1040 or 1040 SR You figure the credit on Schedule R Form 1040 Credit for the Elderly or the Disabled For more information see the instructions for Schedule 3 Form 1040 line 6d and Pub 524 Credit for Under the tax code most payments to compensate you for being injured including most legal settlements may be taxable or not depending on your injuries If you have non physical injuries like

Tax Filing for Disability Benefits Accurate tax filing for disability benefits requires understanding if the benefits are taxable considering income sources like disability insurance social security disability and any work related income AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in the IRS publications referenced Standard Deduction If you are legally blind you may be entitled to a higher standard deduction on your tax return

Download What Can Disability Workers Claim On Tax

More picture related to What Can Disability Workers Claim On Tax

We Can And We Do Highlighting The Ability In DisAbility Disability

http://www.lifeontheslowlane.co.uk/wp-content/uploads/2017/05/disability.jpg

Social Security Disability Missoula Workers Compensation And Social

https://clarkforklaw.com/wp-content/uploads/2017/06/iStock-183295330.jpg

The Compelling Facts About Disability Infographic

https://www.tmait.org/hubfs/infographic_disability.jpg

You can claim the cost of using a car you own when you drive directly between separate jobs on the same day for example from your first job as a ato gov au carers personal care assistant to your second job as a disability support worker Fact Checking Claims About Tim Walz s Record Republicans have leveled inaccurate or misleading attacks on Mr Walz s response to protests in the summer of 2020 his positions on immigration

Unlike a typical tax credit the bill would allow taxpayers to receive the benefit up to 500 on a monthly basis so families don t have to turn to payday loans with very high interest To help you make heads AND tails of it all we ve put together a quick cheat sheet for 15 NDIS worker expenses that you can claim might be able to claim and can t claim We ve also included a few guidelines explaining why an expense will may won t be

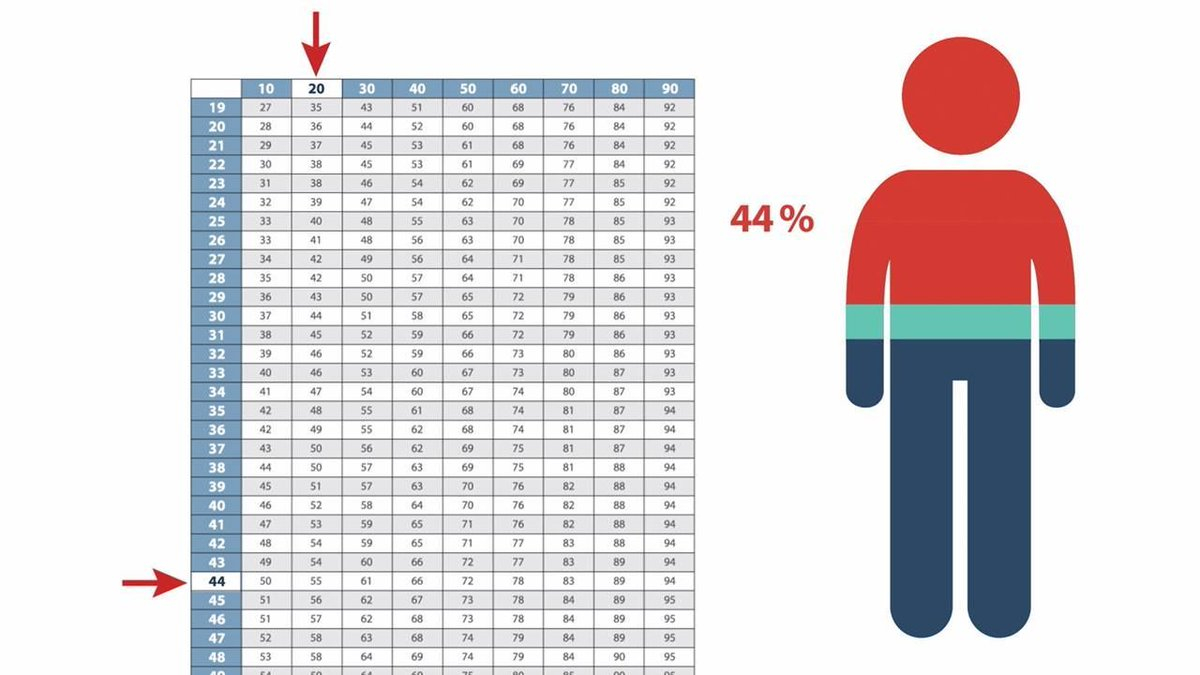

VA Disability Payment Increase VA Disability Rates 2021

https://va-disability-rates.com/wp-content/uploads/2021/08/2020-va-disability-pay-chart-va-claims-insider-1.jpg

Do Workers Compensation Settlements Affect Social Security Disability

https://socialsecuritydisabilityadvocatesusa.com/wp-content/uploads/2021/04/64670085_m-1024x683.jpg

https://www.disabilitysecrets.com/resources/tax...

A number of tax deductions and exclusions benefit people who are on SSDI or SSI and they can also gain from a few special rules for tax advantaged savings and retirement accounts These deductions and rules are in addition to several tax credits that help recipients of disability benefits

https://www.irs.gov/individuals/more-information...

If you are unable to complete your tax return because of a disability you may be able to obtain assistance from an IRS office or the Volunteer Income Tax Assistance or Tax Counseling for the Elderly Programs sponsored by IRS

.jpg)

How Can Disability Support Workers Seek Support From More Experienced

VA Disability Payment Increase VA Disability Rates 2021

VA Disability Pay Chart VA Disability Rates 2021

DISABILITY INSURANCE NH LAW

Sample Resume For Disabled Person Wavingwithmyhands

How To Apply For Disability In Va Disability Talk

How To Apply For Disability In Va Disability Talk

Senate Unanimously Passes Job Training Bill For Floridians With

Va Disability Pay Chart 2020 Calendar Best Picture Of Chart Anyimage Org

VA Compensation Tables VA Disability Rates 2021

What Can Disability Workers Claim On Tax - Tax Filing for Disability Benefits Accurate tax filing for disability benefits requires understanding if the benefits are taxable considering income sources like disability insurance social security disability and any work related income