What Can I Claim As An Independent Contractor Web 5 Dez 2023 nbsp 0183 32 As an independent contractor unless you ve set your business up as an LLC or a corporation you will report your taxes as a sole proprietor This means you will

Web 22 Dez 2023 nbsp 0183 32 You could be considered an independent contractor if you operate as a sole proprietor form a limited liability company LLC Web 15 Juni 2021 nbsp 0183 32 The IRS has rules and tests to help make the decision but at a high level if a business only has the ability to control the result of the work you perform not how you perform the work you might

What Can I Claim As An Independent Contractor

What Can I Claim As An Independent Contractor

https://americansforprosperity.org/wp-content/uploads/2021/02/Infographic_v02-01.png

Compensation Claim Letter Template Amazing Certificate Template Ideas

https://lowetechphones.com/wp-content/uploads/2021/08/sample-claim-letter-for-work-best-letter-template-throughout-compensation-claim-letter-template-1106x1536.png

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

https://assets-global.website-files.com/601d611d601043ab3e22931b/63c0f1e767846cf05c7af85e_how-to-write-off-expenses-as-an-independent-contractor.webp

Web Independent contractor status usually gives you a lot more autonomy and control over your work You re your own boss set your own hours and make your own tax payments Web An independent contractor is a person or company that provides goods or services to another entity under a verbal agreement or specified contract It s essential to know what tax deductions you qualify

Web Any money spent on your work as an independent contractor can be claimed as a tax deduction If you purchase a computer printer or other office machinery to be used in your business you can Web As an independent contractor you re required to pay your federal and state if applicable taxes to the Internal Revenue Service IRS and state revenue departments on your own so they are not withheld from your

Download What Can I Claim As An Independent Contractor

More picture related to What Can I Claim As An Independent Contractor

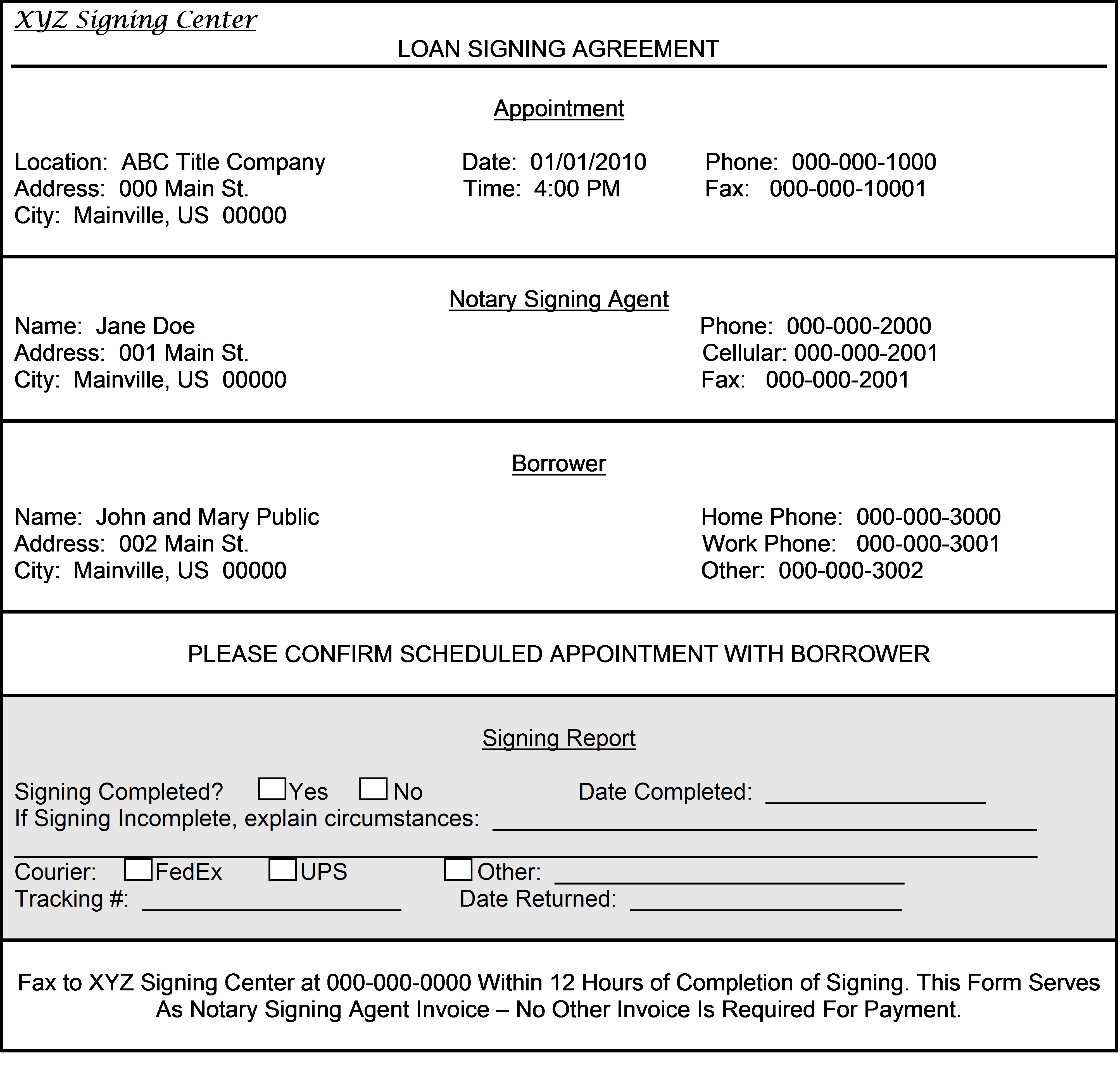

Independent Contractor s Agreement

https://application.notaries.com/images/sa-course/3-1.png

Simple Construction Contract Template Pdf Hot Sex Picture

https://hocl460.com/ee727160/https/7ece76/signaturely.com/wp-content/uploads/2020/06/independent_contractor_agreement_template3.jpg

How Do I Know If I m Really An Employee Or An Independent Contractor

http://static1.squarespace.com/static/59504e122cba5e9f91c23be2/597149e14402434f8c326209/5bb3fe114785d3ef5425f4aa/1636570203613/Independent+Contractor+Agreement.jpg?format=1500w

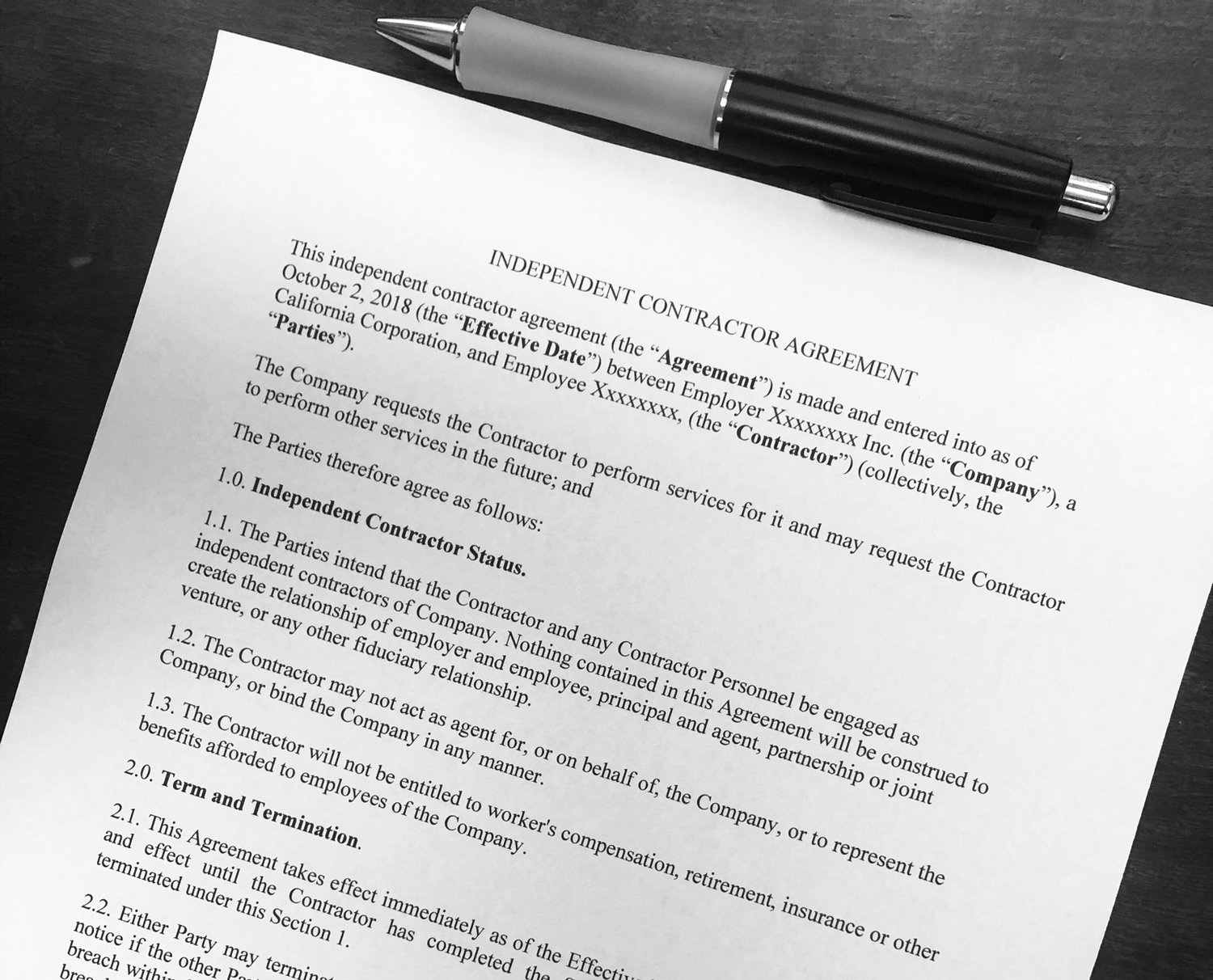

Web 18 Jan 2022 nbsp 0183 32 It is a legally binding document between an employer individual or company and a 1099 worker contractor Here are five things that should be in every Web 20 Sept 2022 nbsp 0183 32 Taxes for an Independent Contractor an Example An independent contractor works for several clients in 2020 and earns in total 27 000 for the year as shown on the 1099 NEC form received from

Web 3 Mai 2022 nbsp 0183 32 Business insurance such as a professional liability policy is a common example You can also deduct 100 percent of medical vision and dental premiums Web Where to claim it Schedule C Box 22 Supplies As a 1099 contractor you ll probably need some supplies and tools to run your business Luckily you can deduct the amount

Independent Contractor Agreement Hire A Skilled Consultant From

https://www.bizzlibrary.com/Storage/Media/c2c5c77f-fecf-48b4-812d-8ca895a0a055.png

12 Common Mistakes Of The Independent Contractor

https://contractortaxation.com/wp-content/uploads/2019/01/22-scaled.webp

https://www.nextinsurance.com/blog/tax-deductions-for-independent...

Web 5 Dez 2023 nbsp 0183 32 As an independent contractor unless you ve set your business up as an LLC or a corporation you will report your taxes as a sole proprietor This means you will

https://smartasset.com/taxes/independe…

Web 22 Dez 2023 nbsp 0183 32 You could be considered an independent contractor if you operate as a sole proprietor form a limited liability company LLC

Stronger Together Labor And Employment Update Employee Or

Independent Contractor Agreement Hire A Skilled Consultant From

Hiring An Independent Contractor

The Tech Contracts Handbook Pdf Download Sean Opsahl

Work Parallel Independent Contractor Vs Self Employed

Independent Contractor Offer Letter Template

Independent Contractor Offer Letter Template

The Ultimate Independent Contractor Vs Employee Checklist How To

How To File Taxes As An Independent Contractors H R Block

Independent Contractor Agreement For Brokers And Licensees Associate

What Can I Claim As An Independent Contractor - Web 28 Okt 2022 nbsp 0183 32 What Is an Independent Contractor An independent contractor is a self employed person or small business owner who performs services for another