What Can I Claim On My Taxes For Education Expenses What are examples of education expenses SOLVED by TurboTax 3203 Updated November 23 2023 Education expenses can be complex but we ll simplify them for you Here are examples of what you can and can t deduct You can deduct Tuition Enrollment fees Expenses paid to school on condition of enrollment lab fees for

There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit Who can claim an education credit Deductions Tuition and fees deduction Student loan interest deduction Qualified student loan Qualified education expenses Business deduction for work related education Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit

What Can I Claim On My Taxes For Education Expenses

What Can I Claim On My Taxes For Education Expenses

https://i.insider.com/5e2b52f924306a57700c4fc4?width=750&format=jpeg&auto=webp

What Travel Costs Can I Claim As A Business Expense When I Travel Full

https://images.squarespace-cdn.com/content/v1/5510bad9e4b0ce924f0445c5/1591045269227-VP84B76ENM22TGRFB25R/Can+I+claim+my+travel+expenses+as+business+expenses+when+I+travel+full+time+as+a+digital+nomad+or+full-time+RVer.+NuventureCPA.com

How Much Tax Can I Claim For Working From Home 2024 Updated

https://rechargevodafone.co.uk/wp-content/uploads/2023/01/how-much-tax-can-i-claim-for-working-from-home_447383-1.jpg

You can claim either the American opportunity tax credit or the lifetime learning credit American Opportunity Tax Credit The American opportunity tax credit AOTC is available for students who College is an expensive endeavor Luckily some higher education expenses can be used to claim a tax credit or in certain scenarios a tax deduction It s important to know which expenses count and what documentation you need to keep so you can maximize your tax benefit Read on for details

There are three possible ways to deduct qualified education expenses on your tax return The tuition and fees deduction is available to all taxpayers Then there are two education credits you can claim the American opportunity tax credit AOTC and the lifetime learning credit LLC Educational Tax Credits and Deductions You Can Claim for Tax Year 2023 Several tax breaks can help you cover the high costs of education future college expenses and interest you pay on

Download What Can I Claim On My Taxes For Education Expenses

More picture related to What Can I Claim On My Taxes For Education Expenses

3 Ways To Stay On Top Of Your Taxes ArticleCity

https://www.articlecity.com/wp-content/uploads/2017/02/taxpreparation.jpg

Can You Deduct Unreimbursed Employee Expenses In 2022

https://www.efile.com/image/Form-2016-employee-business-expenses.jpg

College Students Body The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2022/11/College-Students-Body-scaled.jpg

You can claim both the American Opportunity Tax Credit and the Lifetime Learning Credit on the same tax return but not for the same student Keep records of qualifying expenses you ve paid The student should receive an IRS Form 1098 T Tuition Statement from the educational institution What education expenses are tax deductible Another tax break for your educational expenses Rules for claiming education expenses Here are the IRS s guidelines for tax deductible education expenses It allows you to maintain or improve your job skills Over time there are updates to the tools software and processes you

Key Takeaways The Tuition and Fees Deduction was extended through the end of 2020 and allows you to deduct up to 4 000 from your income for qualifying tuition expenses paid for you your spouse or your dependents Deductions you can claim Find out which expenses you can claim as income tax deductions and work out the amount to claim How to claim deductions How to claim income tax deductions for work related expenses and other expenses and record your deductions Cars transport and travel

Expense Claim Form Template Excel Printable Word Searches

https://i2.wp.com/wordtemplate.net/wp-content/uploads/2017/10/Expense-Claim-Form.jpg

Small Business Expenses Tax Deductions 2023 QuickBooks

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/standard-vs-itemized-deductions.png

https://ttlc.intuit.com/turbotax-support/en-us/...

What are examples of education expenses SOLVED by TurboTax 3203 Updated November 23 2023 Education expenses can be complex but we ll simplify them for you Here are examples of what you can and can t deduct You can deduct Tuition Enrollment fees Expenses paid to school on condition of enrollment lab fees for

https://www.irs.gov/newsroom/tax-benefits-for...

There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit Who can claim an education credit Deductions Tuition and fees deduction Student loan interest deduction Qualified student loan Qualified education expenses Business deduction for work related education

4 Self Employment Expenses I Claim On My Taxes And Why I m Allowed To

Expense Claim Form Template Excel Printable Word Searches

Image Result For Hair Salon Expenses Printable Business Tax

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

529 Plan Guide What College Expenses Are Qualified And Other Need to

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy UK

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy UK

What If I Don t Have Receipts For Last Year s Business Expenses Mazuma

List Of Tax Deductions Here s What You Can Deduct

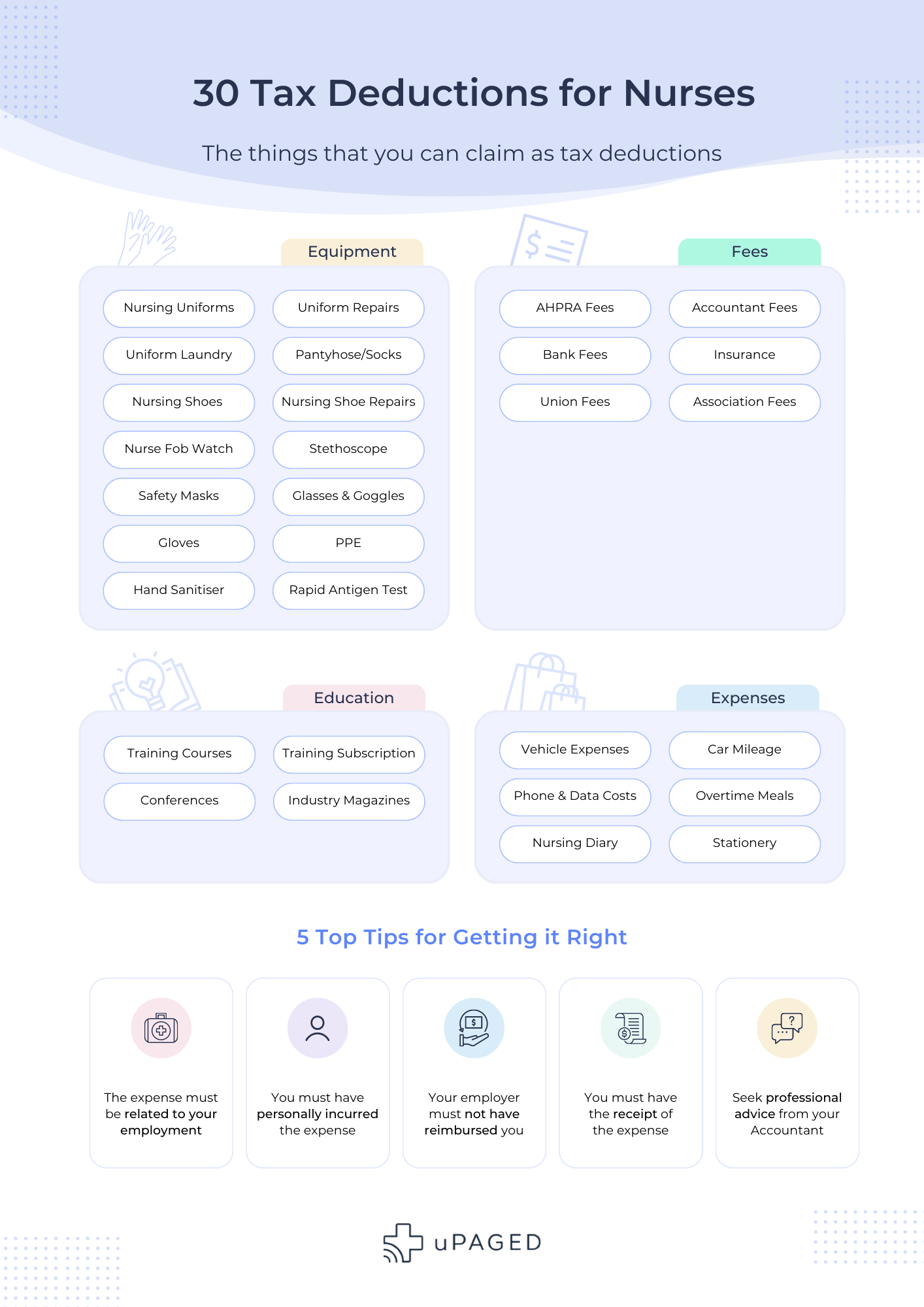

30 Things Nurses Can Claim As Tax Deductions In 2023 UPaged

What Can I Claim On My Taxes For Education Expenses - There are three possible ways to deduct qualified education expenses on your tax return The tuition and fees deduction is available to all taxpayers Then there are two education credits you can claim the American opportunity tax credit AOTC and the lifetime learning credit LLC