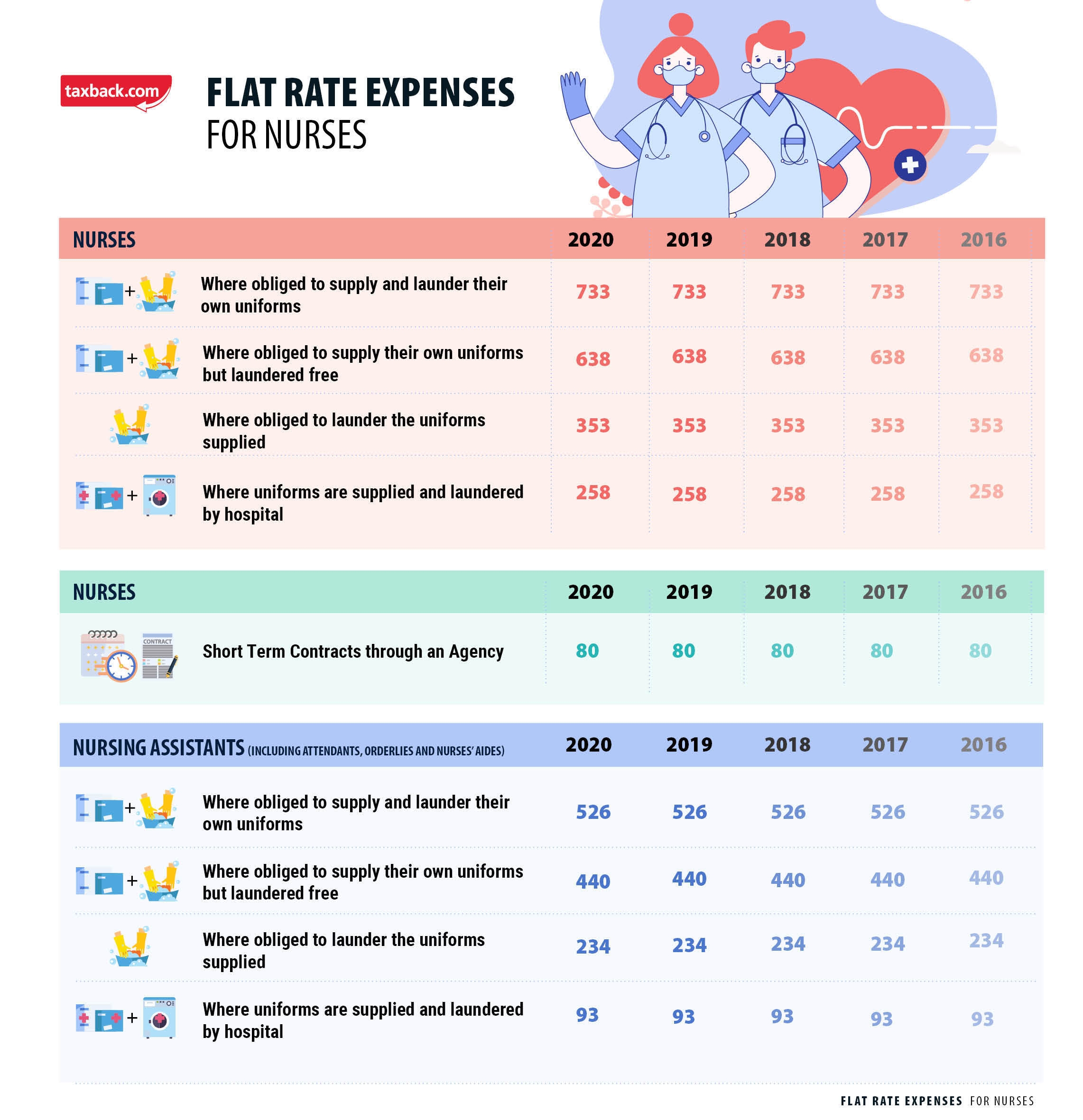

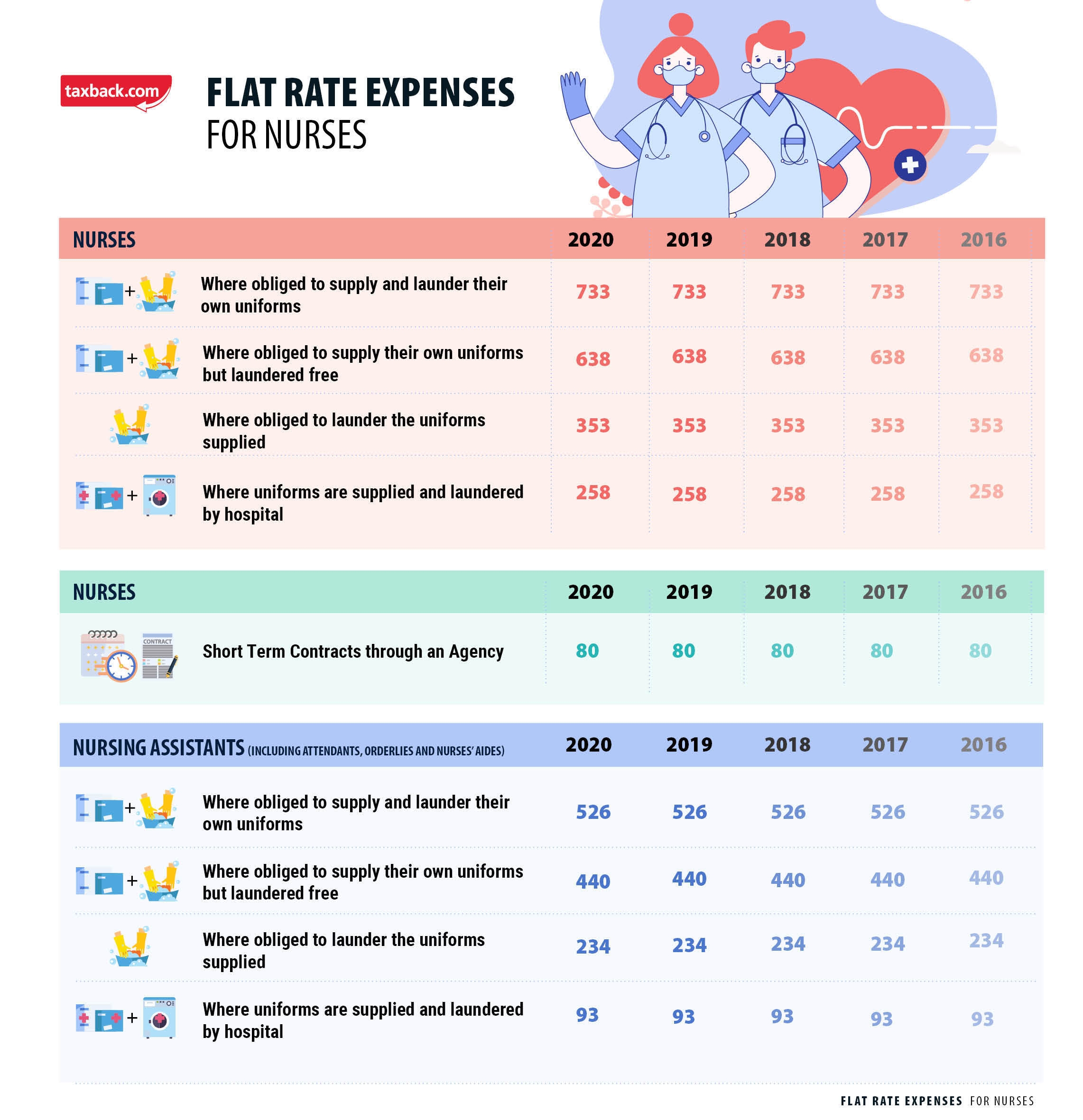

What Can You Claim Back On Tax As A Nurse So what can they claim back on their taxes Some nursing professionals working as bank staff for the NHS are eligible for flat rate expenses for a number of

When you first claim your Nurses Tax Rebate you get back your tax overpayment for the last four years and an altered tax code continues tax savings for the rest of your working And these out of pocket expenses are often valid tax deductions for nurses and claimable on your next tax return Below we ve covered a range of tax tips and tax deductions all

What Can You Claim Back On Tax As A Nurse

What Can You Claim Back On Tax As A Nurse

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Can You Claim Back On Gym Membership YouTube

https://i.ytimg.com/vi/P4tVp8mqFrQ/maxresdefault.jpg

HM Revenue and Customs HMRC allow individuals to claim tax relief on professional subscriptions or fees which have to be paid in order to carry out a job This includes our To claim the expenses you can use form P87 if they amount to less than 2 500 per annum which is available on HMRC s website or alternatively submit a tax return You may also find that the professional

If your claim is for previous tax years HMRC will either adjust your tax code or give you a tax refund How to claim How you claim depends on what you re claiming for How far back can I claim The general time limit for making a claim is four years after the end of the tax year in question For example if you wanted to claim for

Download What Can You Claim Back On Tax As A Nurse

More picture related to What Can You Claim Back On Tax As A Nurse

5 Hidden Expenses You Never Knew You Could Claim Back On Tax Star 104

https://www.star1045.com.au/wp-content/uploads/2020/03/hidden_expenses_claim_tax_1.jpg

What Tax Can You Claim Back On A Rental Property CIA Landlords

https://www.datocms-assets.com/50462/1643028077-shutterstock_581002882.jpg?auto=format&crop=focalpoint&fit=crop&fp-x=0.5&fp-y=0.5&h=540&w=1280

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

As a guide members who pay basic rate tax in the UK can claim up to 20 on their RCN membership fees This rises to 40 for higher rate tax payers Please note that there There are no longer deductions available for you as an employee If you work as a contract nurse such as a traveling nurse home health care etc you are generally

To claim a deduction for work related expenses You must have spent the money yourself and weren t reimbursed It must be directly related to earning your income You must have This article was originally published in July 2019 and updated in June 2022 Here are our tips for making the most of tax time this year 1 Know what you can claim Knowing

What Tax Can You Claim Back On A Rental Property

https://d2ypxhkb4lw69u.cloudfront.net/wp-content/uploads/2022/11/07155654/shutterstock_1601693080-768x512.jpeg

Top 5 Types Of Property Occupants Infographic

https://d2ypxhkb4lw69u.cloudfront.net/wp-content/uploads/2022/11/08145501/property-occupants-infographic.jpeg

https://countingup.com/resources/what-can-you-claim-on-tax-as-a-nurse

So what can they claim back on their taxes Some nursing professionals working as bank staff for the NHS are eligible for flat rate expenses for a number of

https://www.taxrebateservices.co.uk/tax-guides/nurse-tax-rebate-guide

When you first claim your Nurses Tax Rebate you get back your tax overpayment for the last four years and an altered tax code continues tax savings for the rest of your working

What Can You Claim On Tax LawPath

What Tax Can You Claim Back On A Rental Property

Tax Return 2017 The Weird Things You Didn t Know You Could Claim

What Can You Claim Back On CIS Daily Business Study

Personal Injury Claims Car Accident Injury Claim Singapore BRZE

The Ultimate Tax Refund Guide Every Nurse Needs Right Now

The Ultimate Tax Refund Guide Every Nurse Needs Right Now

What Tax Can You Claim Back On A Rental Property

Major U Turn On Plans To Abolish The 45p Income Tax Rate TI

Self Assessment Tax Returns What Can You Claim Back Sapphire Clear

What Can You Claim Back On Tax As A Nurse - Tax Tips Every Nurse Should Know Staff Writer Mar 29 2022 Taxes it s the five letter word everyone dreads come April Chances are if you re a working