What Charities Qualify For Az Tax Credit Learn how to claim tax credits for donations to Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs in Arizona Find out the eligibility

Learn how to use the Arizona Charitable Tax Credit to support local charities like A New Leaf and get a dollar for dollar reduction of your state taxes Find out the eligibility limits deadlines and Arizona Charitable Tax Credit Give to a qualified charity that provides immediate basic needs to residents of Arizona who receive temporary assistance for needy families TANF benefits are

What Charities Qualify For Az Tax Credit

What Charities Qualify For Az Tax Credit

https://www.patriotsoftware.com/wp-content/uploads/2022/12/az-state-income-tax-form-2023.jpg

How To Make Your Rental Property Qualify For The QBI Deduction

https://amynorthardcpa.com/wp-content/uploads/2022/10/How-to-Make-Your-Rental-Property-Qualify-for-the-QBI-Deduction-FB.png

Donate To Your Favorite Charities Through Workplace Giving America s

https://charities.org/sites/default/files/campaign landing page graphic_cfc_2.jpg

The Arizona Charitable Tax Credit allows individuals to reduce their state tax liability by making eligible contributions to qualifying charitable organizations QCOs When you donate to a certified QCO you can receive a dollar for AZ Tax Credit Funds helps you donate to any qualified organization or school in Arizona and get a tax credit Learn how to donate online or by phone choose from different categories and find

Find out which charities are eligible for the Arizona Charitable Tax Credit for cash donations made in 2022 The list includes the QCO code name address and tax ID of each organization Formerly known as the Working Poor tax credit the Charitable Tax Credit allows Arizona taxpayers to claim a dollar for dollar credit when they make donations to qualifying charities

Download What Charities Qualify For Az Tax Credit

More picture related to What Charities Qualify For Az Tax Credit

14 Different Types Of Charities You Should Know About With Examples

https://nonprofitpoint.com/wp-content/uploads/2022/08/Different-Types-of-Charities-You-Should-Know-About-min.png

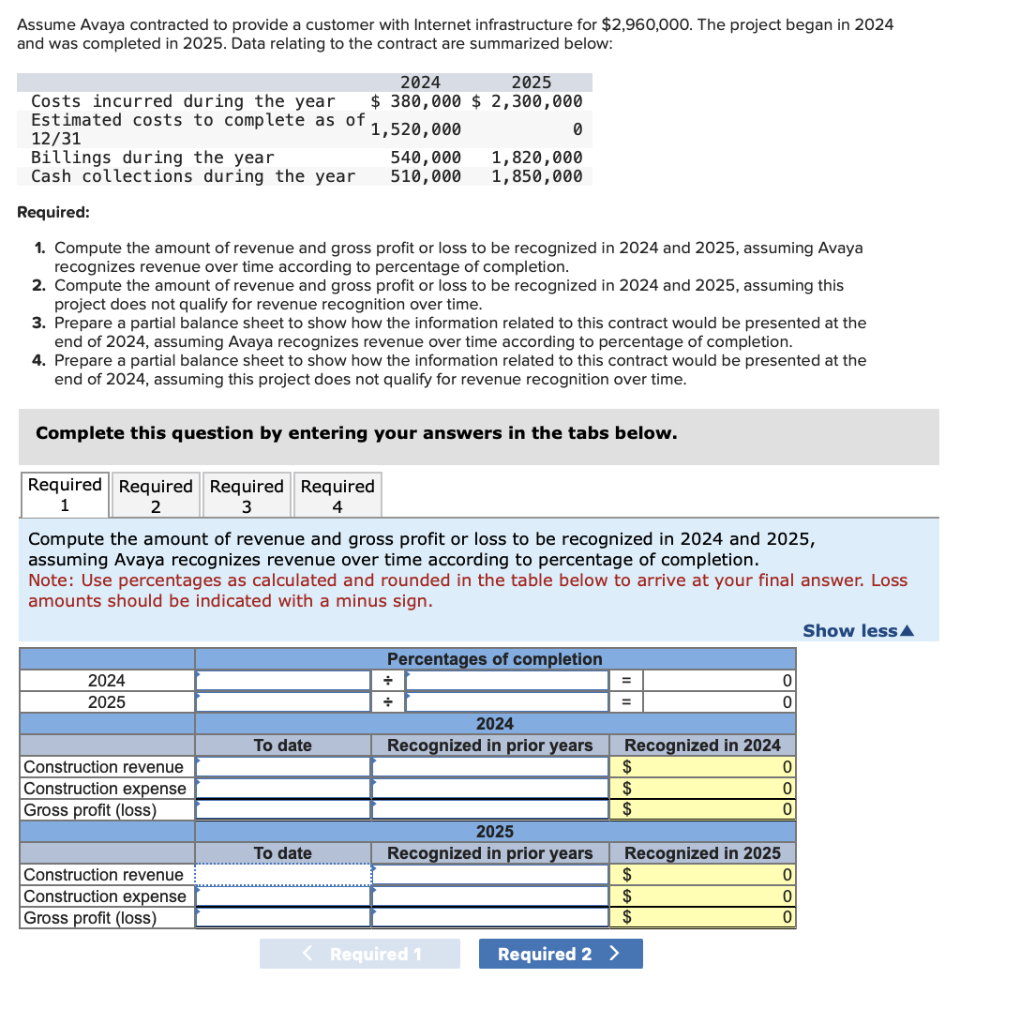

Solved Assume Avaya Contracted To Provide A Customer With Chegg

https://media.cheggcdn.com/media/7a5/7a5c78a7-0180-4bc3-aaa9-afd0bed0461e/phpXWWabT

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Yes you can give to AZCEND for your charitable tax credit while also giving to organizations approved for school foster care and veteran tax credits What if I don t itemize my taxes You Learn how to become a Qualifying Charitable Organization QCO eligible for the Arizona income tax credit program in 2024 Find out the requirements services populations and application

According to the Arizona Department of Revenue ADOR qualified organizations for tax credits are Qualifying Charitable Organizations QCOs These are non profit What is the Arizona Charitable Tax Credit Arizona allows you to take a dollar for dollar credit on your state taxes when you donate up to 470 for single filers or 938 for married couples filing

2020 AZ Form 140 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/551/820/551820369/large.png

Arizona Tax Credit Choices Pregnancy Centers

https://www.choicesaz.com/wp-content/uploads/2022/12/unnamed.png

https://azdor.gov/tax-credits/credits-contributions-qcos-and-qfcos

Learn how to claim tax credits for donations to Qualifying Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs in Arizona Find out the eligibility

https://www.turnanewleaf.org/wp-content/uploads/...

Learn how to use the Arizona Charitable Tax Credit to support local charities like A New Leaf and get a dollar for dollar reduction of your state taxes Find out the eligibility limits deadlines and

How To Fill Out Form 1040 For 2022 Taxes 2023 Money Instructor

2020 AZ Form 140 Fill Online Printable Fillable Blank PdfFiller

Surprise Only 13 EVs Qualify For Tax Credit Pirate s Cove Pirate s

AZ Tax Credit Donation Verde Valley Sanctuary

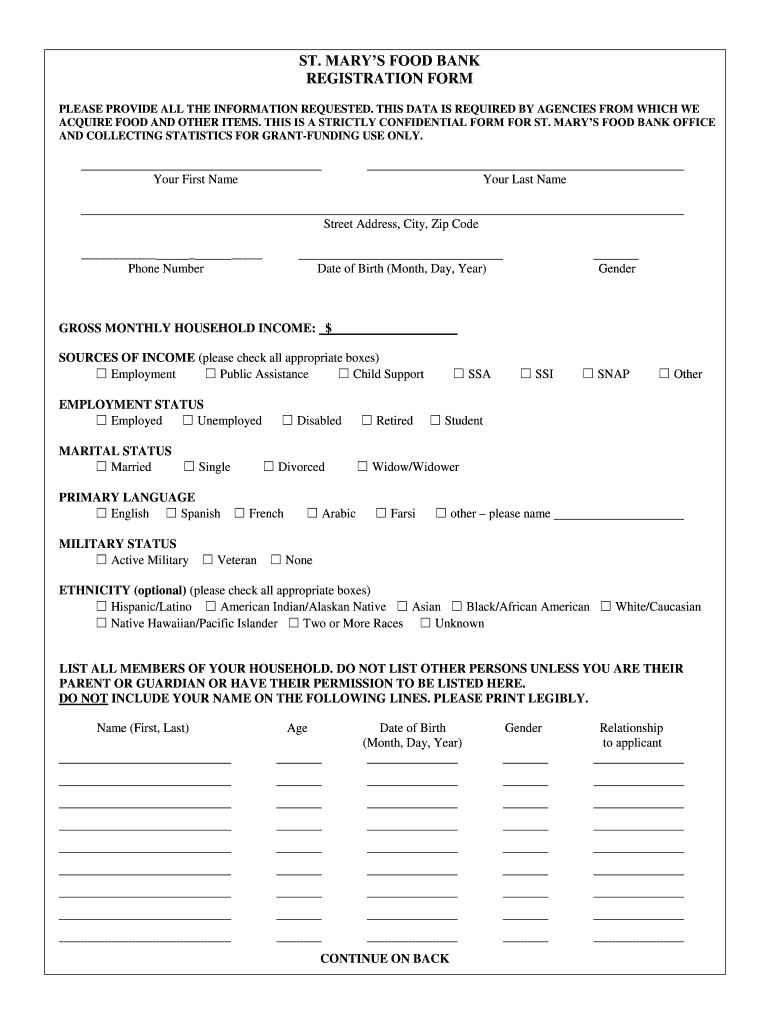

AZ St Marys Food Bank Registration Form 2018 2022 Fill And Sign

Arizona Tax Rate H R Block

Arizona Tax Rate H R Block

These Electric Vehicles Qualify For A 7 500 Tax Credit

Bunching Up Charitable Donations Could Help Tax Savings

Individual Golf Fundraiser Ticket Chandler Service Club

What Charities Qualify For Az Tax Credit - You as a taxpayer in Arizona can make financial contributions to certain qualifying organizations and schools which you can then claim as an up to dollar for dollar tax credit on your AZ