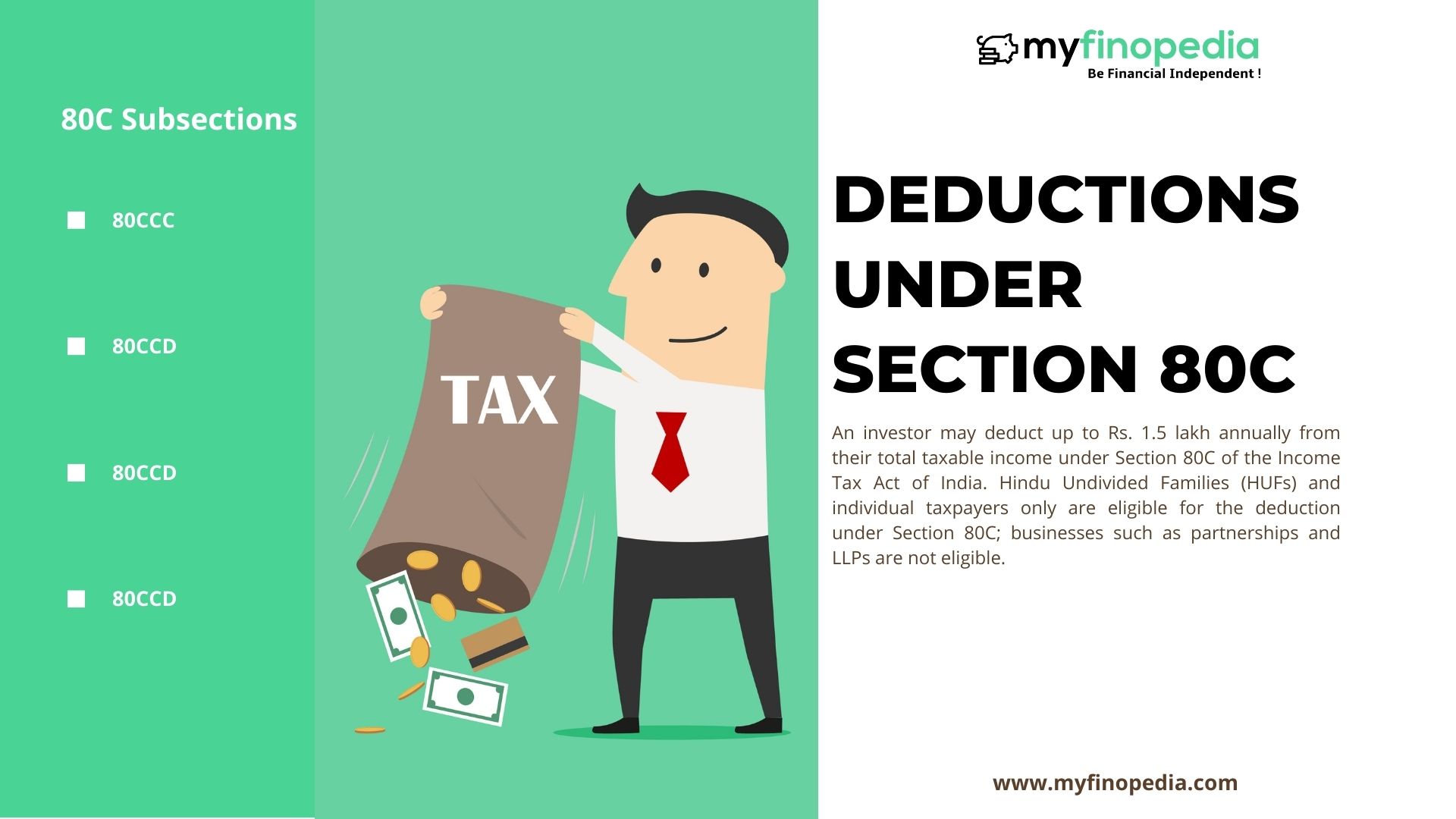

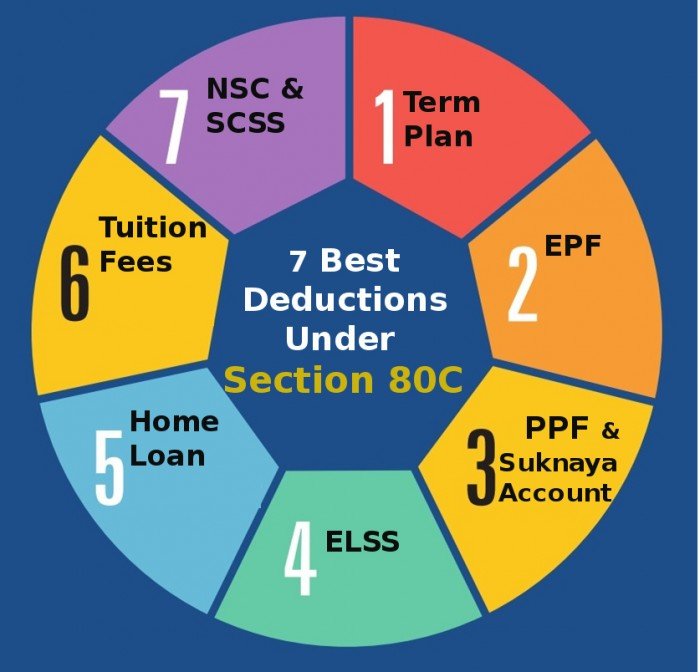

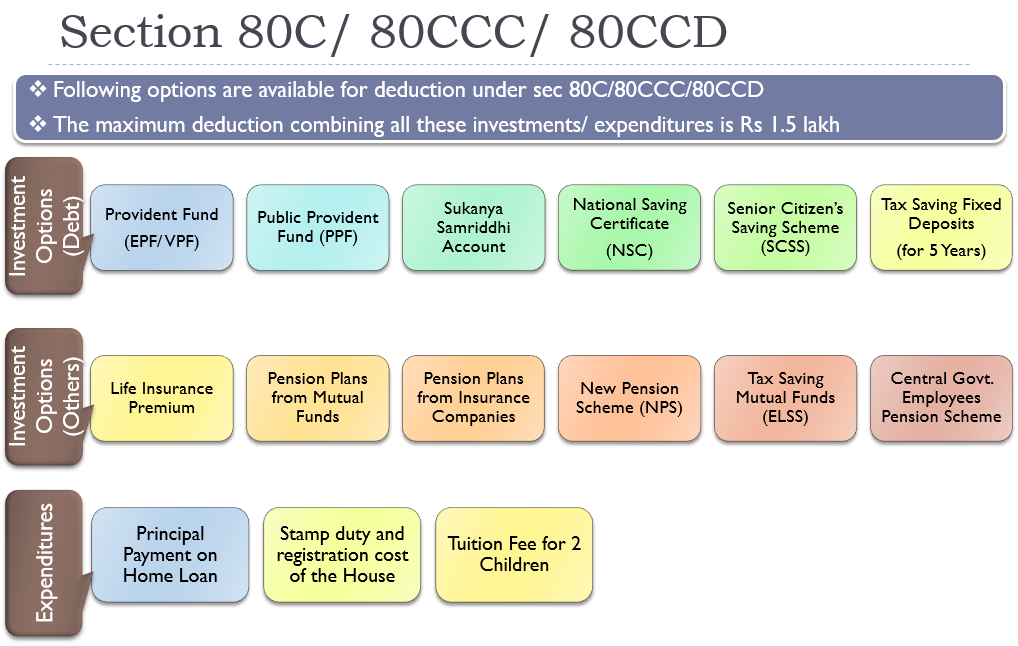

What Comes Under 80c 80ccc 80ccd Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different financial assets such

The maximum exemption amount allowed by Section 80C is 1 5 lakh per year which is made up of deductions allowed by Sub sections 80C Section 80C of the Act provides for a deduction of up to Rs 1 5 lakh from the total taxable income of Individuals and Hindu Undivided Families

What Comes Under 80c 80ccc 80ccd

What Comes Under 80c 80ccc 80ccd

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

All Deductions In Section 80C Chapter VI A FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/03/All-Deductions-in-Section-80C-80CCC-80CCD-80D-in-Hindi-Chapter-VI-A-1.webp

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

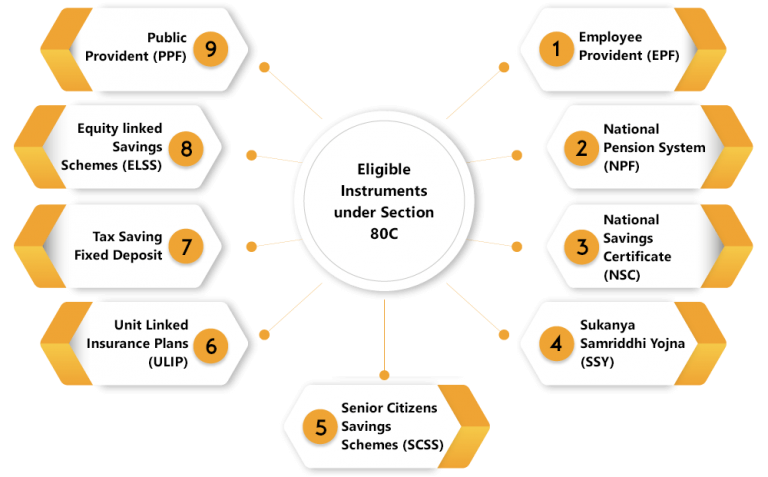

There are many such ways how you can get the deduction Under Section 80C 80CCC 80CCD This article presents you with complete insight What is Section 80C The Income Tax Act of India has set a separate clause The limit of Rs 1 5 lakh deduction of Section 80C includes 80CCC contribution towards pension plan and 80CCD 1 80CCD 1b and 80CCD 2 Section 80CCCD 1 is a contribution towards the National pension scheme by

With effect from assessment year 2016 17 sub section 1A of Section 80CCD which laid down maximum deduction limit of Rs 1 00 000 under sub section 1 has been deleted Further a new sub section 1B is inserted Section 80C provides tax deductions for individuals and Hindu Undivided Families HUFs through certain investments and expenses The maximum deduction is Rs 1 5 lakh per year Companies partnership firms and LLPs cannot use this

Download What Comes Under 80c 80ccc 80ccd

More picture related to What Comes Under 80c 80ccc 80ccd

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

https://life.futuregenerali.in/media/2zjhyg5j/section-80c-deductions.jpg

Exemptions Under Sections 80C 80CCC 80CCD And 80D For A Y 2022 23

https://1.bp.blogspot.com/-NfDpaEl2BCM/YVhxBWhKsGI/AAAAAAAASDE/jx8Nlvt4Lv8AGE-yMT7-tU2HwN6fegqCgCNcBGAsYHQ/w1200-h630-p-k-no-nu/80C.jpg

Tax benefits on expenses incurred for purchasing or continuing retirement plans are defined under Section 80CCC allowing qualifying investors to reap additional benefits The annual pension received upon submission of the annuity is Here is a list of all the deductions under the Section 80C limit in India 1 Life Insurance Premium A premium paid by the taxpayer for a life policy or endowment policy shall be covered under this

To encourage long term investments and savings tax saving options are included in the Income Tax Act under sections 80C 80CCC 80CCD 80CCE These section states The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions under

![]()

Section 80C Deduction Under Section 80C In India Paisabazaar

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_800/https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

Open ended Semi structure Interview Questions Download Scientific

https://www.researchgate.net/publication/373389938/figure/fig1/AS:11431281184538089@1693386909966/Open-ended-semi-structure-interview-questions.tif

https://www.bankbazaar.com › tax

Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different financial assets such

https://groww.in › blog

The maximum exemption amount allowed by Section 80C is 1 5 lakh per year which is made up of deductions allowed by Sub sections 80C

Why Is 80C The Best Tax Saving Instrument

Section 80C Deduction Under Section 80C In India Paisabazaar

Deduction U s 80C 80CCC 80CCD 80D Income Tax 80c

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

A Complete Guide On Income Tax Deductions Under Section 80C 80CCC

Deduction Of 80C 80CCC 80CCD Under Income Tax

Deduction Under Section 80C A Complete List BasuNivesh

What Comes Under 80c 80ccc 80ccd - Under Section 80C you can claim deductions of up to 1 5 lakh on your taxable income by investing in various tax saving instruments and investments This provision applies to