What Comes Under Section 80ccd 1b What is the difference between 80CCD 1 and 80CCD 1B Section 80CCD 1 allows a deduction of up to 1 50 000 for self contributions to NPS or APY Section 80CCD 1B allows an additional deduction of up to

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to maximize your savings with additional tax relief on NPS contributions As per Sec 80CCE aggregate deduction u s 80C 80CCC and 80CCD 1 is restricted to maximum of Rs 1 50 000 Therefore in current regime Rs 90 000 is allowed u s

What Comes Under Section 80ccd 1b

What Comes Under Section 80ccd 1b

https://i.ytimg.com/vi/9zU4iMCWPdM/maxresdefault.jpg

Section 80CCD Deduction Under 80CCD 1 80CCD 1B 80CCD 2

https://cdnlearnblog.etmoney.com/wp-content/uploads/2022/09/3-6.jpg

How To Claim Section 80CCD 1B TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/How-to-claim-Section-80CCD1B-National-Pension-Scheme-600x600.png

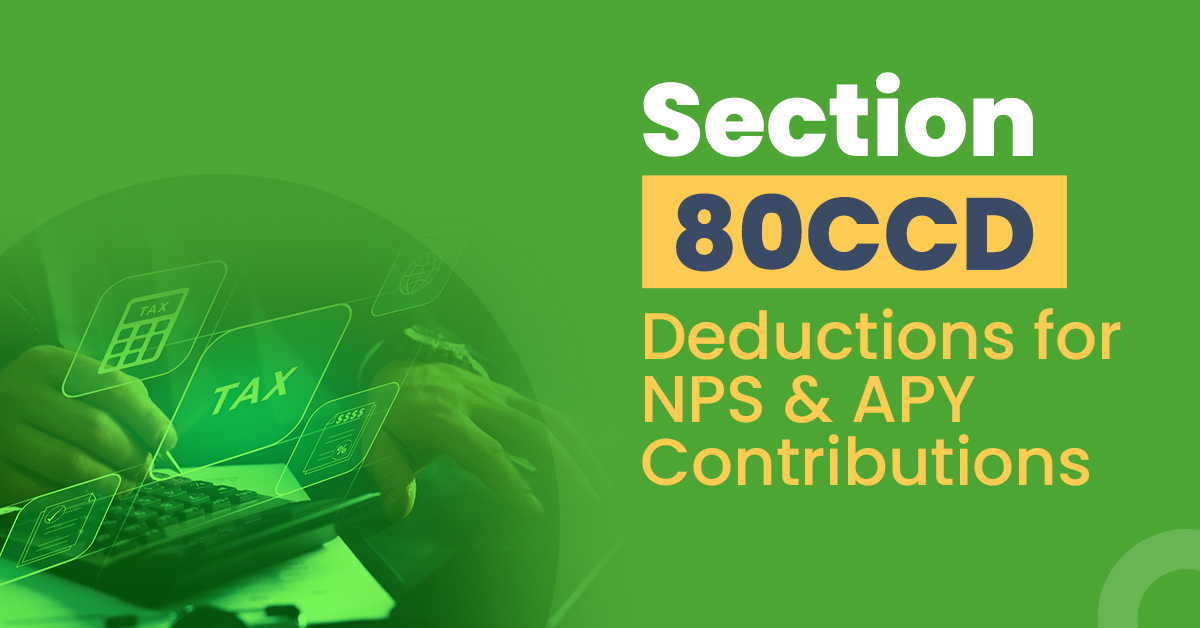

The allowable deduction is 10 of the salary or gross total income for NPS contributions whichever is lower The maximum limit for deduction under 80CCD 1 is Rs 1 50 000 After all your 80C deductions you can get an additional Section 80CCD 1 is a deduction for employees as well as self employed for making contributions to the National Pension scheme An employee can claim deduction under 80CCD 1 at a maximum of 10 of basic salary

What is the Exclusive Tax Benefit to all NPS Subscribers u s 80CCD 1B Under Section 80CCD 1B you can claim an additional tax deduction of upto Rs 50 000 for NPS contribution This limit is over and above It is conditional on the following Employees in the private sector can deduct up to 10 of their compensation base salary dearness allowance under Section 80CCD 2 Employees of

Download What Comes Under Section 80ccd 1b

More picture related to What Comes Under Section 80ccd 1b

What Is The National Pension System Section 80CCD 1B In Hindi

https://i0.wp.com/www.howtrending.com/wp-content/uploads/2022/01/et44t4.jpg?fit=720%2C432&ssl=1

Deductions Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

What Is Section 80CCD Sharda Associates

https://shardaassociates.in/wp-content/uploads/2021/03/Section-80CCD-1024x576.jpg

Section 80CCD1 allows every tax paying individual in India to get tax deduction benefits from the amount you deposit in your NPS account This tax benefit is open to both employed and self Deductions under Section 80CCD 1 are capped at INR 1 5 Lakhs per year and an additional deduction of INR 50 000 may be claimed under Sub section 80CCD 1B with a maximum deduction limit of INR 2 Lakhs

Self employed individuals can claim an additional tax deduction of up to Rs 50 000 under Section 80 CCD 1B over and above the limit of Rs 1 5 lakh under Section 80 CCE Section 80CCD 1B is a special provision under the Income Tax Act that allows taxpayers to claim an additional deduction over and above the limits specified in Section 80C

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/11/Section-80GGC.jpg

Section 80EEA Eligibility And Deduction Amount

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/income-tax/Section.jpg

https://www.etmoney.com › ...

What is the difference between 80CCD 1 and 80CCD 1B Section 80CCD 1 allows a deduction of up to 1 50 000 for self contributions to NPS or APY Section 80CCD 1B allows an additional deduction of up to

https://tax2win.in › guide

Learn about tax benefits under the National Pension System NPS and deductions available under Section 80CCD 1B Discover how to maximize your savings with additional tax relief on NPS contributions

Section 80 Eligibility Limit Investments For Which Deduction Is Claimed

Section 80GGC Of Income Tax Act Tax Deduction IndiaFilings

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Best Tax Saving Investments Under Section 80C 80CCD 80D ManipalBlog

What Is Dcps In Salary Deduction Login Pages Info

Section 80CCD Deductions And Rules

Section 80CCD Deductions And Rules

Section 80CCD Deductions For NPS And APY Contributions

Section 80CCC Tax Deductions On Pension Fund Contributions Tax2win

Have You Claimed These ITR Deductions On Section 80C 80CCD 80D

What Comes Under Section 80ccd 1b - What is Section 80CCD 1B Section 80CCD 1B of the Income Tax Act provides an additional tax benefit for contributions to the National Pension System NPS Under this