What Deductions Can I Claim Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions Tax deductions lower your taxable income how much of your income you actually pay tax on while tax credits are a dollar for dollar reduction to your tax bill Knowing which deductions or credits to claim is challenging so we created this handy list of 49 tax deductions and tax credits to take this year Ready to shop for life insurance 1

What Deductions Can I Claim

What Deductions Can I Claim

https://jajohnsoncpa.com/wp-content/uploads/2023/09/What-deductions-can-I-claim-without-reciepts-Jeremy-A-Johnson.webp

What Deductions Can I Claim Without Receipts YouTube

https://i.ytimg.com/vi/8-IAYfCyXsQ/maxresdefault.jpg

Taxes 101 What Deductions Can I Claim Without Receipts

https://www.doola.com/wp-content/uploads/2023/05/What-Deductions-Can-I-Claim-Without-Receipts-1080x565.jpg

Tax deductions lower your taxable income and the amount of income tax you have to pay If you want to lower your tax bill consider these popular tax deductions What is a tax deduction 1 Standard Deduction Tax deductions reduce your taxable income whereas tax credits reduce your tax liability on a dollar for dollar basis In the 2023 tax year individuals can claim a 13 850 standard deduction and married couples can claim 27 700 Those who file as head of household can claim 20 800 For each taxpayer 65 or older or blind the standard deduction goes up 1 500 1 850 for single filers and heads of households

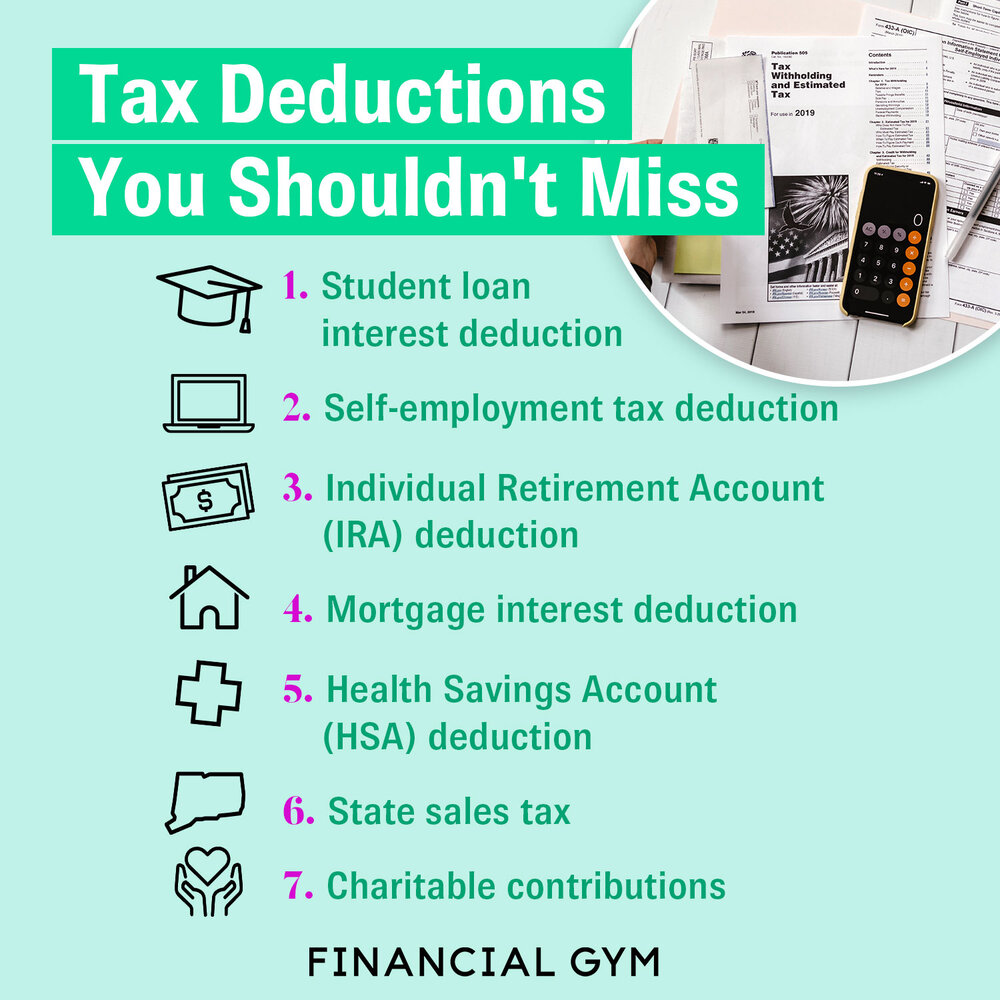

Examples include deductions for sales tax student loan interest IRA contributions charitable donations and home offices More tax write off examples are listed below What can you write off on your taxes as a deduction 1 State income or sales tax deduction 2 Property tax deduction In this article you ll learn more about common tax deductions tax breaks and how to claim them If you itemize you can deduct the mortgage interest not the principal that you pay on a loan secured by your primary residence or a second home

Download What Deductions Can I Claim

More picture related to What Deductions Can I Claim

What Deductions Can I Claim Without Receipts Blog Receiptor AI

https://receiptor.ai/_next/image?url=https:%2F%2Fimages.ctfassets.net%2Fa799ocu07ar5%2F667AycGs8BavCjE4WictFI%2Fc8526f1a1b12124a57578a1dffdae550%2FWhat_Deductions_Can_I_Claim_Without_Receipts_.png&w=3840&q=75

TAX TIPS What Deductions Can I Claim On Tax 2022 One Click Life

https://oneclicklife.com.au/wp-content/uploads/2022/01/deductions-i-can-claim-scaled.jpg

How To Obtain Small Business Tax Deductions

https://southernpb.com/wp-content/uploads/2021/06/How-To-Obtain-Small-Business-Tax-Deductions-1.png

You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of taxable income People should understand which credits and deductions they can claim and the records they need to show their eligibility A tax credit reduces the income tax bill dollar for dollar that a taxpayer owes based on their tax return Some tax credits such as the Earned Income Tax Credit are refundable

[desc-10] [desc-11]

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

https://www.nerdwallet.com › article › taxes › tax-deductions-tax-breaks

Tax deductions can lower the amount of income that is subject to tax Here s more on how tax deductions work plus 22 tax breaks that might come in handy

https://www.irs.gov › credits

You can claim credits and deductions when you file your tax return to lower your tax Make sure you get all the credits and deductions you qualify for If you have qualified dependents you may be eligible for certain credits and deductions

Top 10 Tax Deductions Synchrony Bank Synchrony Bank

Deductions Under Chapter VIA

What Expenses Can I Claim FREE Printable Checklist Of 100 Tax

What Deductions Can I Claim Galaidesigns

Small Business Expenses Tax Deductions 2023 QuickBooks

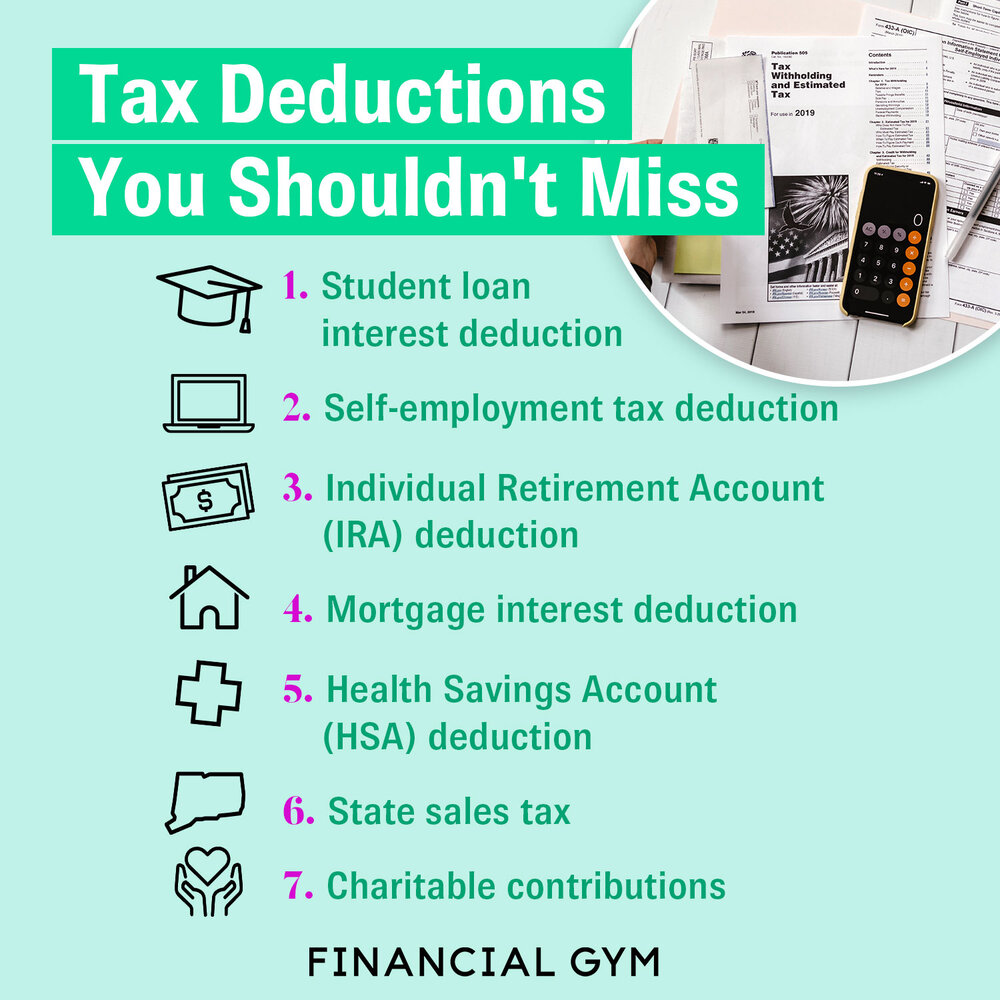

Tax Deductions Write Offs To Save You Money Financial Gym

Tax Deductions Write Offs To Save You Money Financial Gym

List Of Tax Deductions Here s What You Can Deduct

What Can I Claim As A Deduction Proactive Accounting FS

10 Most Common Small Business Tax Deductions Infographic

What Deductions Can I Claim - Examples include deductions for sales tax student loan interest IRA contributions charitable donations and home offices More tax write off examples are listed below What can you write off on your taxes as a deduction 1 State income or sales tax deduction 2 Property tax deduction