What Do I Need To Claim Solar Tax Credit To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your

What you need to claim the tax credit Fill out your Form 1040 as you normally would Stop when you reach line 20 and move to Schedule 3 How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to your federal tax return Form 1040 or Form

What Do I Need To Claim Solar Tax Credit

What Do I Need To Claim Solar Tax Credit

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Federal Solar Tax Credit What It Is How To Claim It For 2023

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

How Many Years Can I Claim Solar Tax Credit YouTube

https://i.ytimg.com/vi/NWOSYlRLgc4/maxresdefault.jpg

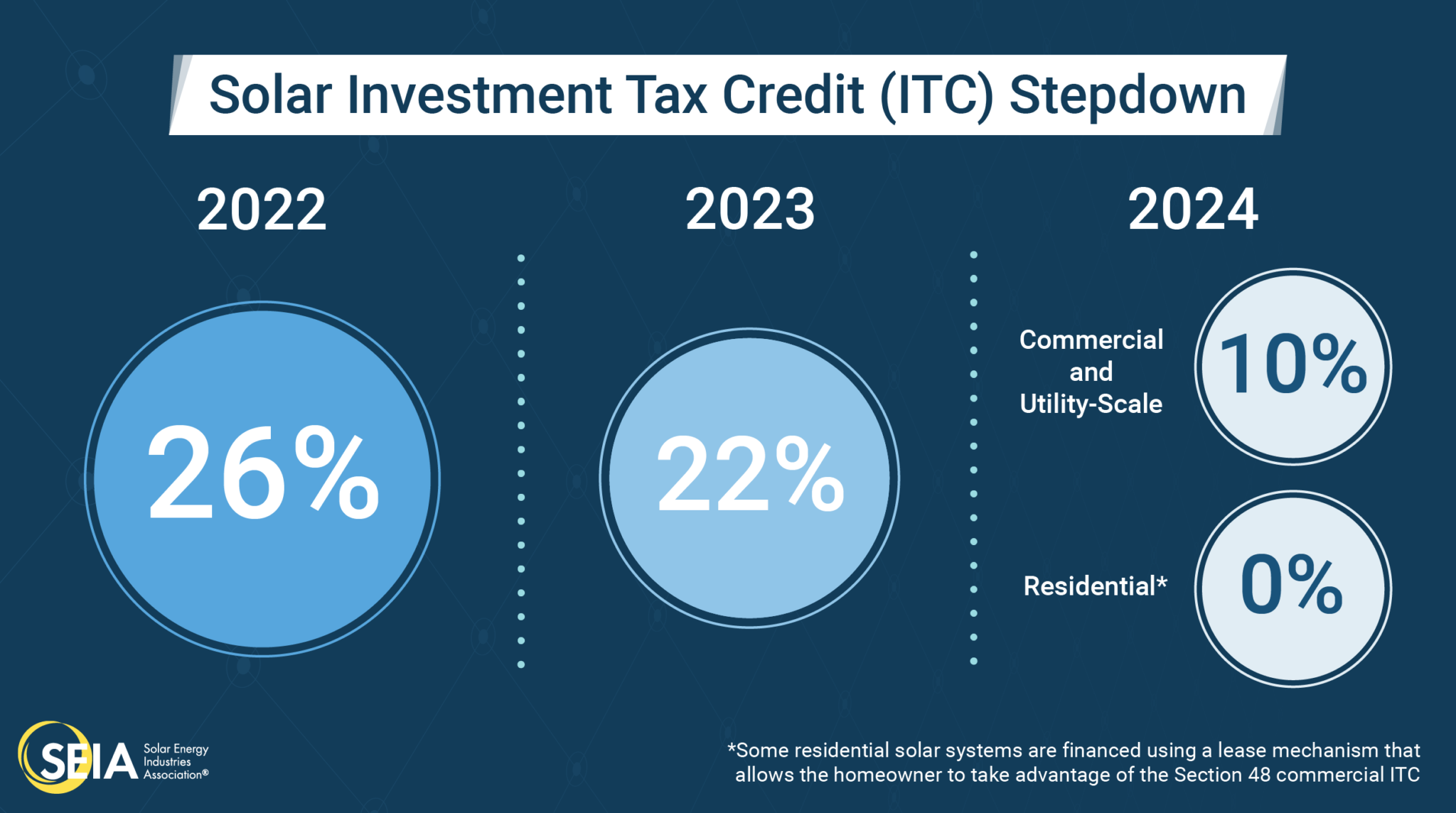

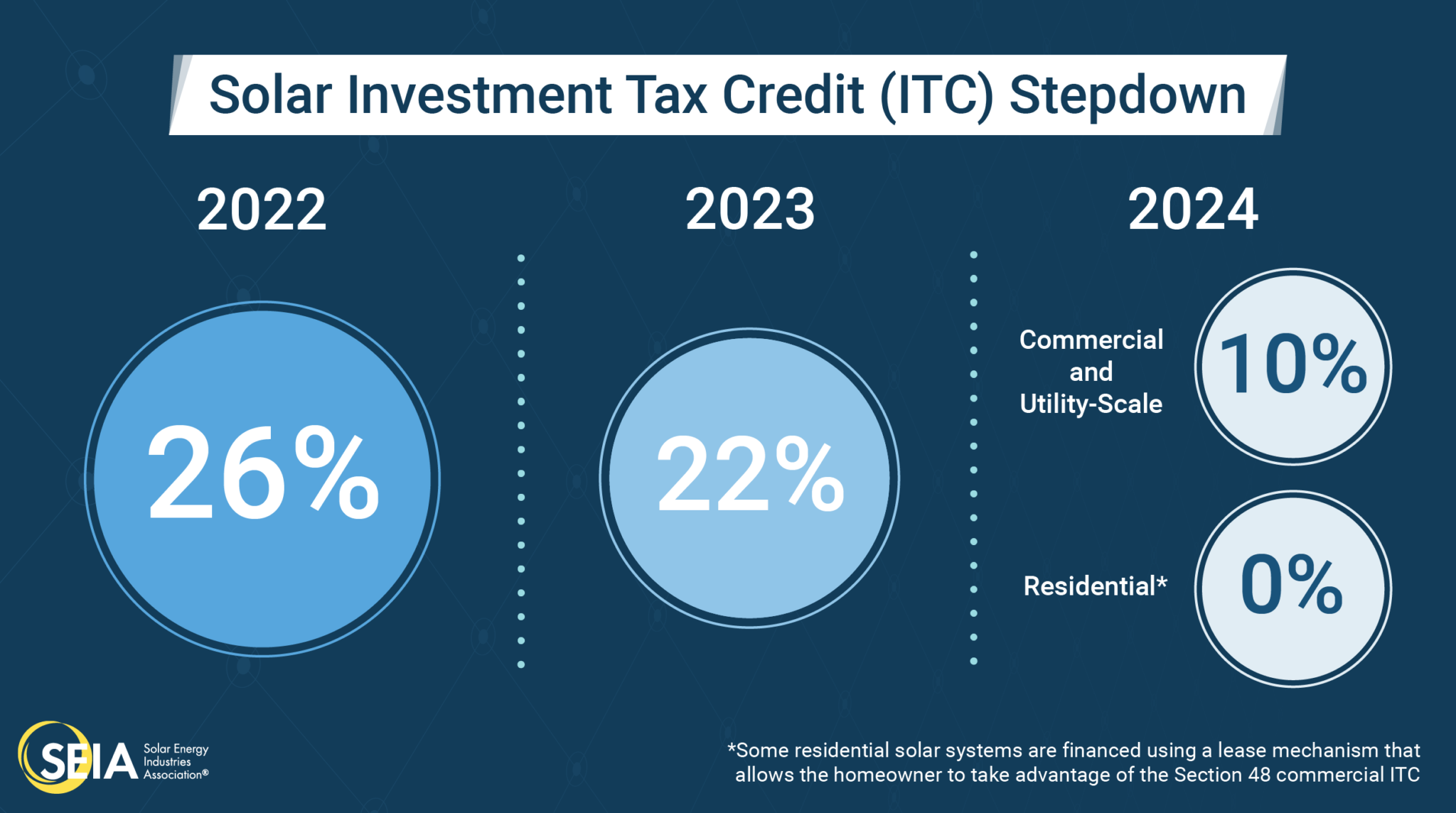

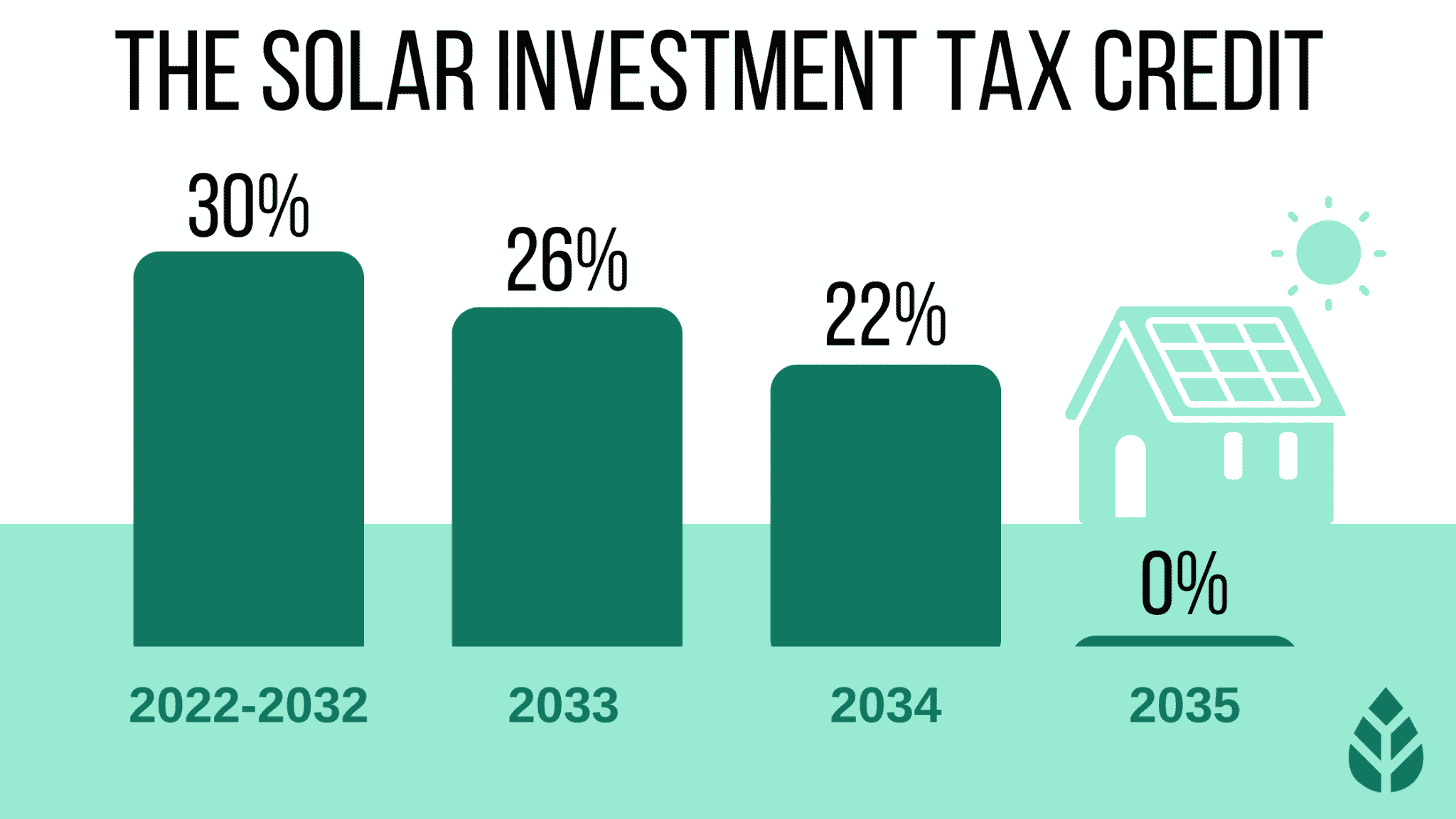

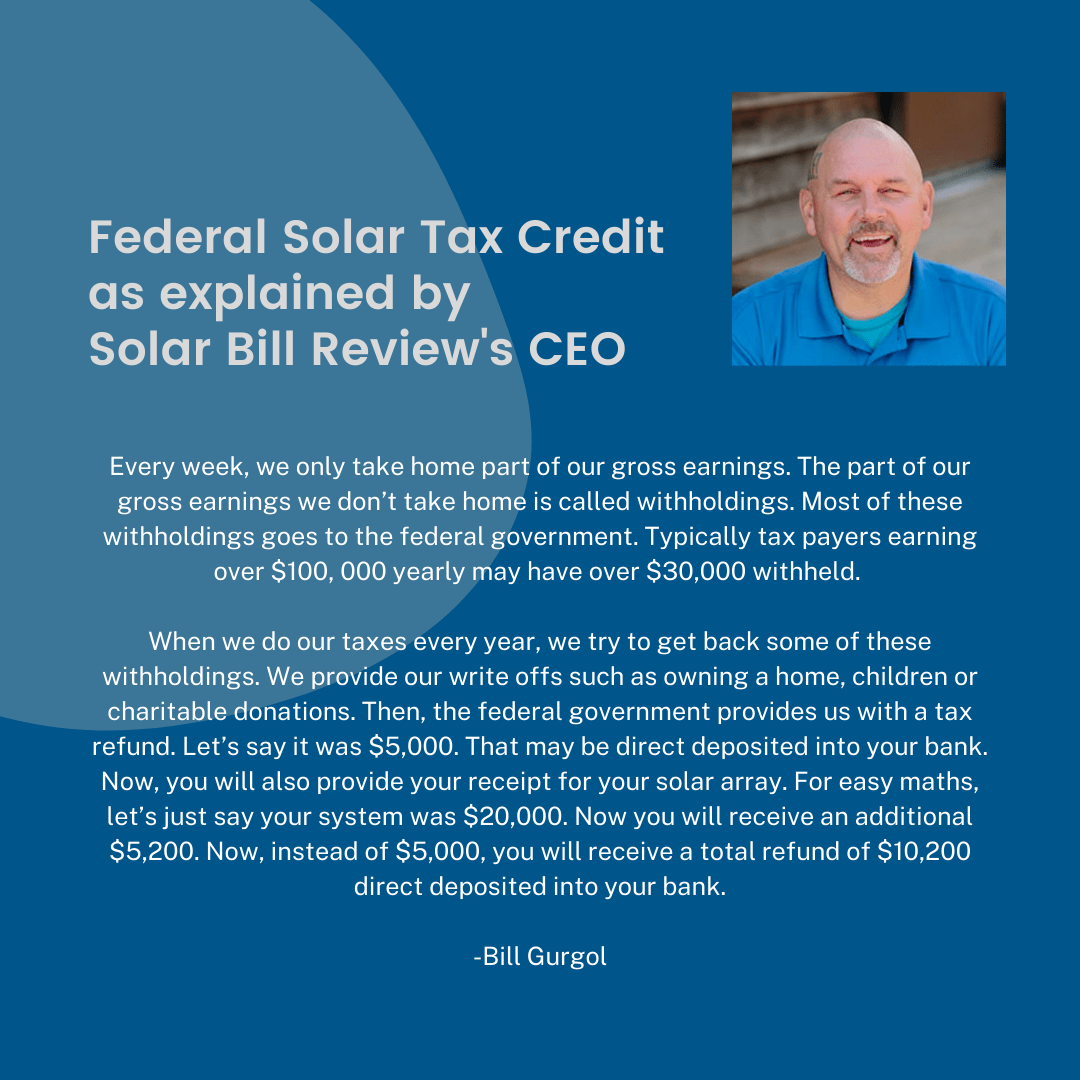

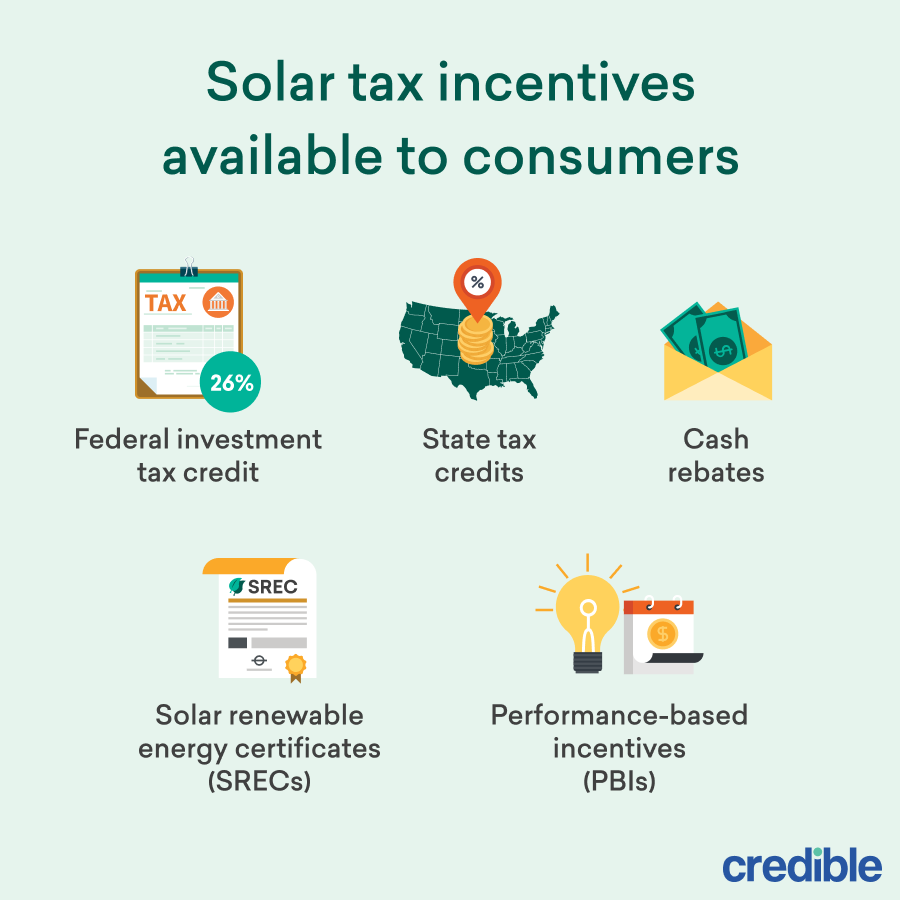

The federal solar tax credit can cover up to 30 of the cost of a system in 2024 The amount you can claim directly reduces the amount of tax you owe For tax years 2022 to 2032 you can get a credit for up to 30 of the expense of installing solar panels this may include the price of the panels themselves sales taxes and labor costs

Am I eligible to claim the federal solar tax credit You might be eligible for this tax credit if you meet all of the following criteria Your solar PV system was installed between Filing requirements for the solar tax credit To claim the credit you ll need to file IRS Form 5695 as part of your tax return You ll calculate the credit on Part I of the form and then enter the result on

Download What Do I Need To Claim Solar Tax Credit

More picture related to What Do I Need To Claim Solar Tax Credit

How To Claim Solar Tax Credit Wheelhouse Credit Union

https://www.wheelhousecu.com/files/iStock-985363900-1114x530-1.png

Solar Tax Credit How It Works And Claim Limits FireFly Solar

https://firefly.solar/wp-content/uploads/solar-tax-credit-solar-panel-systems.jpg

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

https://www.altestore.com/blog/wp-content/uploads/2021/12/form-5695-example.png

To claim the nonrefundable Solar Energy Federal Tax credit you need to complete and attach IRS Form 5695 to your federal tax return Solar photovoltaic PV systems Claim Your Solar Tax Credit With Form 5695 The solar tax credit makes investing in solar panels a wise financial investment for your home Earning the Residential Clean Energy Credit includes the

The solar tax credit is claimed on tax form 5695 when you file your federal income tax return This credit must be claimed in the same tax year that your system was deemed operational by passing city How the Federal Solar Tax Credit Works in 2024 In 2024 homeowners purchasing a solar energy system may be able to claim a tax credit worth up to 30 of

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

https://greenridgesolar.com/wp-content/uploads/2021/01/Solar-Tax-Credit-ITC-Step-Down-2.jpg

How To Claim Solar Tax Credit Solar Tax Credit 2021

https://andersonadvisors.com/wp-content/uploads/2021/04/Solar-Tax-Credit-1080x675.jpeg

https://www.energysage.com › solar › h…

To claim the solar tax credit you ll need first to determine if you re eligible then complete IRS Form 5695 and finally add your

https://www.solarreviews.com › blog › g…

What you need to claim the tax credit Fill out your Form 1040 as you normally would Stop when you reach line 20 and move to Schedule 3

Your Guide To Solar Federal Tax Credit

26 Solar Tax Credit Extended Oregon Incentives Green Ridge Solar

8 Incredible Tips How To Claim Solar Tax Credit Outbackvoices

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

The 30 Solar Tax Credit Has Been Extended Through 2032

The Federal Solar Tax Credit What You Need To Know 2022

The Federal Solar Tax Credit What You Need To Know 2022

Solar Tax Credit Calculator NikiZsombor

How To Claim Solar Tax Credit 2023 Internal Revenue Code Simplified

Solar Tax Credit And Your Boat Updated Blog

What Do I Need To Claim Solar Tax Credit - Filing requirements for the solar tax credit To claim the credit you ll need to file IRS Form 5695 as part of your tax return You ll calculate the credit on Part I of the form and then enter the result on