What Do I Need To Claim Tuition On My Taxes The IRS offers two types of education tax credits to offset tuition and fees you have paid You can claim either the American opportunity tax credit or the lifetime learning credit

Key Takeaways Eligible post secondary institutions must send Form 1098 T to tuition paying students by January 31 and file a copy with the IRS by February 28 Schools use Box 1 of the form to report the You cannot claim the tuition amount on your tax certificate if any of the following applies to you the fees were paid or reimbursed by your employer or an employer of one of your

What Do I Need To Claim Tuition On My Taxes

What Do I Need To Claim Tuition On My Taxes

https://www.sunloan.com/wp-content/uploads/2022/12/[email protected]

/88623667-F-56a938af3df78cf772a4e575.jpg)

Can I Claim High School Tuition On My Taxes School Walls

https://www.thebalance.com/thmb/BSkyGTbq8ZX9I5rzKgp3N8q9UlQ=/1137x853/smart/filters:no_upscale()/88623667-F-56a938af3df78cf772a4e575.jpg

How Do I Claim My Tuition On My CanadianTax Return T2202A Form

https://i.vimeocdn.com/video/460641874-82b7f618b213a63bf9d37d32d256d6395d4a78be3b9b08a59a76e00c87e74f5f-d

Students enrolled at designated educational institutions receive a form T2202 the Tuition and Enrollment Certificate which tells the CRA how much tuition can be claimed on your tax return To claim your tuition fees you may receive an official tax receipt from your educational institution instead to reflect the amount of eligible tuition fees you have paid for a

Information about Form 1098 T Tuition Statement including recent updates related forms and instructions on how to file Form 1098 T is used by eligible educational institutions to You have to first claim your current year s federal tuition fees and any unused tuition education and textbook amounts carried forward from previous years on your Income

Download What Do I Need To Claim Tuition On My Taxes

More picture related to What Do I Need To Claim Tuition On My Taxes

Sending Kids To School Tax Breaks For Parents Paying For College

https://www.templateroller.com/img/blog_post_img/17acfc59af0c79d09e902ac65de1d57c.jpg

How Do I Claim Tuition On My Tax Return Can My Parents Or Spouse Claim

https://torontoaccountant.ca/wp-content/uploads/2013/03/iStock_000005137369Small-822x411.jpg

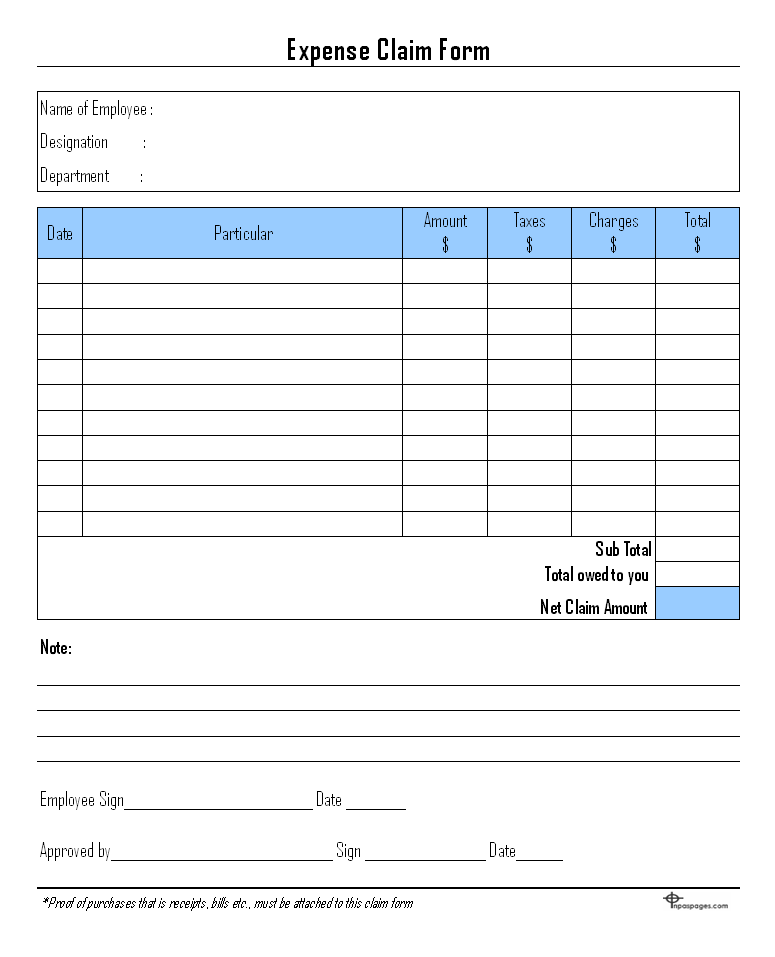

Expense Claim

https://www.inpaspages.com/wp-content/uploads/2015/09/expense_claim_form.png

Your 1098 T tax form sometimes dubbed as the college tax form or the tuition tax form will show you the total payments of qualified education expenses in Box 1 within a tax It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the

There are several options for deducting college tuition and textbooks on your federal income tax return including the American Opportunity Tax Credit Lifetime If you or your parents paid qualified tuition and college related expenses during the tax year you ll likely receive a Form 1098 T from your school This form is

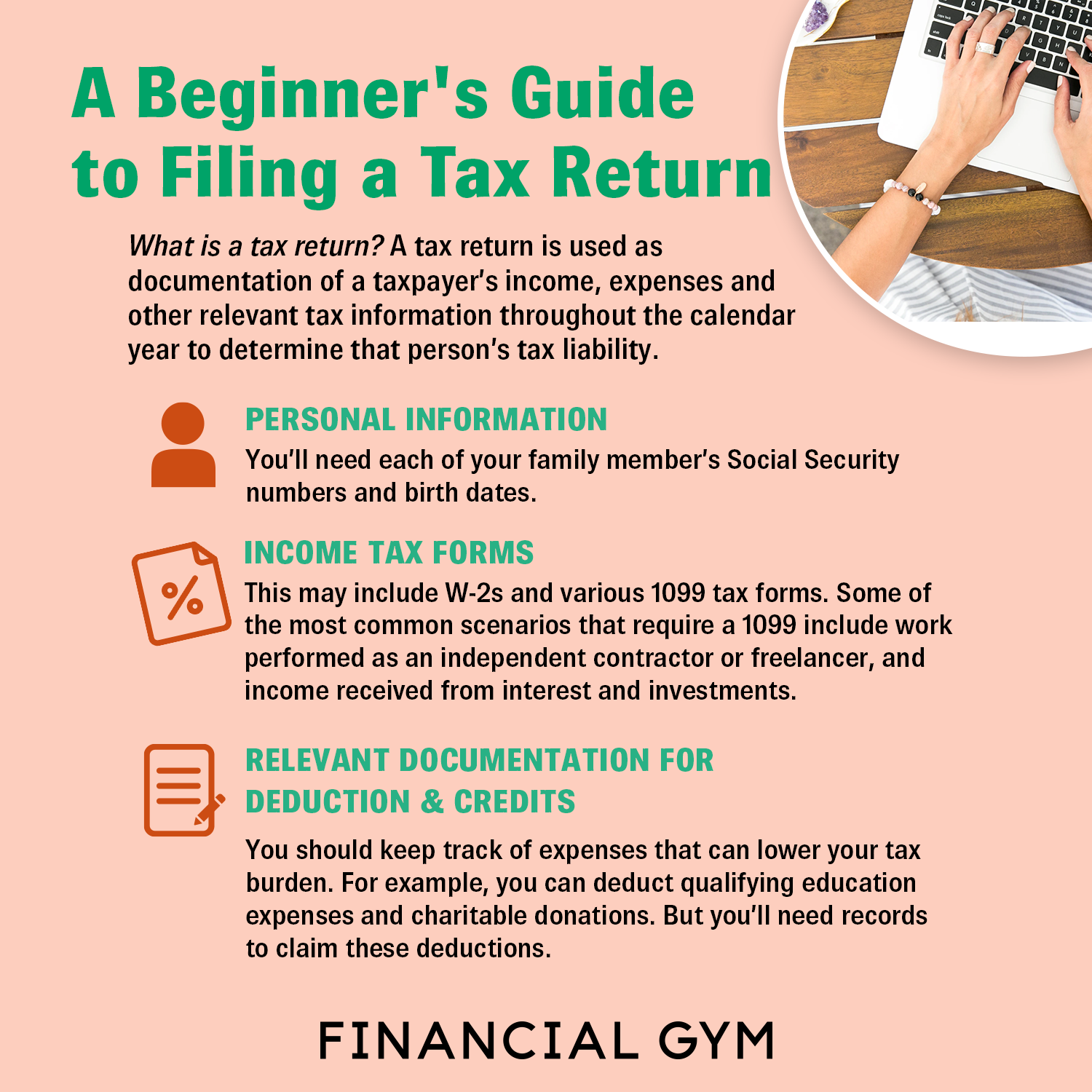

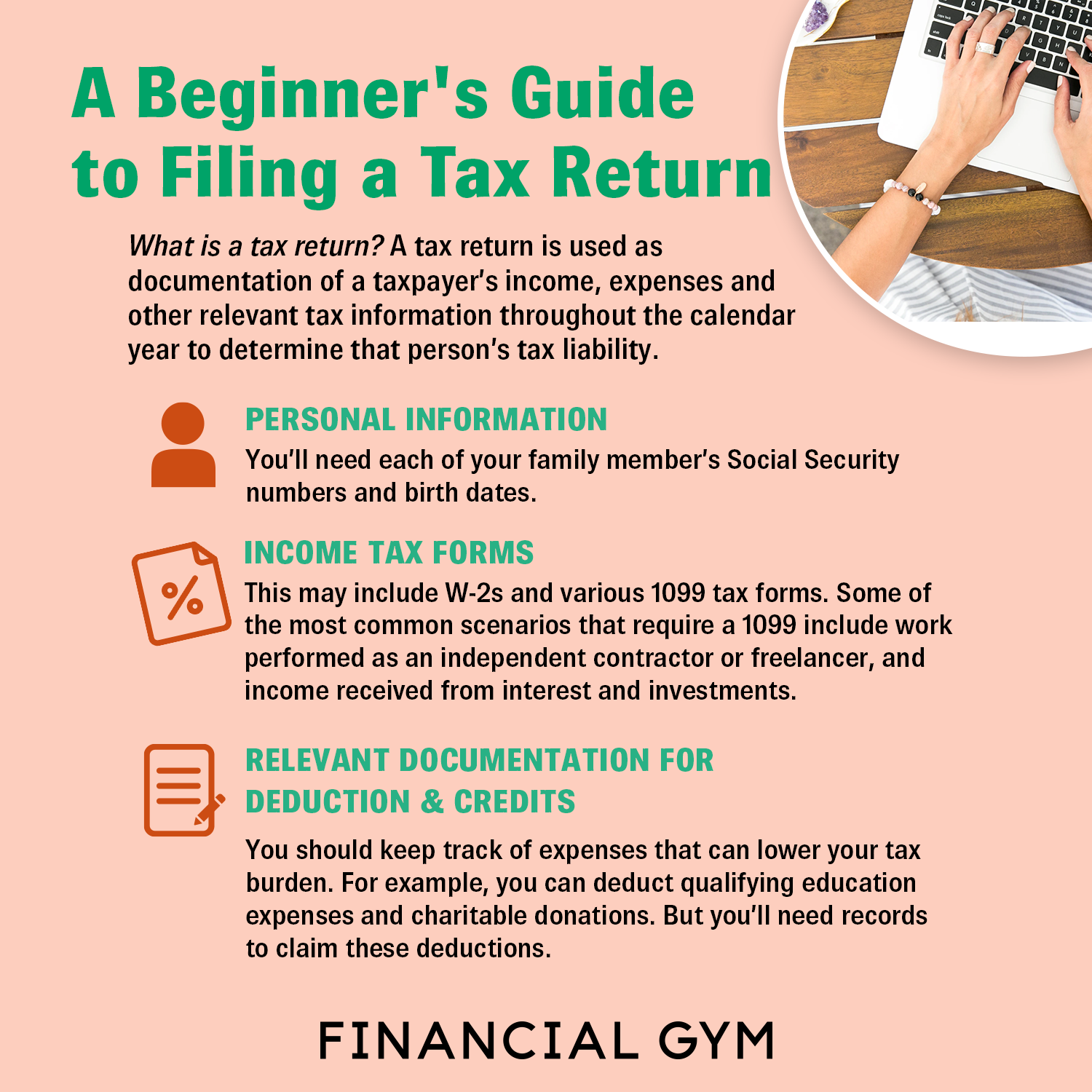

A Beginner s Guide To Filing A Tax Return

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1583496520149-15B7KX0KSGFE4JVCHSNQ/ke17ZwdGBToddI8pDm48kJUlZr2Ql5GtSKWrQpjur5t7gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1UYapt4KGntwbjD1IFBRUBU6SRwXJogFYPCjZ6mtBiWtU3WUfc_ZsVm9Mi1E6FasEnQ/TFG_A-Beginner's-Guide-to-Filing-a-Tax-Return.png

5 Valuable Tips On How To Pay Trade School Tuition InterCoast Colleges

https://intercoast.edu/wp-content/uploads/2018/06/image_1559540.jpg

https://www.forbes.com/advisor/taxes/t…

The IRS offers two types of education tax credits to offset tuition and fees you have paid You can claim either the American opportunity tax credit or the lifetime learning credit

/88623667-F-56a938af3df78cf772a4e575.jpg?w=186)

https://turbotax.intuit.com/tax-tips/colle…

Key Takeaways Eligible post secondary institutions must send Form 1098 T to tuition paying students by January 31 and file a copy with the IRS by February 28 Schools use Box 1 of the form to report the

Do I Need To File A Tax Return YouTube

A Beginner s Guide To Filing A Tax Return

When Making An Offer Keep In Mind What Do I Need You Have Certain

Do I Need To Claim My Credit Card Points And Air Miles On My Taxes

How Much Money Do I Need To Retire Karma Cashflow Get Rich Quick

Education Tax Benefits Can You Claim Tuition On Taxes

Education Tax Benefits Can You Claim Tuition On Taxes

How To Write A Claim Letter For Insurance Amelie Text

When Do I Need To Worry About Taxes For My Shop The Hobby Vs

Blake Butler Quote Reality Is Overrated To Me Everyone Spends Enough

What Do I Need To Claim Tuition On My Taxes - Students enrolled at designated educational institutions receive a form T2202 the Tuition and Enrollment Certificate which tells the CRA how much tuition can be claimed on your tax return