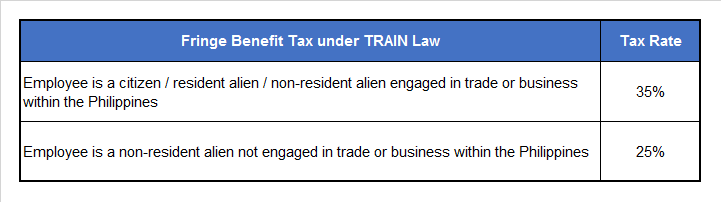

What Do You Pay Fringe Benefits Tax On Fringe benefits tax FBT is a tax paid by employers on certain benefits provided to their employees or to their employees family or other associates FBT is separate to income tax It s calculated on the taxable value of the fringe benefit

Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental wage rate of 22 on the benefit s value If the recipient of a taxable fringe benefit is your employee the benefit is generally subject to employment taxes and must be reported on Form W 2 Wage and Tax Statement However you can use special rules to withhold deposit and report the employment taxes

What Do You Pay Fringe Benefits Tax On

What Do You Pay Fringe Benefits Tax On

https://connollysbs.com.au/wp-content/uploads/2023/03/fringe-benefits-tax-time.jpg

Fringe Benefits Tax What Employers Need To Know EI

https://www.employmentinnovations.com/wp-content/uploads/2022/03/Fringe-Benefits-Tax-What-Employers-Need-to-Know_Feature-Image.jpg

Pay Teachers Tower Hamlets The City

https://eastlondonnut.files.wordpress.com/2021/09/neu_pay_scales_2021-22-1.jpg?w=1200

Taxing for Fringe Benefits Tax reporting requirements can vary depending upon who receives the benefit Taxable fringe benefits paid by the employer are included in the employee s annual W 2 statement while taxing fringe benefits paid to independent contractors are reported on the Form 1099 NEC By default fringe benefits are taxable unless they are specifically exempted Recipients of taxable fringe benefits include the fair market value in their taxable

The IRS provides guidance on the tax treatment of various fringe benefits in its Tax Guide to Fringe Benefits which can help you understand the tax implications of the benefits All you need to do is add the total cost of the benefits and payroll taxes the employee receives Next divide that number by the wages or salary the employee earns in a year Finally multiply the number you generate by 100 to get a percentage

Download What Do You Pay Fringe Benefits Tax On

More picture related to What Do You Pay Fringe Benefits Tax On

Taxable Vs Nontaxable Fringe Benefits Hourly Inc

https://assets-global.website-files.com/5e6aa7798a5728055c457ebb/610db3408091a50fded87ae4_hero-taxable vs free tax fringe.jpg

Fringe Benefits Tax Meaning Pherrus

https://www.pherrus.com.au/wp-content/uploads/2023/05/Blog_3__01_cover_Fringe-Benefits-Tax-Meaning--768x768.jpg

Fringe Benefits Tax FBT Mason Lloyd

https://masonlloyd.com.au/wp-content/uploads/2023/06/fringe-benefits-tax-fbt-to-pay-with-personal-income-tax-on-fringe-benefits-they-receive-vector.jpg

What Is a Fringe Benefit A fringe benefit is a form of pay including property services cash or cash equivalent in addition to stated pay for the performance of services Under Internal Revenue Code IRC Section 61 all income is taxable unless an exclusion applies Most fringe benefits are taxable at fair market value but some benefits such as health and life insurance are nontaxable As an employer you can choose to estimate total annual taxes payable

Here we take a look at what you need to do in order to calculate report and pay fringe benefits tax in Australia Fringe Benefits are split into Type 1 and Type 2 benefits The below steps provided by the ATO to help you calculate your FBT For example you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to commute to and from work Fringe benefits are generally included in an employee s gross income there are some exceptions The benefits are subject to income tax withholding and employment taxes

In Depth Guide To Mandatory Employee Benefits In The Philippines Hot

https://velocityglobal.com/sites/default/files/inline-images/What Are Statutory Benefits_ A Guide to Mandatory Employee Benefits _ 1725 _ Graphic.jpg

Fringe Benefits Tax Update

https://s3.studylib.net/store/data/008297340_1-dd435714b5c8c595a8b01d2eb8962ee2-768x994.png

https://www.ato.gov.au/businesses-and...

Fringe benefits tax FBT is a tax paid by employers on certain benefits provided to their employees or to their employees family or other associates FBT is separate to income tax It s calculated on the taxable value of the fringe benefit

https://www.investopedia.com/ask/answers/011915/...

Fringe benefits may be taxed at the employee s income tax rate or the employer may elect to withhold a flat supplemental wage rate of 22 on the benefit s value

Fringe Benefits Tax And Business Range Business Services

In Depth Guide To Mandatory Employee Benefits In The Philippines Hot

Job Offer Benefits Packages Can Be A Stronger Incentive Than Salary

How Does Fringe Benefits Tax Work Pherrus

Fringe Benefits Tax Explained Sleek

7 Lessons I Learned From An Accidental Millionaire

7 Lessons I Learned From An Accidental Millionaire

Fringe Benefits Tax And Business Fiskl Advisory

Tax Talk Understanding Fringe Benefits Tax Macmillans Accountants

What Is The Tax Rate For Fringe Benefits

What Do You Pay Fringe Benefits Tax On - Your employer pays fringe benefits tax on any fringe benefits they offer you What are fringe benefits A fringe benefit is something extra you get from your employer in addition to your wage or salary or in return for foregoing some of your salary under a salary sacrifice arrangement