What Does Low Income Tax Credit Mean Verkko The Low Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low and moderate income tenants The LIHTC was enacted as part of the 1986 Tax Reform

Verkko 21 marrask 2023 nbsp 0183 32 The Low Income Housing Tax Credit LIHTC is a tax incentive for housing developers to construct purchase or renovate housing for low income individuals and families The Low Income Verkko 13 huhtik 2023 nbsp 0183 32 A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

What Does Low Income Tax Credit Mean

What Does Low Income Tax Credit Mean

https://houstoncasemanagers.com/wp-content/uploads/2022/11/Dallas-low-income-tax-credit-apartments-1-2048x1024.png

Replace Minimum Wages With The Earned Income Tax Credit By Fred

https://uploads-ssl.webflow.com/56b26b90d28b886833e7a055/57ca19588bb9d6ee1a1ed827_pexels-photo-58728.jpeg

Pending Low Income Tax Credit Expiration Could Cost 2 000 Affordable

https://www.theurbanist.org/wp-content/uploads/2023/04/LIHTC-Process.jpg

Verkko 7 maalisk 2023 nbsp 0183 32 The tax credit for low to moderate income working individuals and families known as the Earned Income Tax Credit does not use the FPL guidelines Verkko Working tax credit or WTC is paid to people who work and are on a low income it does not matter whether you are an employee or self employed You do not need to have children to get WTC Child tax credit or CTC is paid to people who have children It is paid in addition to child benefit and you do not have to be working to get it

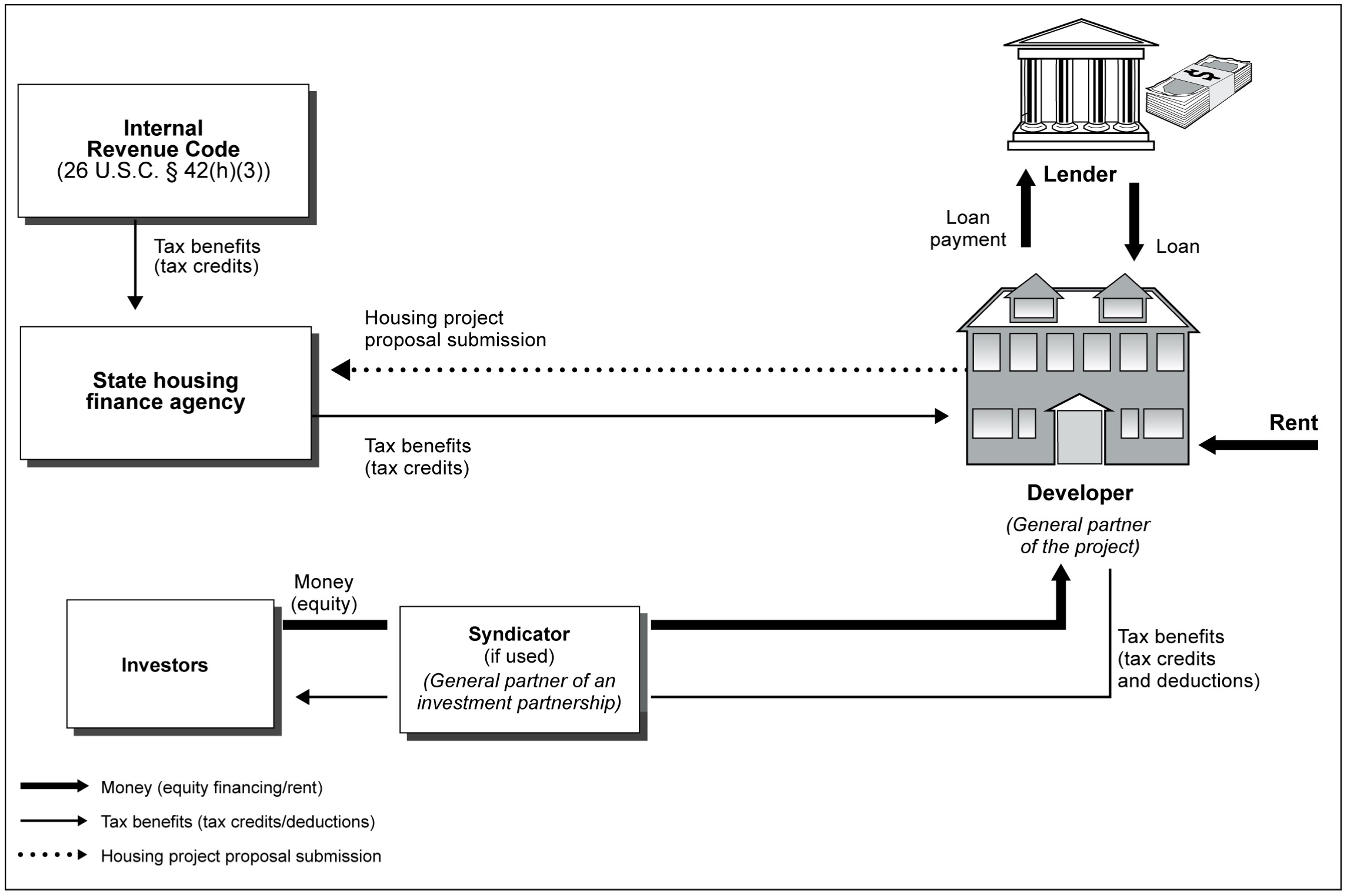

Verkko 3 toukok 2023 nbsp 0183 32 A tax credit property is a housing project owned by a developer or landlord who participates in the federal low income housing tax credit LIHTC program The property owners can claim Verkko 11 elok 2020 nbsp 0183 32 The Low Income Housing Tax Credit LIHTC offers developers nonrefundable and transferable tax credits to subsidize the construction and rehabilitation of housing developments that have strict income limits for eligible tenants and their cost of housing

Download What Does Low Income Tax Credit Mean

More picture related to What Does Low Income Tax Credit Mean

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Low income Tax Credit Now Available In Washington Publications

https://www.washingtonpolicy.org/library/imglib/iStock-1349187299.jpg

Verkko To qualify for the 2022 tax year you must have an AGI between 16 480 and 53 057 if you have a filing status of single head of household or married filing separately Married filers must have Verkko The EITC is the single most effective means tested federal antipoverty program for working age households providing additional income and boosting employment for low income workers In 2020 the earned income tax credit EITC will provide maximum credits ranging from 538 for workers with no children to 6 660 for workers with at

Verkko The Low Income Housing Tax Credit LIHTC is a federal program in the United States that awards tax credits to housing developers in exchange for agreeing to reserve a certain fraction of rent restricted units for lower income households 1 Verkko 26 huhtik 2023 nbsp 0183 32 The low income housing tax credit LIHTC program which was created by the Tax Reform Act of 1986 P L 99 514 is the federal government s primary policy tool for the development of means it is completed and available to be rented Due to the need for upfront financing to

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

https://img.ifunny.co/images/3382f1a55559bec88f3b196fd0b64c54d0b7f05c9859b9db8752c14bce201f36_1.jpg

What Does Tax Credit Apartment Mean Apartment Notes

https://apartmentnotes.com/wp-content/uploads/placid-social-images/c1df11a820342329c731fdbcfa129343.png

https://www.taxpolicycenter.org/briefing-book/what-low-income-housing...

Verkko The Low Income Housing Tax Credit LIHTC subsidizes the acquisition construction and rehabilitation of affordable rental housing for low and moderate income tenants The LIHTC was enacted as part of the 1986 Tax Reform

https://www.investopedia.com/terms/l/long-income-housing-tax-credit.asp

Verkko 21 marrask 2023 nbsp 0183 32 The Low Income Housing Tax Credit LIHTC is a tax incentive for housing developers to construct purchase or renovate housing for low income individuals and families The Low Income

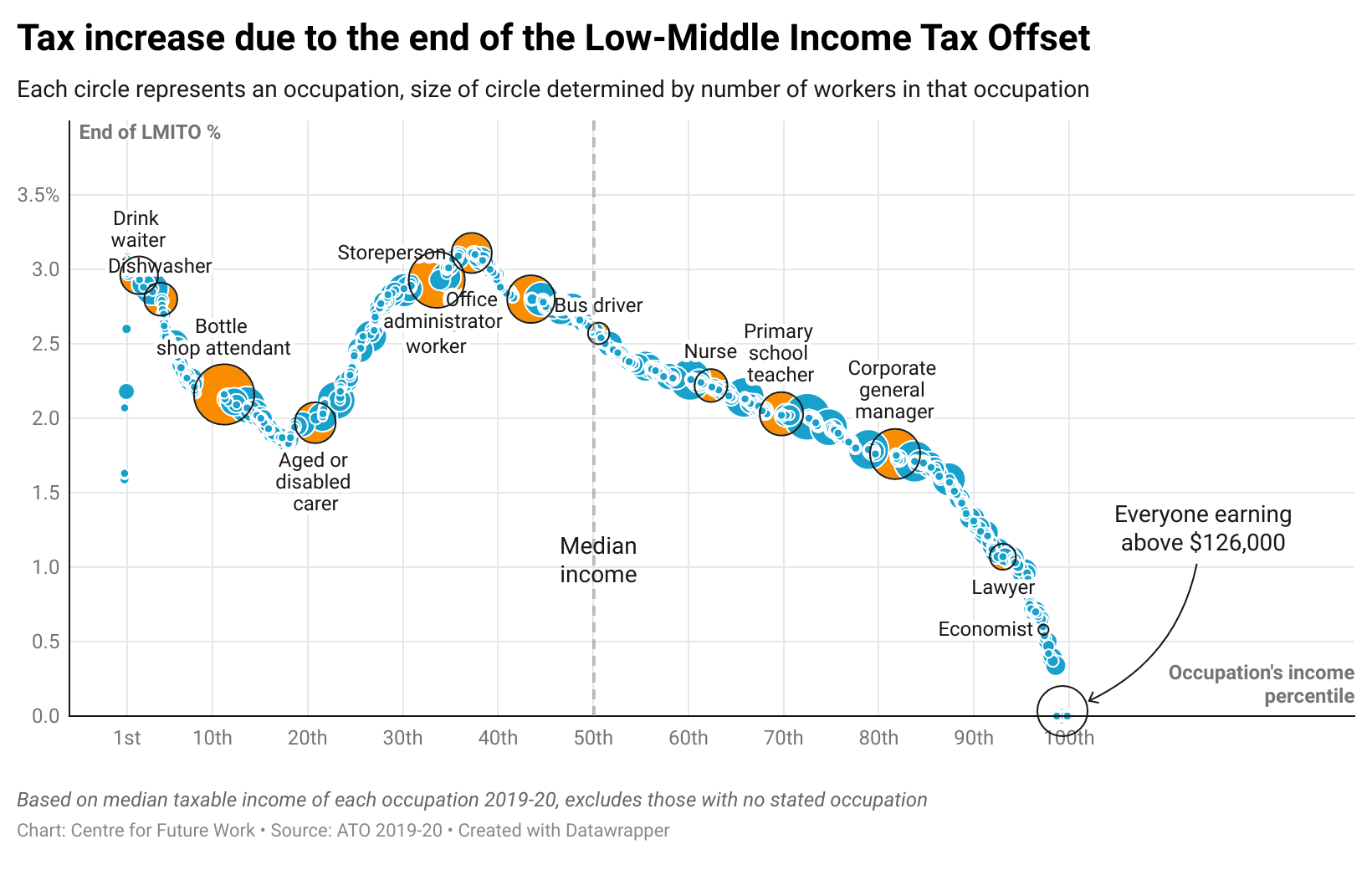

Low And Middle Income Earners About To Be Hit With A Massive Tax

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

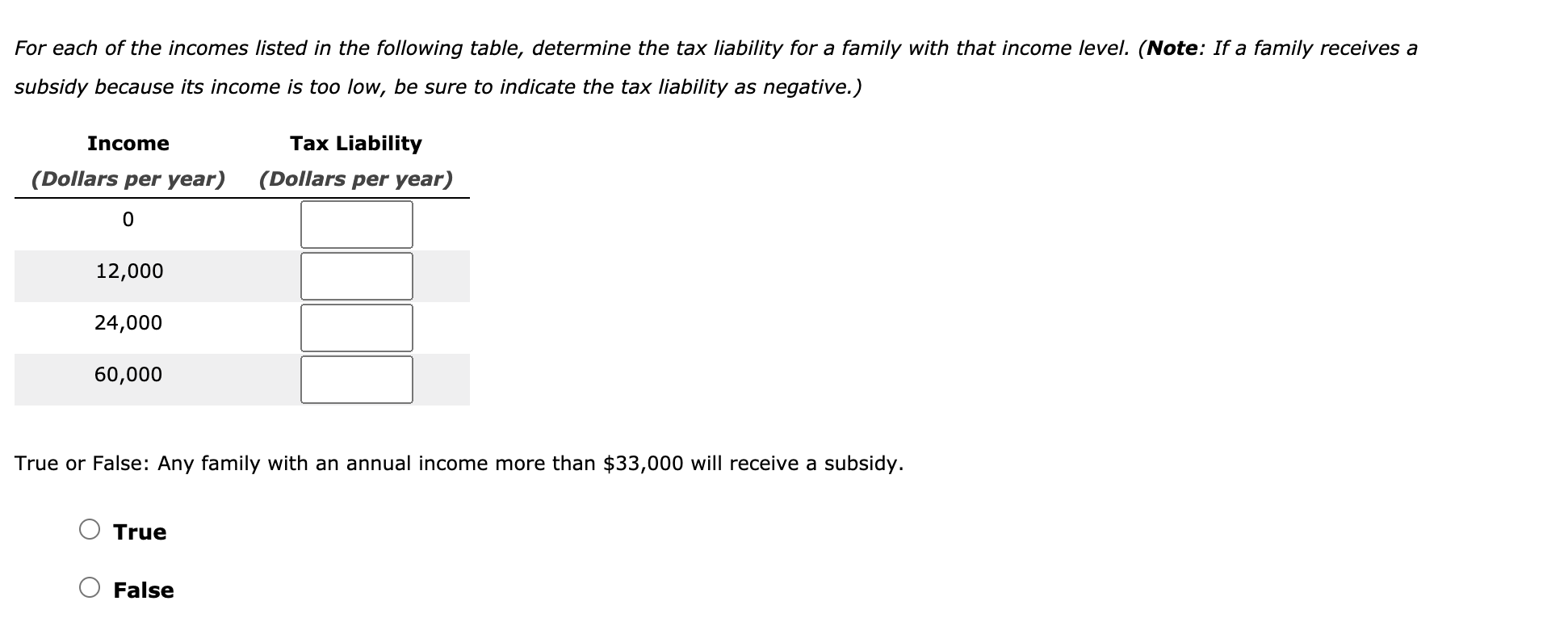

Solved 6 The Negative Income Tax Many Economists Believe Chegg

The Increased Antipoverty Effects Of The Expanded Childless Earned

What Does Tax Credit Mean Commons credit portal

Astounding Gallery Of Eic Tax Table Concept Turtaras

Astounding Gallery Of Eic Tax Table Concept Turtaras

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

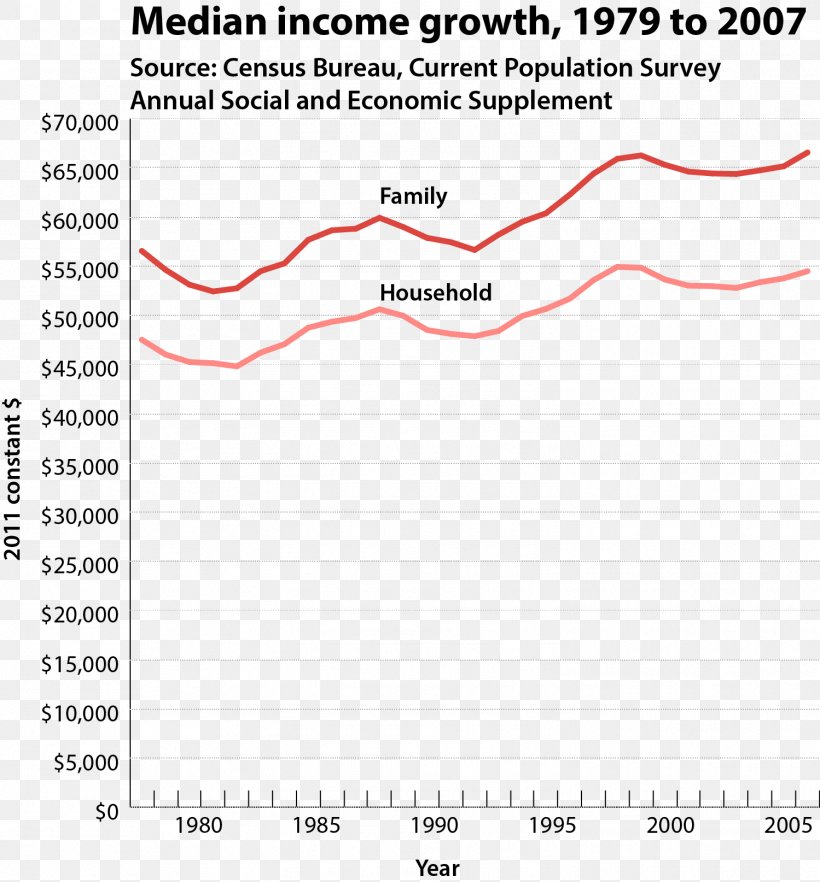

Median Income Household Income Income Tax PNG 1499x1614px Median

Earned Income Tax Credit EITC Are You Eligible Kiplinger

What Does Low Income Tax Credit Mean - Verkko 31 maalisk 2023 nbsp 0183 32 The Low Income Housing Tax Credit LIHTC is a tax incentive for rental owners and developers who provide affordable housing for low income residents That means the rent they charge is considered affordable by those whose income falls below the median household income of the area