What Expenses Can I Claim As A Sole Proprietor Eligible owners of sole proprietorships partnerships S corporations and certain limited liability companies LLCs can deduct up to 20 of their QBI from their taxes

You often hear sole proprietors talking about various expenses as a tax write off That can be a huge benefit of owning a small business you can deduct many ordinary business expenses from your taxable income which allows you to pay a smaller tax bill As we mentioned earlier as a sole proprietor you re responsible for self employment taxes the social security and Medicare taxes that an employer normally takes out of an employee s pay

What Expenses Can I Claim As A Sole Proprietor

What Expenses Can I Claim As A Sole Proprietor

https://i.ytimg.com/vi/0h_l9wY_3XQ/maxresdefault.jpg

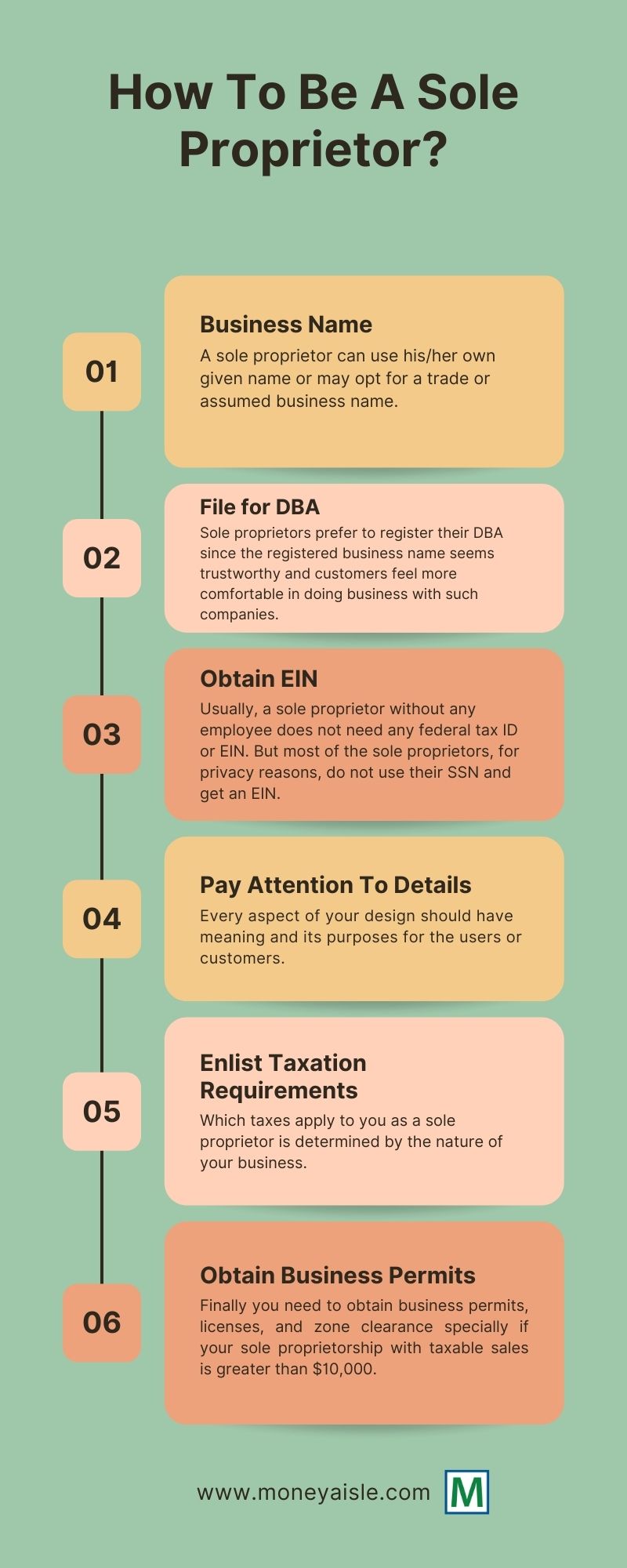

How To Become Sole Proprietor Considerationhire Doralutz

https://www.moneyaisle.com/wp-content/uploads/2022/01/Business-Name.jpg

What Expenses Can I Claim For The Accountancy Partnership

https://www.theaccountancy.co.uk/wp-content/uploads/2014/02/manage-your-expenses-1110x511.jpg

Generally what a sole proprietor can pay themselves is determined by the amount of equity they have in their business and what they need for living expenses Every business has operating expenses and a sole proprietorship is no different As long as your expenses are ordinary and necessary in the parlance of the Internal Revenue Service you can claim them on your tax return In addition to health insurance common deductions include equipment utilities subscriptions travel and

A sole proprietor is someone who owns an unincorporated business by themselves If you are the sole member of a domestic limited liability company LLC and elect to treat the LLC as a corporation you are not a sole proprietor Forms you may need to file Use this table to help determine some forms you may be required to file as a sole Sole proprietor A sole proprietor is someone who owns an unincorporated business by themselves You are also a sole proprietor for income tax purposes if you are an individual and the sole member of a domestic LLC unless you elect to

Download What Expenses Can I Claim As A Sole Proprietor

More picture related to What Expenses Can I Claim As A Sole Proprietor

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

What Expenses Can I Claim With My Novated Lease Maxxia

https://www.maxxia.com.au/sites/default/files/styles/infographic/public/2021-11/MAX_Blog_Article_WhatExpensesCanIClaim_800x392.jpg?itok=FgEoQAM_

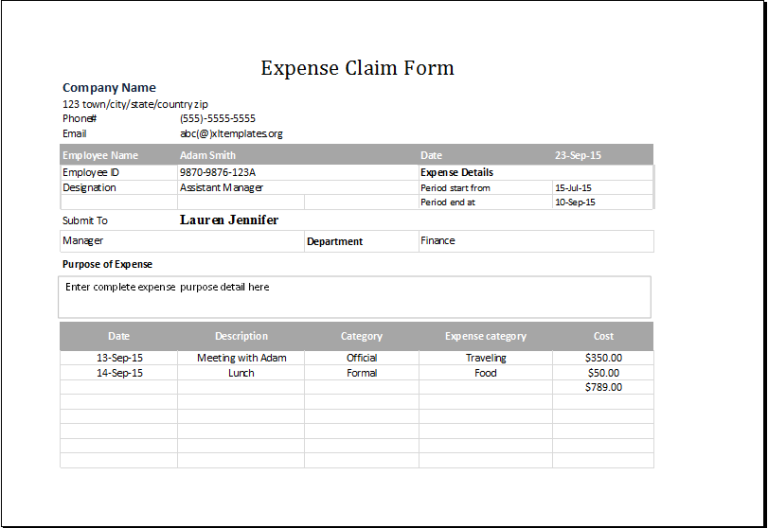

Expense Claim Form Template Excel

https://www.xltemplates.org/wp-content/uploads/2016/02/expense-claim-form-1-768x528.png

Expenses can include home office costs and vehicle expenses Self employment taxes One of the key aspects of sole proprietorship taxes is self employment tax This tax supports Social Security and Medicare As a sole proprietor you must pay the full self employment tax rate of 15 3 If you are a sole proprietor your business income and expenses should be reported on Schedule C You ll be responsible for paying self employment taxes such as Social Security and Medicare Partnerships and Corporations If you have a business partner you will likely file as either a partnership or as a corporation

Table of Contents Self employment tax deduction calculator Do I need to pay self employment taxes How much are self employment taxes before deductions How do tax deductions lower self employment taxes What are some common self employment tax deductions Self employment tax deductions based on your career Expenses April 30 2024 The top 25 tax deductions for a small business in the 2023 2024 tax year as outlined in this comprehensive tax deductions cheat sheet can help business owners lower their income tax bills by claiming all the deductions relevant to

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

https://assets-global.website-files.com/601d611d601043ab3e22931b/63c0f1e767846cf05c7af85e_how-to-write-off-expenses-as-an-independent-contractor.webp

Accounts Expense Report Template Sample Images And Photos Finder

https://i.pinimg.com/originals/d0/e9/5e/d0e95eac3b3732ea691f3c344d4a2c2d.jpg

https://www.investopedia.com/articles/tax/09/self...

Eligible owners of sole proprietorships partnerships S corporations and certain limited liability companies LLCs can deduct up to 20 of their QBI from their taxes

https://www.53.com/content/fifth-third/en/...

You often hear sole proprietors talking about various expenses as a tax write off That can be a huge benefit of owning a small business you can deduct many ordinary business expenses from your taxable income which allows you to pay a smaller tax bill

Self Employed Allowable Expenses Accounting Basics Best Accounting

Can I Claim My Laptop As An Education Expense Leia Aqui Is A Laptop

What Expenses Can I Claim As A Sole Trader self employed UK Tax

Pros And Cons Of Sole Proprietorship SimplifyLLC

Expense Claim Form Template Excel Printable Word Searches

What Expenses Can I Claim CIS EEBS

What Expenses Can I Claim CIS EEBS

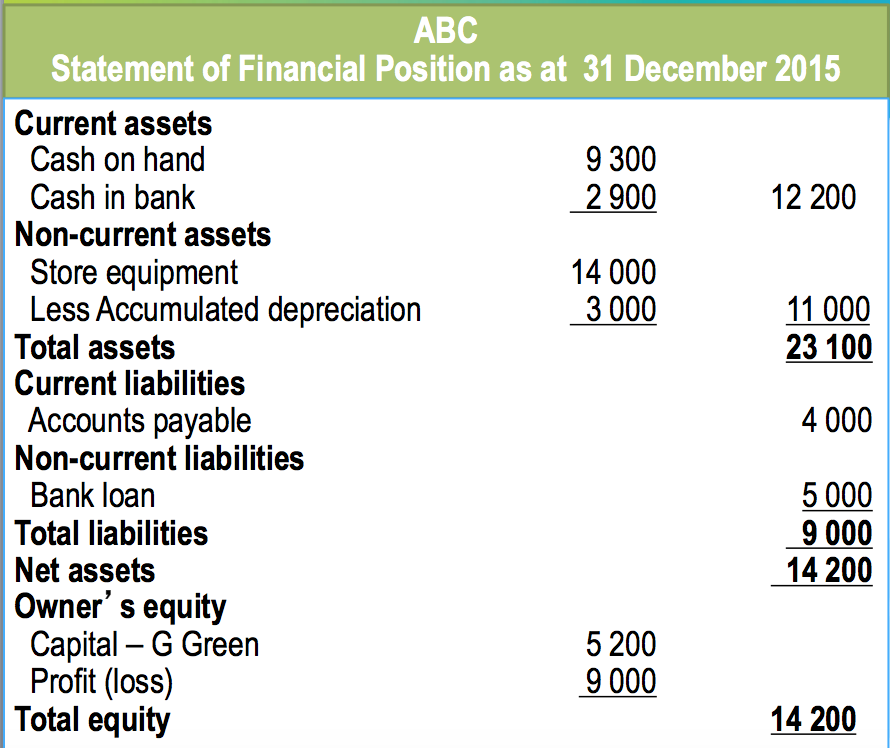

Blog Archives Page 4 Of 16 Finance Tutor Statistics Tutor

What Expenses Can I Claim For My Business The Freelancer Club

What Expenses Can I Claim As A Sole Trader 2024 Updated RECHARGUE

What Expenses Can I Claim As A Sole Proprietor - A sole proprietor is someone who owns an unincorporated business by themselves If you are the sole member of a domestic limited liability company LLC and elect to treat the LLC as a corporation you are not a sole proprietor Forms you may need to file Use this table to help determine some forms you may be required to file as a sole