What Expenses Can I Deduct As A 1099 Contractor Web 15 Apr 2022 nbsp 0183 32 Employee portion 19 500 for 2021 and 20 500 in 2022 Those over 50 years old can also make a 6 500 catch up contribution Employer portion 25 of your net self employment income up to

Web 21 Feb 2023 nbsp 0183 32 Can I write off expenses if I get a 1099 Yes all self employed individuals can write off business expenses Self employment includes 1099 contractors Web From home office expenses to vehicle usage we ll dive into a wide range of potential deductions that can significantly reduce your taxable income ensuring that you re paying

What Expenses Can I Deduct As A 1099 Contractor

What Expenses Can I Deduct As A 1099 Contractor

https://www.lendio.com/wp-content/uploads/2016/03/SBA-Loan-Calculator-800x433.jpg

What Expenses Can I Deduct As A 1099 Contractor Lendio

https://www.lendio.com/wp-content/uploads/2023/03/hRimage2.jpg

Hair Salon Monthly Expenses Google Search Tax Deductions Tax

https://i.pinimg.com/originals/59/a8/f5/59a8f5c21289277936f1e4c5ed2b0d42.png

Web Independent contractors use a 1099 form which is why they re often called 1099 contractors What Is a Write Off A write off is when you claim tax deductions on the money spent as an independent contractor on Web 10 Aug 2022 nbsp 0183 32 Contract Labor A Tax Deductible Expense Building Your Business Business Taxes Using Contract Labor as a Tax Deductible Expense By Rosemary

Web If you pay independent contractors you may have to file Form 1099 NEC Nonemployee Compensation to report payments for services performed for your trade or business File Web 5 Dez 2023 nbsp 0183 32 100 of your health insurance is one of the many deductible business expenses for independent contractors to include on your 1099 You can deduct

Download What Expenses Can I Deduct As A 1099 Contractor

More picture related to What Expenses Can I Deduct As A 1099 Contractor

Claim Car Expenses From The ATO In 5 Simple Steps 2023 ATO Claims

https://storage.googleapis.com/driversnote-marketing-pages/AU infographic - how to deduct mileage-landscape.png

Individual Tax Deductions

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/8654/images/dGtNNfyFRc2jd72ieCJV_Blog_graphics_10.png

What Can I Deduct As A Business Expense

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/2147486381/images/9ktBEMokQQaQxFIwbbaB_What_Can_I_Deduct_As_A_Business_Expense.jpeg

Web 8 Juli 2020 nbsp 0183 32 A contractor is not entitled to any benefits from an employer Independent contractors do have more benefits when it comes to taxes If they use their own tools or Web 17 Jan 2023 nbsp 0183 32 The Top Ten 1099 Self Employment Tax Deductions Plus 13 More You Probably Didn t Know About Stride Blog Save money on taxes by taking advantage

Web 3 Mai 2022 nbsp 0183 32 Here s a list of the most common taxes independent contractors can deduct There s a good chance that several of these will pertain to you Self employment tax Web So what expenses can I deduct as a 1099 contractor The list is long It generally includes all the ordinary and necessary expenses related to doing your work Some of the

What Is A 1099 Vs W 2 Employee Nin Finance

https://napkinfinance.com/wp-content/uploads/2016/11/NapkinFinance-1099vsW2-01-07-19-v03-1.jpg

Can I Deduct Moving Expenses Simpleetax YouTube

https://i.ytimg.com/vi/KmlR-incq18/maxresdefault.jpg

https://www.lendio.com/.../what-expens…

Web 15 Apr 2022 nbsp 0183 32 Employee portion 19 500 for 2021 and 20 500 in 2022 Those over 50 years old can also make a 6 500 catch up contribution Employer portion 25 of your net self employment income up to

https://www.unitedcapitalsource.com/blog/1099-self-employed-tax-d…

Web 21 Feb 2023 nbsp 0183 32 Can I write off expenses if I get a 1099 Yes all self employed individuals can write off business expenses Self employment includes 1099 contractors

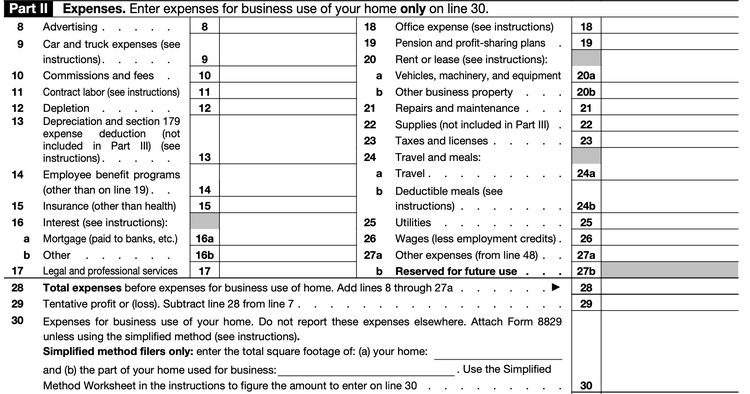

A Guide To Filling Out and Filing Schedule C For Form 1040

What Is A 1099 Vs W 2 Employee Nin Finance

List Of Tax Deductions Here s What You Can Deduct

Top 22 1099 Tax Deductions And A Free Tool To Find Your Write Offs

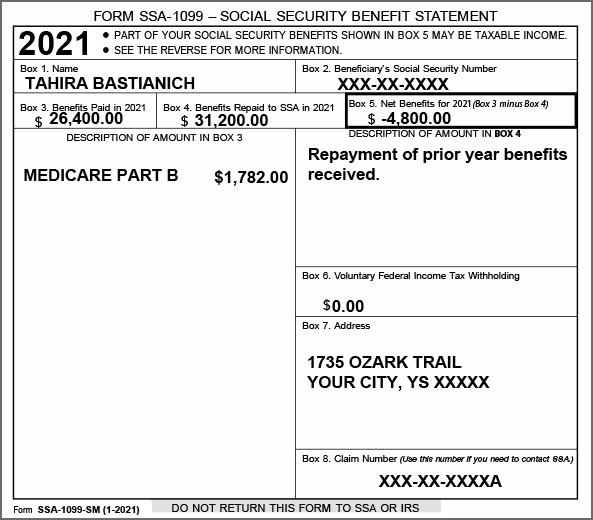

Solved FORM SSA 1099 SOCIAL SECURITY BENEFIT STATEMENT Chegg

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

Katie Is Preparing 1099 Tax Forms Which Quickbooks Function Would Be

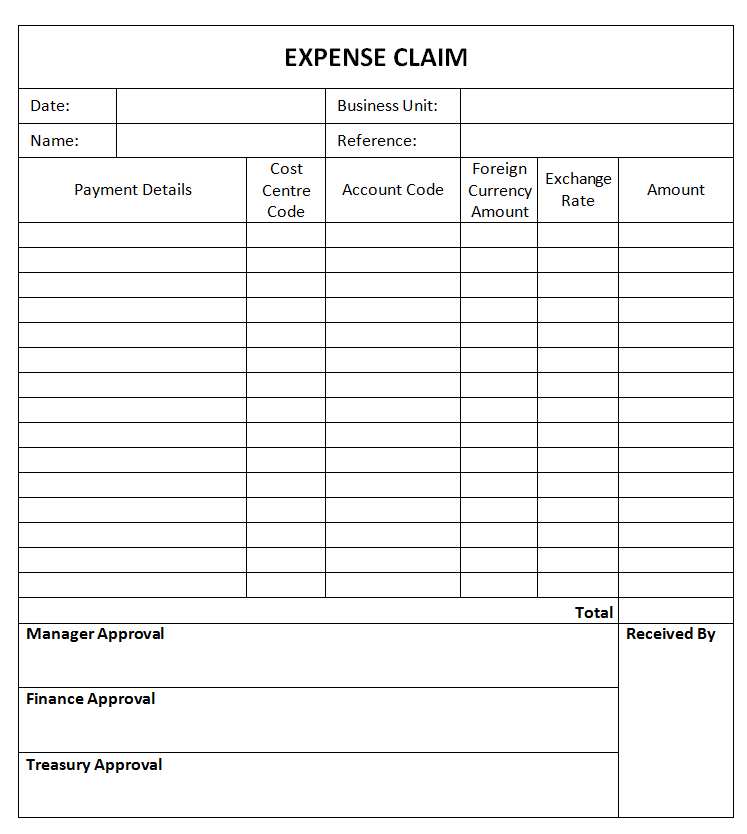

Free Expenses Claim Form Template Uk Printable Templates

24 Amazing Tax Deductions For Therapists Nicole Arzt

Independent Contractor Expenses Spreadsheet Free Template 2023

What Expenses Can I Deduct As A 1099 Contractor - Web Independent contractors use a 1099 form which is why they re often called 1099 contractors What Is a Write Off A write off is when you claim tax deductions on the money spent as an independent contractor on