What Food Is Taxed In Massachusetts Massachusetts has a separate meals tax for prepared food That statewide tax is currently 6 25 which is also Massachusetts statewide sales tax rate Local

Payment is made with 10 00 in food stamps and 40 00 in cash The purchase included 38 00 worth of tax exempt items and 12 00 worth of food that may While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes This page describes the

What Food Is Taxed In Massachusetts

What Food Is Taxed In Massachusetts

https://resource-center.hrblock.com/wp-content/uploads/2020/08/massachusetts-taxes.jpg

What Food Is Considered True American Food According To The Internet

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1dBQ2f.img?w=1000&h=667&m=4&q=64

What Food Is Taxed In Canada If You re A Foodie Living In Canada

https://miro.medium.com/v2/resize:fit:900/1*jzhxQuDUCQpvmeg5QTsdig.jpeg

Food products for human consumption and food items purchased with federal food stamps are generally exempt from the sales tax The following operations How is food taxed in Massachusetts In Massachusetts most food items are subject to sales tax However there are exceptions and certain categories of food that are exempt

Although Massachusetts still levies a 6 25 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more Is there tax on food in Massachusetts Luckily for consumers the answer to this particular question is no there is no sales tax on most groceries in

Download What Food Is Taxed In Massachusetts

More picture related to What Food Is Taxed In Massachusetts

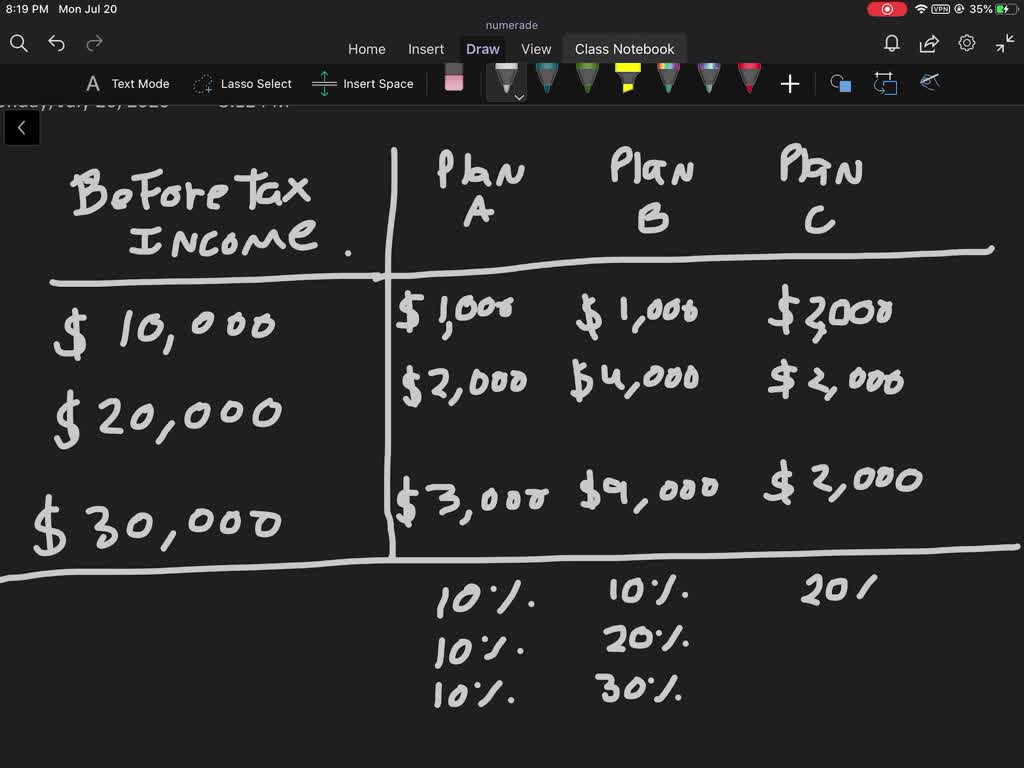

SOLVED In A System Designed To Work Out The Tax To Be Paid An

https://cdn.numerade.com/previews/a7d5d033-62da-4ac9-b0a1-81c40e9029a3_large.jpg

The Taxation Of Popcorn In Wisconsin Popcorn Carnival

https://cdn.popcorncarnival.com/what_food_is_not_taxed_in_wisconsin.png

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra

https://equitablegrowth.org/wp-content/uploads/2021/12/policies-in-house-passed-build-back-better-act-reduce-burden-on-all-but-highest-income-americans-1080x691.png

The Massachusetts meal tax is a 6 25 tax that is imposed on meals purchased at restaurants cafes food trucks and other dining establishments throughout the state What Isn t Taxed In Massachusetts For the purpose of this post will talk about food and clothing Sales of food for human consumption other than meals sold

What purchases are exempt from the Massachusetts sales tax While the Massachusetts sales tax of 6 25 applies to most transactions there are certain items that may be Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries Arizona Georgia Louisiana

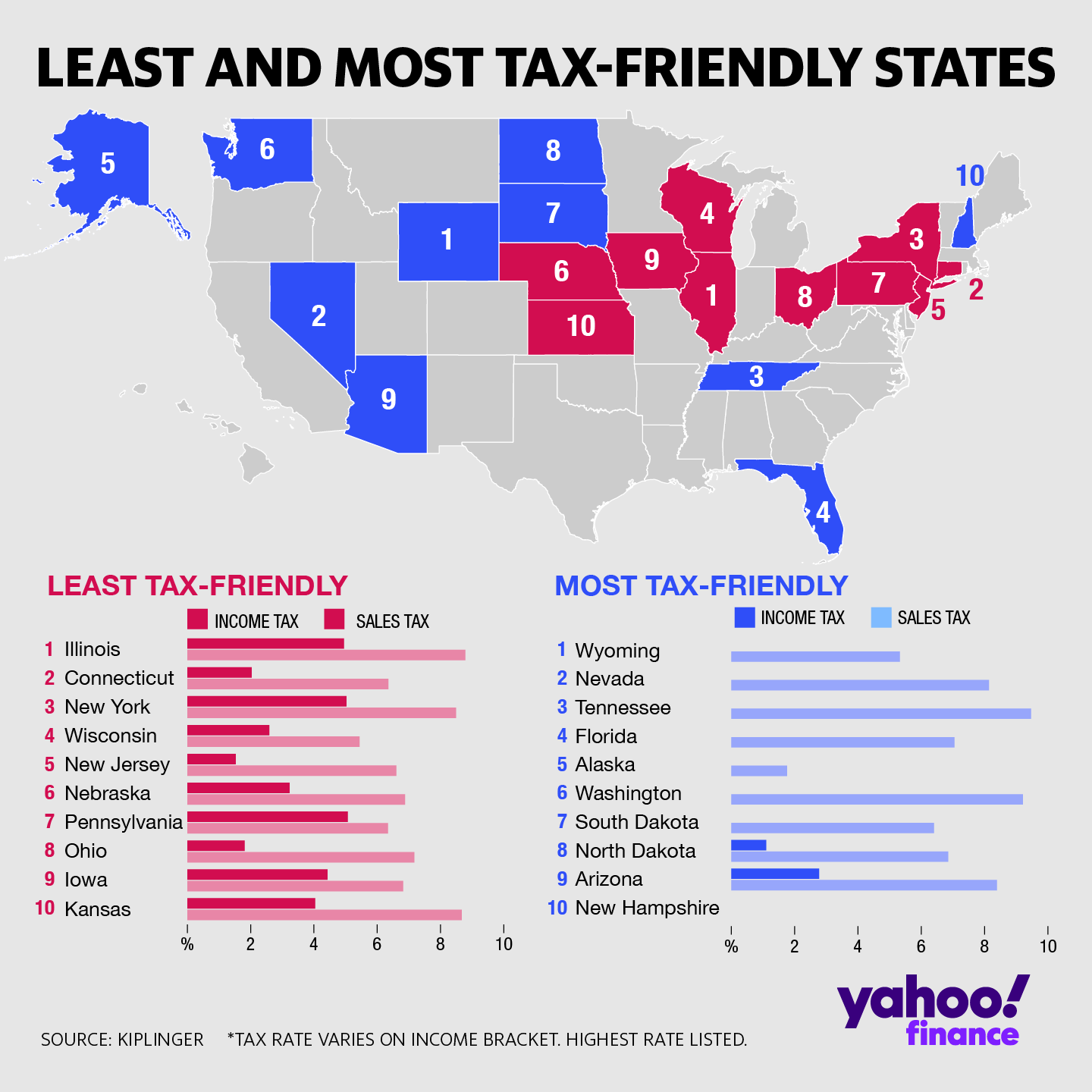

These Are The Best And Worst States For Taxes In 2019

https://s.yimg.com/uu/api/res/1.2/t0T57qH2r0_mKnvotSawYA--~B/aD0xNDQwO3c9MTQ0MDtzbT0xO2FwcGlkPXl0YWNoeW9u/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2019-10/a543ee60-eaba-11e9-adb7-08d19ab5aa72

LLC Vs S Corporation Which One Can Save You More On Your Taxes RBA

https://images.squarespace-cdn.com/content/v1/57a4b7ec15d5db04f2470371/1518372319375-0E9ZOUL6050B3ZJEFN3N/new.jpg

https://www.taxjar.com/blog/food/massachusetts-sales-tax-food

Massachusetts has a separate meals tax for prepared food That statewide tax is currently 6 25 which is also Massachusetts statewide sales tax rate Local

https://www.mass.gov/regulations/830-CMR-64h65...

Payment is made with 10 00 in food stamps and 40 00 in cash The purchase included 38 00 worth of tax exempt items and 12 00 worth of food that may

Food To Avoid Food To Eat K Web

These Are The Best And Worst States For Taxes In 2019

How To Calculate Your Marginal Tax Rate Haiper

States That Tax Social Security Benefits Tax Foundation

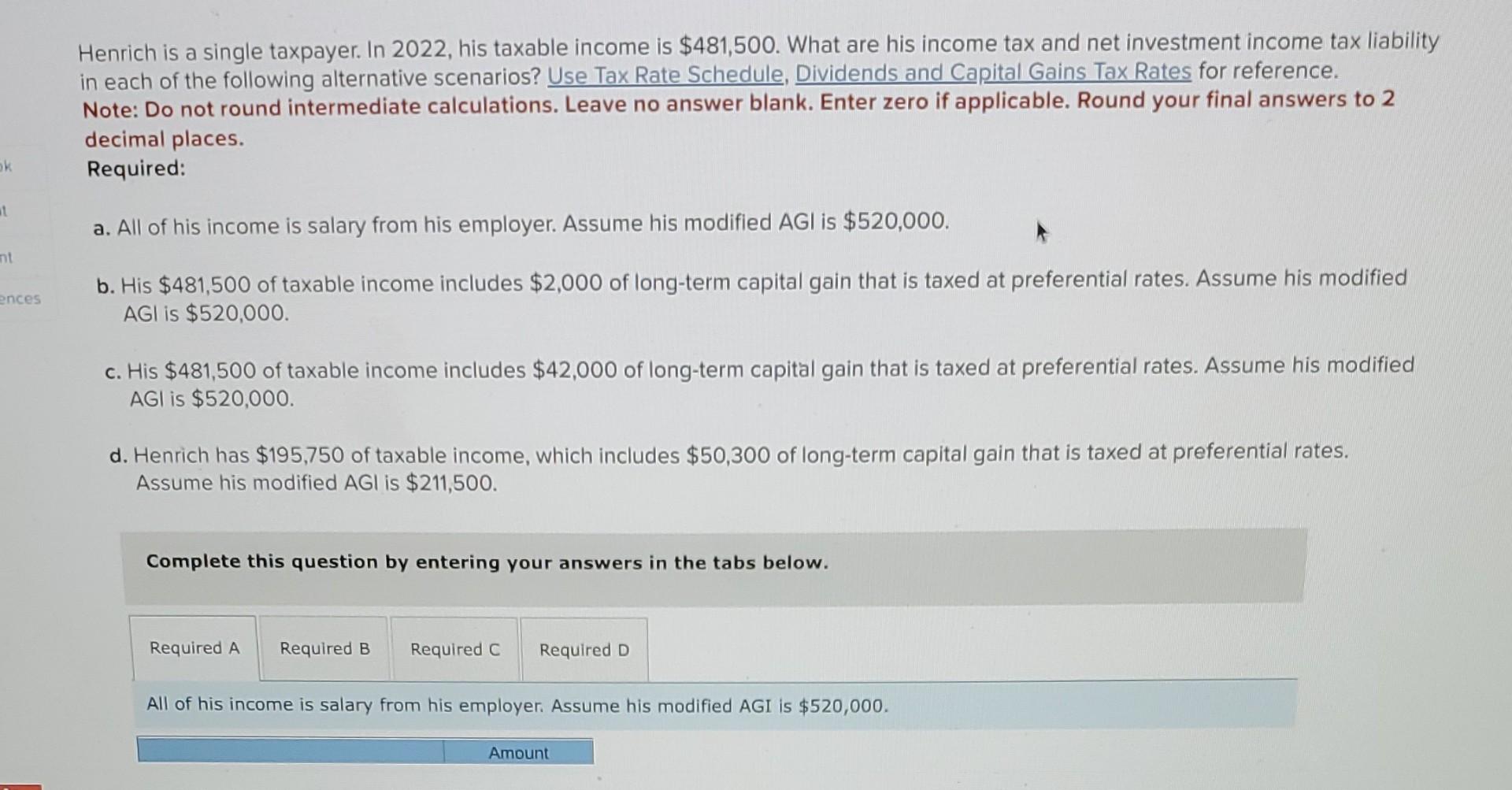

Solved Henrich Is A Single Taxpayer In 2022 His Taxable Chegg

37 States That Don t Tax Social Security Benefits

37 States That Don t Tax Social Security Benefits

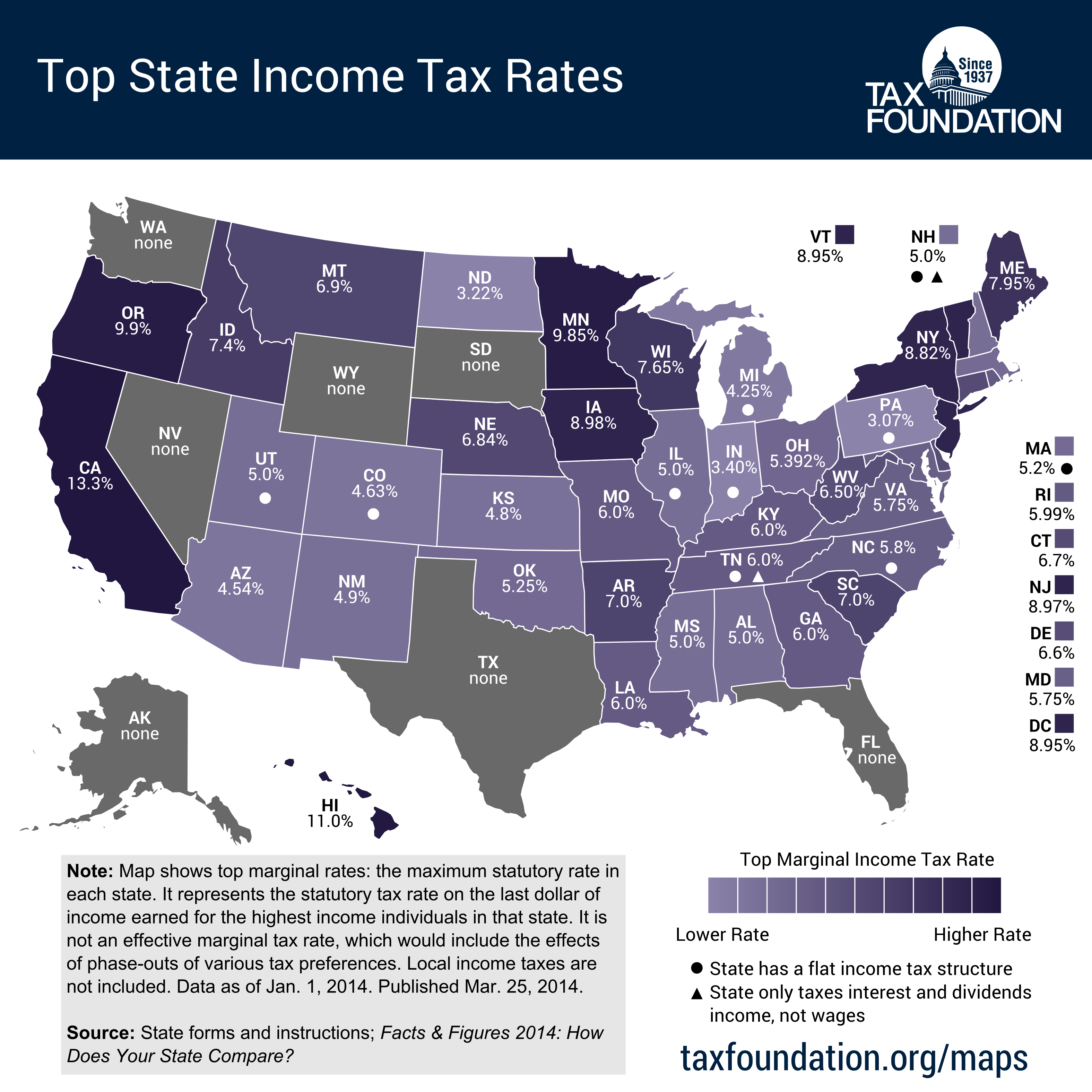

California Tops List Of 10 States With Highest Taxes

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales

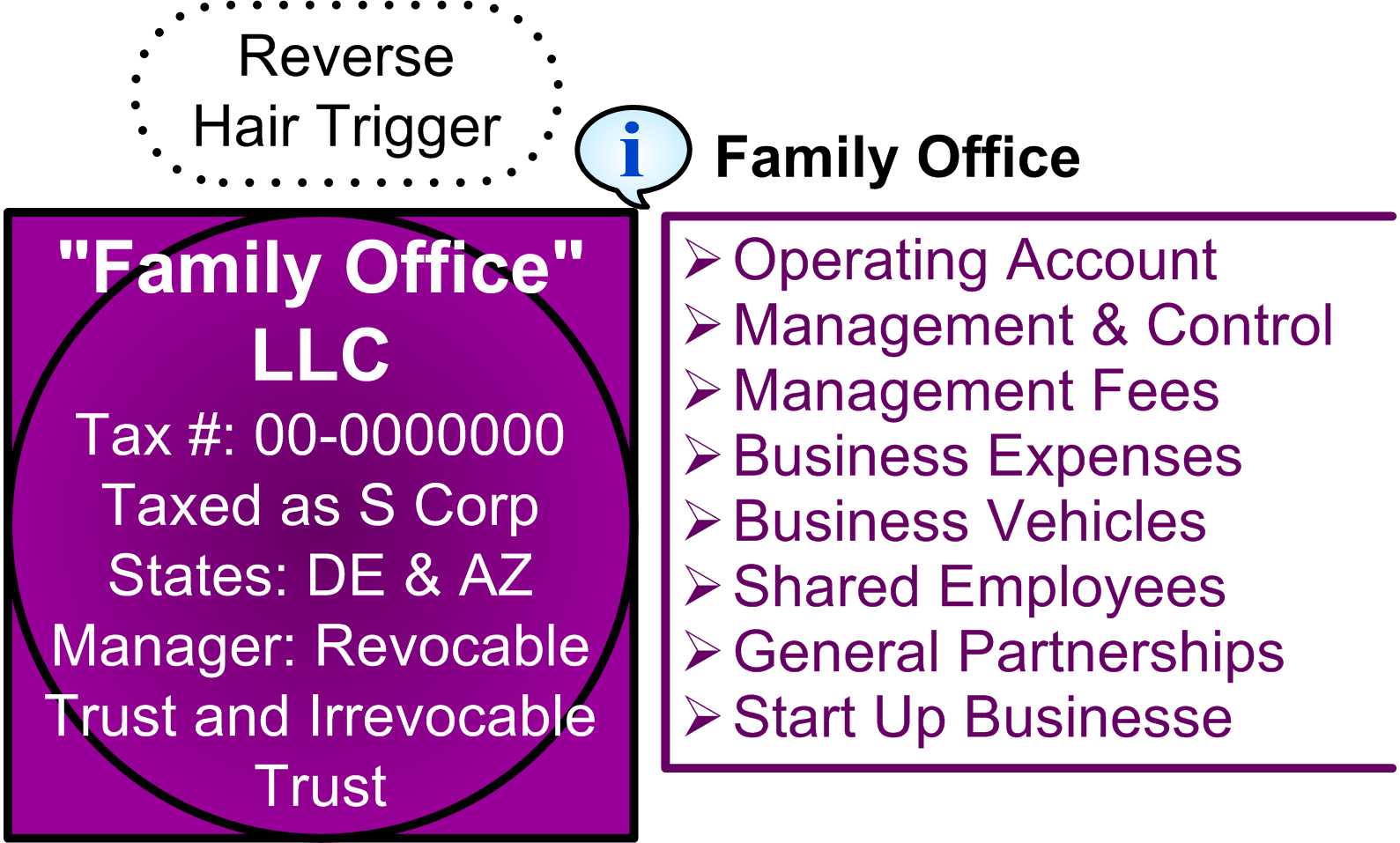

LLC Taxed As S Corporation Durfee Law Group

What Food Is Taxed In Massachusetts - Although Massachusetts still levies a 6 25 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more