What Foreign Taxes Qualify For The Foreign Tax Credit Qualifying Foreign Taxes You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U S possession Generally only income war profits and excess profits taxes qualify for the credit See Foreign Taxes that Qualify For The Foreign Tax Credit for more information

Foreign taxes on income wages dividends interest and royalties generally qualify for the foreign tax credit How the Foreign Tax Credit Works If you paid taxes to a foreign To choose the foreign tax credit you generally must complete Form 1116 Foreign Tax Credit and attach it to your U S tax return However you may qualify for an exception that allows you to claim the foreign tax credit without using Form 1116

What Foreign Taxes Qualify For The Foreign Tax Credit

What Foreign Taxes Qualify For The Foreign Tax Credit

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

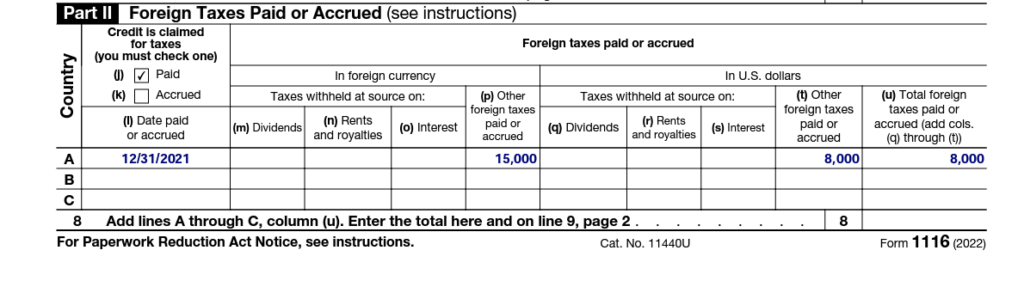

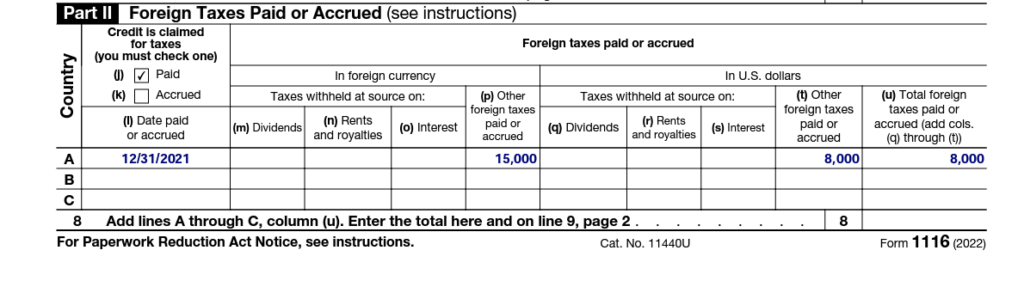

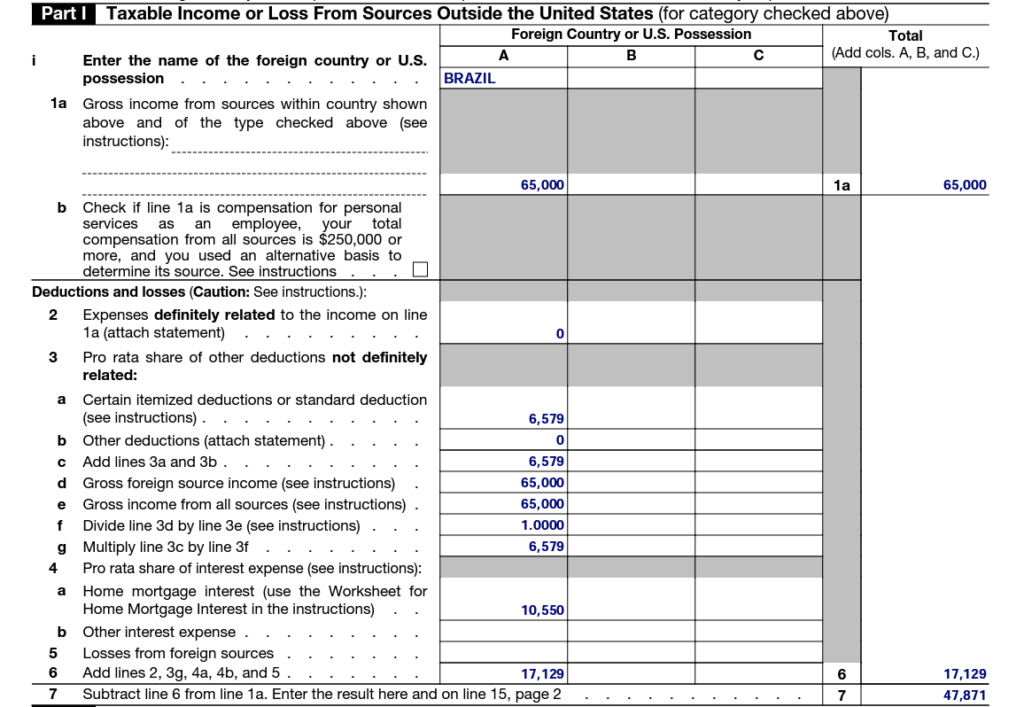

IRS Form 1116 Instructions Claiming The Foreign Tax Credit

https://www.teachmepersonalfinance.com/wp-content/uploads/2023/01/irs_form_1116_featured_image.png

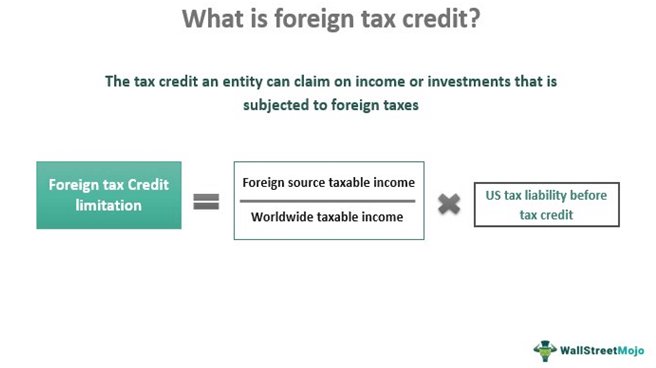

The foreign tax credit is a U S tax credit for income tax paid to other countries The general objective is to help taxpayers avoid double taxation on foreign income Taxpayers can Taxpayers who have paid or accrued foreign income taxes to a foreign country or U S possession may generally credit those taxes against their U S income tax liability on foreign source income The foreign tax credit is designed to relieve taxpayers from double taxation when income is subject to both U S and foreign tax

Foreign taxes on income wages dividends interest and royalties generally qualify for the foreign tax credit Foreign Income Tax Deduction or Foreign Tax Credit The Foreign Tax Credit FTC is a tax provision that allows U S taxpayers to reduce their U S income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States The main purpose of the FTC is to prevent double taxation of income by both the U S and the foreign country where the income is sourced

Download What Foreign Taxes Qualify For The Foreign Tax Credit

More picture related to What Foreign Taxes Qualify For The Foreign Tax Credit

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

Claiming The Foreign Tax Credit With Form 1116 TurboTax Tax Tips Videos

https://digitalasset.intuit.com/IMAGE/A2s0UrkOy/Claiming_the_Foreign_Tax_Credit_with_Form_1116.jpg

Foreign Tax Credit

https://img.indiafilings.com/learn/wp-content/uploads/2018/09/12005520/Foreign-Tax-Credit.jpg

U S citizens and resident aliens including green card holders are eligible for the foreign tax credit They can claim the FTC for foreign income taxes paid on both earned and unearned income such as wages dividends interest and capital gains U S nonresident aliens are not eligible for the credit Foreign income source To be eligible for the Foreign Tax Credit you must be a U S citizen or resident alien or a U S nonresident alien who is a full year resident of Puerto Rico You must have paid accrued or owe taxes on foreign income

[desc-10] [desc-11]

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

https://sftaxcounsel.com/wp-content/uploads/2020/07/shutterstock_1719160864.jpg

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

https://klasing-associates.com/wp-content/uploads/2018/03/WHY-IS-FOREIGN-TAX-CREDIT-ALLOWED.jpg

https://www.irs.gov/.../international-taxpayers/foreign-tax-credit

Qualifying Foreign Taxes You can claim a credit only for foreign taxes that are imposed on you by a foreign country or U S possession Generally only income war profits and excess profits taxes qualify for the credit See Foreign Taxes that Qualify For The Foreign Tax Credit for more information

https://www.investopedia.com/terms/f/foreign-tax-credit.asp

Foreign taxes on income wages dividends interest and royalties generally qualify for the foreign tax credit How the Foreign Tax Credit Works If you paid taxes to a foreign

Foreign Tax Credit Processing Of Tax Returns HLS 2234 Harvard

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

Foreign Tax Credit Guide For Expats with Video Online Taxman

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

Form 1116 How To Claim The Foreign Tax Credit

Form 1116 How To Claim The Foreign Tax Credit

What Is Foreign Tax Credit FTC Company Registration In India

Paid As An Itemized Deduction Rather Than As A Foreign Tax Credit A

Form 1116 How To Claim The Foreign Tax Credit

What Foreign Taxes Qualify For The Foreign Tax Credit - Taxpayers who have paid or accrued foreign income taxes to a foreign country or U S possession may generally credit those taxes against their U S income tax liability on foreign source income The foreign tax credit is designed to relieve taxpayers from double taxation when income is subject to both U S and foreign tax