What Happens If You Claim Exempt On W4 For One Pay Period In order to file tax exempt for one paycheck you must submit a new IRS Form W 4 with your employer and meet the IRS criteria of having no tax liability in the

If you claim exempt on your Form W 4 without actually being eligible anticipate a large tax bill and possible penalties after you file your tax return If both of the following statements apply you could face a tax If you put exempt on your W 4 your employer would not withhold federal taxes from your weekly paycheck If you do not have a tax liability then you simply

What Happens If You Claim Exempt On W4 For One Pay Period

What Happens If You Claim Exempt On W4 For One Pay Period

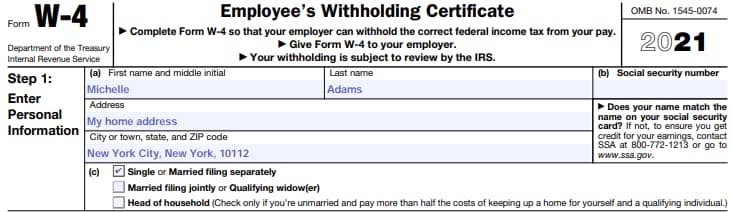

https://personal-accounting.org/wp-content/uploads/2021/02/form-w4-part-1.jpg

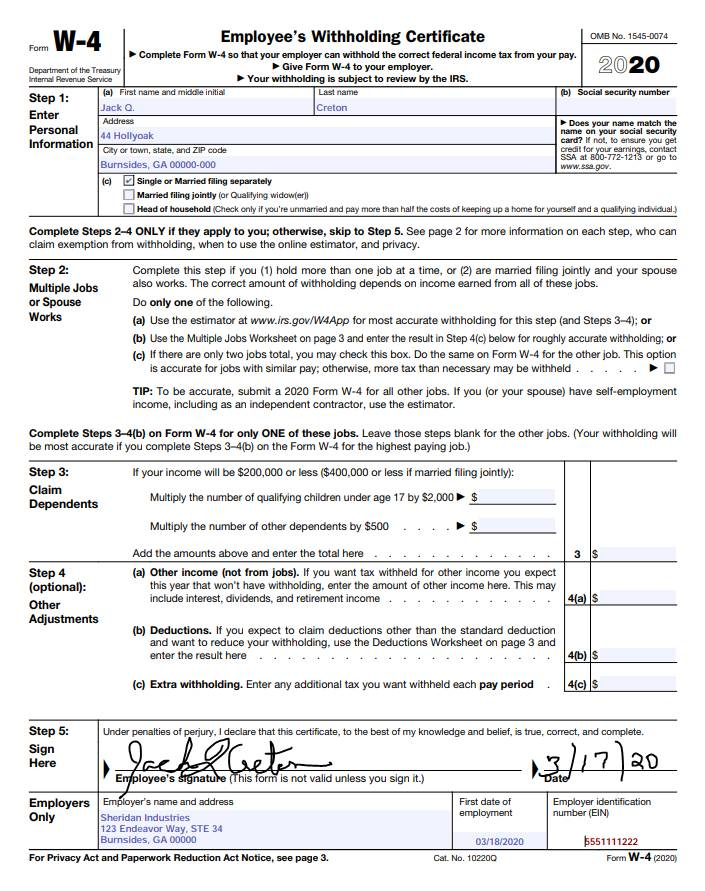

Sample W 4 Form Completed 2022 W4 Form

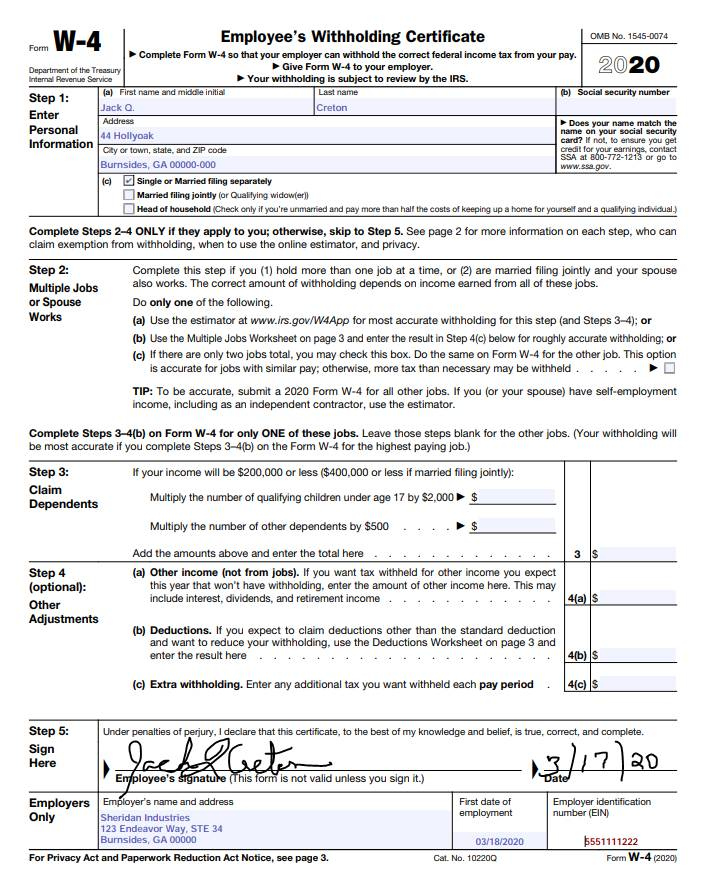

https://w4formsprintable.com/wp-content/uploads/2021/07/what-is-a-w4-form-and-how-does-it-work-form-w-4-for-employers-2.jpg

How To Claim Dependents On 2020 W4

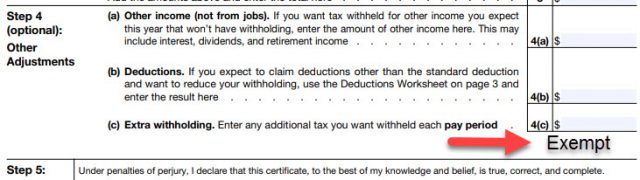

https://apspayroll.com/wp-content/uploads/2019/12/2020-Form-W-4-Image.png

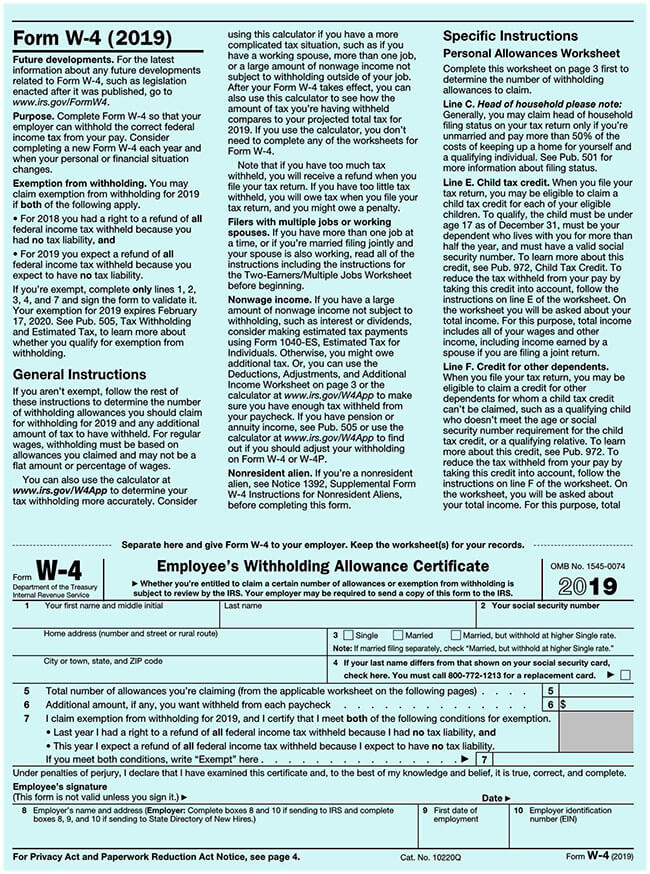

When filling out a W 4 an employee has the option to claim exempt from federal withholding tax If you claim exempt this means no taxes will be taken out of If an employee wants to claim exemption they must write Exempt on Form W 4 in the space below Step 4 c and complete Steps 1 and 5 An employee who wants an exemption for a year must give you

If you think you may still owe sufficiently to end up with a penalty you may file a form 1040 ES Fourth quarter tax payments are due January 16th so you still have Allowances are no longer used for the redesigned Form W 4 This change is meant to increase transparency simplicity and accuracy of the form In the past the value of a

Download What Happens If You Claim Exempt On W4 For One Pay Period

More picture related to What Happens If You Claim Exempt On W4 For One Pay Period

Il W 4 2020 2022 W4 Form

https://w4formsprintable.com/wp-content/uploads/2020/09/how-to-fill-out-a-w-4-form-the-only-guide-you-need.png

Can I Claim Exempt On My W4

https://blog.paymaster.com/wp-content/uploads/2020/11/2020-11-29_13-53-45-640x180.jpg

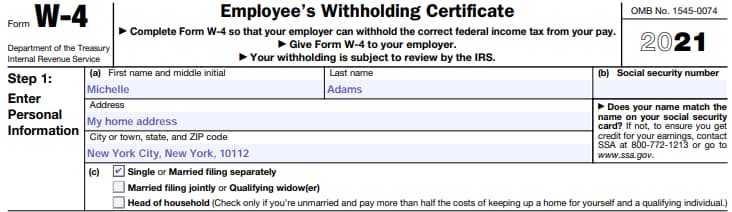

Modelos De Motos 2023 W4 Form IMAGESEE

https://w4formprintable.com/wp-content/uploads/2022/01/2022-federal-tax-withholding-forms-w4-form-2021.png

Note If you claim an exemption you will not have income tax withheld from your paycheck and you may owe taxes when you file your return You might be hit with an underpayment penalty This interview will help you determine if your wages are exempt from federal income tax withholding Information you ll need Information about your prior year income a copy of

If you claim exempt status on your Form W 4 when you aren t eligible you might expect a high tax bill and possible penalties when you do file your tax return You may also be When you file a W 4 you can claim anywhere between zero and three withholding allowances The more allowances you claim the less your employer will

How To Correctly Fill Out Your W4 Form Youtube Gambaran

https://db-excel.com/wp-content/uploads/2019/09/figuring-out-your-form-w4-how-many-allonces-should-you-1.png

How To Fill Out An Exempt W4 Form 2023 Money Instructor

https://content.moneyinstructor.com/wp-content/uploads/2023/06/exemption-1536x997.png

https://budgeting.thenest.com/temporarily-stop...

In order to file tax exempt for one paycheck you must submit a new IRS Form W 4 with your employer and meet the IRS criteria of having no tax liability in the

https://www.hrblock.com/tax-center/irs/tax...

If you claim exempt on your Form W 4 without actually being eligible anticipate a large tax bill and possible penalties after you file your tax return If both of the following statements apply you could face a tax

What Tax Forms Do New Hires Fill Out NewHireForm

How To Correctly Fill Out Your W4 Form Youtube Gambaran

Create Your W 4 Form Now Sign And EFile Your Form Now

What Happens If I Claim Exempt On One Paycheck YouTube

Fillable Online Usfweb2 Usf Claiming Exempt On Form W 4 Fax Email Print

Claiming Exemptions the W 4 For Dummies Robergtaxsolutions

Claiming Exemptions the W 4 For Dummies Robergtaxsolutions

Should I Claim 1 Or 0 On My W4 What s Best For Your Tax Allowances

How To Complete 2020 New Form W 4 Payroll Tax Knowledge Center

United States Computing Federal Withholding Based On W4 Personal

What Happens If You Claim Exempt On W4 For One Pay Period - If you think you may still owe sufficiently to end up with a penalty you may file a form 1040 ES Fourth quarter tax payments are due January 16th so you still have