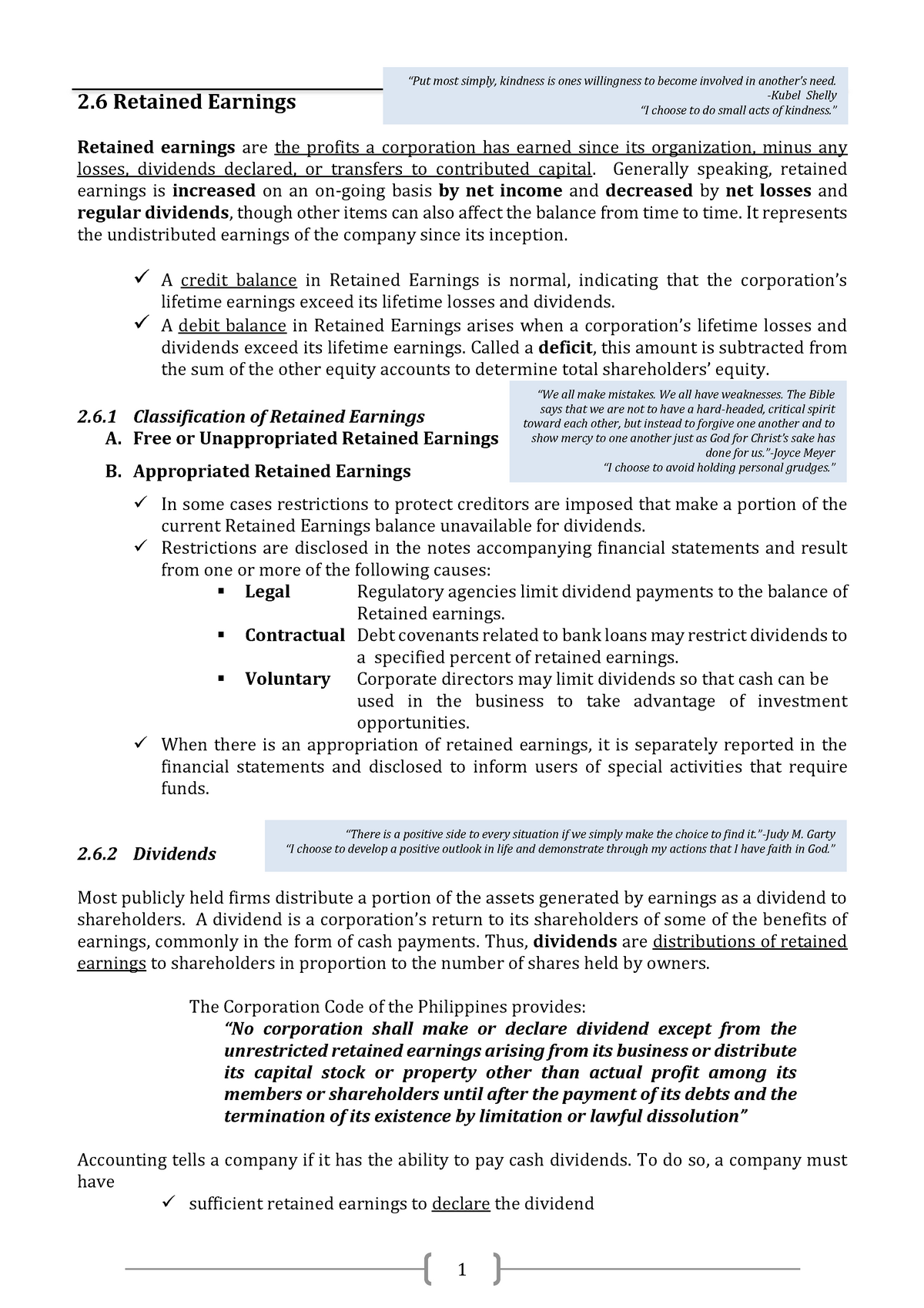

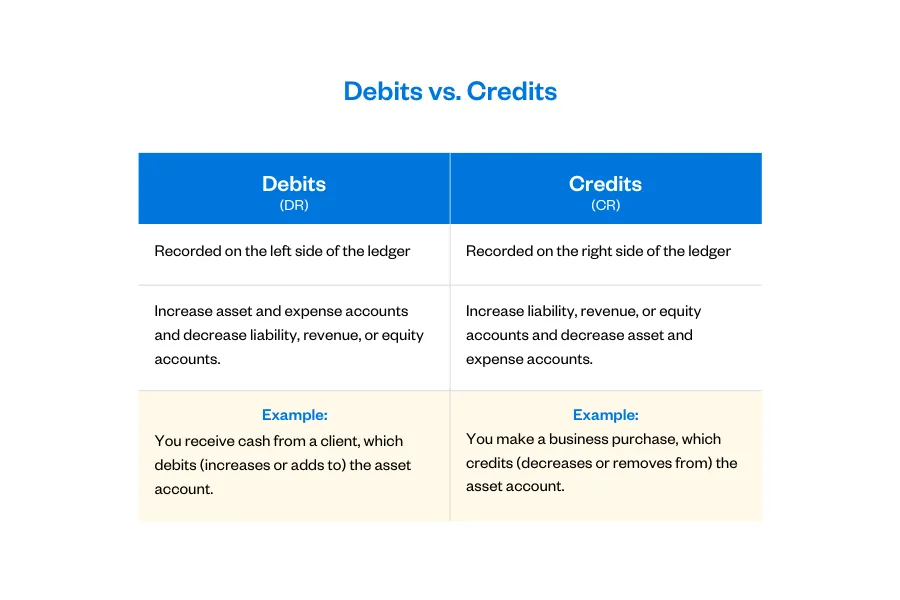

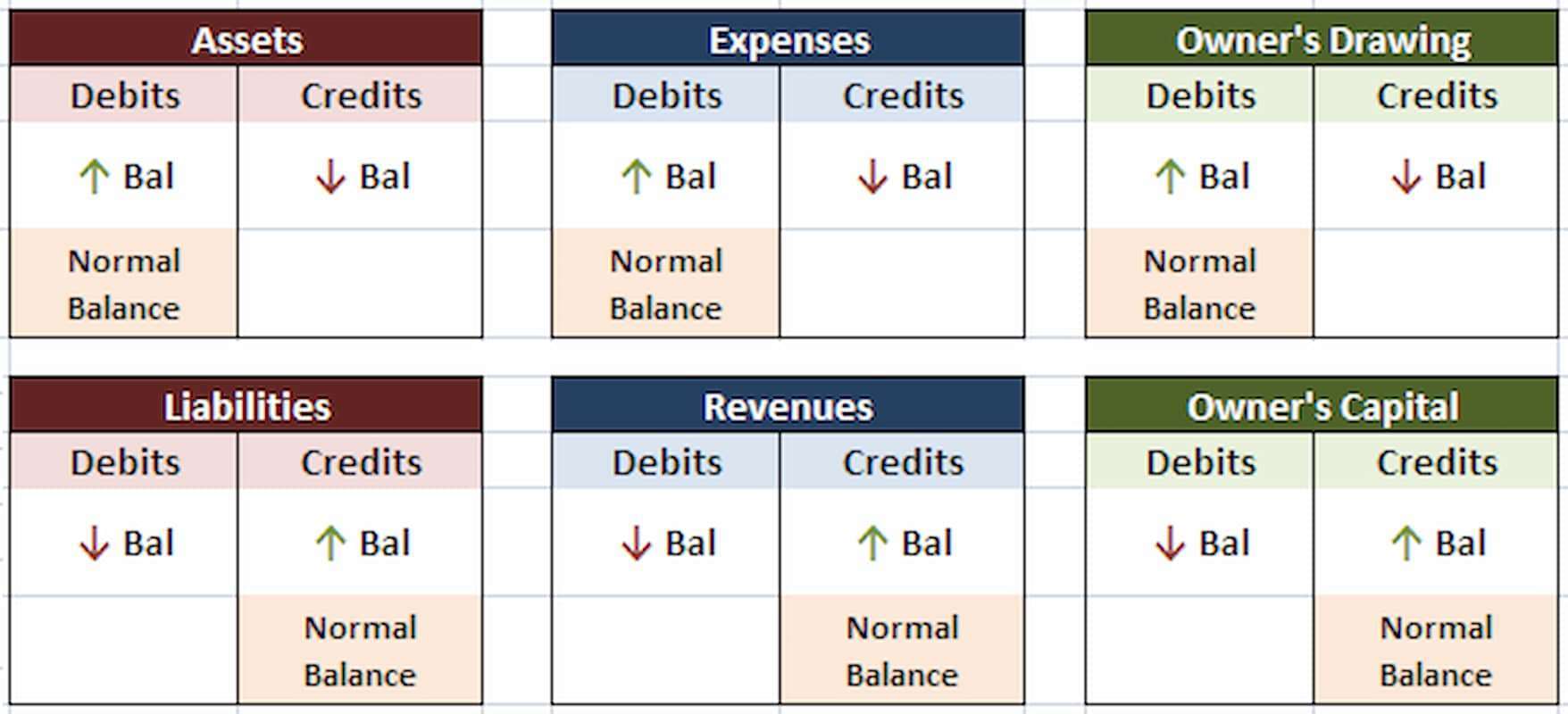

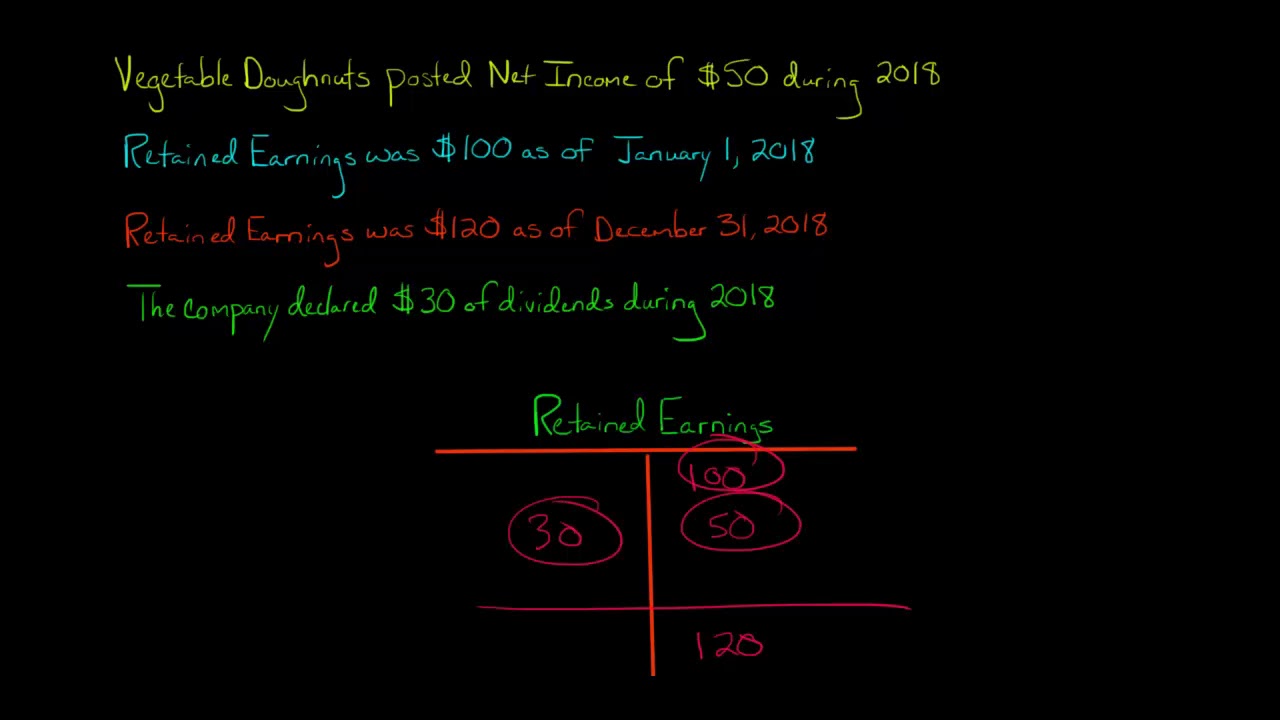

What Happens When You Debit Retained Earnings Retained Earnings liability are Credited Cr when increased Debited Dr when decreased Why is it like this According to this rule an increase in retained earnings is credited and a decrease in retained earnings is debited

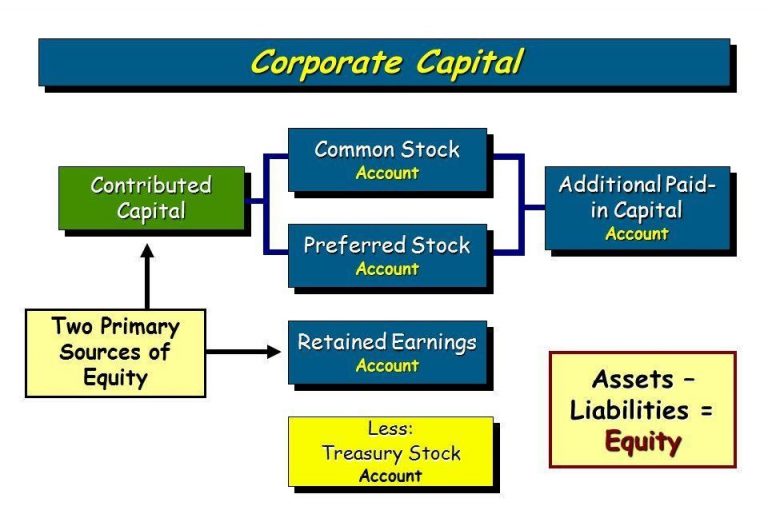

Shareholder Equity Impact Retained earnings are reported under the shareholder equity section of the balance sheet while the statement of retained earnings outlines the changes in RE during the What are Retained Earnings Retained Earnings RE are the accumulated portion of a business s profits that are not distributed as dividends to shareholders but instead are reserved for reinvestment back into the business Normally these funds are used for working capital and fixed asset purchases capital expenditures or allotted for

What Happens When You Debit Retained Earnings

What Happens When You Debit Retained Earnings

https://bramabimanyup.files.wordpress.com/2018/05/bram-35.png

Excel

https://cdn.educba.com/academy/wp-content/uploads/2019/01/Ending-Retained-Earnings-Formula-738x379.jpg

Retained Earnings Debit Or Credit Simple Accounting

https://simple-accounting.org/wp-content/uploads/2020/12/image-2-768x526.jpeg

A retained earnings balance is increased when using a credit and decreased with a debit If you need to reduce your stated retained earnings then you debit the earnings What if the company overstated its net income in the previous period and needs to make an adjusting entry To decrease the retained earnings account it will be debited A debit entry would also be essential if the company would take from retained earnings to pay for something

When a company consistently experiences net losses those losses deplete its retained earnings Prolonged periods of declining sales increased expenses or unsuccessful business ventures can lead to negative retained earnings Retained earnings are reported in the shareholders equity section of a balance sheet Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders That is the amount of residual net income that is not distributed as dividends but is reinvested or ploughed back into the company

Download What Happens When You Debit Retained Earnings

More picture related to What Happens When You Debit Retained Earnings

Retained Earnings Transactions And Statement The Stockholders Equity

https://img.homeworklib.com/questions/6f32a000-710a-11ea-bd69-111c94cfd9cc.png?x-oss-process=image/resize,w_560

What Is Financial Accounting Definition Principles Examples

https://www.founderjar.com/wp-content/uploads/2021/07/Statement-of-Retained-Earnings-Example-Company-ABC.jpg

How To Calculate Retained Earnings formula Examples

https://assets-global.website-files.com/6253f6e60f27498e7d4a1e46/626280ea6fd9a49d0072b448_Screen-Shot-2021-12-20-at-9.25.04-AM.png

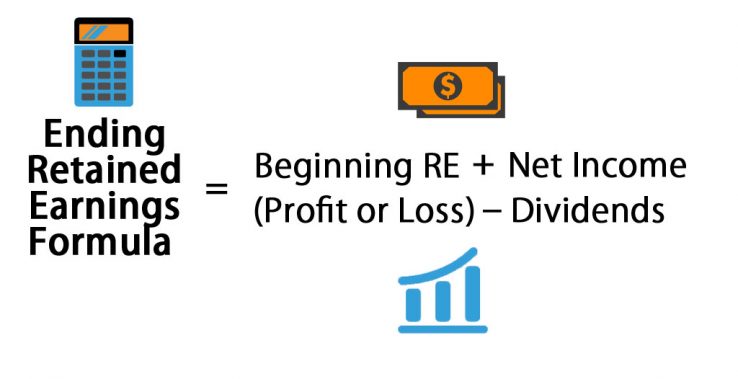

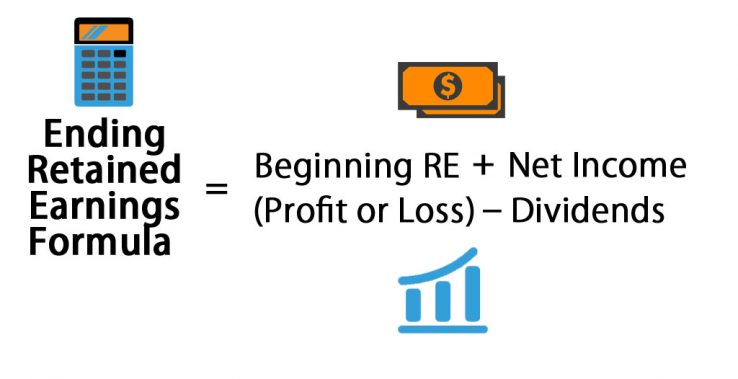

Current retained earnings Net income of shares x FMV of each share Retained earnings 9 000 10 000 500 x 10 14 000 This means that on April 1 retained earnings for the business would be 14 000 Retained earnings shareholders equity and working capital Definition A retained earnings deficit also called an accumulated deficit happens when cumulative losses are greater than cumulative profits causing the account to have a negative or debit balance In other words an RE deficit is a negative retained earnings account

Hence the retained earnings account will increase credit or decrease debit by the amount of net income or net loss after the journal entry For example company A which is a trading company has a net income of 25 000 which all of its respective income and expenses have already been transferred to the income summary account at the end of Retained earnings are an accumulation of a company s net income and net losses over all the years the business has been operating Retained earnings make up part of the stockholder s equity on

2 6 Retained Earnings 2 Retained Earnings Retained Earnings Are The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8a592d7f640d6493e69402f26764fa97/thumb_1200_1698.png

Retained Earnings Debit Or Credit Financial Falconet

https://www.financialfalconet.com/wp-content/uploads/2022/10/Retained-earnings-debit-or-credit.png

https://www.accountingcapital.com/question/...

Retained Earnings liability are Credited Cr when increased Debited Dr when decreased Why is it like this According to this rule an increase in retained earnings is credited and a decrease in retained earnings is debited

https://www.investopedia.com/ask/answers/10/...

Shareholder Equity Impact Retained earnings are reported under the shareholder equity section of the balance sheet while the statement of retained earnings outlines the changes in RE during the

Practice Safe Spending How To Use Your Debit Card Safely Mastercard

2 6 Retained Earnings 2 Retained Earnings Retained Earnings Are The

What Is The Real Meaning Of Credit Leia Aqui What Is The Literal

Debits And Credits Accounting And Finance Learn Accounting

Debit And Credit Learn Their Meanings And Which To Use

What Are Retained Earnings How To Calculate Retained Earnings

What Are Retained Earnings How To Calculate Retained Earnings

Debits And Credits Explanation BooksTime

T Account For Retained Earnings YouTube

What Is Debit And Credit Explanation Difference And Use In Accounting

What Happens When You Debit Retained Earnings - Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders That is the amount of residual net income that is not distributed as dividends but is reinvested or ploughed back into the company