What Heat Pumps Qualify For Federal Tax Credit South ENERGY STAR certified heat pumps with SEER2 16 EER2 12 HSPF2 9 North ENERGY STAR Cold Climate heat pumps with SEER2 16 EER2 9 HSPF2 9 5 Note The information provided here about Air Source heat pumps that are eligible for the tax credit is the most current available

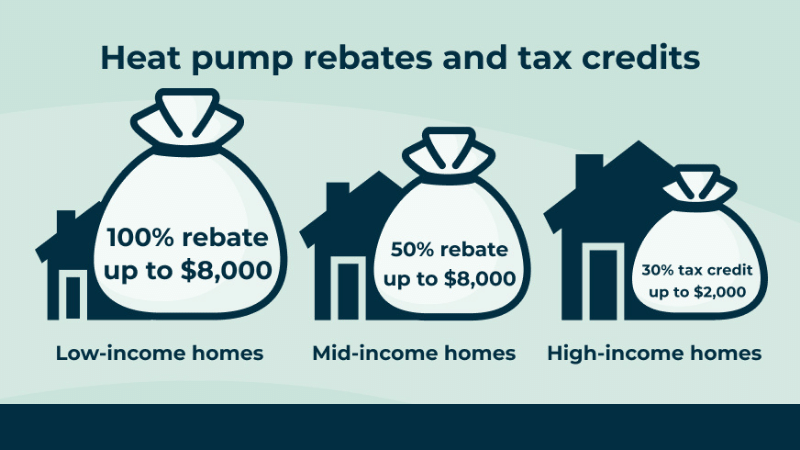

Q What is the federal tax credit for installing a heat pump The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the Inflation Reduction Act 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov

What Heat Pumps Qualify For Federal Tax Credit

What Heat Pumps Qualify For Federal Tax Credit

https://images.hgmsites.net/hug/2022-rivian-r1t_100807855_h.jpg

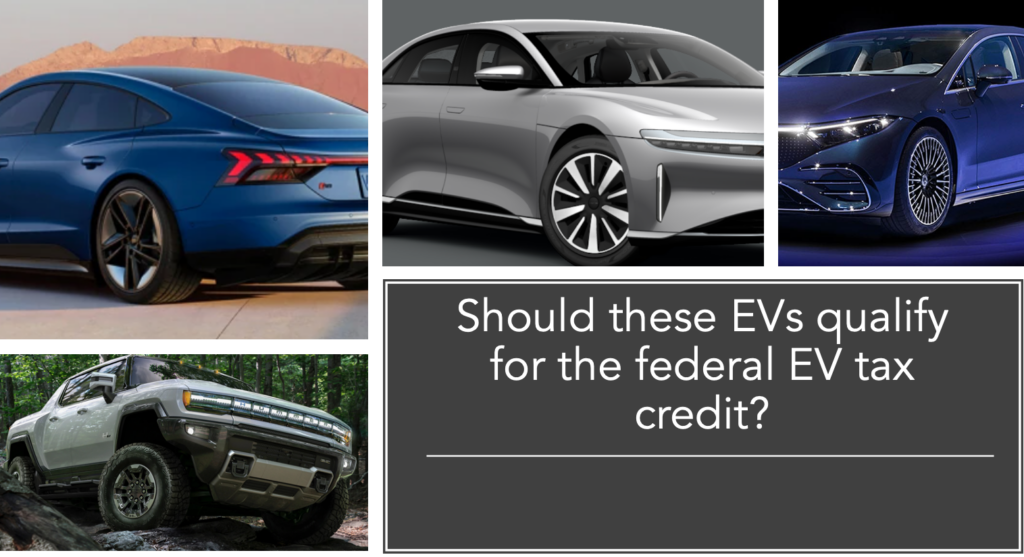

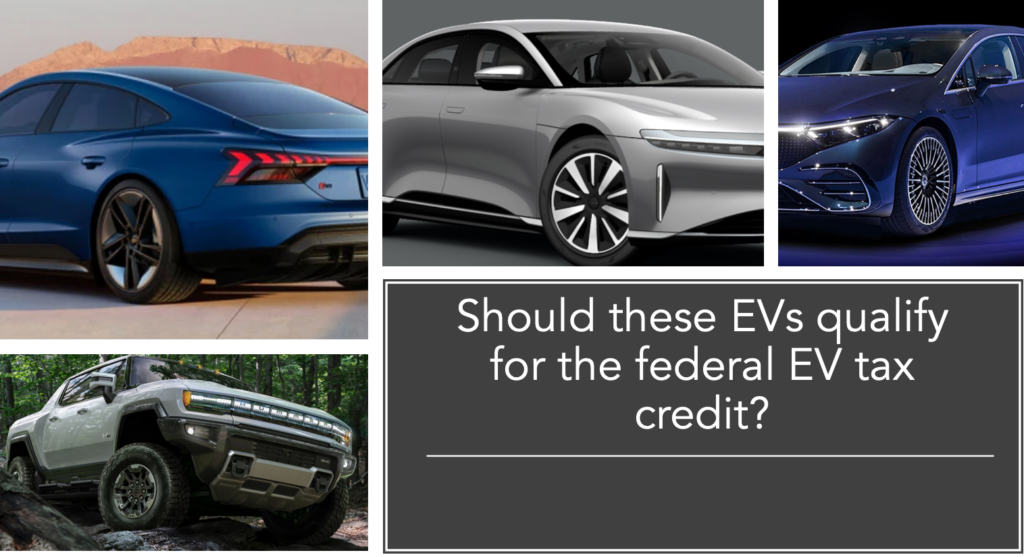

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit-1024x557.png

Do MRCOOL DIY Ductless Mini Split Heat Pumps Qualify For The 30

https://www.techwalls.com/wp-content/uploads/2023/02/mrcool-768x695.jpg

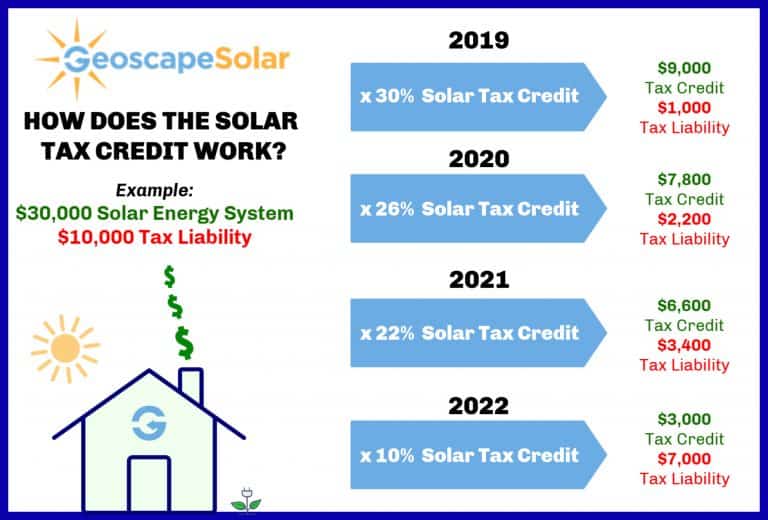

Qualified expenses include the costs of new clean energy property including Solar electric panels Solar water heaters Wind turbines You purchase an air source heat pump that qualifies for the energy efficient home improvement credit In the same tax year you can claim 30 of the cost of that project for up to an additional 2 000

Thanks to the IRA if you made or are planning to make certain qualified energy efficient improvements to your home after January 1 2023 you may qualify for a tax credit from the IRS For Heat pumps that are ENERGY STAR certified meet the requirements for this tax credit Tax Credit Amount 300 Requirements Split Systems HSPF 8 5 EER 12 5 SEER 15 Package systems HSPF 8 EER 12 SEER 14 See Definitions More Information How to apply Central Air Conditioning CAC

Download What Heat Pumps Qualify For Federal Tax Credit

More picture related to What Heat Pumps Qualify For Federal Tax Credit

Heat Pump Tax Credit And Rebates Qualifications For Federal Incentives

https://storage.googleapis.com/sealed-prod.appspot.com/1/2022/08/still2forali_EDIT-watermark.jpg

GM Has Sold 200 000 EVs Federal Tax Credit Will Be Phased Out

https://i.pinimg.com/originals/d1/7b/e3/d17be393c609a07a29ea72d9a7e1b0e3.jpg

The Inflation Reduction Act pumps Up Heat Pumps Hvac

https://www.hvac.com/wp-content/uploads/2022/09/heat-pump-rebates-2023.png

Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners Furnaces

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps Eligible models as listed above are qualified and dependent upon specific system combinations You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Auto Makers Warn Most Electric Vehicles Won t Qualify For Federal Tax

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA10uxET.img?w=1280&h=640&m=4&q=79

Who Qualifies For Federal Tax Credit Leia Aqui Do I Qualify For

https://geoscapesolar.com/wp-content/uploads/2021/10/ITC-Infographic-768x520-1.jpg

https://www.energystar.gov/about/federal-tax...

South ENERGY STAR certified heat pumps with SEER2 16 EER2 12 HSPF2 9 North ENERGY STAR Cold Climate heat pumps with SEER2 16 EER2 9 HSPF2 9 5 Note The information provided here about Air Source heat pumps that are eligible for the tax credit is the most current available

https://sealed.com/resources/heat-pump-tax-credits-and-rebates

Q What is the federal tax credit for installing a heat pump The 25c tax credit allows taxpayers to claim certain home energy upgrades like heat pumps to reduce their tax burden In 2023 the maximum federal tax credit for installing a heat pump increased to 30 of your project costs up to 2 000 under the Inflation Reduction Act

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

Auto Makers Warn Most Electric Vehicles Won t Qualify For Federal Tax

MOST ELECTRIC VEHICLES WON T QUALIFY FOR FEDERAL TAX CREDIT

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Only Six EVs Will Qualify For The 7 500 Federal Tax Credit Starting

Only Six EVs Will Qualify For The 7 500 Federal Tax Credit Starting

Energy Credits How To Qualify For A Federal Tax Credit When Installing

Heating Cooling Experts In Kalamazoo HVAC Services Metzger s Inc

30 Federal Tax Credits For Heat Pump Water Heaters 2023

What Heat Pumps Qualify For Federal Tax Credit - Qualified expenses include the costs of new clean energy property including Solar electric panels Solar water heaters Wind turbines