What Home Equity Loans Are Tax Deductible To deduct the interest paid on your home equity loan or your HELOC you ll need to itemize deductions at tax time using IRS Form 1040 Itemizing is worth doing only if all your

Strictly speaking only the interest on a home equity loan is tax deductible not the loan principal itself Whether or not you can deduct the interest paid on your home equity Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC just for the tax deduction

What Home Equity Loans Are Tax Deductible

What Home Equity Loans Are Tax Deductible

https://www.cobaltcu.com/sites/default/files/2022-01/Home-Equity-Loan-VS-Line-of-Credit.png

Mortgages Vs Home Equity Loans Differences And Similarities

https://www.freedomcapital.com/wp-content/uploads/2022/07/mortgages-vs-home-equity-loans.jpeg

Advantages And Disadvantages Of A Home Equity Loan Mortgage Broker

https://matrixmortgageglobal.ca/wp-content/uploads/2022/12/home-equity-loan-flat-lay-written-with-tile-letter-2022-11-11-16-50-35-utc-scaled.jpg

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or Home equity loan interest home equity line of credit HELOC interest and the interest you pay on a mortgage to purchase a new home are all tax deductible if you meet the criteria A home equity loan may help you improve and update your home but remember your home is the collateral so make sure you re able to repay it so you

Homeowners who used funds from a home equity loan can write off the interest on their taxes Here s what you need to know before filing your 2021 taxes The interest you pay on a home equity loan is tax deductible but only if you use the money to buy build or substantially improve your home in the words of the IRS For example if

Download What Home Equity Loans Are Tax Deductible

More picture related to What Home Equity Loans Are Tax Deductible

Taxes Are Due July 15 Experts Say Save 90 Money

https://img.money.com/2020/03/mm_ds_33_income_tax_refund-2.gif

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

5 Risky Loans To Avoid At All Costs

https://storage.googleapis.com/pg-prd-pgblog-uploads/2016/02/refund-anticipation-loan-feature-021916.jpg

In this article we ll go through the tax implications of home equity loans and when you may be able to get a tax break Discover if home equity loan interest is tax deductible Interest on a home equity loan is deductible only if the borrowed funds create what the IRS deems a substantial improvement which includes anything that adds value prolongs the

[desc-10] [desc-11]

Home Equity Loans Are Deductible Sometimes

https://www.mcb.cpa/wp-content/uploads/2020/08/Home-Equity-Loan-980x677.jpg

How Home Equity Loans Affect Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

https://www.nerdwallet.com/article/mortgages/home...

To deduct the interest paid on your home equity loan or your HELOC you ll need to itemize deductions at tax time using IRS Form 1040 Itemizing is worth doing only if all your

https://www.bankrate.com/home-equity/home-equity...

Strictly speaking only the interest on a home equity loan is tax deductible not the loan principal itself Whether or not you can deduct the interest paid on your home equity

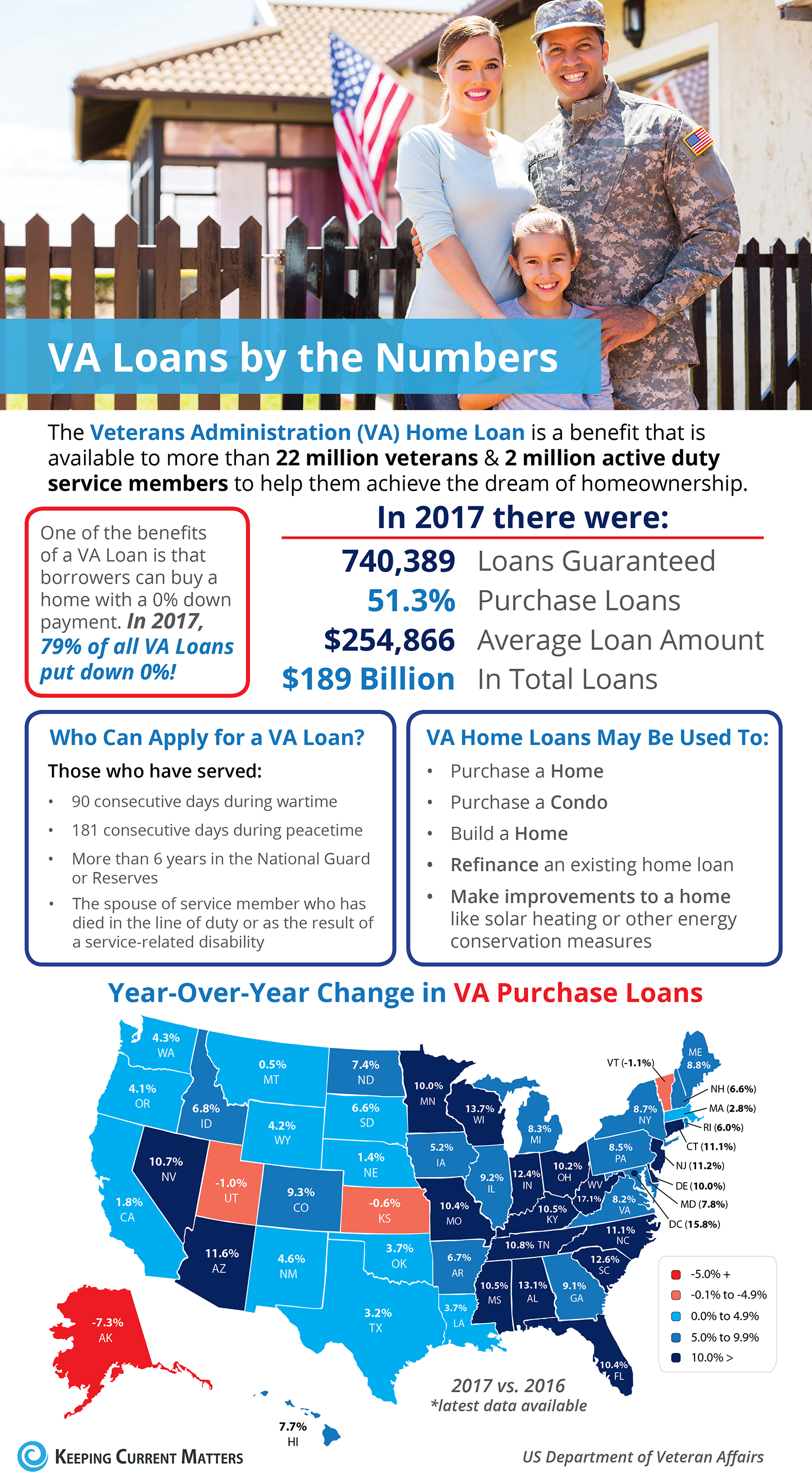

VA Home Loans By The Numbers INFOGRAPHIC Blog

Home Equity Loans Are Deductible Sometimes

Are Home Equity Loans Tax Deductible Credello

Is A Home Equity Loan Right For Me PaloRATE Bellevue Mortgage Broker

How Much Equity Do I Have In My Home Money 2022

The 5 Best Home Equity Loans For 2024 Free Buyers Guide

The 5 Best Home Equity Loans For 2024 Free Buyers Guide

Home Equity Loan Rates In NH ME Kennebunk Savings

9 Best Home Equity Loans Of 2022

Is My Business Loan Repayment Tax Deductible IIFL Finance

What Home Equity Loans Are Tax Deductible - Homeowners who used funds from a home equity loan can write off the interest on their taxes Here s what you need to know before filing your 2021 taxes