What If I Don T File Income Tax Return In India In India you must file an ITR under the following circumstances If your total income exceeds the tax free threshold based on your age When seeking an income tax refund If

Legal consequences If you don t file tax returns the income tax department may send you a notice You may face huge penalties and taxes if you do not file ITR despite their File a Belated Return You can file a belated return until December 31 of the relevant assessment year However it will attract penalties and interest Respond to Tax

What If I Don T File Income Tax Return In India

What If I Don T File Income Tax Return In India

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/income-tax-return-online.jpg

Don t File Income Tax

https://gumlet.assettype.com/afaqs/2022-07/f3df38cf-4b33-40d7-9aa8-0921036df26c/twitter.jpg?rect=0%2C167%2C767%2C403&w=1200&auto=format%2Ccompress&ogImage=true

File Revenue Tax Return For FY 2021 22 Now On line To Keep Away From Rs

https://images.hindustantimes.com/tech/img/2022/07/15/1600x900/itr_1638249050262_1657879361820_1657879361820.PNG

Yes all taxpayers must file their income tax returns on time to remain compliant Failure to do so will attract penalties and can hamper your chances of getting a loan a visa for travel purposes or property registration You may receive a refund based on your total income deduction and exemptions that you qualify for when you file an income tax return Several sections of the IT Act offer

What happens when I don t file my income tax returns The I T Department will send you a notice telling you to file your return You will not be given your refund If you are found to owe the government taxes the interest keeps adding up till What happens if I don t pay income tax in India If a person does not file ITR and misses the ITR date his returns will be filed late and refunds if any will be processed late Also a late filing fee is applicable under Section 234F

Download What If I Don T File Income Tax Return In India

More picture related to What If I Don T File Income Tax Return In India

Income Tax Return Filing In Lahore Pakistan Tax Filing Procedure

https://www.taxcare.pk/wp-content/uploads/2020/04/INCOME-TAX-RETURN-FILING-IN-PAKISTAN-TAX-CARE.png

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)

What Happens If You Don t File Taxes

https://www.thebalancemoney.com/thmb/BhruxzFJdCSvPAryStQ61pShUug=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png

What Happens If You Don t File Taxes On Time In India What Are The

https://ind-strapi-cms.s3.ap-south-1.amazonaws.com/xlarge_tax_28_44dbb56ecd.jpg

Not filing income tax returns is not an option Here s all you need to know about the hassles fines and repercussions of tax default in India In case any individual hasn t filed their income tax returns in India before the prescribed date then he or she can submit their belated IT returns within the period of two years that is from the end of FY

If a filed ITR is not verified then your tax return will not be treated as a valid return by the income tax department Further your ITR will not be taken up for processing by the tax department if not verified For non filing of your ITR the tax department can levy penalty a minimum penalty equal to 50 of the tax which would have been avoided by you in addition to the liability to

Avoid THESE Mistakes While Filing Your Income Tax Return

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/08/13/990627-984603-income-tax-return-itr-1200-1-1024x569.jpg

How To File Income Tax Return Online In Hindi YouTube

https://i.ytimg.com/vi/KG6fme5psps/maxresdefault.jpg

https://tax2win.in › guide › consequences-if-i-fail-to...

In India you must file an ITR under the following circumstances If your total income exceeds the tax free threshold based on your age When seeking an income tax refund If

https://cleartax.in › what-is-itr

Legal consequences If you don t file tax returns the income tax department may send you a notice You may face huge penalties and taxes if you do not file ITR despite their

Income TAX Return Which ITR Form To Fill In 2017

Avoid THESE Mistakes While Filing Your Income Tax Return

What Happens If You Don t File Taxes On Time In India What Are The

What Happens If You Don t File Taxes On Time In India What Are The

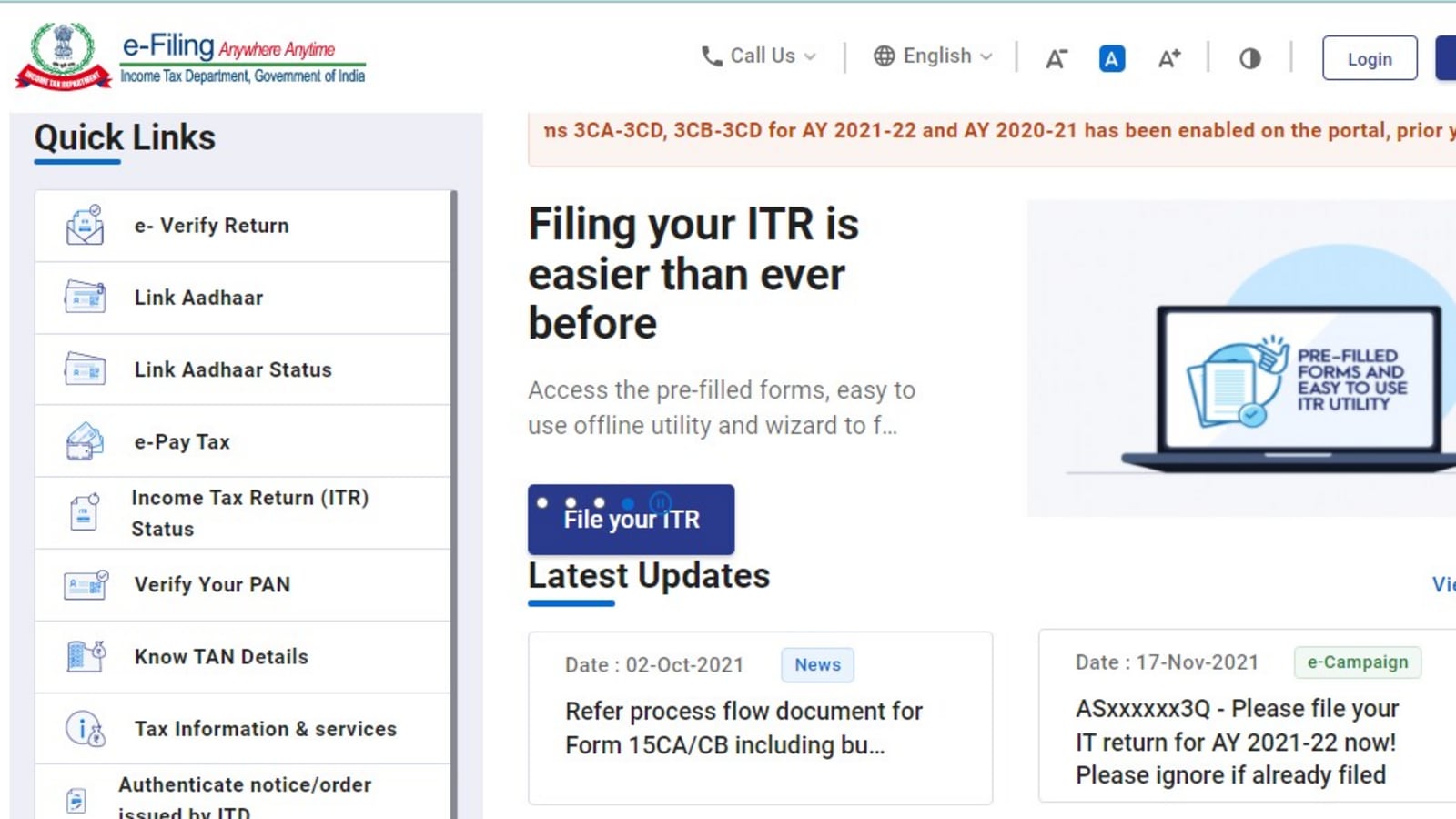

How To File Income Tax Returns ITR Online In India Complete Guide

Online Income Tax Return India

Online Income Tax Return India

File Income Tax Return How To E File Your Income Tax Return Online

Is It Mandatory For NRI To File Income Tax Return In India NRI

How To File Income Tax Return In India Capitalante

What If I Don T File Income Tax Return In India - ITR filing What happens if you don t file tax return today ITR filing 2024 Given that today is the last date to file ITR for AY2 24 25 it is crucial to understand the