What If You Paid Too Much Social Security Tax You may be entitled to a refund if you paid both tier 1 RRTA tax and Social Security tax which combined exceed the Social Security wage base If you had more

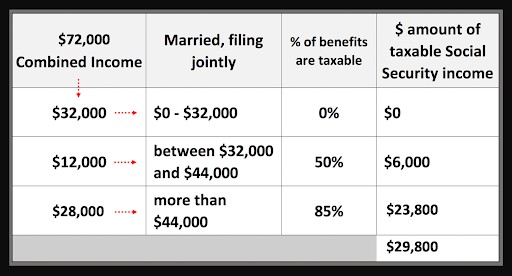

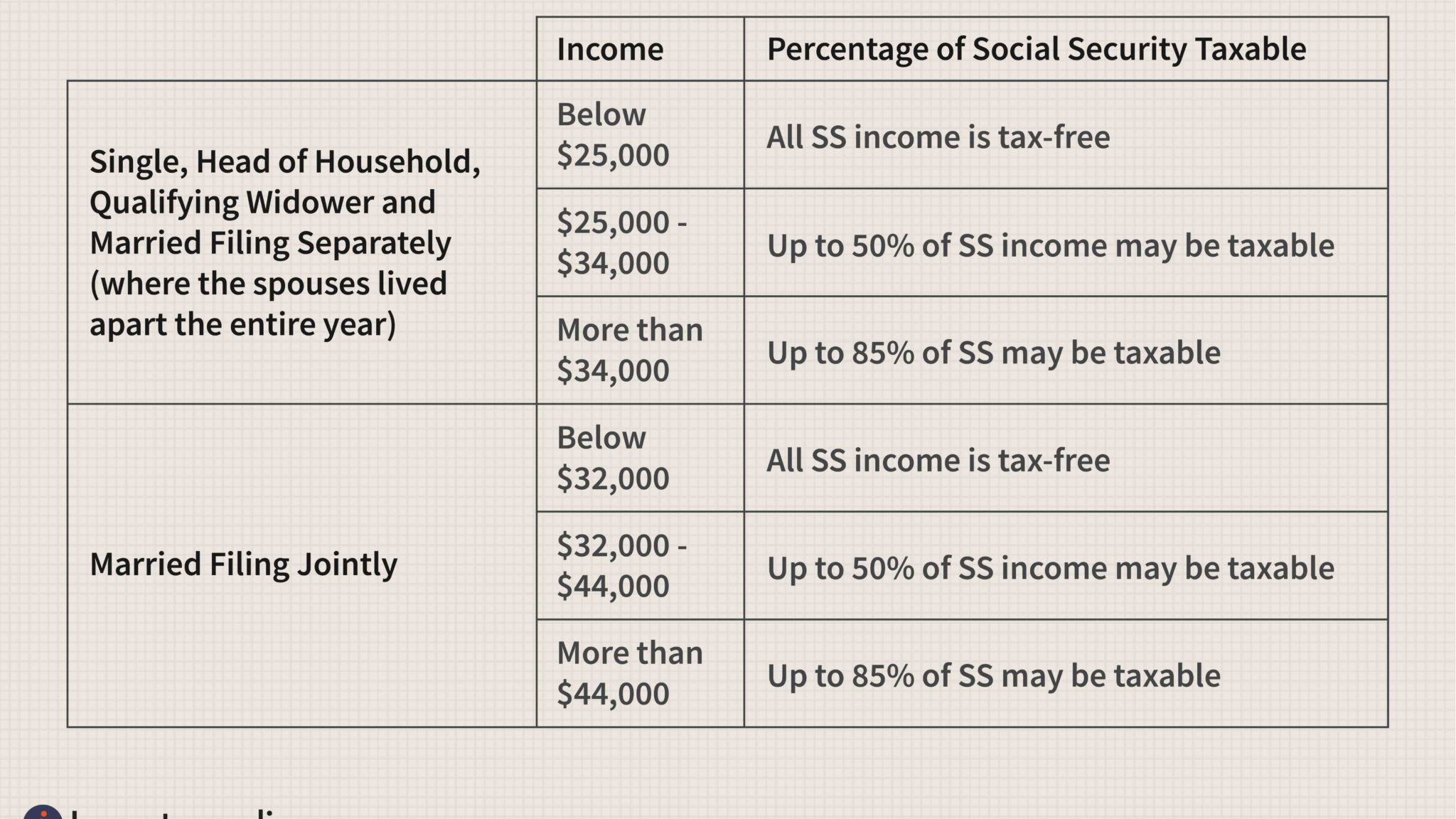

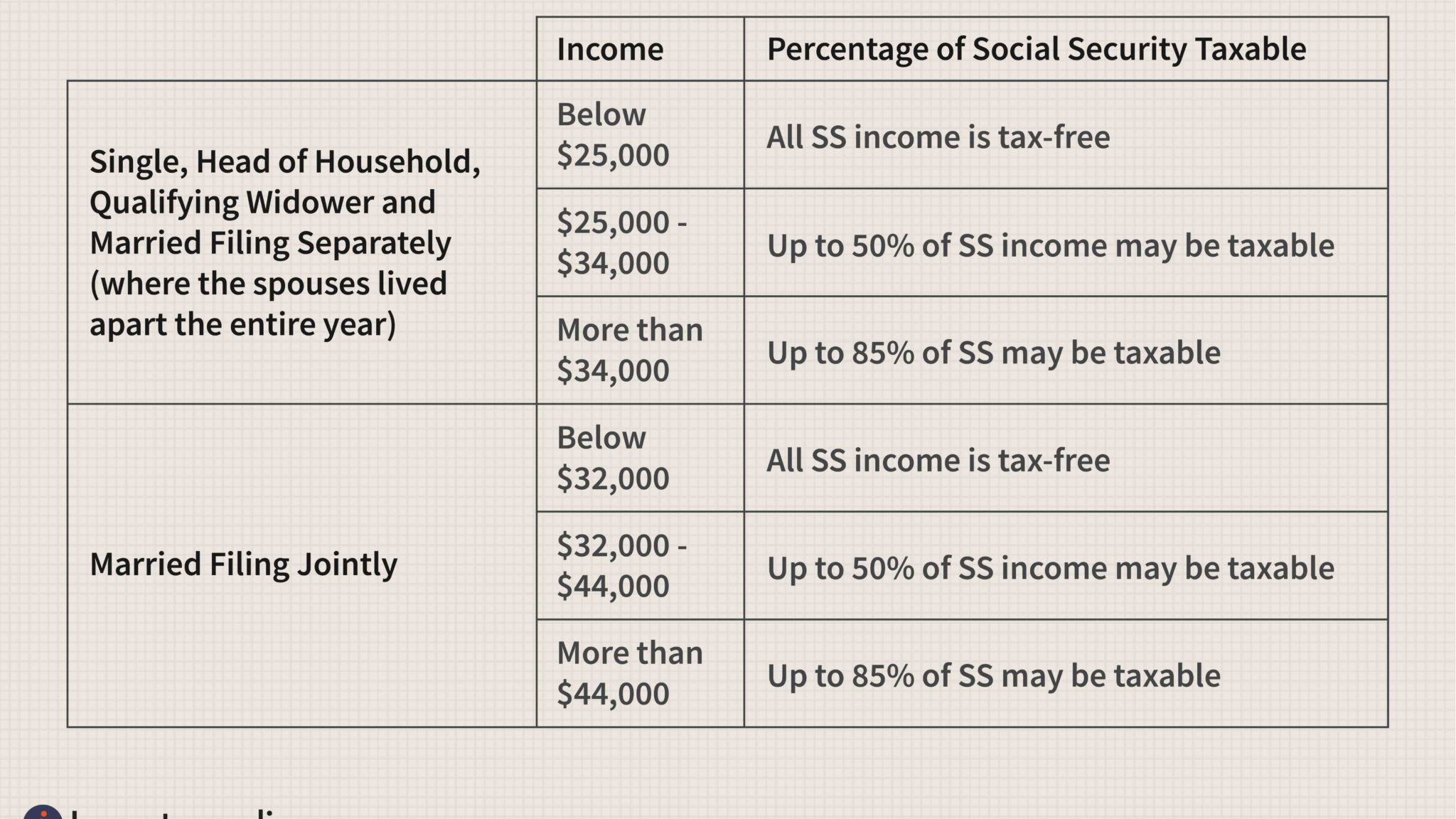

For tax year 2021 once an employee earns 142 800 from an employer social security taxes are no longer withheld This results in a max social security tax Up to 85 of Social Security benefits are subject to federal income tax depending on your total household income However Fidelity recently presented options

What If You Paid Too Much Social Security Tax

What If You Paid Too Much Social Security Tax

https://i.ytimg.com/vi/_b3sVqfoOFQ/maxresdefault.jpg

Do You Have To Pay Tax On Your Social Security Benefits YouTube

https://i.ytimg.com/vi/yVRdBCJXqAU/maxresdefault.jpg

Get A Bigger Tax Refund Than Expected The Year You Retired From The

https://static.twentyoverten.com/5a4515738296d37425053dec/tsPS7G1J0_T/MoneyTaxes.jpg

If you overpaid Social Security tax there are steps you can take to get the excess amount back in your bank How you proceed however is determined by your If you are working there is a limit on the amount of your earnings that is taxed by Social Security This amount is known as the maximum taxable earnings and changes each

Excess Social Security and Tier 1 RRTA Tax Withheld If you or your spouse if filing a joint return had more than one employer for 2021 and total wages of more than 142 800 Repay overpaid Social Security benefits Please pay us back if your benefit amount was more than it should have been If you got a letter in the mail that says you got more

Download What If You Paid Too Much Social Security Tax

More picture related to What If You Paid Too Much Social Security Tax

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

https://apprisewealth.com/wp-content/uploads/2021/08/6078d22e880cc80157173540_Provisional-Income-Table.png

Working And Taking Social Security At The Same Time Watch Out For This

https://i.pinimg.com/originals/37/e6/aa/37e6aac0fb6ae19a1e2fc59f6657981d.jpg

Estimate Your Federal Tax Refund With The Last Pay Stub

https://www.realcheckstubs.com/media/Deductions.jpg

Do I pay Social Security tax or income tax on my Social Security benefit payments If you earn between 25 000 and 34 000 per year as a single filer or If you paid more than the maximum Social Security tax for the year 9 114 in 2022 then use Schedule 3 before completing your Form 1040 Enter the excess

If your employer withheld too much Social Security tax in Box 4 or Medicare tax in Box 6 you will need to contact your employer for a refund of the excess FICA taxes withheld Excess Social Security tax should be reported if you or your spouse if filing a joint return had more than one employer for the tax year and individually you or your spouse had

How To Find Out If You Owe State Taxes Rowwhole3

https://i.insider.com/5f721b9074fe5b0018a8dc86?width=1000&format=jpeg&auto=webp

Have You Paid Too Much Tax On Your Pension Balance Wealth Planning

https://balancewealth.uk/wp-content/uploads/2022/07/Too-much-tax-on-pensions-3.png

https://www.irs.gov/taxtopics/tc608

You may be entitled to a refund if you paid both tier 1 RRTA tax and Social Security tax which combined exceed the Social Security wage base If you had more

https://schwartzaccountants.com/2021/12/working...

For tax year 2021 once an employee earns 142 800 from an employer social security taxes are no longer withheld This results in a max social security tax

How Much Social Security Is Taxable Social Security Intelligence

How To Find Out If You Owe State Taxes Rowwhole3

Social Security Benefit Worksheets 2021

Don t Be Suprised By Social Security Taxes Issuu

How To Withhold Taxes On Social Security Benefits YouTube

Is Federal Pension Taxed Government Deal Funding

Is Federal Pension Taxed Government Deal Funding

Will Social Security Be Around When I Retire Monarch Money

How Much Your Social Security Benefits Will Be If You Make 30 000

Foreign Social Security Taxable In Us TaxableSocialSecurity

What If You Paid Too Much Social Security Tax - Key Takeaways Depending on your income you might pay income tax on part of your Social Security income For 2023 couples filing jointly with combined