What Income Is Taxable In New Jersey You must use the New Jersey Tax Rate Schedules if your New Jersey taxable income is 100 000 or more Use the correct schedule for your filing status Tax Rate for Nonresident Composite Return Form NJ 1080C

If you make 70 000 a year living in New Jersey you will be taxed 9 981 Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate Gross Income Tax is levied on gross income earned or received by New Jersey resident and nonresident individuals estates and trusts Rate New Jersey has a graduated Income Tax rate which means it imposes a higher tax rate the higher the income See Tax Rate Tables to calculate your tax Filing Threshold

What Income Is Taxable In New Jersey

What Income Is Taxable In New Jersey

http://blog.hubcfo.com/wp-content/uploads/2015/04/What-Income-is-Taxable-1038x576.png

What Counts As Taxable And Non Taxable Income For 2023 The Official

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

Is Repair Labor Taxable In New Jersey Best Reviews

http://155.138.174.80/wp-content/uploads/2020/04/Is-Repair-Labor-Taxable-In-New-Jersey.jpg

Income tax 1 4 percent to 10 75 percent There are seven tax brackets for single filers in New Jersey eight for joint filers ranging from 1 4 percent to 10 75 percent Property tax 2 23 percent of a home s assessed value average Find out how much you ll pay in New Jersey state income taxes given your annual income Customize using your filing status deductions exemptions and more

New Jersey personal income tax rates Table Single and separate filers in New Jersey have seven tax rates while joint filers have eight On average approximately 20 to 40 of your paycheck in New Jersey will go towards taxes Updated on Jul 06 2024 Free tool to calculate your hourly and salary income after federal state and local taxes in New Jersey

Download What Income Is Taxable In New Jersey

More picture related to What Income Is Taxable In New Jersey

What Retirement Income Is Taxable In Nj Retire Gen Z

https://retiregenz.com/wp-content/uploads/2023/05/what-retirement-income-is-taxable-in-nj-NF5C.jpg

Is Labor Taxable In New Jersey Best Reviews

http://155.138.174.80/wp-content/uploads/2020/04/Is-Labor-Taxable-In-New-Jersey-780x470.jpg

Taxable Vs Nontaxable Income Dalby Wendland Co P C

https://dalbycpa.com/wp-content/uploads/2016/03/taxable_nontaxable_income.jpg

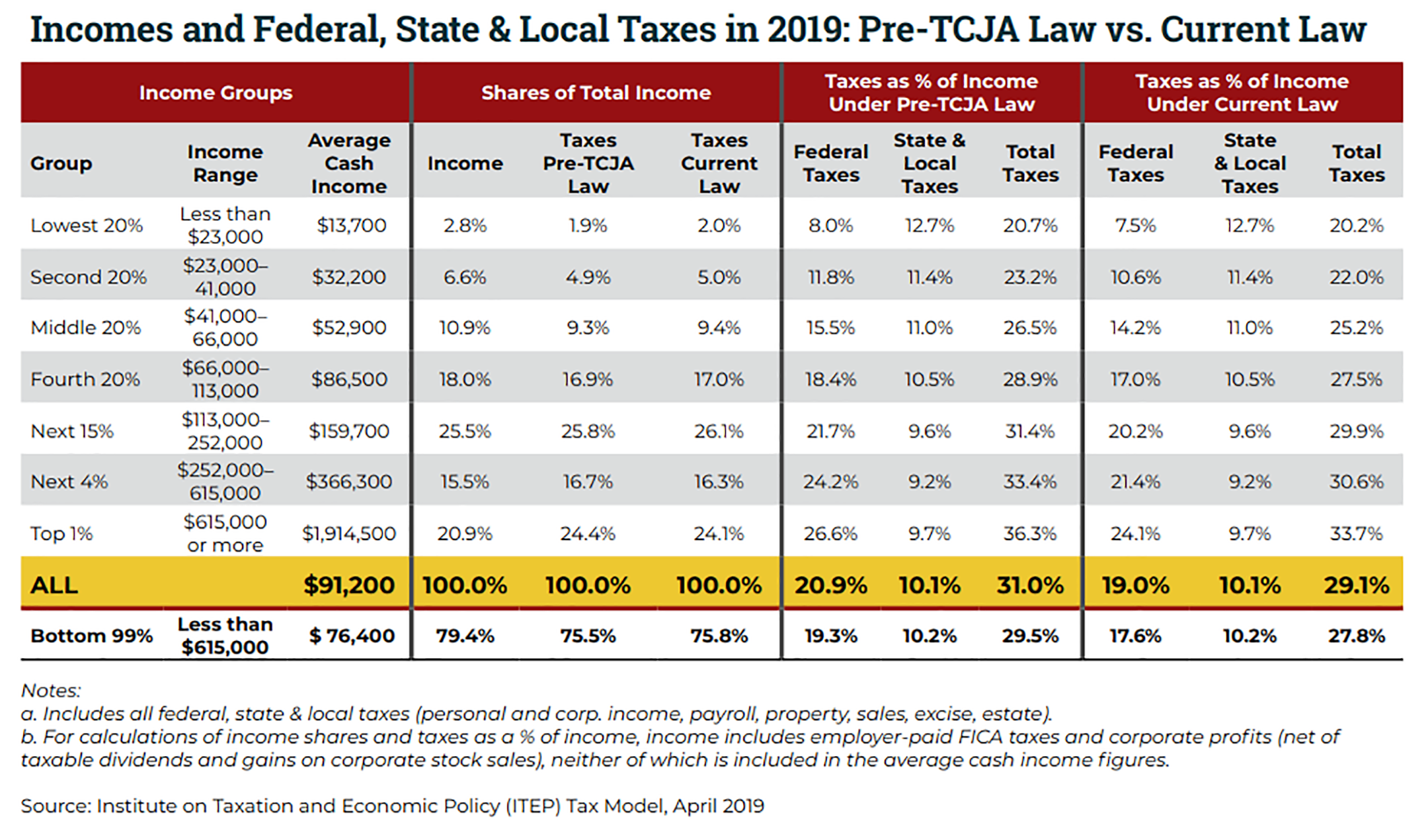

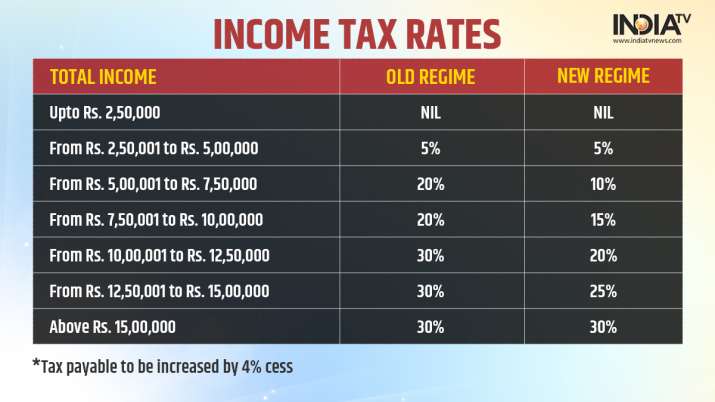

The Income tax rates and personal allowances in New Jersey are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables below include the tax rates thresholds and allowances included in New Jersey state tax rates and rules for income sales property fuel cigarette and other taxes that impact residents

New Jersey s 2024 income tax ranges from 1 4 to 10 75 This page has the latest New Jersey brackets and tax rates plus a New Jersey income tax calculator Income tax tables and other tax information is sourced from the New Jersey Division of Revenue What is NJ state tax NJ state tax is a tax levied by the state on your income earned within the state or as a resident of NJ State income taxes which vary by state are a percentage of money that you pay to the state government based on the income you make at your job

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

https://i.postimg.cc/bN09RcMs/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

https://www.nj.gov › treasury › taxation › taxtables.shtml

You must use the New Jersey Tax Rate Schedules if your New Jersey taxable income is 100 000 or more Use the correct schedule for your filing status Tax Rate for Nonresident Composite Return Form NJ 1080C

https://www.forbes.com › ... › new-jersey

If you make 70 000 a year living in New Jersey you will be taxed 9 981 Your average tax rate is 10 94 and your marginal tax rate is 22 This marginal tax rate means that your immediate

What is taxable income Financial Wellness Starts Here

What Is Taxable Income Explanation Importance Calculation Bizness

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

Nys Withholding Tax Forms 2022 WithholdingForm

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Understanding What Is Taxable Income Definition Track And Receive

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Maximize Your Paycheck Understanding FICA Tax In 2023

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

What Retirement Income Is Taxable In Nj Retire Gen Z

What Income Is Taxable In New Jersey - Income tax 1 4 percent to 10 75 percent There are seven tax brackets for single filers in New Jersey eight for joint filers ranging from 1 4 percent to 10 75 percent Property tax 2 23 percent of a home s assessed value average