What Is 100 Property Tax Exemption In California Taxpayers Rights Advocate The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the California and U S average Basic The basic exemption also referred to as the 100 000 exemption is available to all qualifying claimants The exemption amount is compounded annually by an inflation

What Is 100 Property Tax Exemption In California

What Is 100 Property Tax Exemption In California

https://vaclaimsinsider.com/wp-content/uploads/2021/05/11-States-With-Full-Property-Tax-Exemption-for-100-Disabled-Veterans-1024x576.jpg

Property Tax Exemption

https://cityofriverrouge.com/wp-content/uploads/2021/02/0606_002-scaled.jpg

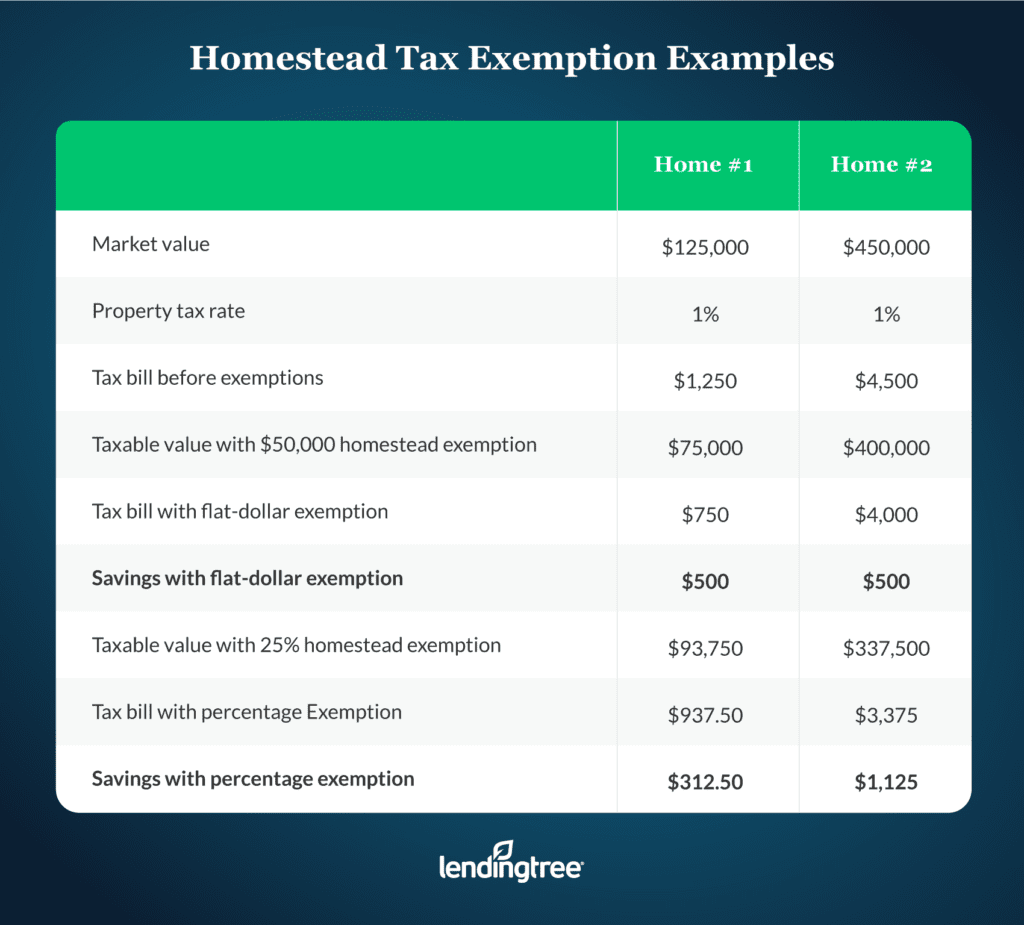

What Is A Homestead Exemption And How Does It Work LendingTree

https://www.lendingtree.com/content/uploads/2020/12/Homestead-Tax-Exemption-Examples-1024x925.png

Beyond reducing the taxable value of your home California allows for exemptions from property taxes if you meet certain requirements Unlike most states which have Exemptions The following is provided as a resource to list types of property tax exemptions and general qualifying factors of each exemption however it is not possible to address

To receive 100 of the exemption 7 000 an owner must file by February 15 If the form is filed after February 15 but before December 10 an owner will receive 80 of the exemption 5 600 for There is a basic 100 000 exemption or a low income less than 52 470 150 000 exemption available to a disabled veteran who because of an injury incurred in military

Download What Is 100 Property Tax Exemption In California

More picture related to What Is 100 Property Tax Exemption In California

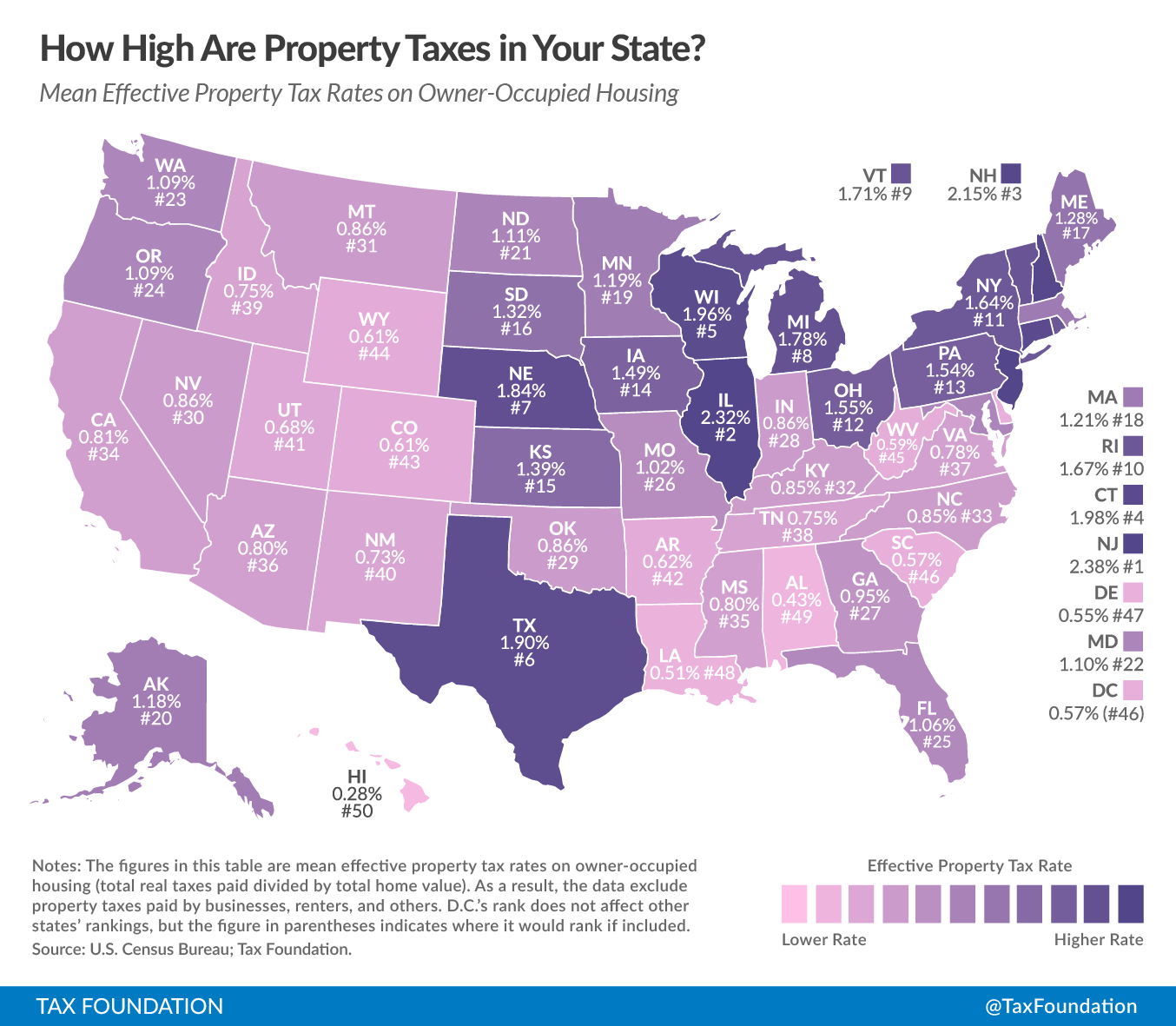

Real Estate Property Tax By State

https://i.pinimg.com/originals/31/5d/12/315d121c14c65a6adce36e7afcc72bb6.png

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/100/589/100589137/large.png

Tax Exempt Form Texas Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/16/915/16915261/large.png

Veterans Property Tax Exemption California provides a 4 000 real property e g a home or personal property e g a boat exemption for honorably discharged veterans or the Jan 11 2023 Granted that s not a huge amount of money per household with property tax rates generally set at 1 of assessed value the 7 000 exemption

Veterans who are rated at 100 disability by the VA due to a service connected disability are eligible for this California disabled Veteran s property tax Property Tax Exemptions That Can Save You Money California law provides a property tax exemption for the primary residence of a disabled veteran or an unmarried spouse of a

Property Tax Exemption

https://cityofriverrouge.com/wp-content/uploads/2021/02/0606_001-scaled.jpg

York County Sc Residential Tax Forms Homestead Exemption CountyForms

https://i0.wp.com/www.countyforms.com/wp-content/uploads/2022/10/sc-application-for-homestead-exemption-fill-and-sign-printable.png

https://www.boe.ca.gov/proptaxes/dv_exemption.htm

Taxpayers Rights Advocate The Disabled Veterans Exemption reduces the property tax liability on the principal place of residence of qualified veterans who due to a service

https://smartasset.com/taxes/california …

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the California and U S average

2016 Form VA DoT ST 11 Fill Online Printable Fillable Blank PdfFiller

Property Tax Exemption

Tax Exempt Letter To Vendors Fill Out Sign Online DocHub

What Are The Tax Benefits On Personal Loans Web ITB Group News

California Tax Exempt Form 2020 2022 Fill And Sign Printable Template

Texas Has Several Exemptions From Local Property Tax For Which

Texas Has Several Exemptions From Local Property Tax For Which

How To Write A Waiver Letter For Tax Exemption Printable Form Vrogue

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

The 10 Worst States For Property Taxes The Fiscal Times

What Is 100 Property Tax Exemption In California - To receive 100 of the exemption 7 000 an owner must file by February 15 If the form is filed after February 15 but before December 10 an owner will receive 80 of the exemption 5 600 for