What Is 80ccd 2 Contribution Limit What is Section 80CCD 1 and 80CCD 2 Section 80CCD 1 and Section 80CCD 2 help individuals claim deductions on contributions to their retirement plans and permit employers to avail deductions for contributions made on

To stand eligible for tax deduction under the NPS Tier 1 Account you are required to contribute a minimum of Rs 6 000 per annum or Rs 500 per month To stand eligible for tax deduction The maximum limit of deduction available under this section is Rs 2 lakhs and this includes an additional deduction of Rs 50 000 which is available under sub section 80CCD 1B

What Is 80ccd 2 Contribution Limit

What Is 80ccd 2 Contribution Limit

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Understanding Section 80CCD 2 Benefits Of Additional NPS

https://margcompusoft.com/m/wp-content/uploads/2023/02/11-2-1024x576.jpg

80CCD 2 Nps Contribution Deduction In Income Tax

https://i.ytimg.com/vi/1enpjPZrdYo/maxresdefault.jpg

Current Limit Under sub section 2 of Section 80CCD contributions by employers other than the Central or State Government are eligible for a deduction of up to 10 of the 80CCD 2 relates to the deduction of employer s contribution to New Pension Scheme NPS This contribution is firstly added in salary income and later allowed as

Q What is the maximum limit for the contribution that can be made by an employer under Section 80CCD 2 A As per Section 80CCD 2 an employer can contribute up to 10 of the employee s salary basic salary plus A salaried person is eligible to claim the following deduction under Section 80CCD 2 a maximum contribution from the Central Government or State Government to NPS of

Download What Is 80ccd 2 Contribution Limit

More picture related to What Is 80ccd 2 Contribution Limit

Section 80CCD 2 Contribution Deduction shorts

https://i.ytimg.com/vi/k0gNKUWM85o/maxresdefault.jpg

80CCD 1 80CCD 2 80CCD 1B NPS CONTRIBUTION NEW PENSION SCHEME

https://i.ytimg.com/vi/LO7AMxTrhyw/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyBHKCowDw==&rs=AOn4CLDfRFVXwN4NeqbGesfWDbGy3ZAZbQ

Irs 401k Contribution Limit 2024 Flor Juditha

https://www.advantaira.com/wp-content/uploads/2023/11/2024-contribution-limits.png

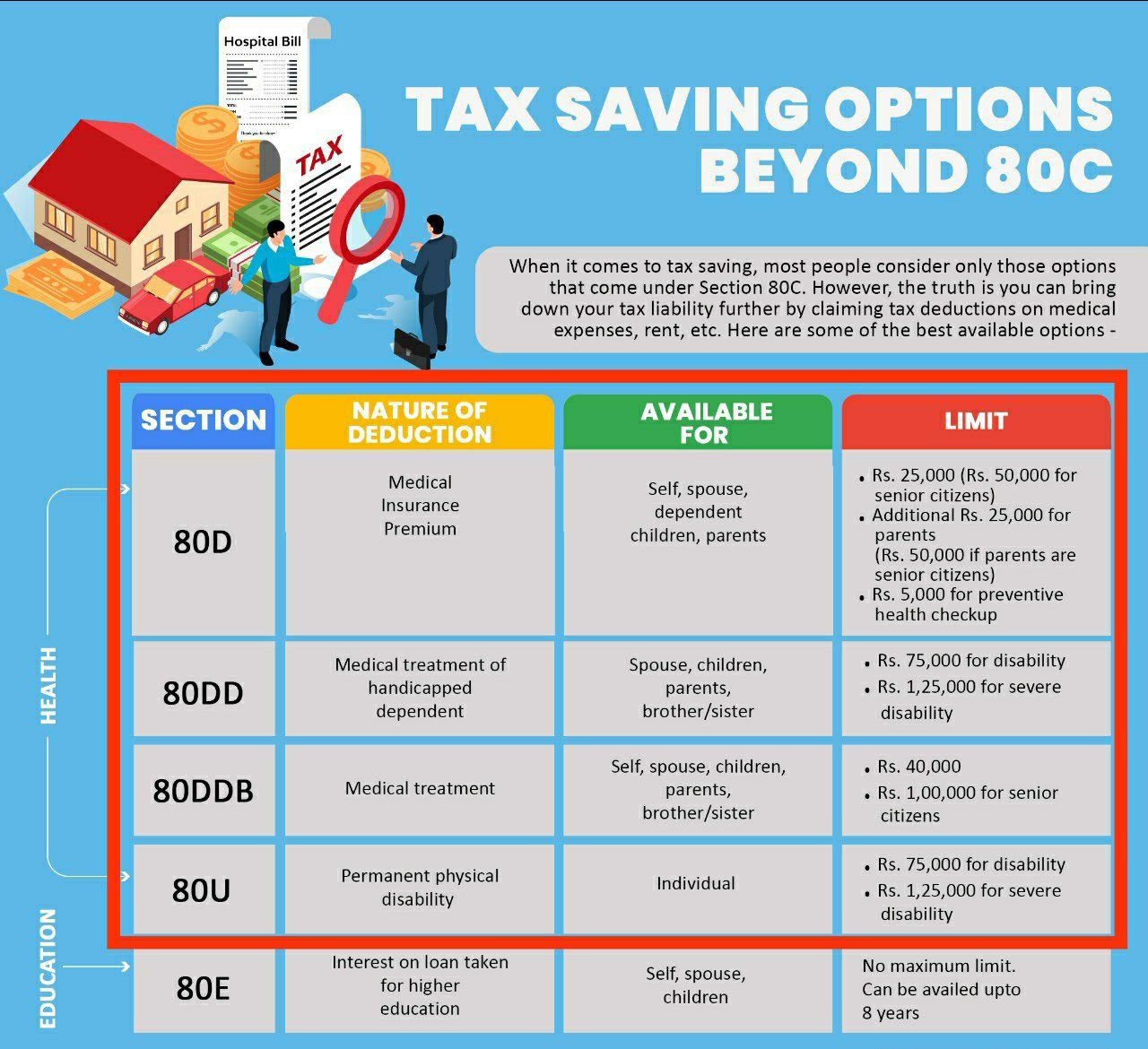

Section 80CCD offers income tax deductions on contributions to the National Pension Scheme NPS and the Atal Pension Yojana APY The section covers NPS The deduction is allowed for contributions made by an employee employer or voluntary self contribution Overall limit of deduction allowed in section 80C is Rs 1 5 lakh plus an additional deduction of Rs 50 000 u s

Limit on contribution There is no specific upper limit on the employer s contribution eligible for deduction under Section 80CCD 2 However it is crucial to note that Section 80 CCD along with Section 80CCD 1B allows an individual to claim a maximum tax deduction of up to Rs 2 lakhs per financial year The major sub sections of Section 80CCD

Understanding Section 80CCD 2 Limit A Comprehensive Guide Marg ERP Blog

https://margcompusoft.com/m/wp-content/uploads/2023/02/12-2-1024x576.jpg

Section 80CCD 2 Employer s Contribution To NPS NPS In New Tax

https://i.ytimg.com/vi/EpqXDIqNGX0/maxresdefault.jpg

https://www.kotaklife.com/insurance-gui…

What is Section 80CCD 1 and 80CCD 2 Section 80CCD 1 and Section 80CCD 2 help individuals claim deductions on contributions to their retirement plans and permit employers to avail deductions for contributions made on

https://groww.in/p/tax/section-80ccd

To stand eligible for tax deduction under the NPS Tier 1 Account you are required to contribute a minimum of Rs 6 000 per annum or Rs 500 per month To stand eligible for tax deduction

Section 80CCD National Pension Scheme Deductions FinCalC Blog

Understanding Section 80CCD 2 Limit A Comprehensive Guide Marg ERP Blog

What Is Dcps In Salary Deduction Login Pages Info

Section 80CCD Deductions For NPS And APY Contributions

Hsa Limits 2024 Dorris Courtnay

National Pension System Trust nps trust Twitter

National Pension System Trust nps trust Twitter

Income Tax Rates Slabs Under The New Tax Regime EconomicTimes

Deductions U S 80C Under Schedule VI Of Income Tax IFCCL

What Is The Roth Ira Limit For 2024 Claire Joann

What Is 80ccd 2 Contribution Limit - Q What is the maximum limit for the contribution that can be made by an employer under Section 80CCD 2 A As per Section 80CCD 2 an employer can contribute up to 10 of the employee s salary basic salary plus