What Is 80dd Deduction In Income Tax Section 80DD and Section 80U provide deductions for expenses incurred for yourself and your dependent To claim deductions you have to make sure that you have filed Form 10 IA Here is our guide to understand what Form 10 IA is and the steps to file it

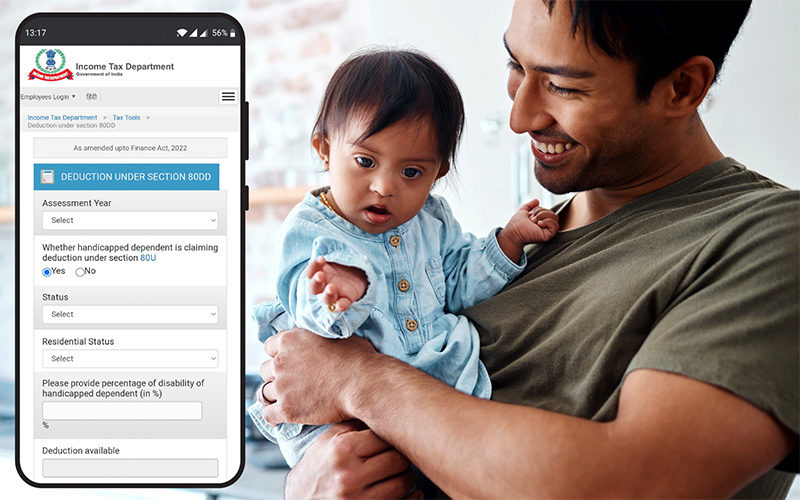

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans Under Section 80DD of the Income Tax Act taxpayers are entitled to a deduction for the expenses incurred on the medical treatment rehabilitation training or deposit in specified schemes for the maintenance of a dependent with a disability

What Is 80dd Deduction In Income Tax

What Is 80dd Deduction In Income Tax

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

Section 80DD of the Income Tax Act 1961 provides for a tax deduction to an assessee or a taxpayer Such a tax deduction is against any sum the taxpayer incurs for the medical treatment of a person suffering from a disability or a severe disability Section 80DD of the Income Tax Act allows flat deductions irrespective of the amount of expenditure incurred during the year but it should not be nil However the amount of deduction depends upon the severity of the disability

What Exactly is Section 80DD of the Income Tax Act Section 80DD of the Income Tax Act allows residents whether individuals or HUFs to claim a deduction for a dependent who is differently abled and completely reliant on Section 80DDB permits a tax deduction for expenses related to the treatment of certain diseases for oneself one s spouse dependent children dependent parents and dependent siblings The diseases eligible for this deduction are outlined in Rule 11DD of the income tax regulations

Download What Is 80dd Deduction In Income Tax

More picture related to What Is 80dd Deduction In Income Tax

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

Section 80DD of Income Tax Act An individual can claim for the deduction if he she incurs expenditure on medical treatment or rehabilitation of a differently abled dependent relative or Section 80DD allows for tax deductions for anyone who pays for a disabled dependent Learn its meaning eligibility benefits limitations etc Section 80DD Deduction of the income tax offers a flat tax deduction irrespective of the amount of expenditure to the caretaker of a disabled dependent

All Indian residents can claim tax deductions under Section 80DD of the Income Tax Act 1961 on the medical treatment of their dependent and disabled family member To claim an individual must submit medical certificates and other essential documents as mentioned under the provision Sections 80DD of the Income Tax Act covers deduction for the medical expenditure incurred for self or for a dependent person A dependent person can be spouse children parents brothers and

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

https://i.ytimg.com/vi/-c0xDC6uha0/maxresdefault.jpg

What Is A Tax Deduction

http://taxreceipts.com/wp-content/uploads/2012/03/what-is-a-deduction.jpg

https://cleartax.in/s/form-10ia

Section 80DD and Section 80U provide deductions for expenses incurred for yourself and your dependent To claim deductions you have to make sure that you have filed Form 10 IA Here is our guide to understand what Form 10 IA is and the steps to file it

https://taxguru.in/income-tax/deduction-section...

Deduction under section 80DD of the Income Tax Act covers the amount paid towards the medical expenditure of a dependant with a specific disability It also covers the amount of insurance premium paid towards specific insurance plans

Income Tax Deductions For The FY 2019 20 ComparePolicy

80DD Deduction Income Tax I 80DD Deduction For Ay 2021 22 YouTube

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

80D DEDUCTION FOR AY2020 21 HEALTH INSURANCE DEDUCTION 80D INCOME TAX

Tax Deduction Under Section 80DD Of Income Tax Eligibility Criteria

Standard Deduction 2020 Self Employed Standard Deduction 2021

Standard Deduction 2020 Self Employed Standard Deduction 2021

Income Tax Sec 80DD Deduction In Relation To Disable Autism Etc

Claim Deduction Under Section 80DD Learn By Quicko

Preventive Check Up 80d Wkcn

What Is 80dd Deduction In Income Tax - Section 80DD of the Income Tax Act allows flat deductions irrespective of the amount of expenditure incurred during the year but it should not be nil However the amount of deduction depends upon the severity of the disability