What Is A Business Payroll Tax Refund The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax

Is your small business looking for ways to reduce its tax liability Learn about 13 payroll tax credits and how to claim them when filing your federal tax returns To enhance cash flow so that businesses can better maintain operations and payroll employers and self employed individuals can defer payment of the employer share of

What Is A Business Payroll Tax Refund

What Is A Business Payroll Tax Refund

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Payroll Tax Refunds In 2023 See If Your Business Qualifies

https://snacknation.com/wp-content/uploads/2022/12/Payroll-Tax-Refund-e1670263549218.png

What Is Payroll Tax Withholding

https://irp-cdn.multiscreensite.com/cda2d8d1/dms3rep/multi/What+is+Payroll+Tax+Withholding.jpg

The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax Businesses that paid employees under these programs during the period from April 1 2020 through December 31 2020 can take the tax credit against their payroll taxes If

Here are answers to some frequently asked questions about the employee retention tax credit ERTC and how it may apply to you Q What exactly is the retention credit A The ERC is a refundable payroll tax credit that can be as high as 21 000 per employee in 2021 The deadline for applying for the 2020 ERC has passed Who qualifies for the

Download What Is A Business Payroll Tax Refund

More picture related to What Is A Business Payroll Tax Refund

What Is A Business Plan Non Disclosure Agreement Sprintlaw

https://sprintlaw.com.au/wp-content/uploads/2022/05/diggity-marketing-s8HyIEe7lF0-unsplash.jpg

Preserve Your Right To A Payroll Tax Refund Texas Employer Handbook

https://www.texasemployerhandbook.com/wp-content/uploads/sites/322/2014/01/Money.jpg

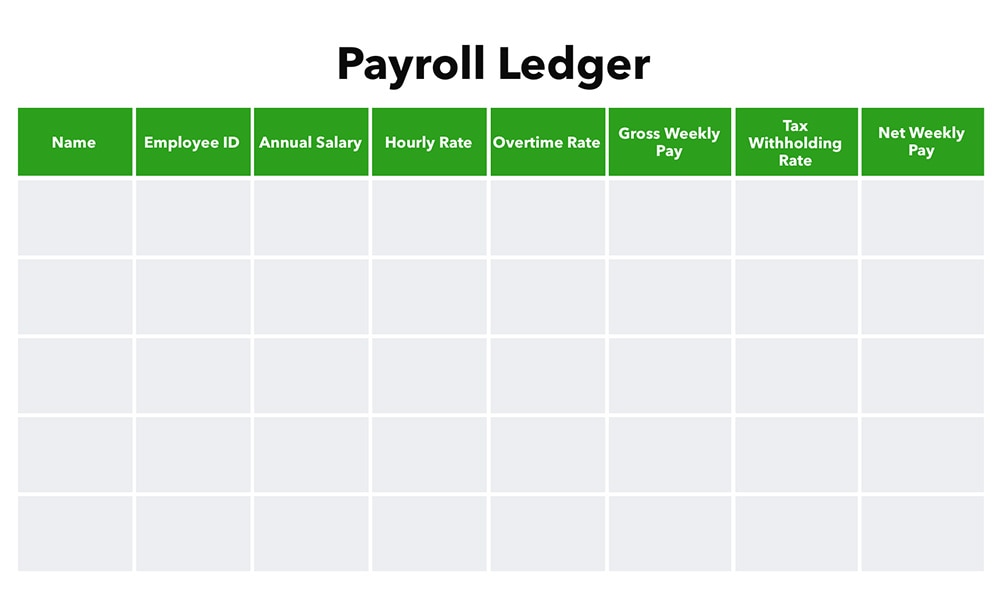

Quickbooks Report Employee Gross Wages By Pay Period Pay Period

https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/payroll-ledger-template-photo-us.jpg

What it is Tax credits for businesses that keep employees on payroll How it works For 2020 the Employee Retention Credit ERC is a tax credit against certain payroll taxes WASHINGTON The Treasury Department and the Internal Revenue Service today launched the Employee Retention Credit designed to encourage businesses to keep

A part of the 2020 CARES Act the Employee Retention Credit ERC also referred to as the Employee Retention Tax Credit ERTC is a refundable payroll tax credit designed OVERVIEW If you re self employed payroll tax relief and other parts of the CARES Act will have an impact on your 2020 taxes TABLE OF CONTENTS Payroll tax relief for the

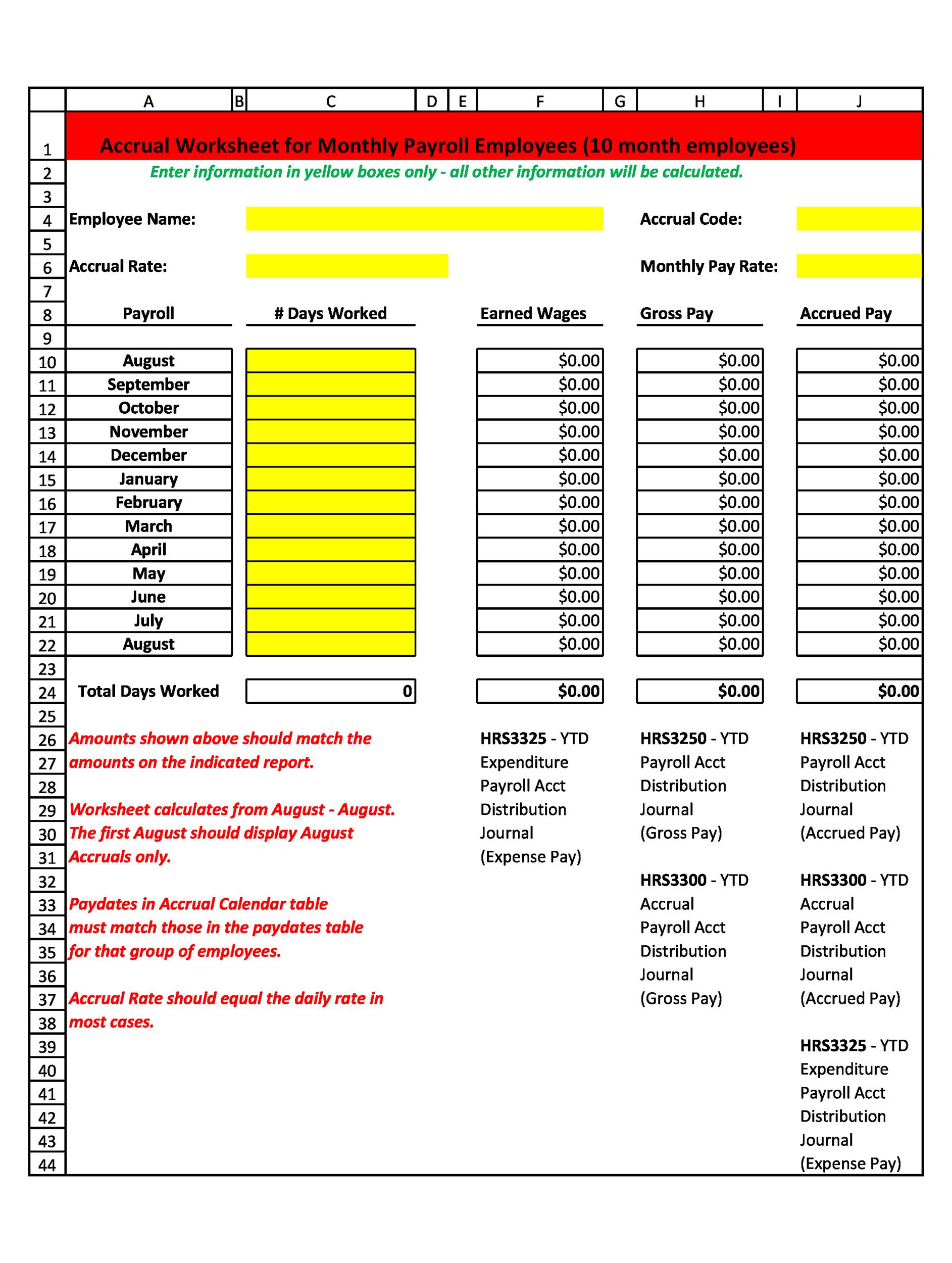

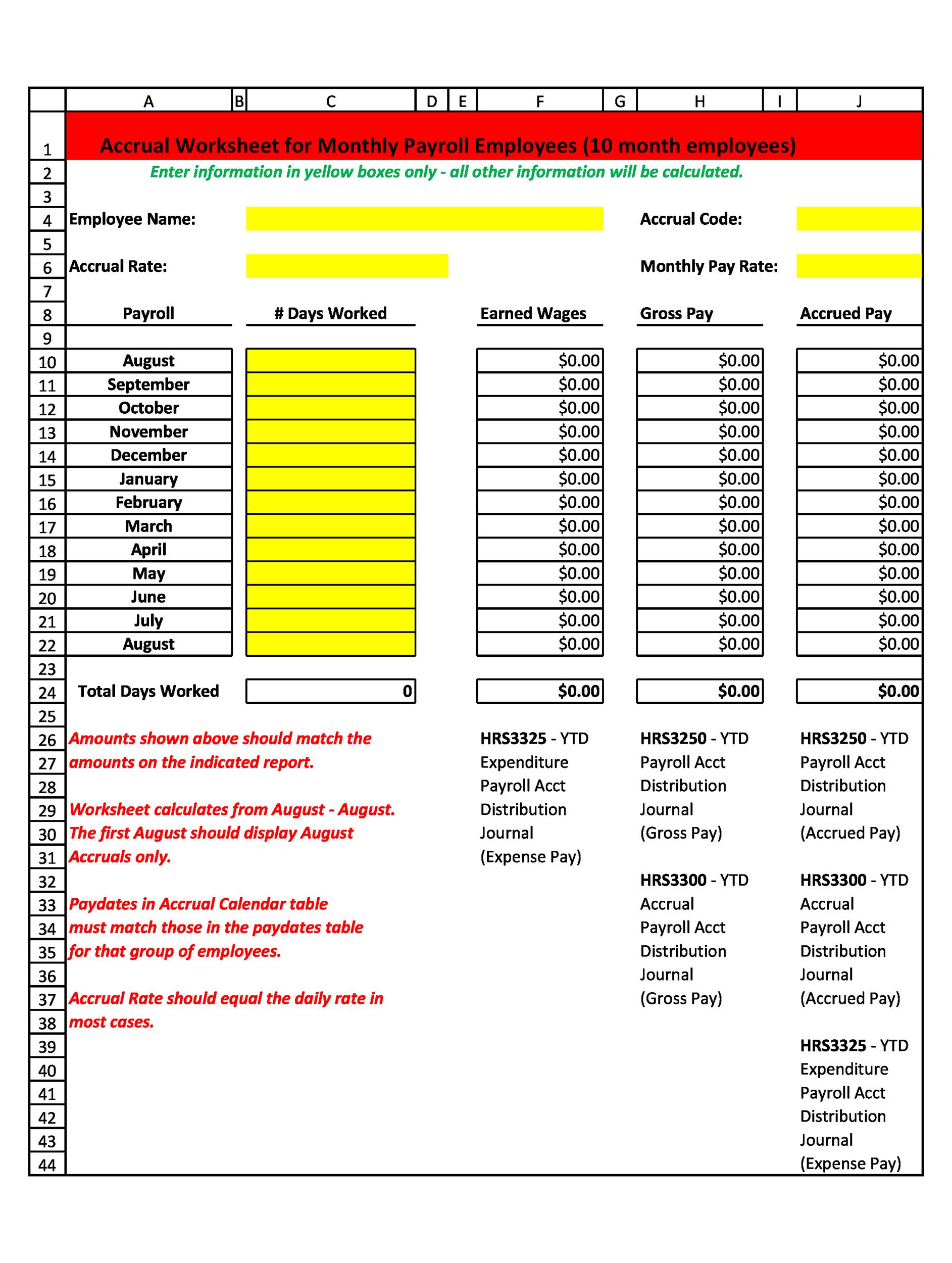

Payroll Calculator Template Microsoft PDF Template

https://templatelab.com/wp-content/uploads/2018/03/payroll-template-25.jpg

How Long Should I Keep My Payroll Records Compass Accounting

https://www.compass-cpa.com/wp-content/uploads/2018/06/Payroll-records.jpeg

https://www.irs.gov/coronavirus/employee-retention-credit

The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax

https://www.netsuite.com/portal/resource/articles/...

Is your small business looking for ways to reduce its tax liability Learn about 13 payroll tax credits and how to claim them when filing your federal tax returns

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Payroll Calculator Template Microsoft PDF Template

Payroll Report Definition How To Free Sample Templates Hourly Inc

What You Don t Know About Payroll Taxes Can Hurt You Taskforce HR

Google Sheets Payroll Template Printable Word Searches

What Is A Secured Credit Card

What Is A Secured Credit Card

What Are Payroll Taxes Payroll Taxes Payroll Bookkeeping Business

Business Taxes

Letter Of Application Letter Of Request For Refund Template Images

What Is A Business Payroll Tax Refund - The ERC is a refundable payroll tax credit that can be as high as 21 000 per employee in 2021 The deadline for applying for the 2020 ERC has passed Who qualifies for the