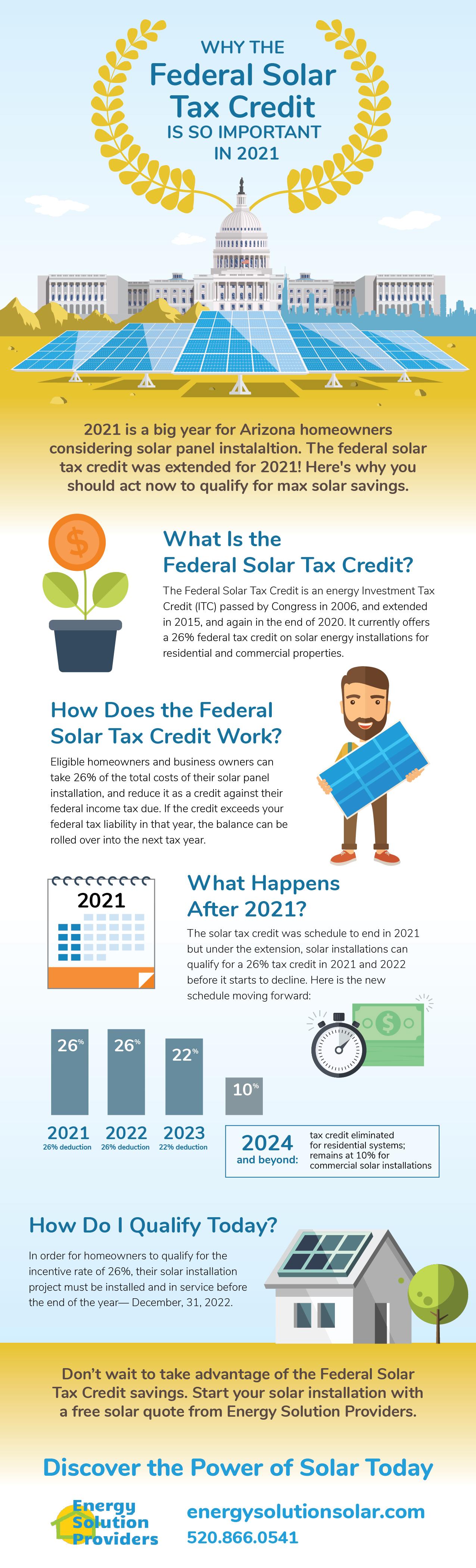

What Is A Federal Tax Credit For Energy Efficiency Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades The following energy efficiency requirements must be met to qualify for the Energy Efficient Home Improvement Credit Exterior doors must meet applicable Energy Star requirements Windows and skylights must meet Energy Star most efficient certification requirements Insulation materials or systems and air sealing materials or

What Is A Federal Tax Credit For Energy Efficiency

What Is A Federal Tax Credit For Energy Efficiency

https://cdn.carbuzz.com/gallery-images/1600/811000/700/811735.jpg

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

Can I Receive A Federal Tax Credit For Replacing My Windows

https://www.proreplacementwindows.com/wp-content/uploads/2022/02/fed-1030x345.jpg

An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either reduces Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you may be eligible to claim them on your taxes when you file for 2022 Energy Efficient Upgrades That Qualify for Federal Tax

Download What Is A Federal Tax Credit For Energy Efficiency

More picture related to What Is A Federal Tax Credit For Energy Efficiency

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

https://nextenergysolution.com/wp-content/uploads/82527958_l-scaled.jpg

Federal Solar Tax Credit What It Is How To Claim It For 2024

https://www.ecowatch.com/wp-content/uploads/2022/10/Solar-Investment-Tax-Credit-5-1-2.png

The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential Clean Energy Credit provides tax credits for the purchase of qualifying equipment including solar wind geothermal and fuel cell technology The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit amount is 1 200 for home

The IRS today issued frequently asked questions FAQs in Fact Sheet 2024 15 to address the federal income tax treatment of amounts paid for the purchase of energy efficient property and improvements A related IRS release IR 2024 113 April 17 2024 identifies the FAQs revisions as The updated FAQs supersede earlier FAQs Tax Credit Definitions Information updated 2 16 2023 Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which meet strict energy efficiency specifications set by the U S EPA to save you energy and money and help protect the environment

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023

https://www.energystar.gov/about/federal-tax-credits

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades

The Federal Solar Tax Credit Energy Solution Providers Arizona

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Tax Incentives May Be Next For E Bikes

How To Find Tax ID Number TIN Number

Everything You Need To Know The New 2021 Solar Federal Tax Credit

The 30 Solar Tax Credit Has Been Extended Through 2032

The 30 Solar Tax Credit Has Been Extended Through 2032

Tax Credits Save You More Than Deductions Here Are The Best Ones

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

45L New Energy Efficient Home Tax Credit Quality Built

What Is A Federal Tax Credit For Energy Efficiency - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant