What Is A Property Tax Credit In Illinois The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

The Illinois Property Tax Credit is a credit on your individual income Prorated property tax you paid in the year you sold your tax return Form IL 1040 equal to 5 percent of Illinois The property tax credit is available to residents who paid taxes on their main home that was located in Illinois for the time you owned and lived in the home Nonresidents of

What Is A Property Tax Credit In Illinois

What Is A Property Tax Credit In Illinois

https://www.tax.state.ny.us/images/orpts/proptaxbills/upstate-2.jpg

You ll Be Getting A 500 Property Tax Credit In Coming Days The Citizen

https://d3ebobe8l15pwo.cloudfront.net/wp-content/uploads/2017/09/news_stock-art_09-28-17_property-tax-label.jpg

How High Are Property Taxes In Your State American Property Owners

https://propertyownersalliance.org/wp-content/uploads/2020/10/property-taxes-by-state-2020-FV-01-1024x868-1.png

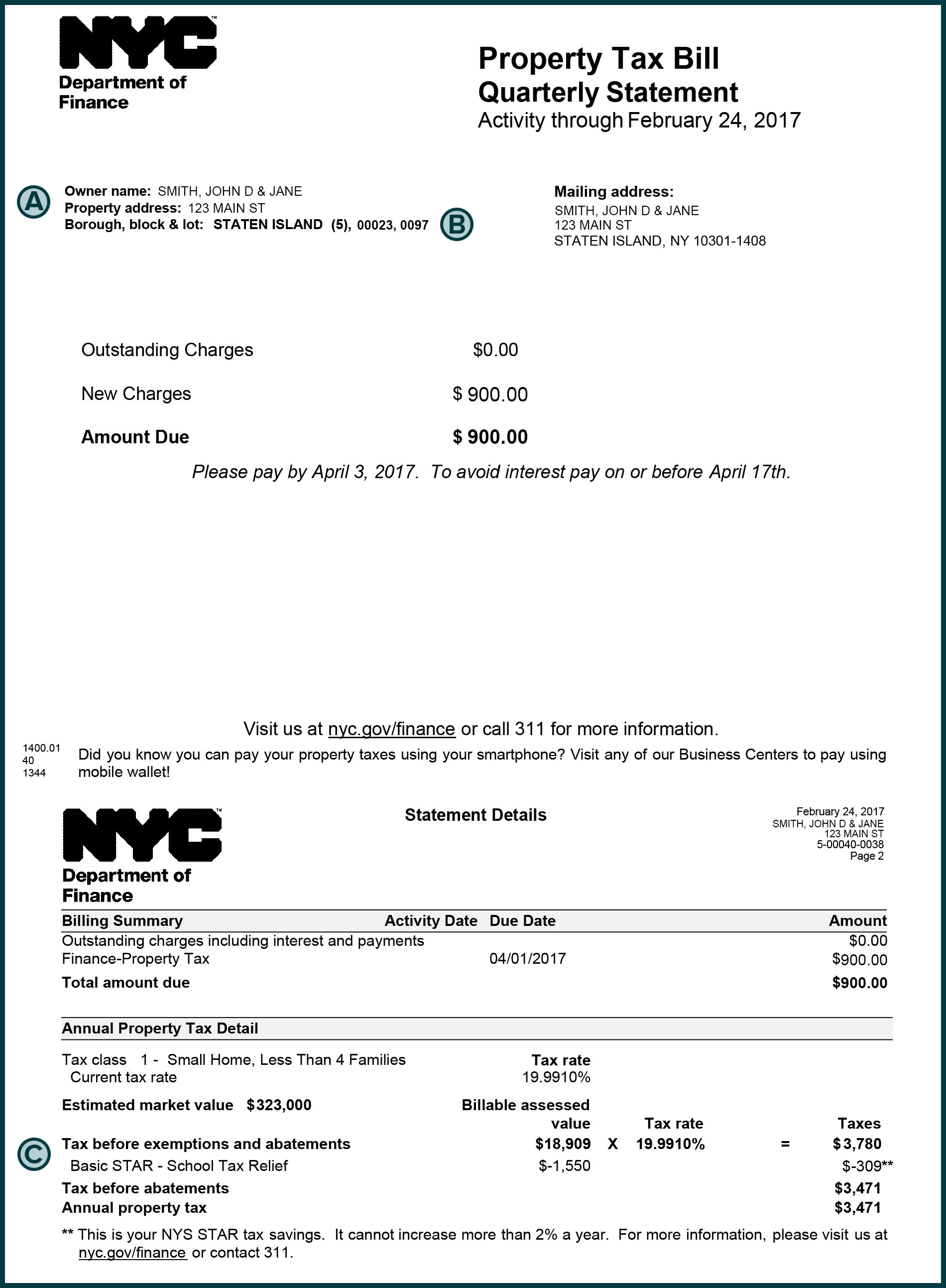

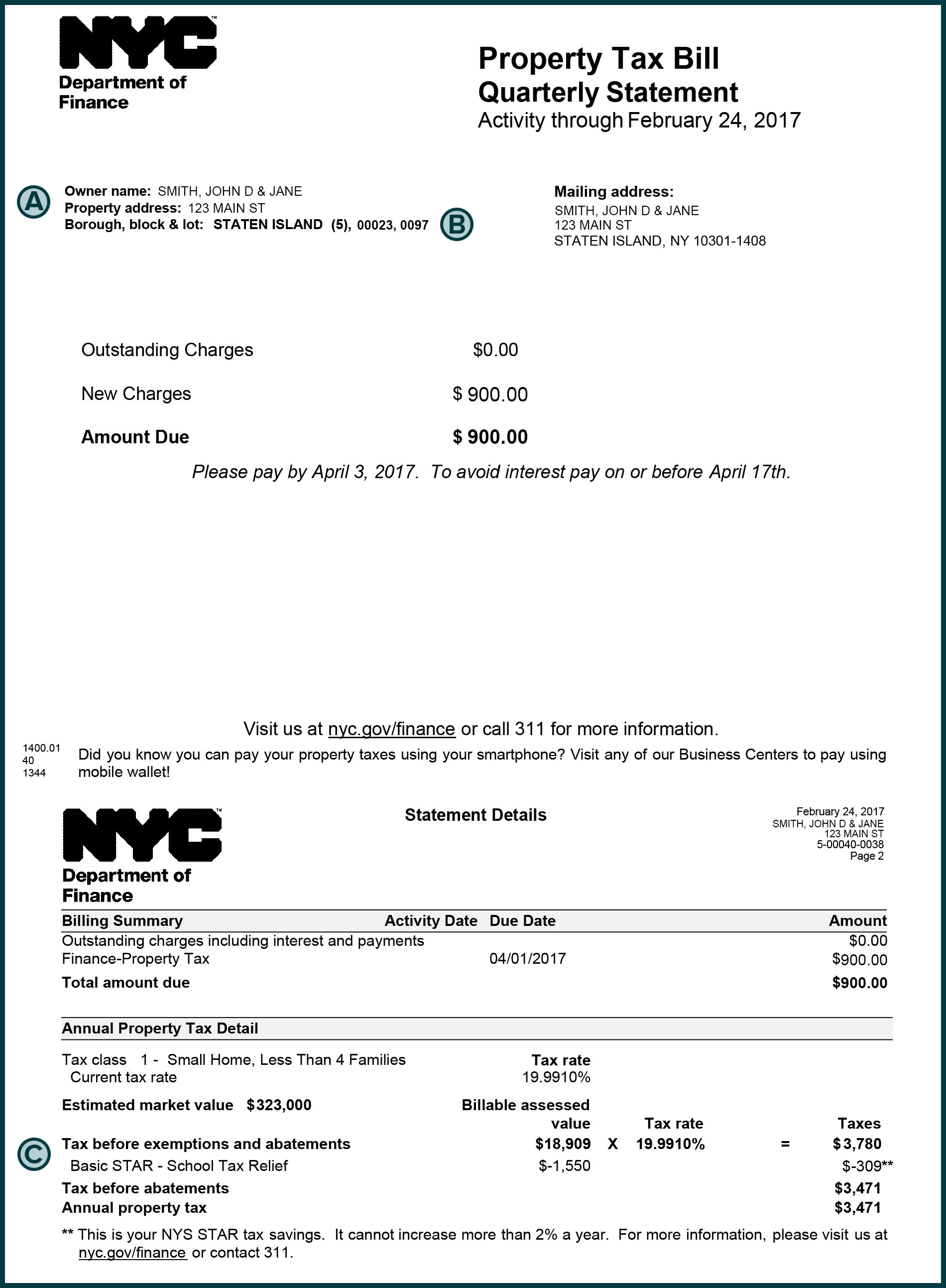

Step 1 Assessments Assessments are a key and often misunderstood part of the property tax process The assess ments estimates of the market value of a property Who Qualifies for the Property Tax Rebate To qualify for the property tax rebate you must be an Illinois resident have paid property taxes in Illinois in 2020

Property taxes are paid one year after they are assessed That means for the bills that are payable in 2023 the homeowner needed to be age 65 by December 31st 2022 or Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To be eligible you must have

Download What Is A Property Tax Credit In Illinois

More picture related to What Is A Property Tax Credit In Illinois

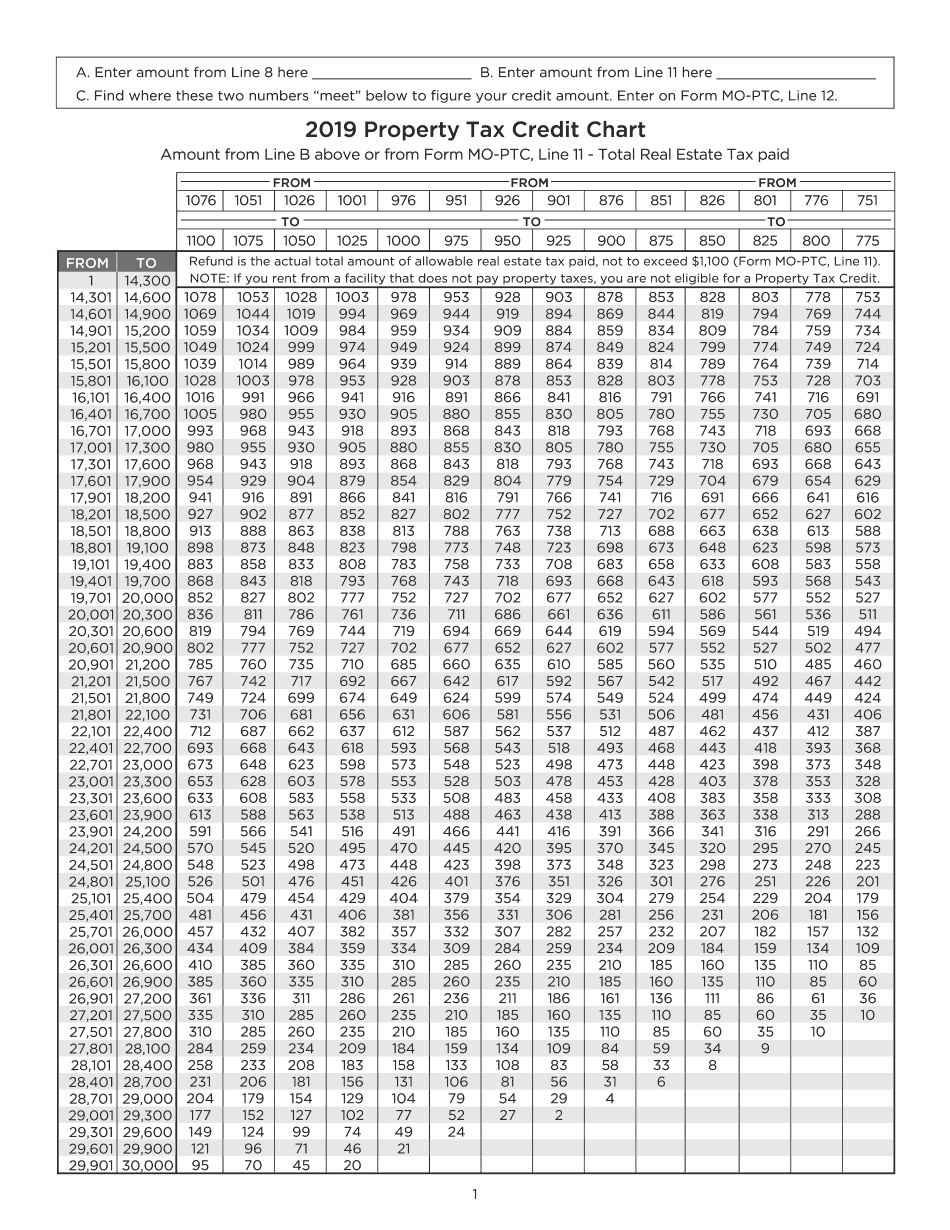

Manage Documents Using Our Editable Form For Property Tax Credit Chart Form

https://www.pdffiller.com/preview/491/866/491866144/big.png

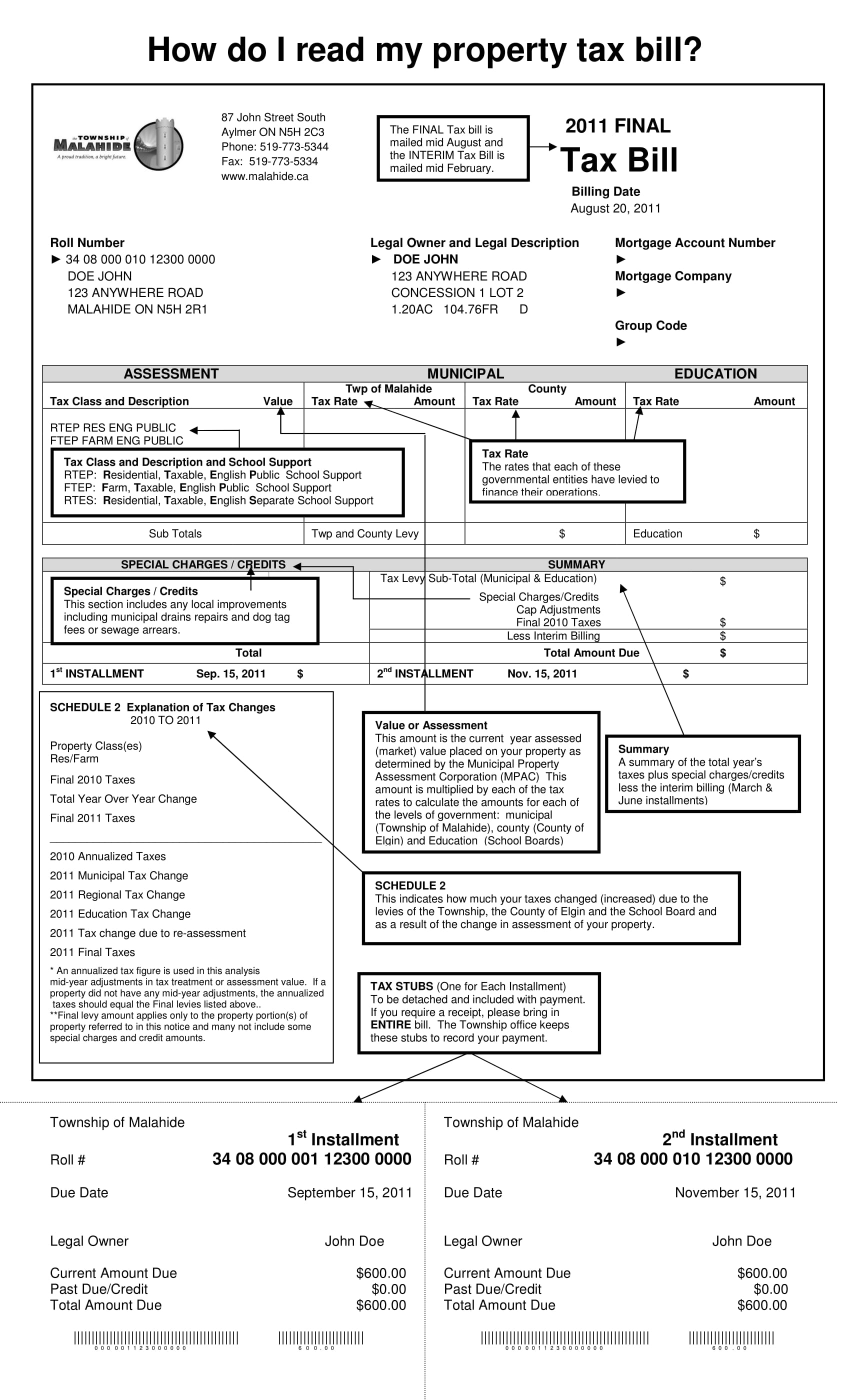

Understanding Your Property Tax Bill Township Of Malahide

https://www.malahide.ca/en/resident-services/resources/Finance/How-do-I-read-my-property-tax-bill-1.jpg

What Is A Property Tax And When Is It Paid

https://life.futuregenerali.in/media/5xebqkkq/property-tax.jpg

Qualified property owners will receive a rebate equal to the property tax credit claimed on their 2021 IL 1040 form with a maximum payment of up to 300 To Fulfilling a promise of offering property tax relief for Illinoisans Gov J B Pritzker Friday signed legislation easing the tax burden for some of the most vulnerable residents including

Illinois offers 11 different property tax exemptions and a deferral option With so many programs to apply for you may have a good chance to qualify for a You may know that the Illinois authorities compute your property tax by multiplying your home s taxable value by the tax rate The taxable value is

Changes To The Homestead Property Tax Credit Program Williams County ND

https://storage.googleapis.com/proudcity/williamscountynd/uploads/2023/05/2023-Homestead-Credit-Program-Changes.jpg

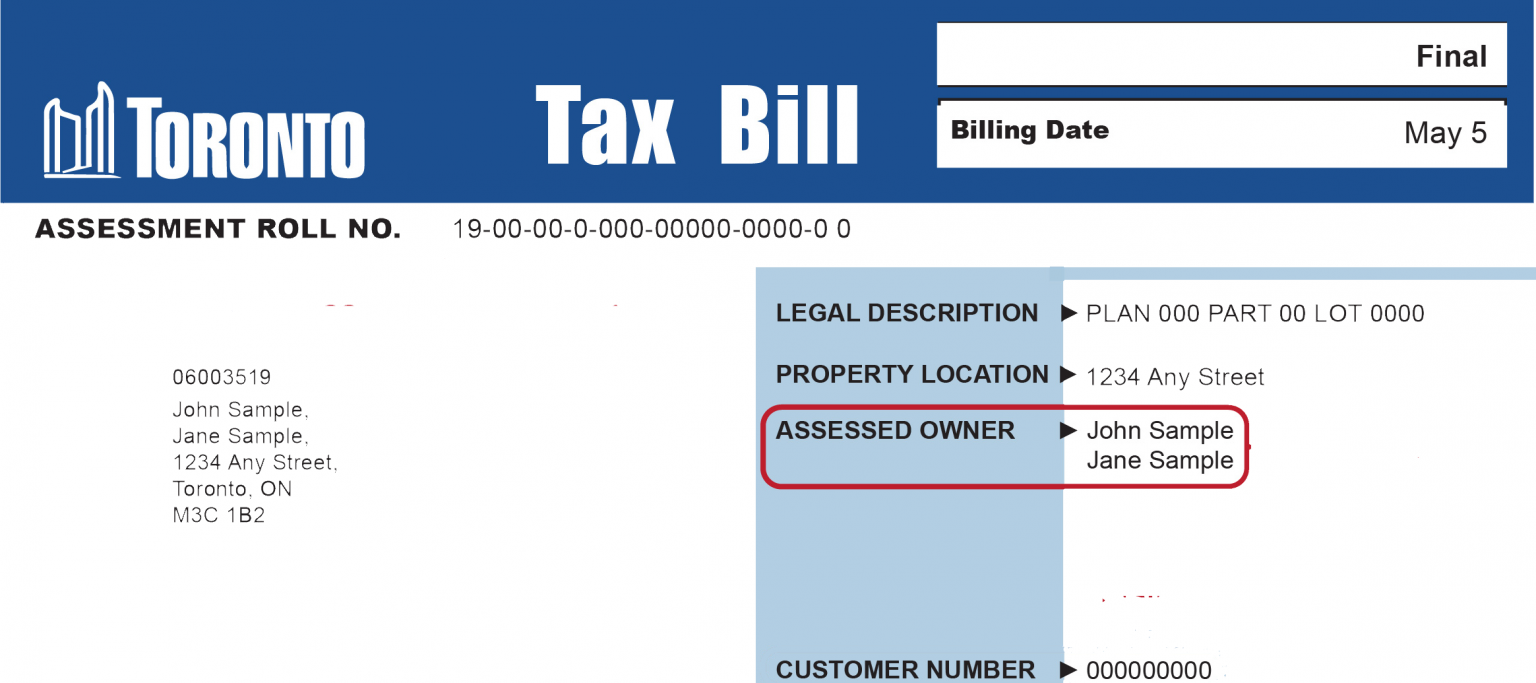

Buying Selling Or Moving City Of Toronto

https://www.toronto.ca/wp-content/uploads/2021/06/8e7f-property-tax-formfull-3.jpg-003-1536x683.png

https://tax.illinois.gov/content/dam/soi/en/web/...

The Illinois Property Tax Credit is a credit on your individual income tax return Form IL 1040 equal to 5 percent of Illinois Property Tax real estate tax you paid on your

https://docslib.org/doc/8565664/publication-108...

The Illinois Property Tax Credit is a credit on your individual income Prorated property tax you paid in the year you sold your tax return Form IL 1040 equal to 5 percent of Illinois

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

Changes To The Homestead Property Tax Credit Program Williams County ND

Illinois With Holding Income Tax Return Wiki Form Fill Out And Sign

Missouri Property Tax Credit Eligibility PRFRTY

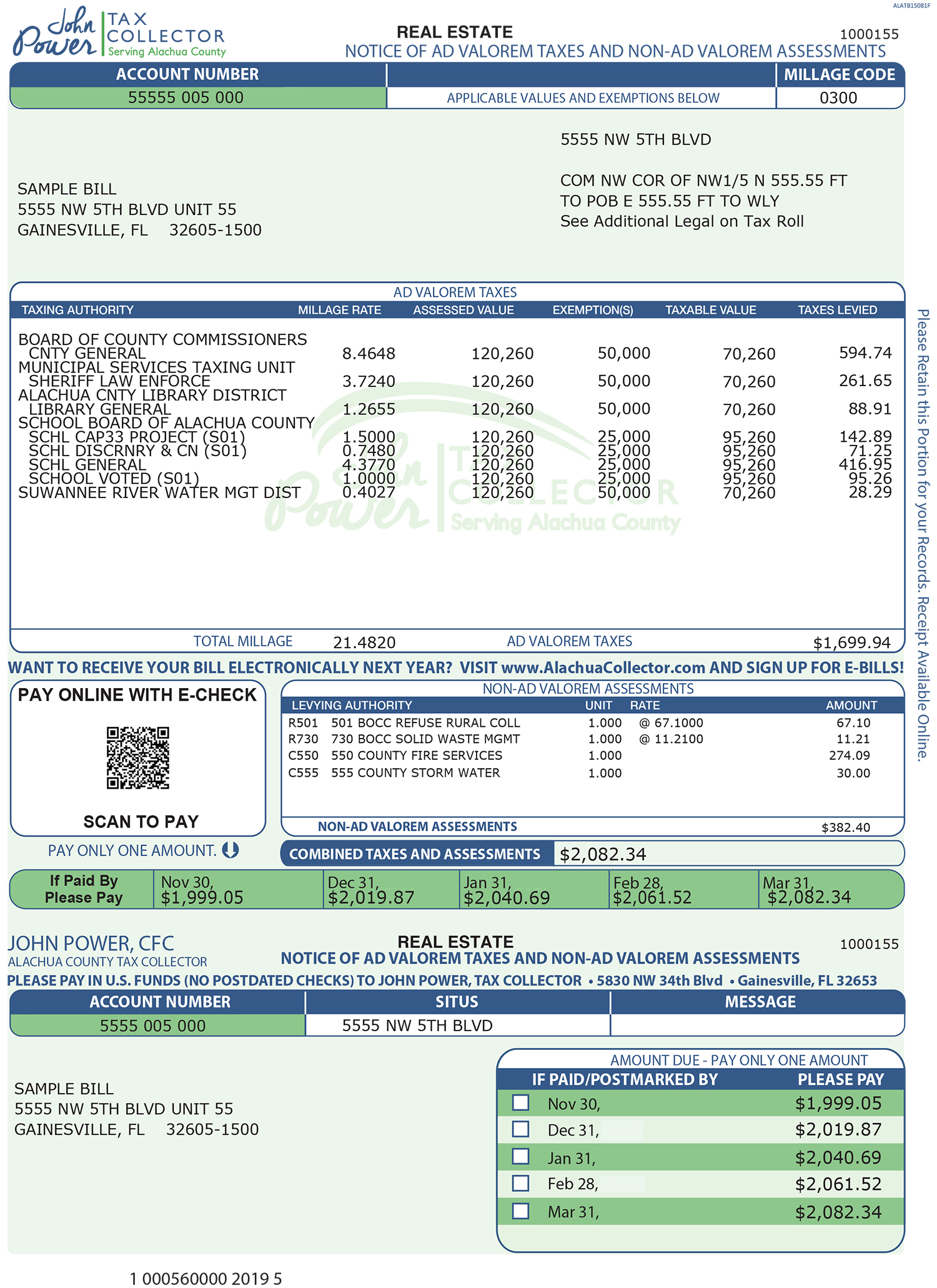

Real Estate And Property Tax Consultation And Appeals Fort Lauderdale

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

Deposit Your Due Property Tax Latest By 31st December 2019 Don T Ignore

MD Leaders Pushing A Property Tax Credit Bill For Developers In

Meaningful Substantive Property Tax Relief In Illinois Is Critical

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/3634692/Estate_20and_20Inheritance_20taxes_0.0.png)

How The Government Taxes Rich Dead People Explained Vox

What Is A Property Tax Credit In Illinois - For qualifying projects rates can be lowered by more than 50 percent for up to 12 years The Class L incentive lowers the property tax rate for individually designated Chicago