What Is A Tax Credit When Buying A House Tax credits apply to the tax owed while tax deductions reduce taxable income Some tax benefits extend beyond the initial purchase of a home One of the biggest benefits of

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize Residential energy efficient tax credits This can vary based on factors such as how fast you want to buy or sell your house But generally both the buyer and the seller will

What Is A Tax Credit When Buying A House

What Is A Tax Credit When Buying A House

https://i.pinimg.com/originals/f4/ef/5a/f4ef5a24479daac8d9c8ce34db69fb31.png

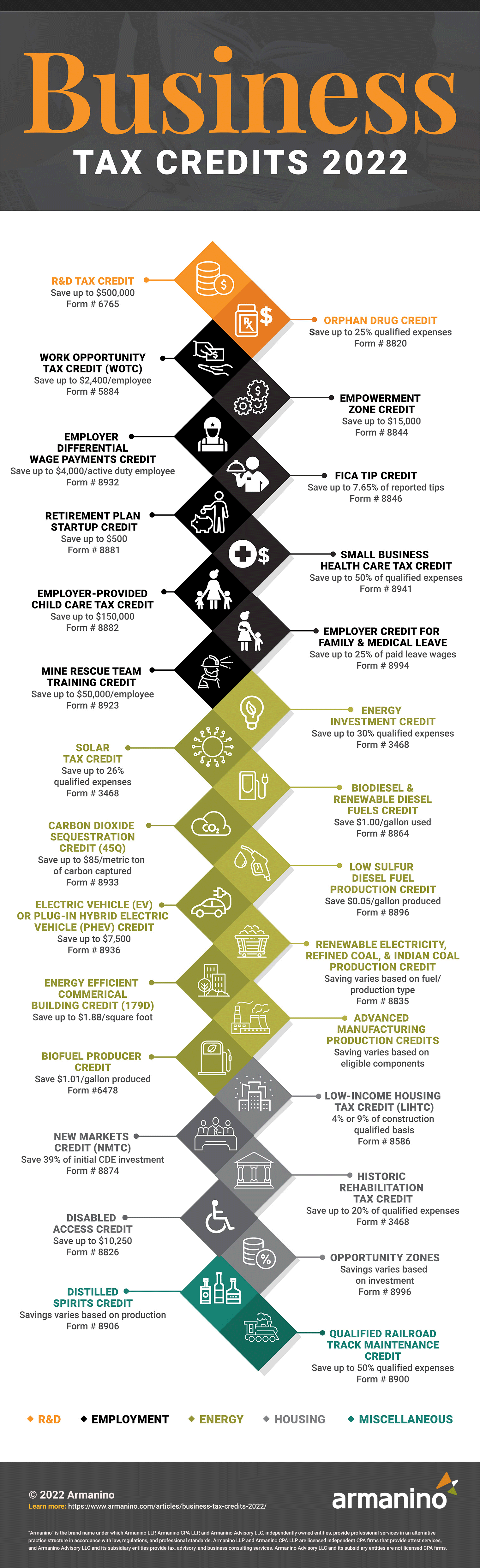

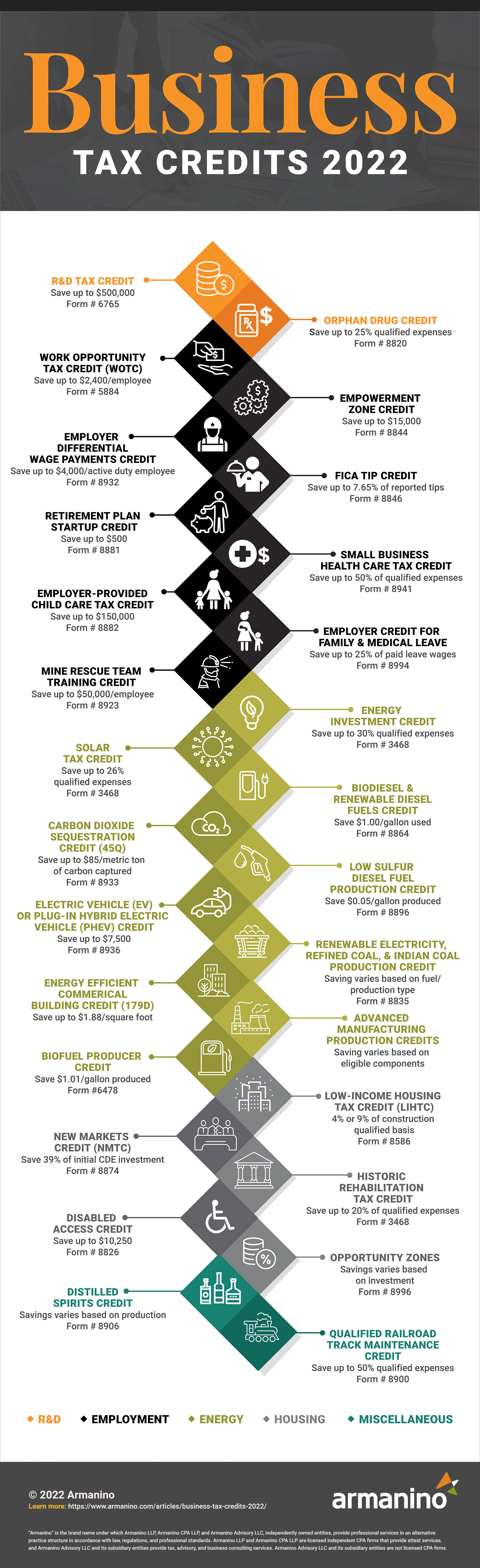

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

What Is A Tax Strategy

https://prevailiws.com/wp-content/uploads/2022/03/What-is-a-tax-strategy.png

Buying your first home is a huge step but tax deductions available to you as a homeowner can reduce your tax bill For tax years prior to 2018 you can deduct interest on up to 1 million of debt used to buy build or improve Tax deductions for buying a house in 2024 Whichever deduction you choose you ll need to properly fill out tax forms or work with a tax advisor to determine what and how much you qualify for If you do decide to

A tax credit is an amount taken off of your tax bill For example if you get a 1 000 tax credit your tax bill due will shrink by 1 000 it s a dollar for dollar reduction in the To get the maximum tax benefit from your home purchase it s important to understand what options are available to you Here are some potential tax deductions for

Download What Is A Tax Credit When Buying A House

More picture related to What Is A Tax Credit When Buying A House

What Is A UK Tax Code What Does It Mean

https://i0.wp.com/farsightfinance.co.uk/wp-content/uploads/2022/08/Understanding-Your-Tax-Code-Feature-Image.png?fit=1620%2C1620&ssl=1

TAX TIPS WITH TIMALYN Bowens Tax Solutions

https://static.wixstatic.com/media/e541b94aa6864b81baee7fda6b5c0e3e.jpg/v1/fill/w_2500,h_1573,al_c/e541b94aa6864b81baee7fda6b5c0e3e.jpg

What Is The Difference Between A Tax Credit And Tax Deduction

https://static.twentyoverten.com/5d5413591d304774fba39eb3/WZASn6oAJLl/Tax-Credits-vs-Deductions.jpg

Tax Credits Tax credits are especially valuable because they reduce the tax you owe dollar for dollar If you get a 1 000 tax credit you owe 1 000 less on your taxes The short answer is yes you can get a tax break for buying a home which can help you save money at tax time But first you have to know which of your expenses qualify

As a homeowner you ll face property taxes at a state and local level You can deduct up to 10 000 of property taxes as a married couple filing jointly or 5 000 if you are single or Tax credits and incentives related to homeownership can vary over time and may depend on specific circumstances such as being a first time homebuyer or making energy

SimplyWise

https://www.simplywise.com/blog/wp-content/uploads/2024/03/shutterstock_1921993913.jpg

What Is A Tax Deduction PDF Life Insurance Taxes

https://imgv2-1-f.scribdassets.com/img/document/51826174/original/5b927da6ce/1667725984?v=1

https://www.gdblaw.com › resources › these-are-tax...

Tax credits apply to the tax owed while tax deductions reduce taxable income Some tax benefits extend beyond the initial purchase of a home One of the biggest benefits of

https://www.thebalancemoney.com

You can get a tax break for buying a house through tax deductions and credits for a few expenses you pay every month but rules and limits apply and you must itemize

Everything You Need To Know About Tax Reference Numbers

SimplyWise

Vincere Tax Tax Credit Vs Deduction What Is The Difference

What Is A Tax Credit Tax Credits Sales Tax Goods Services

What You Need To Know About Cap Rates

Are Small Business Tax Write Off A Good Thing Nsail

Are Small Business Tax Write Off A Good Thing Nsail

Tax Return Vs Tax Refund What Is It And What Is The Difference

Why Is Credit Important Home Loans Finance Tips Mortgage Lenders

What Is A Tax Write off And How Does It Work Workhy Blog

What Is A Tax Credit When Buying A House - To get the maximum tax benefit from your home purchase it s important to understand what options are available to you Here are some potential tax deductions for