What Is A Tax Refund Claim Value added tax VAT is a multi stage sales tax the final burden of which is borne by the private consumer VAT at the appropriate rate will be included in the price you pay for the goods you purchase As a visitor to the EU who is returning home or going on to another non EU country you may be eligible to buy goods free of VAT in special shops

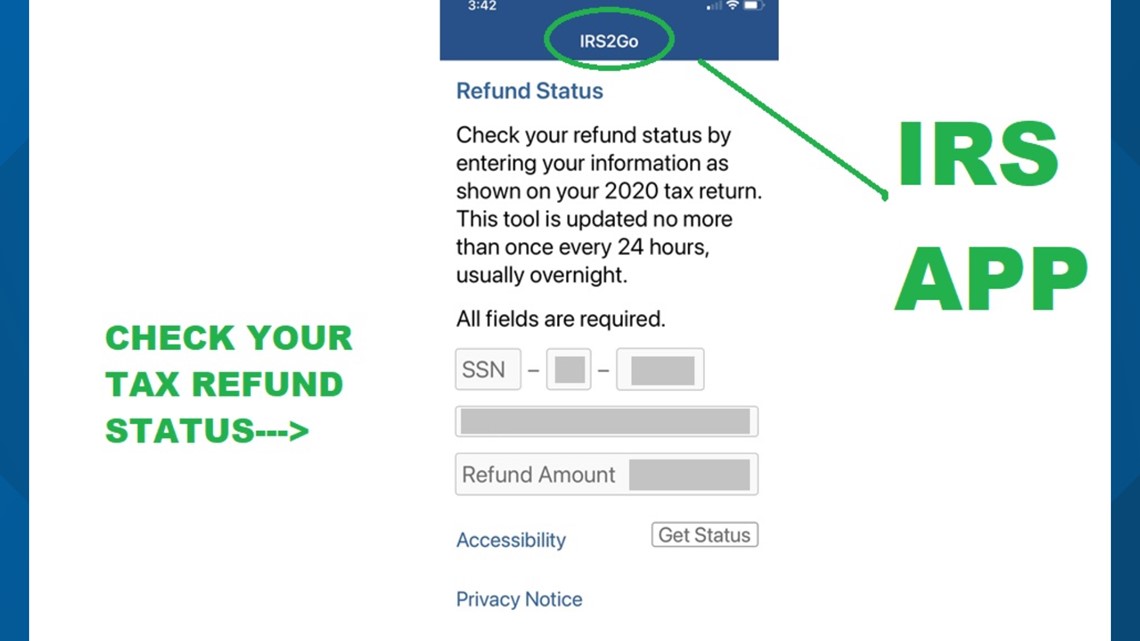

Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job You can claim your tax refund online using the Government Gateway site The amount of tax refund you receive is based on several factors What is a tax refund Whether you ve been overtaxed on your personal income or are eligible for certain tax benefits that can be refunded you can get a tax refund or a rebate to get some of your money back

What Is A Tax Refund Claim

What Is A Tax Refund Claim

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

https://i.ytimg.com/vi/fHARONBG43g/maxresdefault.jpg

This Map Shows The Average Tax Refund In Every State ValueWalk Premium

https://valuewalkpremium.com/wp-content/uploads/2019/02/Tax-Refund.jpg

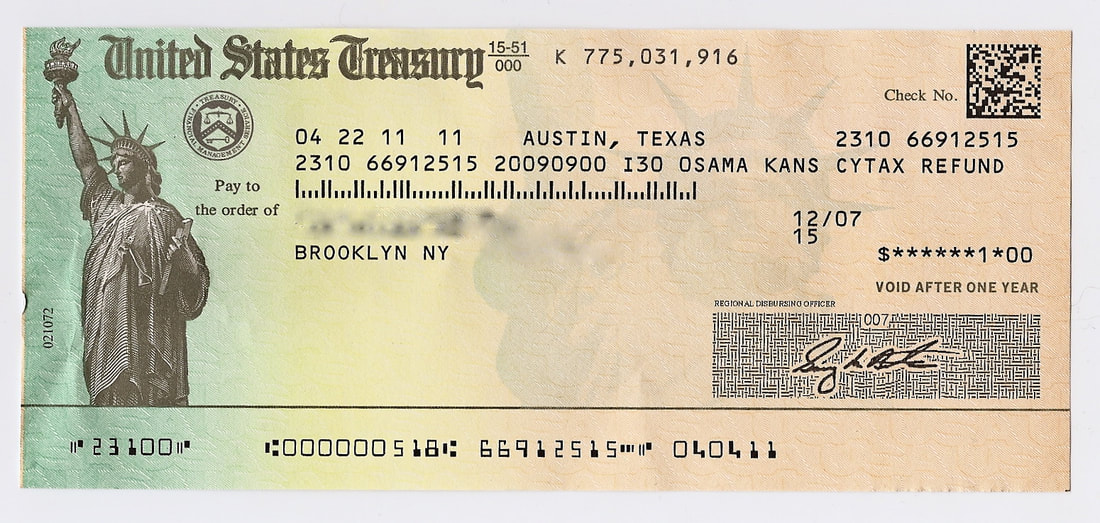

What is a tax Refund It is a reimbursement of excess tax paid in a given period Who is Eligible for Individual Income Tax Refunds How do I apply for an income tax refund Which documents will I require to apply for my refund When should I apply for a tax refund How do I know if my refund is approved Taxpayers receive a refund at the end of the year when they have too much money withheld If you re self employed you get a tax refund when you overpay your estimated taxes While you might consider this extra income to be free money it s actually more like a loan that you made to the IRS without charging interest

Its main purpose is to document the amount of tax you owe or how much the IRS owes you for a given year United States citizens are required to file tax returns once they hit the Claim a refund of Income Tax deducted from savings and investments R40 English Cymraeg Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self

Download What Is A Tax Refund Claim

More picture related to What Is A Tax Refund Claim

Tax Refund How To Claim Tax Back PAYE Self Assessment

https://media.freshbooks.com/wp-content/uploads/2021/09/tax-refund-1-600x400.jpg

How Long Does It Take To Get A Tax Refund CashBlog

https://cashblog.com/wp-content/uploads/2023/05/Depositphotos_2303498_XL-scaled.jpg.webp

Here s What Americans Do With Their Tax Refunds Successful People

https://i.pinimg.com/originals/35/a0/18/35a018b75c27cd040b2c05dcbcc2e056.jpg

For 2020 tax returns people have a little more time than usual to file their claim for refunds Typically the filing deadline to claim old refunds falls around the tax deadline of April 15 However the 2020 filing deadline was pushed to May 17 due to COVID 19 making the three year window deadline for 2020 unfiled returns May 17 2024 13 Jul 2022 Think you re owed a tax refund Here s how to get 100 of your rebate Claiming back overpaid tax should be easy enough to do yourself directly through HMRC Matthew Jenkin Senior writer If you think you ve paid too much tax over the course of a financial year then you may be eligible for a rebate

Claim back Income Tax when you ve stopped working P50 English Cymraeg How to claim a refund in the current tax year if you are not getting taxable benefits or a pension from your The easiest way to claim your donation tax credit is online in myIR and you ll receive your refund sooner Using myIR means we can work out your tax credit without you having to file a claim when the tax year ends on 31 March You can submit your receipts any time throughout the tax year or submit them all together at the end of the tax year

Will I Get A Tax Refund How Much Idea Economics

https://ideaeconomics.org/wp-content/uploads/2021/01/13369028814_263315857c_o.jpg

Tax Largie Inc Blog TAX LARGIE INC

https://www.taxlargiecpa.com/uploads/8/5/3/9/85397038/851856077.jpg

https://taxation-customs.ec.europa.eu/guide-vat-refund-visitors-eu

Value added tax VAT is a multi stage sales tax the final burden of which is borne by the private consumer VAT at the appropriate rate will be included in the price you pay for the goods you purchase As a visitor to the EU who is returning home or going on to another non EU country you may be eligible to buy goods free of VAT in special shops

https://www.gov.uk/claim-tax-refund

Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job

Tax Refund Meaning In Hindi TAXIRIN

Will I Get A Tax Refund How Much Idea Economics

What To Do With Your Tax Refund ATB Financial

How Your Tax Refund Can Improve Your Credit

Tax Refunds Finance I Introduction A Tax Refund Is A Payment That

Never Do This With Your Tax Refund Never Make These Mistakes One

Never Do This With Your Tax Refund Never Make These Mistakes One

My 8 220 Tax Refund Disappeared I ve Been Warned free Is Rarely

Claim Tax Refund Image Photo Free Trial Bigstock

How To Check Where Your Tax Refund Is Wfmynews2

What Is A Tax Refund Claim - What is a tax Refund It is a reimbursement of excess tax paid in a given period Who is Eligible for Individual Income Tax Refunds How do I apply for an income tax refund Which documents will I require to apply for my refund When should I apply for a tax refund How do I know if my refund is approved