What Is Adjusted Refund Amount 0 00 Means Adjusted refund amount means the IRS either owes you more money on your return or you owe more money in taxes For example the IRS may use your refund to pay an existing tax debt and issue you a CP49 notice

If the adjusted refund amount is 0 it means you are not getting a federal tax refund As Tax Expert DMarkM1 explained the IRS will send you a letter explaining why your refund was adjusted A 0 refund suggests your refund was taken for an unpaid debt such So am i getting my expected or adjusted refund of 0 00 I never had this happen where i had any issues filing my taxes I just need some clarity and advice February 26 2022 11 31 AM manderson344690 If your return amount changes you will receive a letter from the IRS indicating the change

What Is Adjusted Refund Amount 0 00 Means

What Is Adjusted Refund Amount 0 00 Means

https://globalgatecpa.com/wp-content/uploads/2020/07/GettyImages-641141038-635672bd575846b5bfcb889f7665134e.jpg

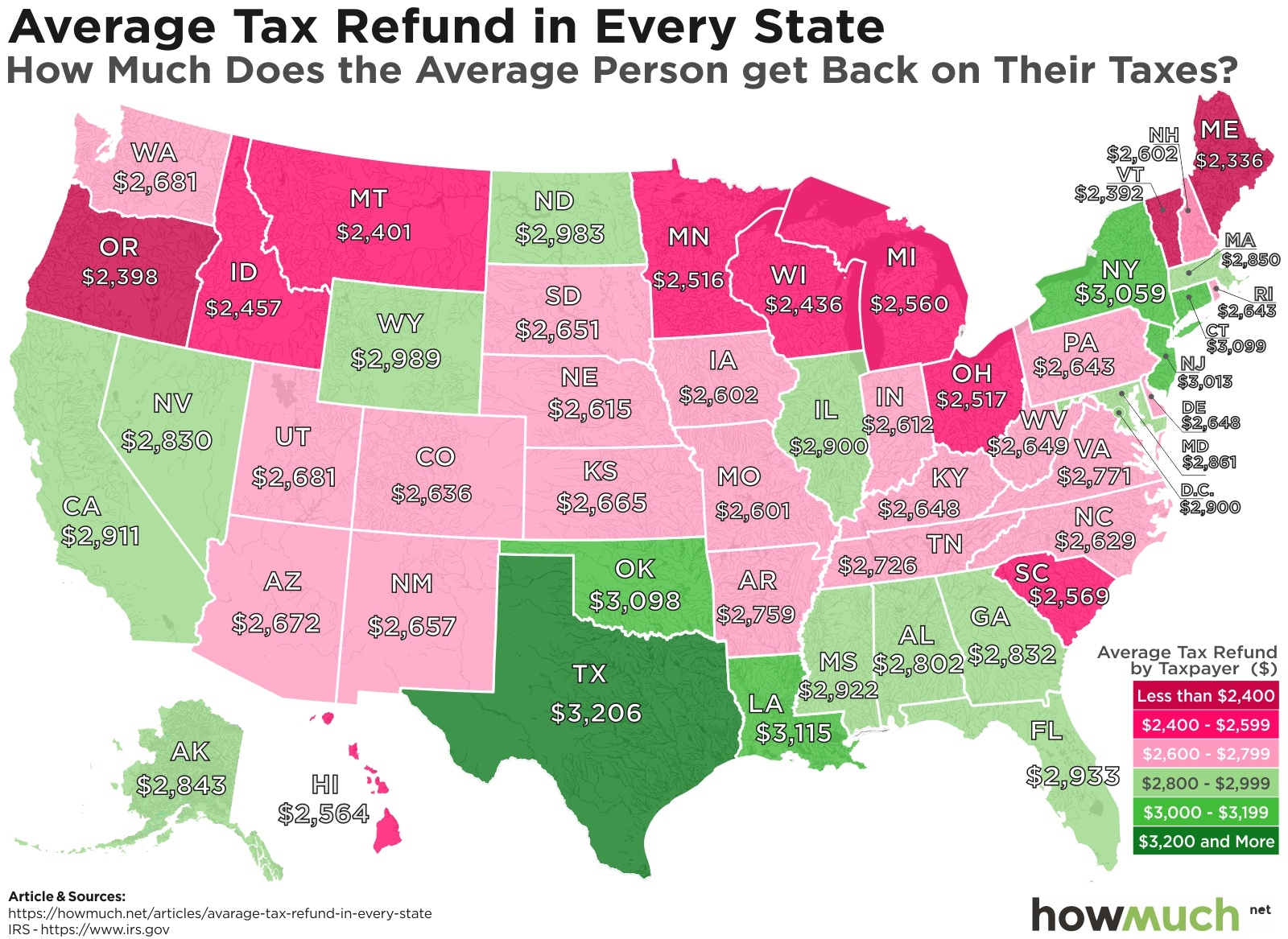

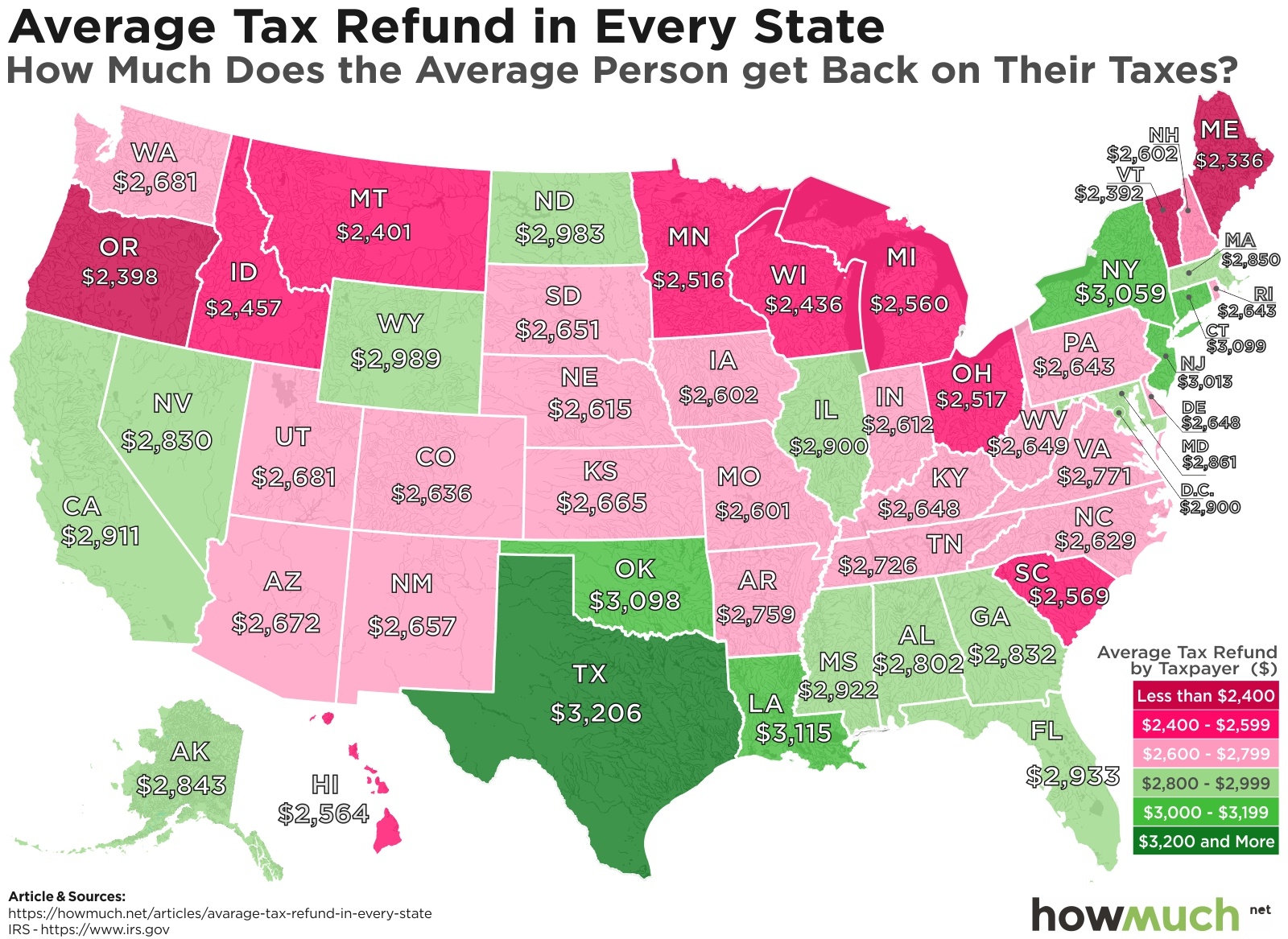

This Map Shows The Average Tax Refund In Every State ValueWalk Premium

https://valuewalkpremium.com/wp-content/uploads/2019/02/Tax-Refund.jpg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Adjusted refund amount means the IRS either owes you more money on your return or you owe more money in taxes For example the IRS may use your refund to pay an existing tax debt and issue you a CP 49 notice Or a simple math error can turn out in your favor with a CP 12 notice that corrects one or more mistakes on your tax return For What does adjusted refund mean Adjusted refund amount means the IRS either owes you more money on your return or you owe more money in taxes For example the IRS may use your refund to pay an existing taxes owed and issue you a CP 49 notice

If the adjusted refund amount is 0 it means you are not getting a federal tax refund Why does it say 0 refund on Turbotax It sounds like whatever changes you made to your original return when you amended it resulted in a reduction of the original balance due refund What does adjusted Refund Amount 0 00 mean If the adjusted refund amount is 0 it means you are not getting a federal tax refund As Tax Expert DMarkM1 explained the IRS will send you a letter explaining why your refund was adjusted A 0 refund suggests your refund was taken for an unpaid debt such

Download What Is Adjusted Refund Amount 0 00 Means

More picture related to What Is Adjusted Refund Amount 0 00 Means

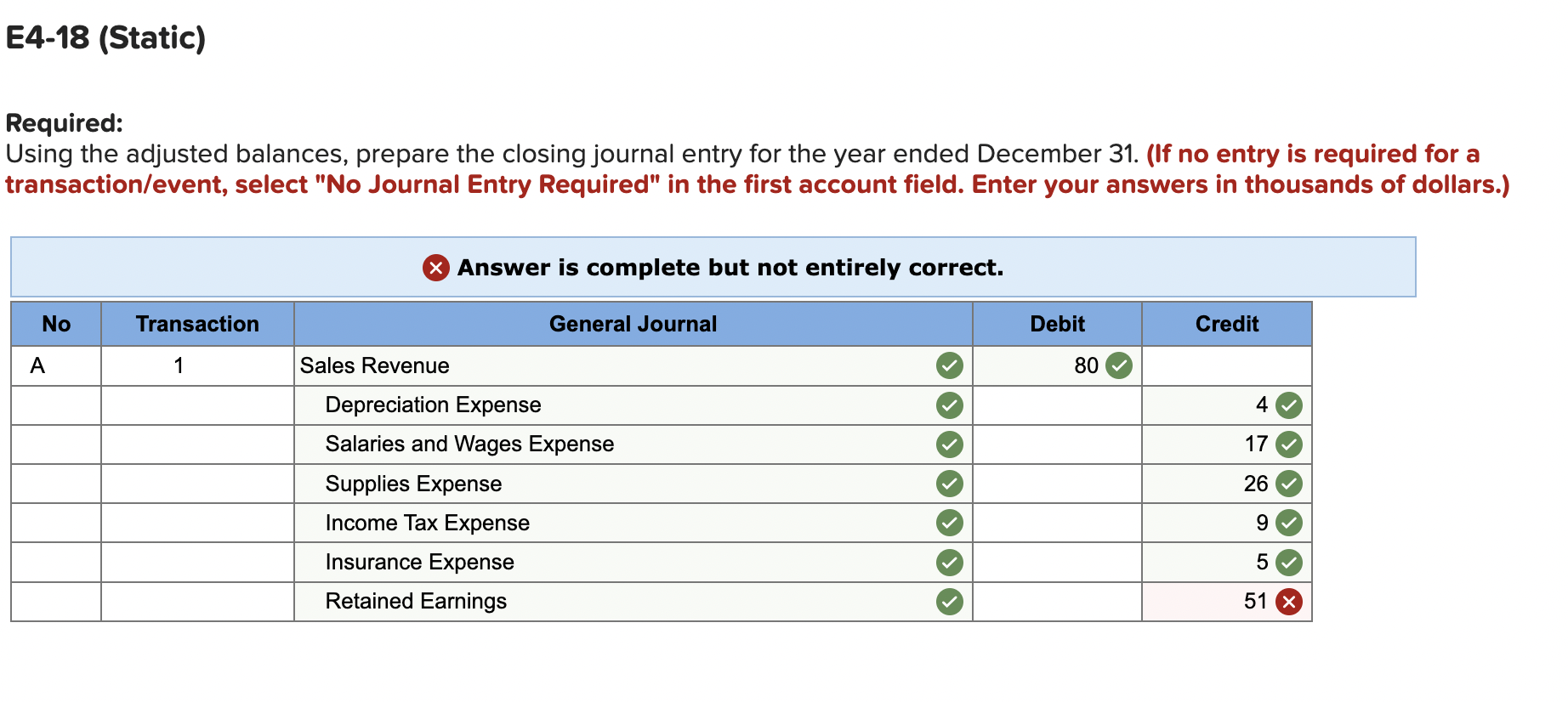

Solved Mint Cleaning Incorporated Prepared The Following Chegg

https://media.cheggcdn.com/media/b52/b522cfb3-b961-41aa-acfd-018be27d74e8/phpZFhSBR

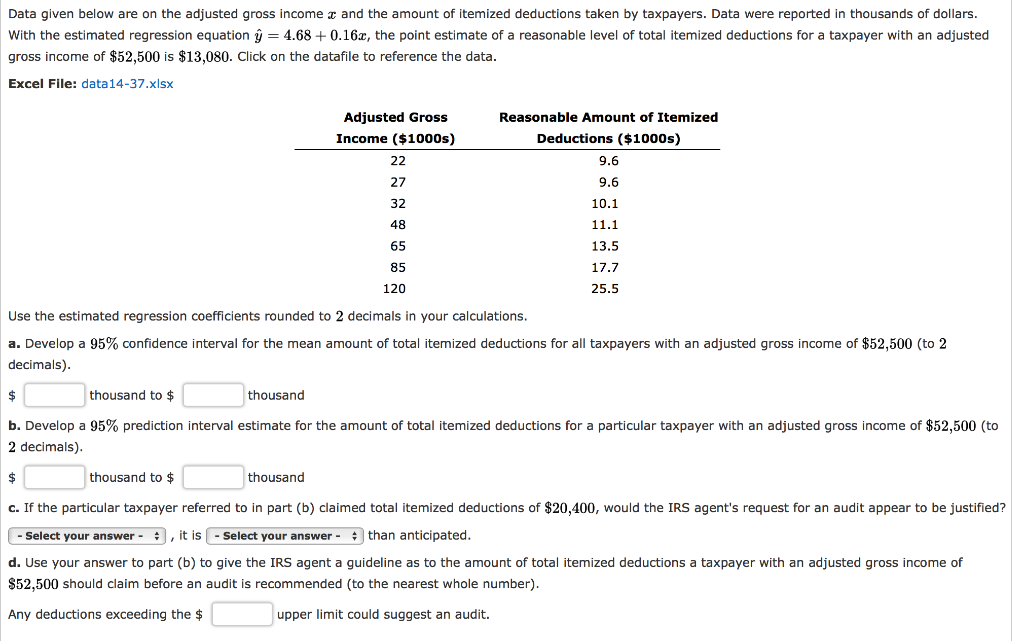

Solved Data Given Below Are On The Adjusted Gross Income Chegg

https://media.cheggcdn.com/media/216/216722be-1165-45c2-8a6e-fb108092e38b/php6KIofA.png

IRS Check My Refund Check All The Necessary Details Here Eduvast

https://www.eduvast.com/wp-content/uploads/2023/08/Untitled-design_20230822_002740_0000.jpg

The IRS has adjusted your refund amount due to an offset The refund amount will be different on the IRS website but not in your account If you elected to have the filing fees deducted from your refund rather than paying by debit or credit card your It could be due to an offset or a change to your tax return by the IRS An offset is used to pay off past due federal tax state income tax state unemployment compensation debts child support spousal support or other federal non tax debts such as student loans

If you see other codes like 570 898 420 971 with future dates or 0 amounts without a current year 846 code it means your return is under processing refund may be adjusted or delayed You will generally get updates in line with your daily or weekly cycle code I had to have my refund adjusted this year and it did not display as 0 on the wheres my refund page It remained at the original amount for close to a month and then about a week before I actually received it it changed to the actual amount it was adjusted to

Regression Adjusted R 2 Calculations Cross Validated

https://i.stack.imgur.com/3iCf8.png

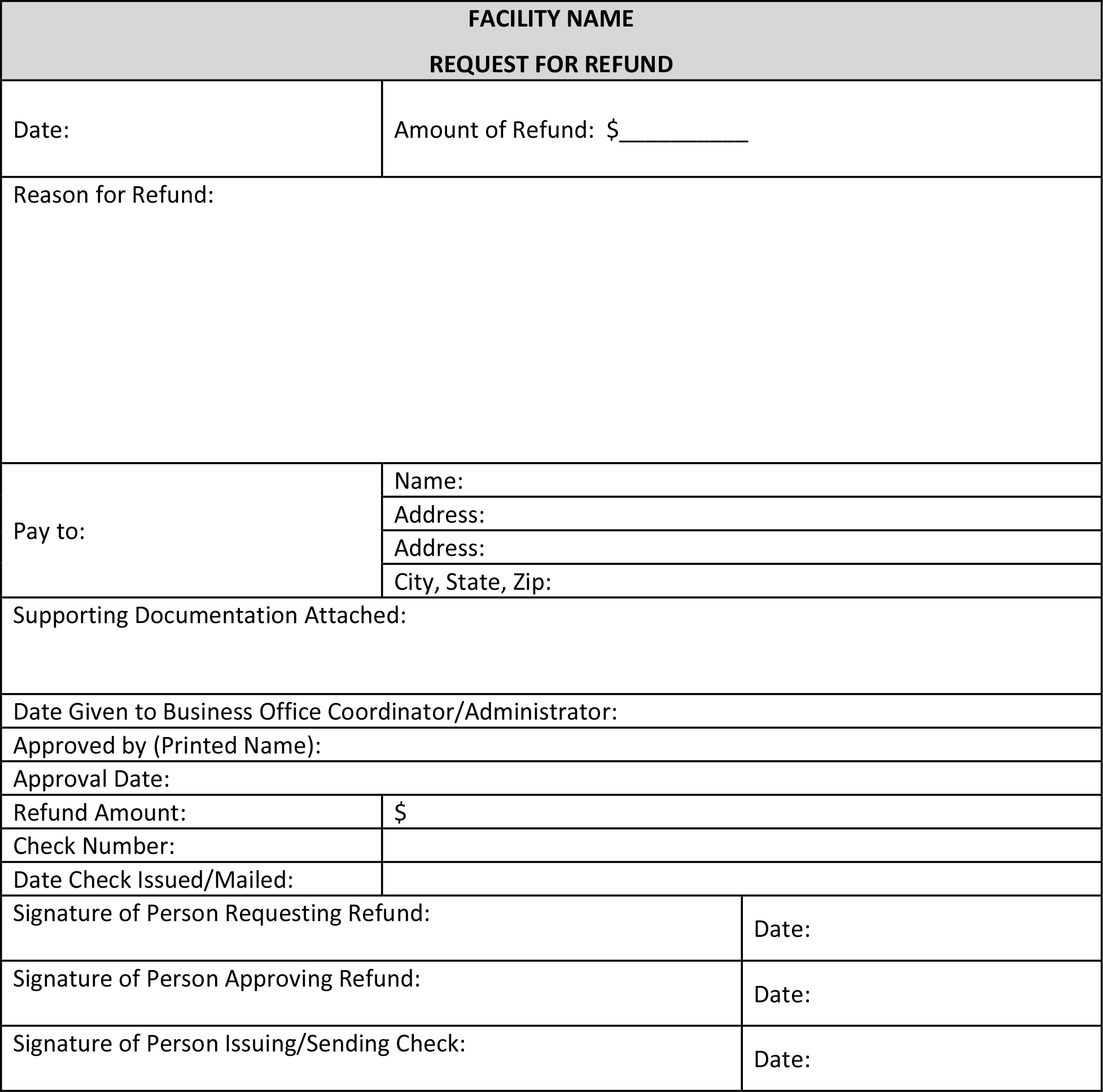

ASC Revenue Cycle E Tool ASC Refund Request Form Serbin Medical

https://images.squarespace-cdn.com/content/v1/580e8ccb725e25ff548940f8/1578580694242-WTJ76UIKEJDVNKGCPRKT/Refund+Form.png

https://globalgatetaxes.com › what-you-need-to-know...

Adjusted refund amount means the IRS either owes you more money on your return or you owe more money in taxes For example the IRS may use your refund to pay an existing tax debt and issue you a CP49 notice

https://financeband.com

If the adjusted refund amount is 0 it means you are not getting a federal tax refund As Tax Expert DMarkM1 explained the IRS will send you a letter explaining why your refund was adjusted A 0 refund suggests your refund was taken for an unpaid debt such

Adjusted Present Value APV Formula And Calculation

Regression Adjusted R 2 Calculations Cross Validated

What Is Pre Tax Commuter Benefit

What Does Code 570 And 971 Mean On My IRS Tax Transcript And Will It

IRS Notice CP12 IRS Adjusted Refund Letter What It Means

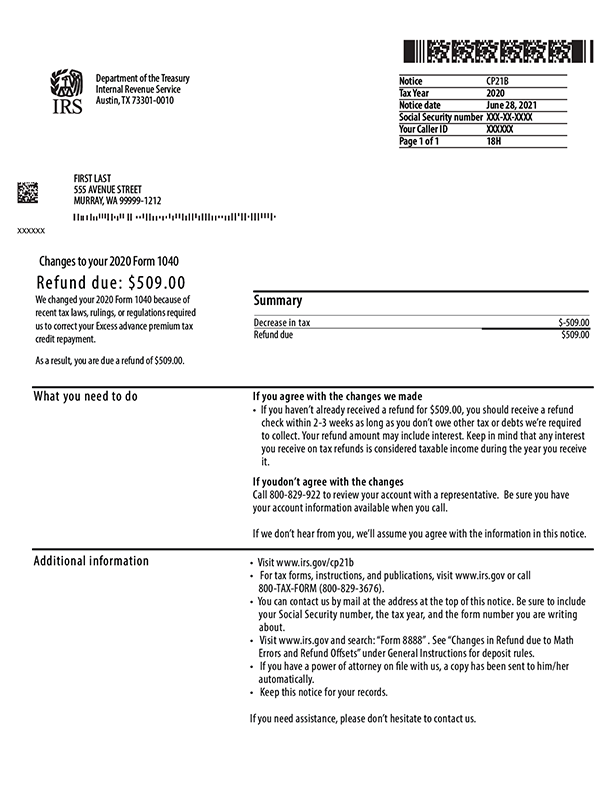

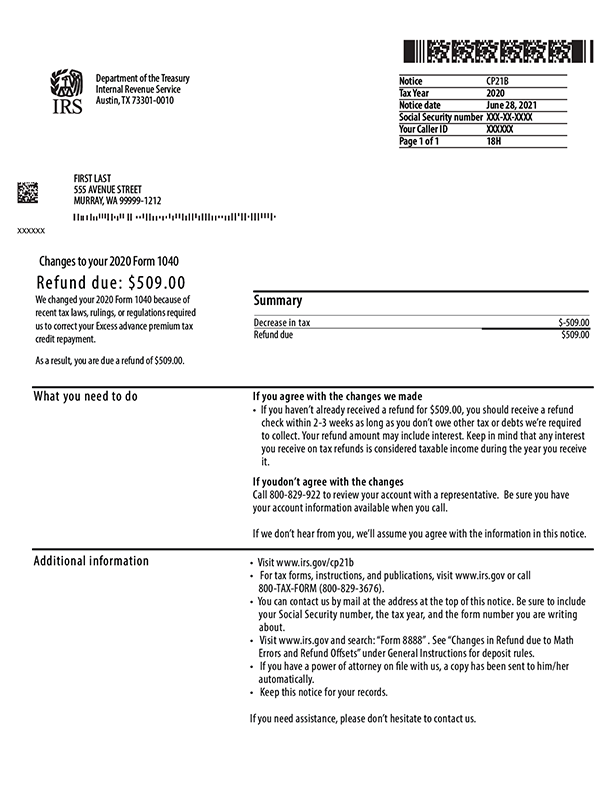

All About IRS Notice CP21B Refund Status

All About IRS Notice CP21B Refund Status

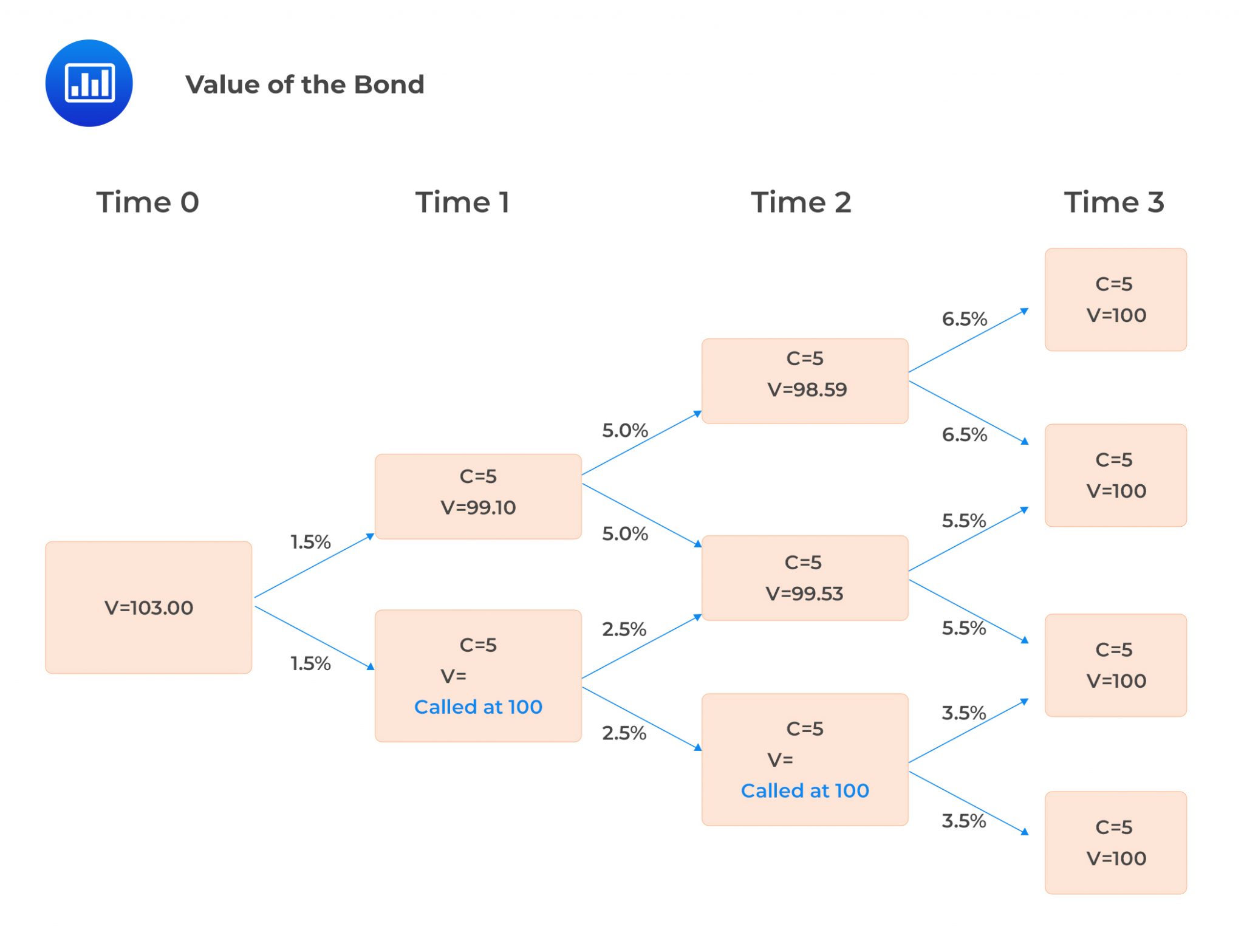

Option adjusted Spreads CFA FRM And Actuarial Exams Study Notes

Key Facts You Need To Know About Income Definitions For Marketplace And

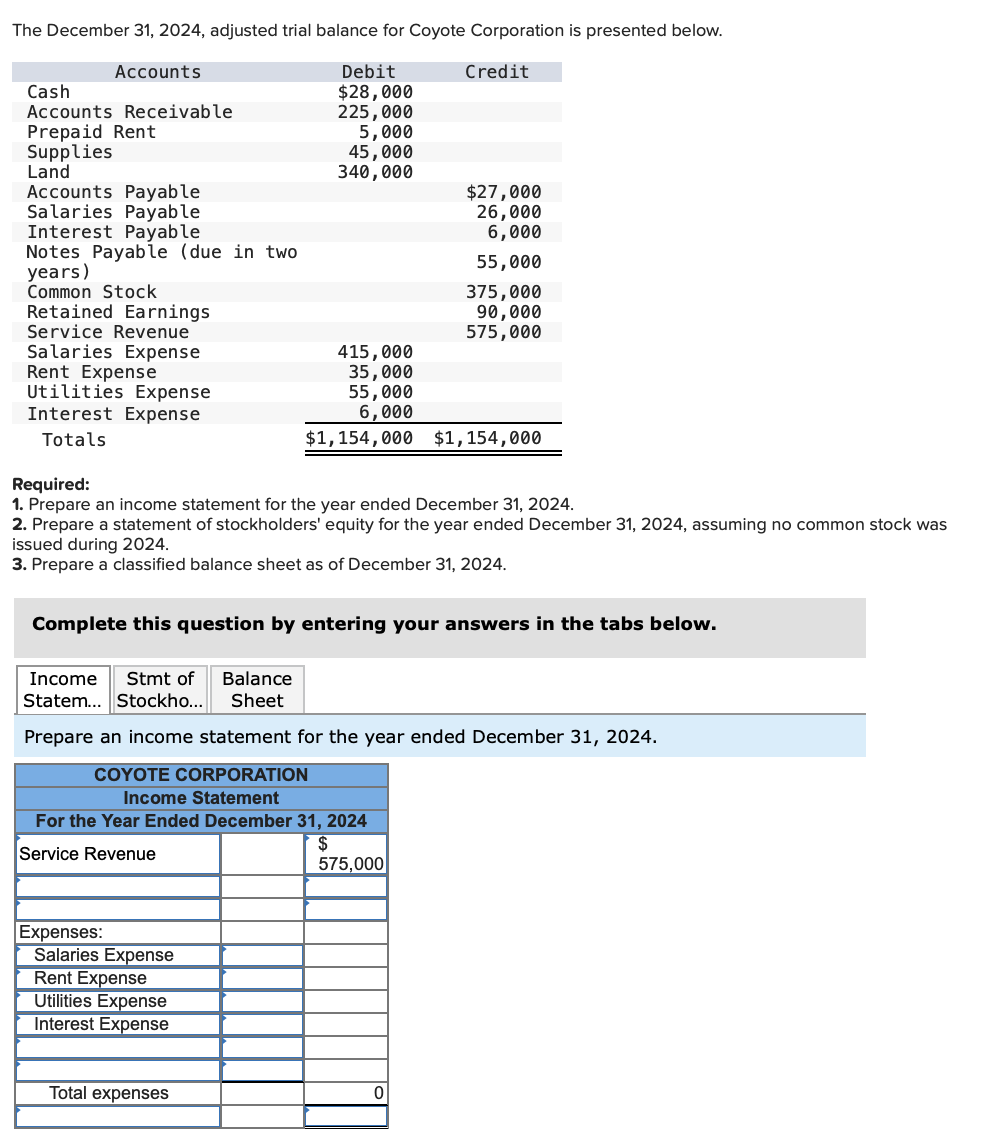

Solved The December 31 2024 Adjusted Trial Balance For Chegg

What Is Adjusted Refund Amount 0 00 Means - I checked the Where s my refund tool on the IRS website earlier today to find that my refund has been adjusted to 0 00 and applied to past due obligations even though I don t owe anything What can I do